How To Get Gross Pay

How To Get Gross Pay: Your Simple Guide to Understanding Your Earnings

Hey there! If you've ever looked at your paycheck stub and wondered, "What is gross pay and exactly how do I figure it out?"—you're definitely not alone. Understanding your income is crucial for budgeting, planning, and managing your financial life.

We're going to break down the calculation steps, making the complex topic of How To Get Gross Pay feel simple and straightforward. Think of gross pay as your total earnings before the government and other entities start taking their cuts. Let's dive in and learn how to master this essential number!

What Exactly Is Gross Pay?

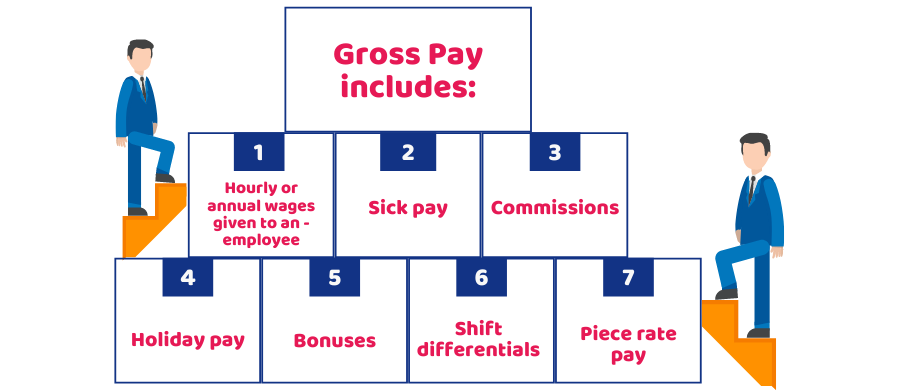

Gross pay is the total amount of money you earn from your employer during a specific pay period before any deductions are taken out. This includes your regular wages, commissions, tips, bonuses, and overtime pay.

