Place To Get A Loan With Bad Credit

Place To Get A Loan With Bad Credit: Your Guide to Finding Funding

Having a less-than-perfect credit score can feel like a huge roadblock when you urgently need funding. Maybe you're facing an unexpected emergency, or perhaps you just need to consolidate high-interest debt. The good news is that securing financing is absolutely possible, even if traditional banks have turned you away.

The key is knowing where to look and understanding the specific requirements of lenders who specialize in working with subprime borrowers. Finding the right Place To Get A Loan With Bad Credit involves careful research, but we are here to walk you through the most reliable and accessible options available today.

Understanding Your Options When You Need A Place To Get A Loan With Bad Credit

When searching for a loan with a low credit score, you'll quickly realize that not all lending institutions are created equal. Big national banks often rely strictly on automated systems that instantly disqualify applicants below a certain FICO threshold (usually 670 or higher). However, several types of institutions are specifically designed to offer a lifeline to borrowers who need a second chance.

These specialized lenders understand that a credit report doesn't tell your entire financial story. They often prioritize factors like stable income, employment history, and existing debt load over solely focusing on past financial missteps. This makes them the best starting point when seeking a reliable Place To Get A Loan With Bad Credit.

Online Lenders: Flexibility is Key

For most people needing fast access to funds, online lenders are the most accessible and popular option. These companies often operate with lower overhead than traditional banks, allowing them to take on higher risks and offer products specifically tailored for people with poor credit. They make the application process incredibly streamlined.

Many online platforms specialize in connecting borrowers with a network of lenders. You fill out one application, and the platform sends it to several potential lenders, greatly increasing your chances of finding an offer. This efficiency means you can often get pre-approved within minutes and receive funds within one to three business days.

Here are a few reasons why online lenders are a prime choice:

- They focus on alternative metrics like cash flow and educational background, not just credit scores.

- Applications can be completed 24/7 from the comfort of your home.

- They often provide flexible repayment terms to match your budget.

- Some perform only soft credit checks initially, which doesn't hurt your score.

