Free Credit Report How To Get

Free Credit Report How To Get: Your Ultimate Guide to Financial Transparency

Are you ready to take control of your financial future? Understanding your credit history is the single best starting point. If you've been asking yourself, "How can I get my Free Credit Report How To Get the most accurate information?" you're in the right place. Thankfully, getting access to this crucial data is not only possible, but it's a right guaranteed by law.

Many people delay checking their reports because they fear the process will be complicated or costly. We're here to show you exactly how easy it is to pull your report for free, why it matters so much, and what you should do once you have it in your hands. Let's dive in!

Why You Need a Free Credit Report Right Now

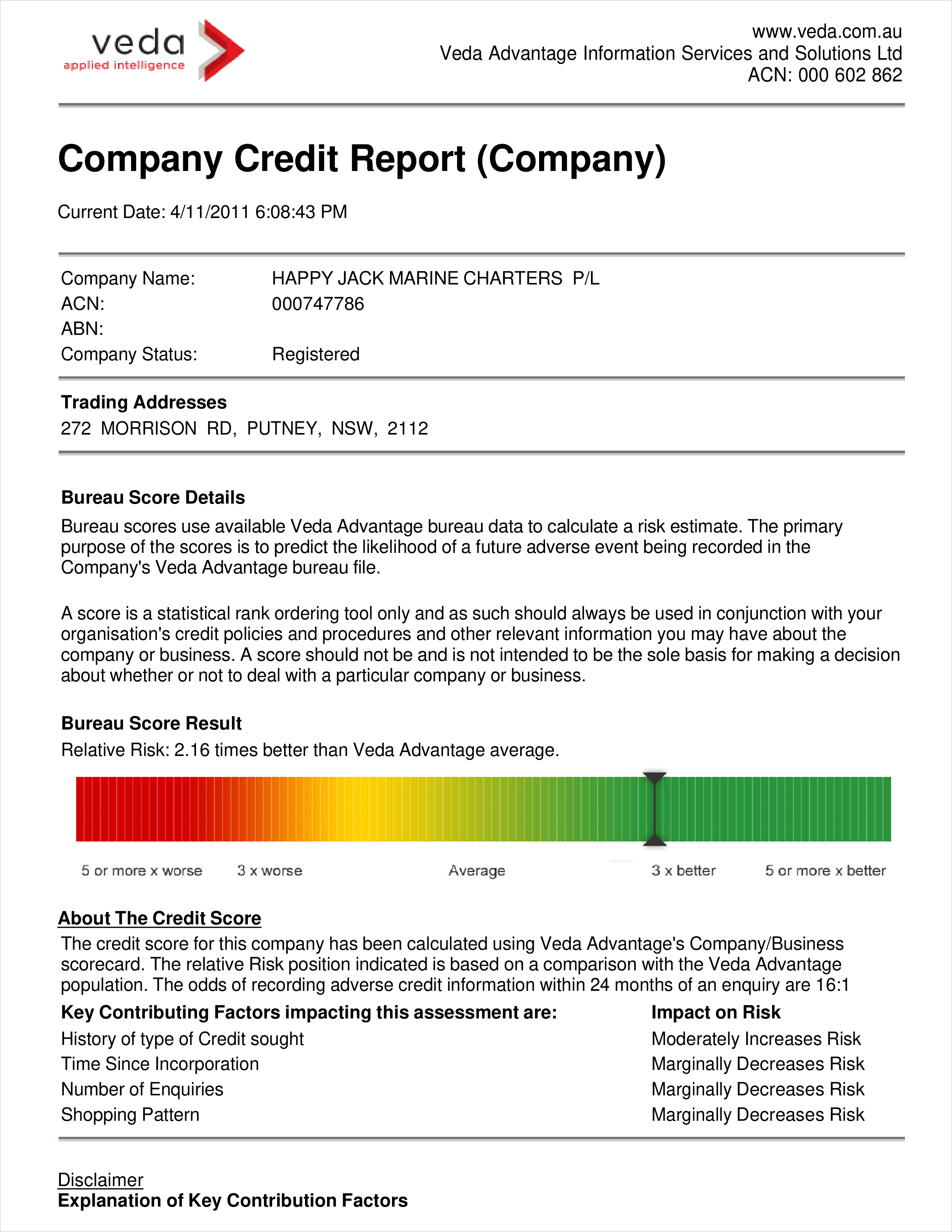

Your credit report is more than just a list of debts; it's a detailed financial résumé that lenders, landlords, and even potential employers use to evaluate your reliability. Checking your report regularly is a proactive step that can save you thousands of dollars and countless headaches.