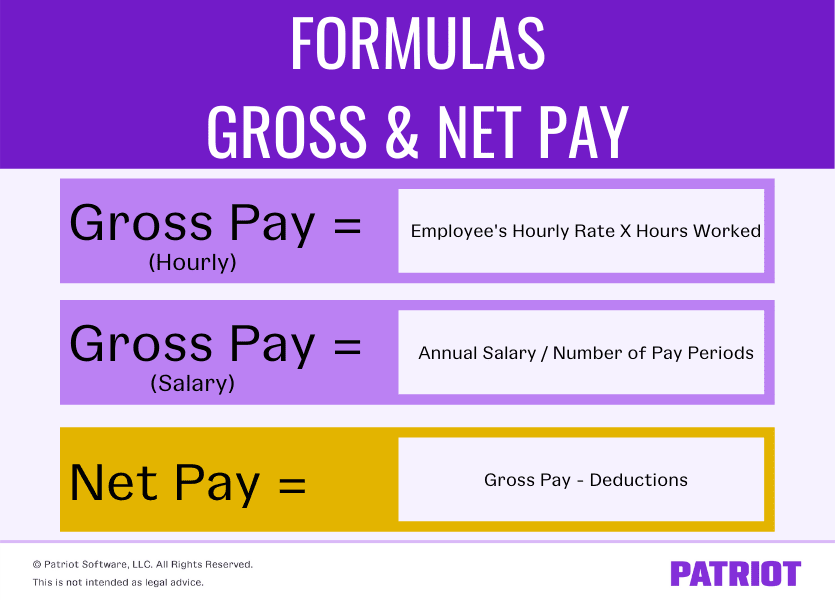

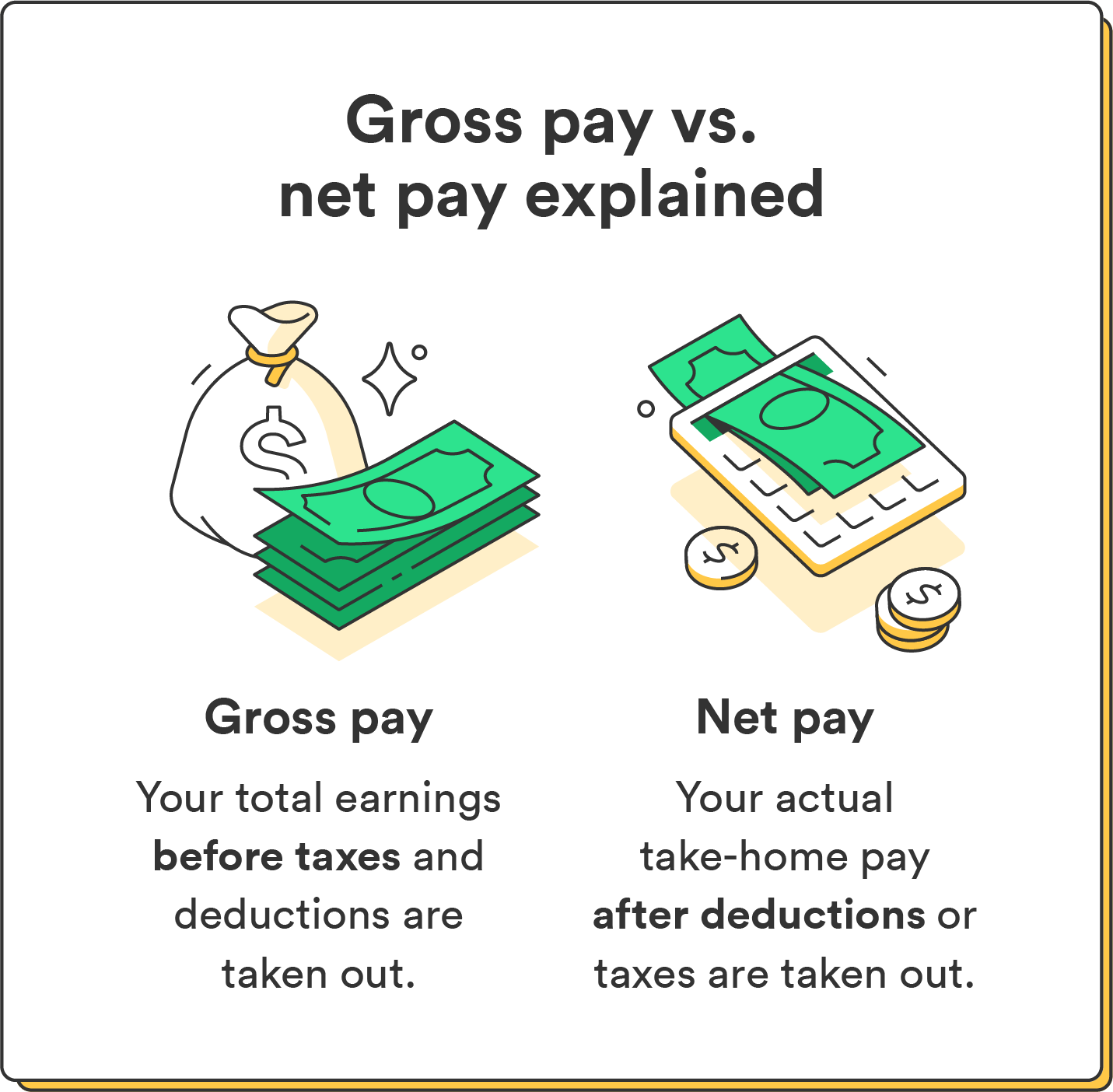

It's important to differentiate gross pay from net pay (sometimes called "take-home pay"). Net pay is what actually lands in your bank account after all deductions—like federal taxes, state taxes, Social Security, Medicare, and maybe health insurance premiums—have been subtracted.

For financial purposes, your gross pay is the number businesses and lenders usually care about. It represents your true earning power.

Gross Pay vs. Net Pay: The Crucial Difference

While both numbers appear on your pay stub, they serve very different purposes. Gross pay is the starting line, and net pay is the finish line. Knowing the difference helps you understand the impact of various withholdings.