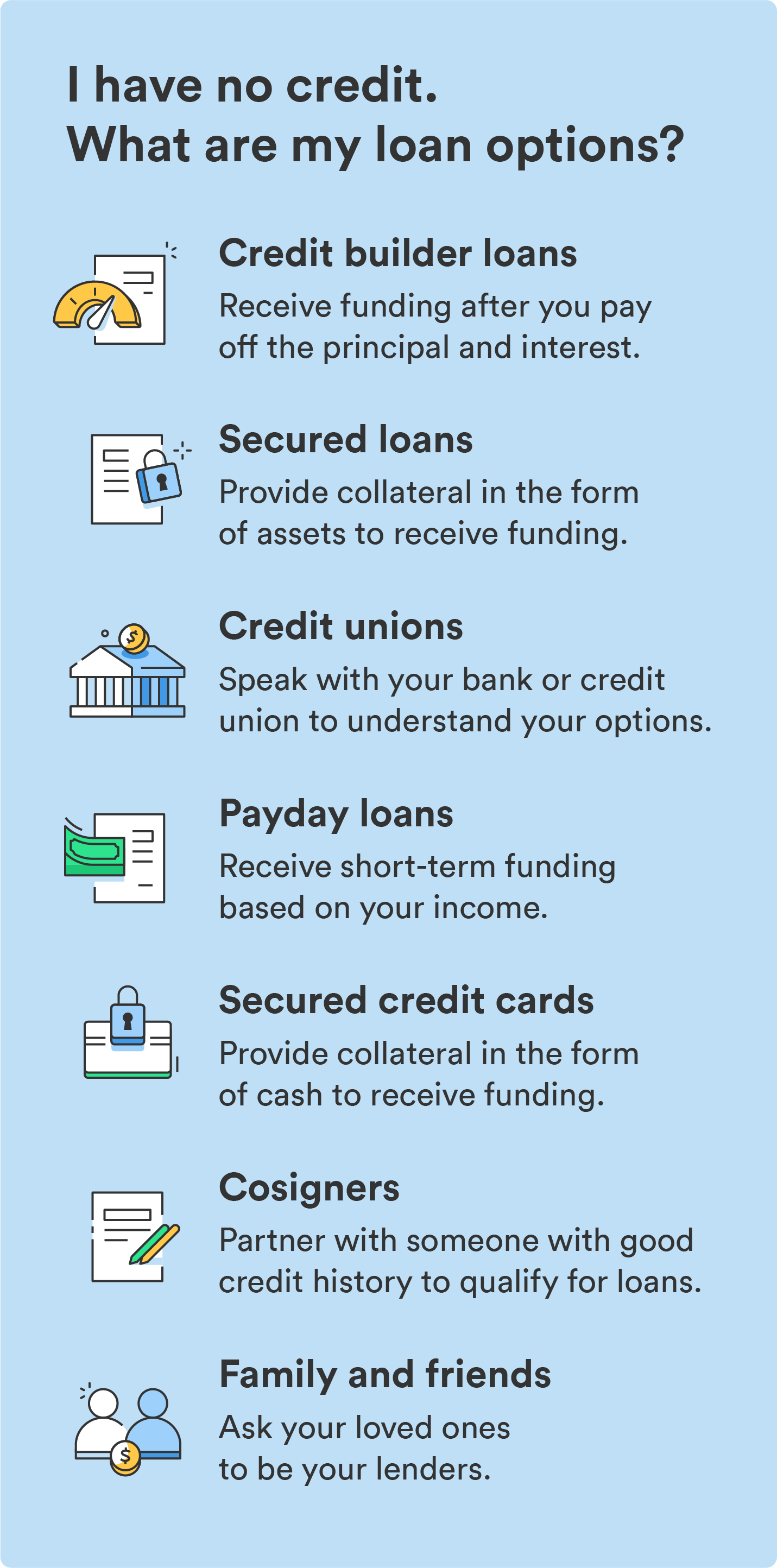

Credit Unions: The Community Approach

Don't overlook credit unions! Unlike profit-driven commercial banks, credit unions are non-profit organizations owned by their members. This difference in philosophy translates into a more personalized and understanding lending approach. If you have a long-standing relationship with a local credit union, this can be a huge advantage.

Credit unions are often more willing to review your overall financial picture—your relationship history, savings, and income—rather than instantly rejecting an application based on a low FICO score. While you must be a member to apply, joining is usually very easy and inexpensive. They may offer "credit-builder" or small personal loans with more favorable rates than those found among some subprime online lenders.

Types of Loans to Consider

When you are looking for a Place To Get A Loan With Bad Credit, the type of loan you choose is just as important as the lender you select. Different loan structures carry different risks and benefits, particularly concerning collateral and interest rates.

Understanding these differences will help you decide which financial product aligns best with your needs and your risk tolerance. Always aim for a product that helps improve your financial health, not one that further exacerbates debt.

Secured Loans vs. Unsecured Loans

This is the fundamental difference in the world of lending. An unsecured loan, like a typical personal loan, requires no collateral. The risk is borne entirely by the lender, which is why these loans often carry higher interest rates when you have bad credit.

A secured loan, conversely, requires you to put up an asset, such as your car or home equity (collateral). If you default on the loan, the lender can seize the asset. While this sounds risky, secured loans usually offer significantly lower interest rates and higher loan amounts because the collateral reduces the lender's risk. If you are comfortable securing an asset, this can be a very affordable Place To Get A Loan With Bad Credit.

Personal Installment Loans

For most consumers with bad credit, the personal installment loan is the most common and manageable option. This loan gives you a lump sum of money upfront, which you then repay over a set period (usually 12 to 60 months) with fixed, predictable monthly payments. This is a much safer option than high-cost payday loans.

Installment loans are transparent regarding interest rates and fees. As long as you make your payments on time, successfully paying off an installment loan is an excellent way to rebuild and improve your credit score for the future. Many online lenders specialize exclusively in offering these installment loans to people who are struggling with their credit history.

