How To Get Health Insurance In Massachusetts

How To Get Health Insurance In Massachusetts: Your Essential Guide

If you've recently moved to the Bay State, started a new job, or are simply tired of navigating confusing insurance websites, you might be asking: How to get health insurance in Massachusetts? The good news is that Massachusetts leads the nation in coverage, meaning there are excellent options available for almost everyone. The key is understanding the system, which primarily runs through the Massachusetts Health Connector.

This guide will walk you through everything you need to know, from eligibility and enrollment periods to maximizing financial assistance. Let's make the process straightforward and stress-free!

Understanding the Massachusetts Health Connector

Unlike many states that use the federal HealthCare.gov marketplace, Massachusetts operates its own robust exchange: the Massachusetts Health Connector. This is your primary hub for purchasing private insurance if you don't receive coverage through an employer, Medicare, or MassHealth (Medicaid).

The Health Connector simplifies the shopping experience by bringing all eligible plans under one roof. It's the only place where residents can access specific state and federal subsidies, which can dramatically lower your monthly premium costs.

Eligibility Requirements and Enrollment Periods

Generally, if you live in Massachusetts and are a U.S. citizen or legally residing immigrant, you are eligible to shop on the Health Connector. However, timing is everything when you want to get health insurance in Massachusetts.

The primary time to enroll is during the Open Enrollment Period (OEP). This usually runs from November 1st to January 23rd each year, though dates can sometimes shift slightly. If you enroll by the December deadline, coverage often starts on January 1st.

If you miss OEP, don't panic. You may qualify for a Special Enrollment Period (SEP). An SEP grants you 60 days to enroll following a qualifying life event (QLE). QLEs include major changes like:

- Losing your existing health coverage (due to job loss, turning 26, etc.).

- Moving to Massachusetts or moving within the state.

- Getting married or divorced.

- Having a baby, adopting a child, or placing a child for foster care.

- Experiencing certain changes in income or household status that affect eligibility for subsidies.

Exploring Your Options: Plans and Subsidies

When you start shopping, you'll encounter various types of plans, typically offered by major insurers in the state. The plans are categorized by "metal tiers," which are designed to help you compare costs and coverage levels easily.

The Different Metal Tiers Explained

The metal tiers reflect the split between the average share of costs the insurance company pays versus what you pay (through deductibles, copays, and coinsurance). Here's the breakdown:

- Bronze: Low monthly premiums, but high costs when you need care (you pay about 40% of costs, on average). Best for those who rarely visit the doctor.

- Silver: Moderate premiums and moderate costs when you receive care (you pay about 30% of costs). These plans are crucial because they are the only plans eligible for cost-sharing reductions (CSRs).

- Gold: High monthly premiums, but lower costs when you need care (you pay about 20% of costs). Good for those who expect frequent medical needs.

- Platinum: Very high premiums, but very low out-of-pocket costs (you pay about 10% of costs). Ideal for individuals with chronic conditions or very predictable, high health care usage.

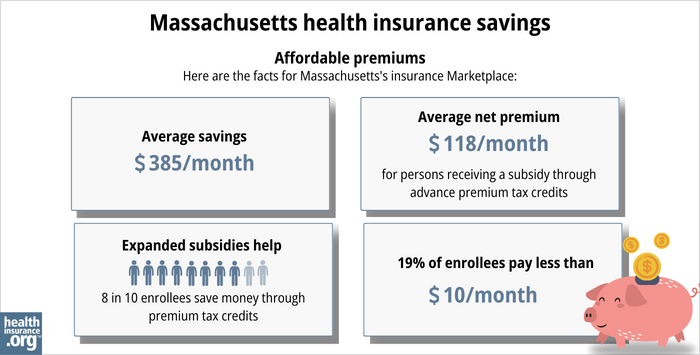

Financial Help: Are You Eligible for Subsidies?

A major benefit of using the Health Connector is the availability of financial assistance, which makes it much easier to afford coverage. When you apply, the system checks you for two main types of subsidies:

- Advanced Premium Tax Credits (APTCs): These are federal tax credits that lower your monthly premium. They are based on your household size and estimated income. You can choose to have these credits paid directly to your insurance company each month, reducing the amount you pay out-of-pocket.