First and foremost, checking your report helps you spot errors. About 1 in 5 consumers have errors on their reports that could negatively affect their credit scores. Finding and correcting these mistakes is essential before applying for a major loan, like a mortgage or car loan.

Secondly, your report is your first line of defense against identity theft. If you notice unfamiliar accounts or unauthorized inquiries, it's a strong signal that someone else may be using your personal information. Regular reviews allow you to catch fraud early.

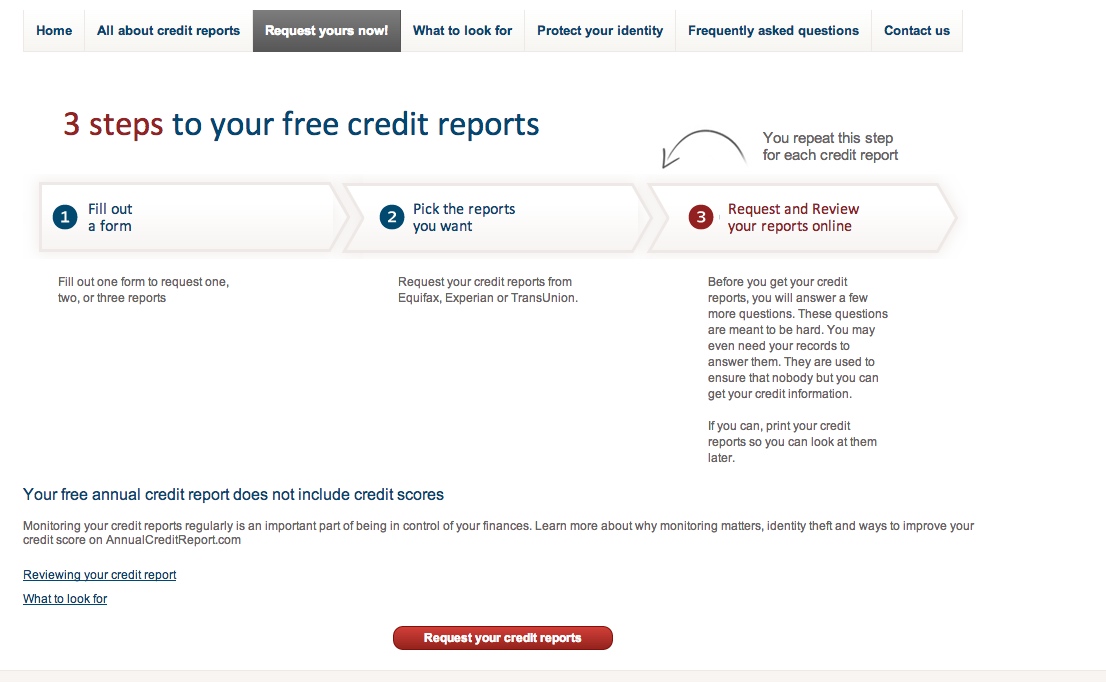

The Official Way: Getting Your Free Credit Report How To Get Started

When seeking the definitive method for a Free Credit Report How To Get the official version, there is one primary source authorized by the government: AnnualCreditReport.com. This website is the only one guaranteed to provide reports from all three major bureaus without cost.

You might see other services offering "free reports," but those often require subscriptions or only provide a credit score, not the full underlying report. To get the most complete, accurate, and legally mandated free report, the official site is your best bet.