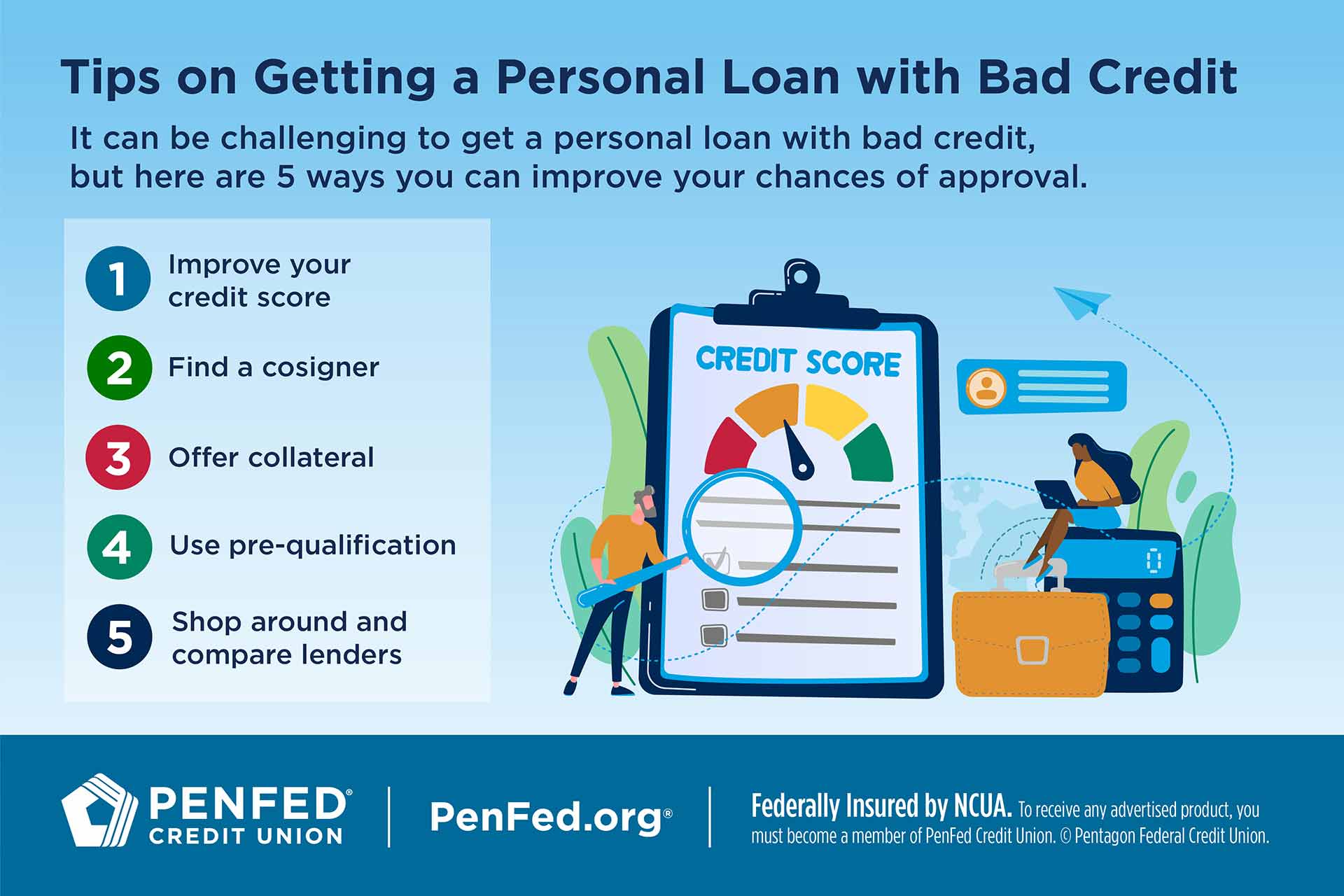

Essential Steps Before Applying

Before you commit to any lender or loan product, it's vital to prepare yourself financially. Preparation not only increases your chances of approval but also ensures you get the best possible terms, saving you money in the long run.

Remember that lenders assess your affordability—they want to be sure you can handle the new monthly payment without difficulty. Taking these proactive steps will show lenders you are a responsible and prepared borrower, despite your past credit issues.

Here are the crucial steps you should take:

- Check Your Credit Report: Get free copies of your credit report from the three major bureaus (Equifax, Experian, TransUnion). Check for errors and dispute any inaccuracies, as fixing mistakes can instantly boost your score.

- Create a Detailed Budget: Know exactly how much you can afford to pay each month. Do not borrow more than you absolutely need, and make sure the monthly payment fits comfortably within your budget.

- Gather Documentation: Lenders for bad credit often require proof of income (pay stubs, tax returns), ID, and residency. Having these documents ready speeds up the application and verification process.

- Get a Co-signer (If Possible): Applying with a creditworthy co-signer dramatically reduces the risk for the lender. This can lower your interest rate significantly, making the loan much more affordable.

By following these steps, you demonstrate financial readiness, which makes any Place To Get A Loan With Bad Credit much more willing to work with you.

Conclusion

The journey to find a Place To Get A Loan With Bad Credit doesn't have to be frustrating. While you may not qualify for the lowest rates available to those with prime credit, reliable options exist through specialized online lenders and local credit unions. Focus on personal installment loans for their manageable structure, and consider secured loans if you need a better rate and have collateral.

Always prioritize transparency, read the fine print regarding APR and fees, and only borrow what you can comfortably repay. By being diligent and utilizing the resources mentioned above, you can successfully secure the financing you need and take a major step toward rebuilding your financial health.

Frequently Asked Questions (FAQ)

- Can I get a loan with a credit score below 580?