To truly grasp How To Get Gross Pay, remember this formula:

- Gross Pay = All Earnings (Base Salary + Overtime + Bonuses + Commissions)

- Net Pay = Gross Pay – Total Deductions (Taxes + Benefits + Garnishments)

The Core Methods: How To Calculate Gross Pay

Calculating your gross pay depends entirely on whether you are paid a fixed salary or an hourly wage. Both methods require different steps, but the goal remains the same: finding the total cash generated before taxes.

Calculating Gross Pay for Salaried Employees

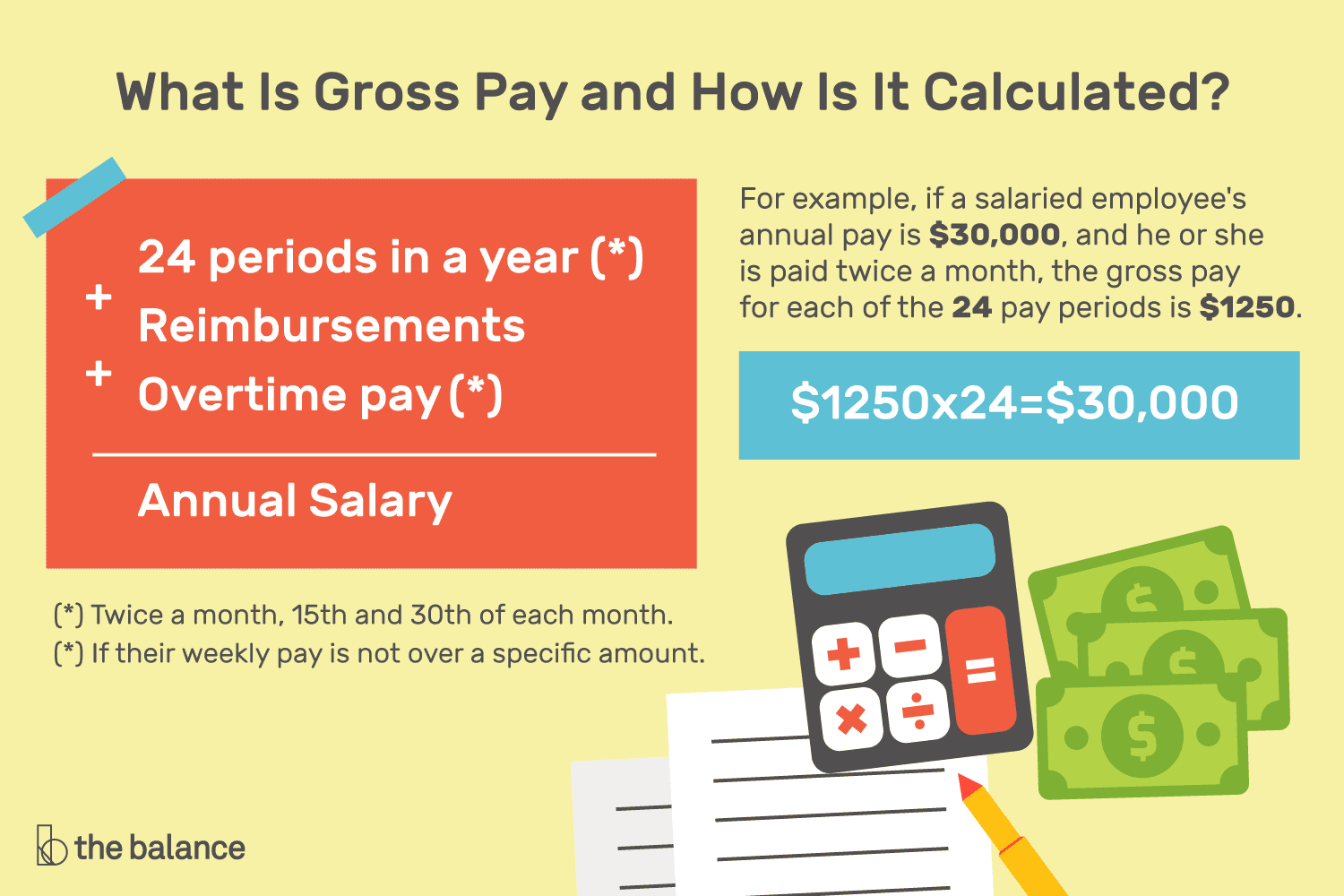

If you are a salaried employee, calculating your gross pay is usually the easiest route. Your gross pay is a fixed amount based on your annual salary, divided by the number of pay periods you have per year.