Understanding the Annual Credit Report Act

The Fair Credit Reporting Act (FCRA) mandates that the three nationwide credit reporting agencies—Equifax, Experian, and TransUnion—must provide you with access to your credit report once every 12 months, completely free of charge. This is your right!

During the COVID-19 pandemic, the bureaus offered weekly free reports, a fantastic measure that allowed consumers to monitor their finances closely. While this weekly access may change over time, you are always entitled to at least one free report from each bureau annually.

Step-by-Step Guide to Requesting Your Report

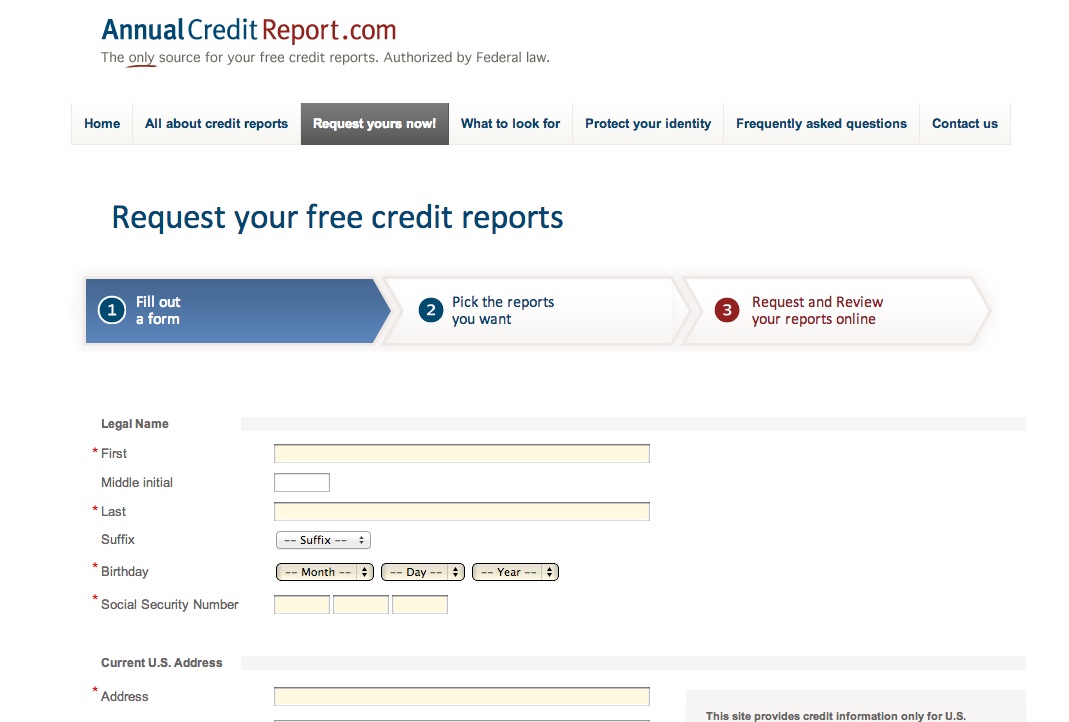

The process is straightforward and can be completed online in minutes. Make sure you have access to a secure connection and be ready to answer some personal verification questions.

- Visit the official site: Navigate directly to AnnualCreditReport.com.

- Request your reports: Click the button to request your free reports. You can choose to pull all three reports at once, or stagger them throughout the year (e.g., pull one every four months) for continuous monitoring.

- Provide verification: You will be asked for your name, address, Social Security number, and date of birth. This information is necessary to locate your file.

- Answer security questions: The site will ask you knowledge-based verification questions about accounts you have or recently had (e.g., "Which of the following addresses have you previously lived at?").

- View and save: Once verified, your reports will be displayed instantly. Download and save a copy of each report securely on your computer or print a physical copy for your records.

Remember that AnnualCreditReport.com will only provide the report itself. If you want your FICO score, you will typically need to pay a small fee or obtain it through a secondary service.