- Yes, it is possible. Many lenders, particularly online lenders specializing in subprime loans, offer financing for scores as low as 500. However, expect interest rates (APR) to be quite high to offset the lender's risk.

- Is "guaranteed approval" for a loan with bad credit realistic?

- No. Legitimate lenders cannot guarantee approval without first reviewing your application, income, and financial ability to repay the loan. Be extremely wary of any lender promising "guaranteed approval," as this is often a sign of predatory lending or scams.

- Will applying for a loan hurt my credit score?

- When you submit a full application that requires the lender to finalize terms, they usually perform a "hard inquiry," which can temporarily drop your score by a few points. However, initial pre-qualification checks often use "soft inquiries," which do not affect your credit score.

- What is the maximum interest rate I might face?

- For consumers with very poor credit, APRs on unsecured personal loans can range anywhere from 20% up to 36%. Rates above 36% are generally considered predatory and should be avoided. Always compare offers carefully.

Place To Get A Loan With Bad Credit

Place To Get A Loan With Bad Credit Wallpapers

Collection of place to get a loan with bad credit wallpapers for your desktop and mobile devices.

Amazing Place To Get A Loan With Bad Credit Scene for Mobile

Experience the crisp clarity of this stunning place to get a loan with bad credit image, available in high resolution for all your screens.

Gorgeous Place To Get A Loan With Bad Credit Photo for Your Screen

A captivating place to get a loan with bad credit scene that brings tranquility and beauty to any device.

Amazing Place To Get A Loan With Bad Credit View Collection

Transform your screen with this vivid place to get a loan with bad credit artwork, a true masterpiece of digital design.

Stunning Place To Get A Loan With Bad Credit View Photography

Immerse yourself in the stunning details of this beautiful place to get a loan with bad credit wallpaper, designed for a captivating visual experience.

Beautiful Place To Get A Loan With Bad Credit Landscape Concept

Explore this high-quality place to get a loan with bad credit image, perfect for enhancing your desktop or mobile wallpaper.

Artistic Place To Get A Loan With Bad Credit View Nature

This gorgeous place to get a loan with bad credit photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Stunning Place To Get A Loan With Bad Credit Moment Art

Find inspiration with this unique place to get a loan with bad credit illustration, crafted to provide a fresh look for your background.

Beautiful Place To Get A Loan With Bad Credit Background Photography

Explore this high-quality place to get a loan with bad credit image, perfect for enhancing your desktop or mobile wallpaper.

Breathtaking Place To Get A Loan With Bad Credit Scene Collection

Explore this high-quality place to get a loan with bad credit image, perfect for enhancing your desktop or mobile wallpaper.

High-Quality Place To Get A Loan With Bad Credit Background Nature

Experience the crisp clarity of this stunning place to get a loan with bad credit image, available in high resolution for all your screens.

Dynamic Place To Get A Loan With Bad Credit Capture for Mobile

Find inspiration with this unique place to get a loan with bad credit illustration, crafted to provide a fresh look for your background.

Lush Place To Get A Loan With Bad Credit Scene Art

Find inspiration with this unique place to get a loan with bad credit illustration, crafted to provide a fresh look for your background.

Vivid Place To Get A Loan With Bad Credit Abstract Collection

Explore this high-quality place to get a loan with bad credit image, perfect for enhancing your desktop or mobile wallpaper.

Captivating Place To Get A Loan With Bad Credit Wallpaper Nature

A captivating place to get a loan with bad credit scene that brings tranquility and beauty to any device.

Vibrant Place To Get A Loan With Bad Credit Photo Illustration

Discover an amazing place to get a loan with bad credit background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Crisp Place To Get A Loan With Bad Credit Scene Concept

A captivating place to get a loan with bad credit scene that brings tranquility and beauty to any device.

Stunning Place To Get A Loan With Bad Credit Wallpaper for Your Screen

Immerse yourself in the stunning details of this beautiful place to get a loan with bad credit wallpaper, designed for a captivating visual experience.

Stunning Place To Get A Loan With Bad Credit Scene for Desktop

Immerse yourself in the stunning details of this beautiful place to get a loan with bad credit wallpaper, designed for a captivating visual experience.

High-Quality Place To Get A Loan With Bad Credit Wallpaper Digital Art

Experience the crisp clarity of this stunning place to get a loan with bad credit image, available in high resolution for all your screens.

Stunning Place To Get A Loan With Bad Credit Abstract Photography

Find inspiration with this unique place to get a loan with bad credit illustration, crafted to provide a fresh look for your background.

Download these place to get a loan with bad credit wallpapers for free and use them on your desktop or mobile devices.

0 Response to "Place To Get A Loan With Bad Credit"

Post a Comment