Here's the simple process:

- Determine your annual salary: This is the total pay agreed upon for the year (e.g., $60,000).

- Find your pay frequency: How often are you paid? Common frequencies include:

- Weekly (52 periods)

- Bi-weekly (26 periods)

- Semi-monthly (24 periods)

- Monthly (12 periods)

- Divide the annual salary by the number of pay periods: This gives you your recurring gross pay per check.

Example: If your annual salary is $60,000 and you are paid bi-weekly (26 periods), your gross pay per paycheck is $60,000 / 26 = $2,307.69. This figure usually remains constant unless you receive a bonus or a raise.

Remember that if you receive performance bonuses or commissions, you must add those amounts to your base salary amount for the period in which they were paid to calculate the total gross pay for that specific check.

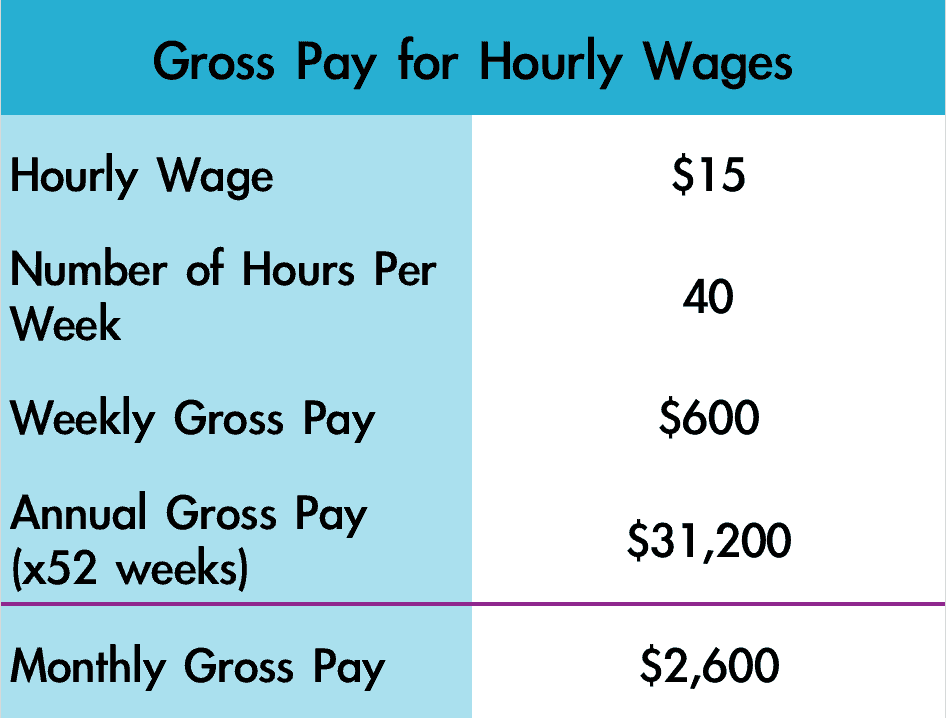