Alternative and Secondary Sources for Free Reports

While the official site guarantees access to the full report, there are other convenient methods to monitor your credit health throughout the year. These tools provide supplementary information and scores, helping you keep tabs on changes between your annual full pulls.

When exploring alternatives for your Free Credit Report How To Get routine, understand that these methods often focus on credit monitoring and scores rather than the comprehensive report itself, but they are incredibly useful for staying current.

Using Credit Monitoring Services (The Catch)

Many third-party sites offer continuous free credit monitoring. Companies like Credit Karma, Credit Sesame, and bank-provided services are popular because they are free and accessible. However, there's a key distinction you must understand.

These services often provide a VantageScore, which is a different scoring model than the FICO score most lenders use. Furthermore, while they show detailed information about your accounts, they may not show the official, raw data format of the mandated credit report.

They are excellent tools for real-time alerts and score estimates, but they should be used in conjunction with your annual pulls from AnnualCreditReport.com, not as a replacement.

When Else Can You Get a Free Report? (Special Circumstances)

The law provides additional rights to receive free reports outside of the annual cycle if certain events occur. This means you might qualify for extra reports at no cost if you fall into one of these categories:

- You have been denied credit, insurance, or employment based on information in your credit file (you must request the report within 60 days of the adverse action).

- You are receiving public assistance or are unemployed and plan to seek employment within 60 days.

- You believe your file contains inaccuracies due to fraud or identity theft, and you have placed a fraud alert on your file.

- You live in a state that mandates more frequent free reports (e.g., Georgia, Colorado, and Massachusetts offer two per year).

How to Read and Dispute Errors on Your Report

Obtaining the report is only half the battle. Once you have your documents, you need to understand what you're looking at and know how to fix any potential problems.

Take your time and analyze each report individually, as the information may differ slightly between Equifax, Experian, and TransUnion. This careful review process is crucial for maximizing the benefit of your Free Credit Report How To Get exercise.

Key Sections to Look Out For

When reviewing your credit report, pay close attention to the following areas:

- Personal Information: Verify your name, current and previous addresses, and Social Security number. Any variation could signal misuse.

- Account History (Trade Lines): Ensure every account listed belongs to you, and check the status (e.g., "Closed," "Open," "Charged Off"). Verify the last payment date and the credit limits are correct.

- Inquiries: Look for hard inquiries, which occur when you apply for credit. Too many hard inquiries in a short period can hurt your score. Soft inquiries (like checking your own report) do not affect your score.

- Public Records and Collections: This section lists bankruptcies, foreclosures, or serious collections. Ensure these are accurate and have the correct dates of occurrence and removal.

The Dispute Process: Fixing Mistakes

If you find an error, you must dispute it directly with the credit reporting agency (CRA) that listed the inaccuracy. You can generally start the dispute online, but many experts recommend following up with certified mail for documentation purposes.

The CRA is required by law to investigate the disputed item, typically within 30 days of receiving your complaint. They must forward all relevant data you provide to the creditor (the information furnisher). If the information cannot be verified, the item must be removed from your report.

Be prepared to provide documentation, such as account statements or proof of payment, to support your claim. Patience is key, as the dispute process sometimes takes a few weeks to finalize.

Conclusion: Mastering Your Financial Health

Understanding the essential steps to obtaining a Free Credit Report How To Get access to this vital data is your first major leap toward financial mastery. By utilizing the official resource, AnnualCreditReport.com, and understanding your rights under the FCRA, you are empowered to monitor, protect, and improve your financial standing without incurring costs.

Make checking your reports a routine practice. Whether you pull all three once per year or stagger them quarterly, consistent monitoring is the best way to guard against identity theft and ensure your credit history accurately reflects your responsibility. Don't wait—get your free report today!

Frequently Asked Questions (FAQ)

- What is the difference between a credit report and a credit score?

- The credit report is the comprehensive document detailing your borrowing history, payment behavior, and current debt. The credit score (like FICO or VantageScore) is a three-digit number derived from the data in that report, used by lenders to quickly gauge risk.