- ConnectorCare Plans (Massachusetts Specific): This program is unique to Massachusetts. If your income falls below a certain threshold (currently 300% of the Federal Poverty Level or FPL), you may qualify for highly subsidized plans. These plans have little to no premiums, low deductibles, and low co-pays, providing comprehensive coverage for a minimal cost.

It's important to provide accurate income estimates during the application process to ensure you receive the correct amount of assistance when determining how to get health insurance in Massachusetts.

Step-by-Step: Navigating the Application Process

Ready to apply? The process on the Health Connector website is designed to be user-friendly, but a little preparation goes a long way. Here is the suggested process to follow:

- Create an Account: Head over to the official Massachusetts Health Connector website and set up your personal account.

- Complete the Application: Fill out the detailed application form. This includes questions about your household, income, tax filing status, and residency.

- Review Results: Once submitted, the system instantly determines your eligibility for MassHealth, ConnectorCare, or commercial plans with APTCs.

- Select a Plan: Compare the plans offered to you based on the metal tier, network (HMO vs. PPO), and out-of-pocket costs.

- Finalize Enrollment: Choose your plan, select your preferred payment method, and complete the sign-up process.

Remember, if you are unsure about any steps, the Health Connector provides certified navigators who can help you apply for free, either over the phone or in person.

Gathering Your Documentation

To ensure a smooth application, have these documents or pieces of information ready before you start. This speeds up the verification process and prevents delays in coverage:

- Social Security Numbers (or document information for legal immigrants).

- Employer and income information for every member of your household (W-2s, pay stubs, 1099s, etc.).

- Proof of Massachusetts residency (utility bills, lease agreements).

- Information about any job-based health insurance available to you or your family, even if you don't plan to enroll in it.

Submitting and Reviewing Your Application

After submission, the Health Connector may need additional documents to verify your eligibility. If they do, they will send you a notice, usually within a few weeks. It is critical that you respond to these requests quickly to finalize your enrollment and avoid losing your calculated subsidies.

Once you are enrolled, be sure to pay your first premium promptly. Your coverage does not officially begin until that first payment is processed by the insurance carrier.

What If You Missed Open Enrollment?

If Open Enrollment has passed and you don't qualify for a Special Enrollment Period, your options become limited. However, there are two important paths to check:

First, if your income is very low, you should apply for MassHealth (Medicaid) at any time of the year. MassHealth enrollment is continuous and not restricted to the OEP.

Second, if you are under age 30, Massachusetts may offer limited catastrophic plans outside of the regular enrollment period, although these typically have high deductibles.

For most people, the simplest solution is to wait for the next OEP unless you experience a qualifying life event. Staying uninsured carries risks, so planning ahead is always best.

Conclusion

Learning how to get health insurance in Massachusetts is straightforward once you know where to look: the Massachusetts Health Connector. Whether you qualify for the robust ConnectorCare program or simply need a competitive private plan, the state offers structured avenues to secure quality coverage.

Don't delay your application, especially if Open Enrollment is underway. By gathering your documents, accurately reporting your income, and understanding the metal tiers, you can confidently choose the best plan for your needs and budget. Good luck on your journey to comprehensive coverage!

Frequently Asked Questions (FAQ)

- What is the difference between the Health Connector and MassHealth?

- The Health Connector is the marketplace where people can purchase subsidized private insurance plans (like ConnectorCare, Silver, Gold, etc.). MassHealth is Massachusetts' Medicaid program, offering free or low-cost coverage to low-income residents, certain disabled individuals, and families.

- Can I enroll in the Health Connector if my employer offers insurance?

- Yes, you can enroll, but you might not qualify for financial help. If your employer's plan is considered "affordable" and provides "minimum essential coverage," you generally cannot receive federal tax credits (APTCs) to purchase a plan through the Connector.

- Do I have to live in Massachusetts to use the Health Connector?

- Yes, you must be a resident of Massachusetts and meet legal immigration/citizenship requirements to use the Health Connector and purchase a plan there.

- How long does it take for my coverage to start?