Calculating Gross Pay for Hourly Employees

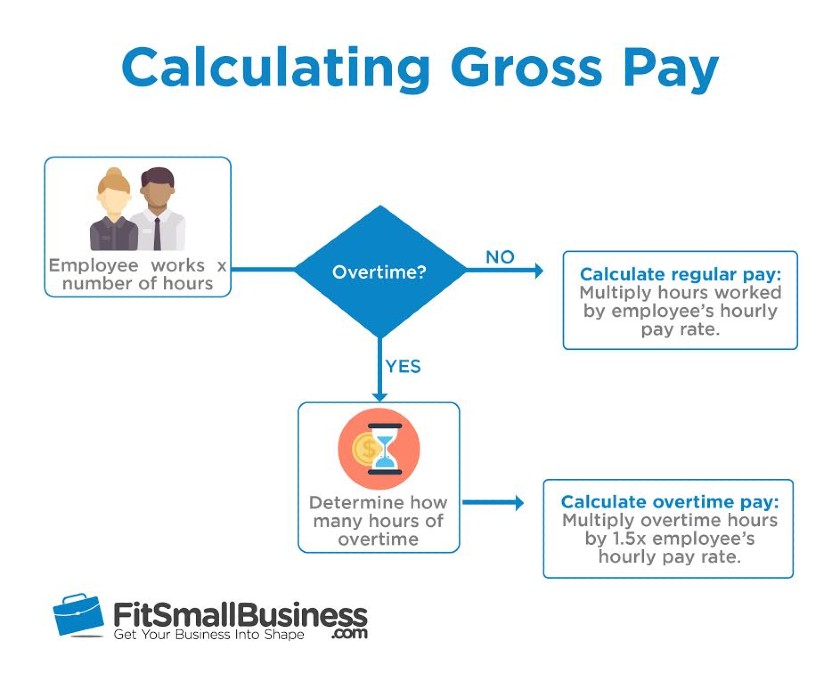

For hourly workers, the calculation is more dynamic because it depends on the exact hours worked during the pay period. This calculation must also account for overtime, which is a major factor in determining your full gross earnings.

The basic formula for non-overtime earnings is:

Hourly Gross Pay (Base) = Hourly Rate × Total Regular Hours Worked

For instance, if you earn $15 per hour and work 80 regular hours in a two-week period, your base gross pay is $15 × 80 = $1,200.

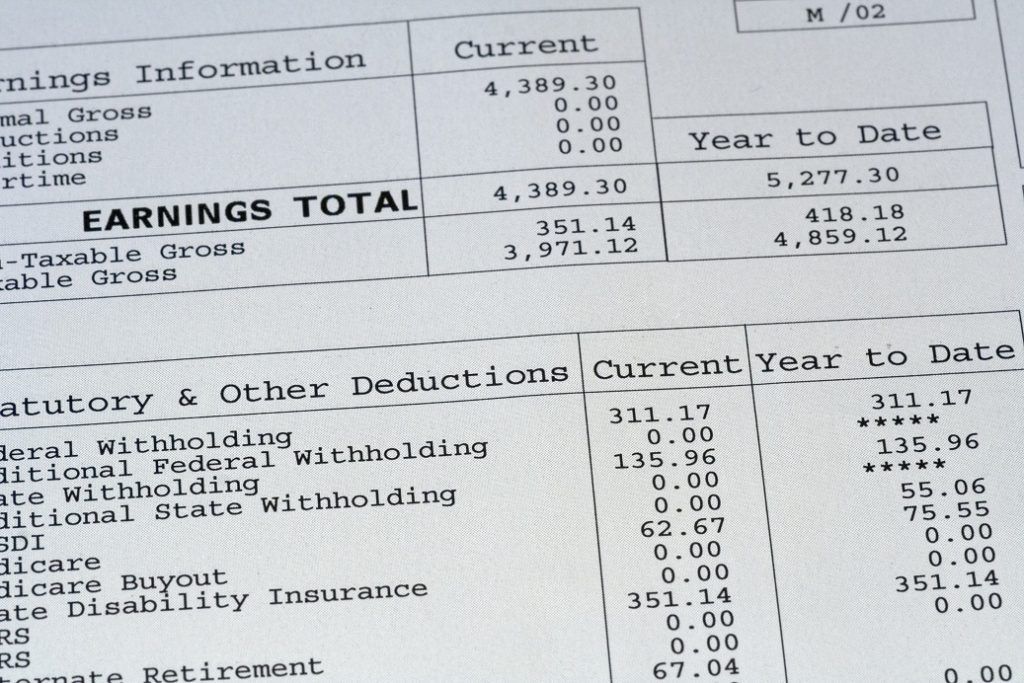

Handling Overtime: A Key Component of Gross Pay

Overtime is defined in the US as any hours worked beyond 40 hours in a standard workweek, and it must be paid at a higher rate—typically "time-and-a-half." This is where many people seeking information on How To Get Gross Pay run into complexity.