- Does checking my own free credit report lower my score?

- No. When you check your own report, this results in a "soft inquiry," which does not affect your credit score. Only "hard inquiries," which occur when you apply for new credit, can slightly lower your score.

- Can I get a free credit report by mail?

- Yes. While requesting online is the fastest method, you can also download and print a request form from AnnualCreditReport.com and mail it to the central processing center. Alternatively, you can call 1-877-322-8228 to request your reports.

- What if the credit bureau doesn't remove an error?

- If the credit bureau verifies the inaccurate information but you still believe it's wrong, you have the right to add a brief statement of dispute (100 words or less) to your credit report file. You can also escalate the issue by submitting a complaint to the Consumer Financial Protection Bureau (CFPB).

Free Credit Report How To Get

Free Credit Report How To Get Wallpapers

Collection of free credit report how to get wallpapers for your desktop and mobile devices.

Vivid Free Credit Report How To Get Image Digital Art

Transform your screen with this vivid free credit report how to get artwork, a true masterpiece of digital design.

Vivid Free Credit Report How To Get Picture Digital Art

Discover an amazing free credit report how to get background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Captivating Free Credit Report How To Get Moment for Desktop

Immerse yourself in the stunning details of this beautiful free credit report how to get wallpaper, designed for a captivating visual experience.

Captivating Free Credit Report How To Get Capture Collection

A captivating free credit report how to get scene that brings tranquility and beauty to any device.

Dynamic Free Credit Report How To Get Capture Collection

This gorgeous free credit report how to get photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Gorgeous Free Credit Report How To Get Background Concept

Immerse yourself in the stunning details of this beautiful free credit report how to get wallpaper, designed for a captivating visual experience.

Artistic Free Credit Report How To Get Artwork for Your Screen

Find inspiration with this unique free credit report how to get illustration, crafted to provide a fresh look for your background.

Gorgeous Free Credit Report How To Get Abstract Concept

Immerse yourself in the stunning details of this beautiful free credit report how to get wallpaper, designed for a captivating visual experience.

Exquisite Free Credit Report How To Get Picture Digital Art

This gorgeous free credit report how to get photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Gorgeous Free Credit Report How To Get Scene Concept

Find inspiration with this unique free credit report how to get illustration, crafted to provide a fresh look for your background.

Amazing Free Credit Report How To Get Image Collection

Experience the crisp clarity of this stunning free credit report how to get image, available in high resolution for all your screens.

Captivating Free Credit Report How To Get Capture in 4K

A captivating free credit report how to get scene that brings tranquility and beauty to any device.

High-Quality Free Credit Report How To Get Image for Your Screen

Transform your screen with this vivid free credit report how to get artwork, a true masterpiece of digital design.

Mesmerizing Free Credit Report How To Get Moment Collection

Explore this high-quality free credit report how to get image, perfect for enhancing your desktop or mobile wallpaper.

Stunning Free Credit Report How To Get Artwork Art

Immerse yourself in the stunning details of this beautiful free credit report how to get wallpaper, designed for a captivating visual experience.

Vivid Free Credit Report How To Get Picture Collection

Discover an amazing free credit report how to get background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Captivating Free Credit Report How To Get Moment in 4K

Immerse yourself in the stunning details of this beautiful free credit report how to get wallpaper, designed for a captivating visual experience.

Captivating Free Credit Report How To Get Design Digital Art

Immerse yourself in the stunning details of this beautiful free credit report how to get wallpaper, designed for a captivating visual experience.

Breathtaking Free Credit Report How To Get Design for Your Screen

Transform your screen with this vivid free credit report how to get artwork, a true masterpiece of digital design.

Exquisite Free Credit Report How To Get Image in HD

A captivating free credit report how to get scene that brings tranquility and beauty to any device.

Download these free credit report how to get wallpapers for free and use them on your desktop or mobile devices.

0 Response to "Free Credit Report How To Get"

Post a Comment