- During Open Enrollment, coverage typically starts on January 1st if you enroll and pay your first premium by the December deadline. For Special Enrollment Periods, coverage usually begins on the first day of the month following your enrollment and first premium payment.

How To Get Health Insurance In Massachusetts

How To Get Health Insurance In Massachusetts Wallpapers

Collection of how to get health insurance in massachusetts wallpapers for your desktop and mobile devices.

Breathtaking How To Get Health Insurance In Massachusetts Photo Collection

Discover an amazing how to get health insurance in massachusetts background image, ideal for personalizing your devices with vibrant colors and intricate designs.

High-Quality How To Get Health Insurance In Massachusetts Image in 4K

Experience the crisp clarity of this stunning how to get health insurance in massachusetts image, available in high resolution for all your screens.

Gorgeous How To Get Health Insurance In Massachusetts Landscape Nature

Find inspiration with this unique how to get health insurance in massachusetts illustration, crafted to provide a fresh look for your background.

Lush How To Get Health Insurance In Massachusetts Abstract in HD

Find inspiration with this unique how to get health insurance in massachusetts illustration, crafted to provide a fresh look for your background.

Artistic How To Get Health Insurance In Massachusetts Artwork for Mobile

A captivating how to get health insurance in massachusetts scene that brings tranquility and beauty to any device.

Crisp How To Get Health Insurance In Massachusetts Wallpaper Nature

This gorgeous how to get health insurance in massachusetts photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Vibrant How To Get Health Insurance In Massachusetts View for Mobile

Transform your screen with this vivid how to get health insurance in massachusetts artwork, a true masterpiece of digital design.

Detailed How To Get Health Insurance In Massachusetts Background in 4K

Experience the crisp clarity of this stunning how to get health insurance in massachusetts image, available in high resolution for all your screens.

Breathtaking How To Get Health Insurance In Massachusetts Image Photography

Explore this high-quality how to get health insurance in massachusetts image, perfect for enhancing your desktop or mobile wallpaper.

Dynamic How To Get Health Insurance In Massachusetts Image Art

A captivating how to get health insurance in massachusetts scene that brings tranquility and beauty to any device.

Breathtaking How To Get Health Insurance In Massachusetts Moment for Your Screen

Transform your screen with this vivid how to get health insurance in massachusetts artwork, a true masterpiece of digital design.

Dynamic How To Get Health Insurance In Massachusetts View for Your Screen

Find inspiration with this unique how to get health insurance in massachusetts illustration, crafted to provide a fresh look for your background.

Exquisite How To Get Health Insurance In Massachusetts Capture Digital Art

Find inspiration with this unique how to get health insurance in massachusetts illustration, crafted to provide a fresh look for your background.

Vibrant How To Get Health Insurance In Massachusetts Design Concept

Explore this high-quality how to get health insurance in massachusetts image, perfect for enhancing your desktop or mobile wallpaper.

Serene How To Get Health Insurance In Massachusetts Image in HD

Explore this high-quality how to get health insurance in massachusetts image, perfect for enhancing your desktop or mobile wallpaper.

Breathtaking How To Get Health Insurance In Massachusetts Wallpaper Collection

Explore this high-quality how to get health insurance in massachusetts image, perfect for enhancing your desktop or mobile wallpaper.

Dynamic How To Get Health Insurance In Massachusetts Picture Photography

Find inspiration with this unique how to get health insurance in massachusetts illustration, crafted to provide a fresh look for your background.

Exquisite How To Get Health Insurance In Massachusetts Wallpaper Collection

This gorgeous how to get health insurance in massachusetts photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Crisp How To Get Health Insurance In Massachusetts Abstract in HD

Immerse yourself in the stunning details of this beautiful how to get health insurance in massachusetts wallpaper, designed for a captivating visual experience.

Spectacular How To Get Health Insurance In Massachusetts Abstract Photography

Find inspiration with this unique how to get health insurance in massachusetts illustration, crafted to provide a fresh look for your background.

Download these how to get health insurance in massachusetts wallpapers for free and use them on your desktop or mobile devices.

0 Response to "How To Get Health Insurance In Massachusetts"

Post a Comment