To calculate overtime gross pay:

- Calculate your overtime rate: Multiply your standard hourly rate by 1.5.

- Identify overtime hours: Determine how many hours exceeded the standard work threshold.

- Calculate Overtime Pay: Multiply the overtime rate by the overtime hours worked.

Example using Overtime:

You earn $15/hour. You worked 90 hours in a two-week pay period (two standard 40-hour weeks, totaling 80 regular hours).

The total hours worked above 80 is 10 hours of overtime.

- Regular Pay: $15 × 80 = $1,200.00

- Overtime Rate: $15 × 1.5 = $22.50/hour

- Overtime Pay: $22.50 × 10 = $225.00

- Total Gross Pay: $1,200.00 + $225.00 = $1,425.00

This $1,425.00 is your true gross pay for that period before any mandatory payroll taxes are deducted.

Adding Commissions, Bonuses, and Tips

Whether you are salaried or hourly, if you receive supplemental wages, they are always added to your gross pay calculation for that pay period. Supplemental income includes things like:

- Sales Commissions

- Year-end Bonuses

- Performance Awards

- Tips reported to your employer

It's essential to include these figures because they contribute to your annual gross income, which is the figure used to calculate tax liability.

Why Understanding How To Get Gross Pay Matters

Knowing your gross pay isn't just about satisfying curiosity; it's a fundamental component of financial literacy. This number impacts several crucial areas of your life.

First and foremost, it allows you to accurately assess tax liabilities. Since most retirement contributions (like 401k plans) are calculated as a percentage of your gross earnings, knowing the full picture ensures you are contributing correctly toward your future.

Budgeting and Financial Planning

Although you budget using your net (take-home) pay, understanding the gross figure helps you track changes and raises effectively. If you get a 5% raise, you want to apply that percentage to your gross income to see the real dollar increase, not the smaller net amount.

Loan and Rental Applications

When you apply for a mortgage, car loan, or even rent an apartment, lenders and landlords nearly always request proof of income based on your gross pay. They use this number to determine your debt-to-income ratio (DTI), which is a key factor in approving credit.

Having a clear understanding of How To Get Gross Pay helps you quickly provide the necessary documentation and confidently speak about your financial standing during application processes.

Negotiating Compensation

When discussing a salary or hourly wage with a potential employer, you are always negotiating the gross pay. If you know how your current gross pay breaks down—especially if you rely on performance bonuses or overtime—you can negotiate a new package that truly reflects your necessary earning threshold.

Conclusion

Calculating your gross pay—the total amount you've earned before taxes and deductions—is a straightforward process once you distinguish between salaried and hourly compensation models. Whether you are dividing your annual salary by 26 pay periods or meticulously tracking regular and overtime hours, the steps for How To Get Gross Pay are easily mastered.

This figure is more than just a number on a statement; it's the foundation of your financial life, impacting everything from retirement contributions to loan eligibility. By keeping track of your base rate, hours worked, and any supplemental earnings like bonuses or commissions, you maintain control and confidence over your total income.

Now that you know the calculation methods, you can check your next pay stub with complete confidence!

Frequently Asked Questions (FAQ) About Gross Pay

- What happens if I receive a bonus? Does it count toward my gross pay?

- Yes, absolutely. All supplemental wages, including bonuses, commissions, and tips, are added to your regular earnings to determine your total gross pay for the period in which they were received. These amounts are generally taxed at a higher rate initially, but they are still part of your overall gross income.

- Is gross pay based on a 40-hour work week?

- Gross pay is based on the hours you actually worked. For salaried employees, the assumption is that you work the hours required to fulfill your duties. For hourly employees, the standard rate applies to up to 40 hours per week, with any hours beyond that counting as overtime, which increases your overall gross pay calculation.

- Why is my gross pay different from the number on my W-2?

- Your W-2 form reports your total taxable gross wages earned over the entire calendar year. If your paychecks include non-taxable benefits (like employer contributions to specific retirement plans), your W-2 might look slightly different than the sum of all your paycheck gross pay figures, but generally, the W-2 reflects your total annual gross taxable income.

- Can my gross pay ever be zero?

- If you are a salaried or hourly employee, your gross pay is only zero if you did not work any hours and did not receive any paid time off (PTO) during that pay period. However, your net pay could theoretically be zero or negative if your deductions (like mandatory benefit premiums or garnishments) exceed your current gross earnings.

How To Get Gross Pay

How To Get Gross Pay Wallpapers

Collection of how to get gross pay wallpapers for your desktop and mobile devices.

Captivating How To Get Gross Pay Picture Collection

Immerse yourself in the stunning details of this beautiful how to get gross pay wallpaper, designed for a captivating visual experience.

Detailed How To Get Gross Pay Capture in HD

Explore this high-quality how to get gross pay image, perfect for enhancing your desktop or mobile wallpaper.

Captivating How To Get Gross Pay Scene Collection

Immerse yourself in the stunning details of this beautiful how to get gross pay wallpaper, designed for a captivating visual experience.

Crisp How To Get Gross Pay Scene Concept

Find inspiration with this unique how to get gross pay illustration, crafted to provide a fresh look for your background.

Gorgeous How To Get Gross Pay Photo Collection

Find inspiration with this unique how to get gross pay illustration, crafted to provide a fresh look for your background.

Captivating How To Get Gross Pay Image for Mobile

A captivating how to get gross pay scene that brings tranquility and beauty to any device.

Breathtaking How To Get Gross Pay Wallpaper Digital Art

Transform your screen with this vivid how to get gross pay artwork, a true masterpiece of digital design.

Dynamic How To Get Gross Pay Wallpaper in 4K

A captivating how to get gross pay scene that brings tranquility and beauty to any device.

Breathtaking How To Get Gross Pay Capture Collection

Transform your screen with this vivid how to get gross pay artwork, a true masterpiece of digital design.

Artistic How To Get Gross Pay Artwork Collection

This gorgeous how to get gross pay photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Crisp How To Get Gross Pay Artwork Collection

This gorgeous how to get gross pay photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Vibrant How To Get Gross Pay Image Photography

Explore this high-quality how to get gross pay image, perfect for enhancing your desktop or mobile wallpaper.

Vibrant How To Get Gross Pay Capture for Mobile

Discover an amazing how to get gross pay background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Lush How To Get Gross Pay Landscape in HD

Immerse yourself in the stunning details of this beautiful how to get gross pay wallpaper, designed for a captivating visual experience.

Lush How To Get Gross Pay Abstract for Desktop

Immerse yourself in the stunning details of this beautiful how to get gross pay wallpaper, designed for a captivating visual experience.

Detailed How To Get Gross Pay Moment for Desktop

Explore this high-quality how to get gross pay image, perfect for enhancing your desktop or mobile wallpaper.

Beautiful How To Get Gross Pay View for Desktop

Transform your screen with this vivid how to get gross pay artwork, a true masterpiece of digital design.

Dynamic How To Get Gross Pay Abstract in 4K

A captivating how to get gross pay scene that brings tranquility and beauty to any device.

Serene How To Get Gross Pay Scene for Desktop

Transform your screen with this vivid how to get gross pay artwork, a true masterpiece of digital design.

Crisp How To Get Gross Pay Wallpaper for Your Screen

Find inspiration with this unique how to get gross pay illustration, crafted to provide a fresh look for your background.

Download these how to get gross pay wallpapers for free and use them on your desktop or mobile devices.

0 Response to "How To Get Gross Pay"

Post a Comment