Get Credit Report From All 3 Bureaus

Get Credit Report From All 3 Bureaus: Your Complete Guide

Taking control of your financial life starts with understanding your credit profile. But here's a crucial piece of advice: simply checking one credit report isn't enough. To truly safeguard your financial health and ensure accuracy, you need to know how to Get Credit Report From All 3 Bureaus—Experian, Equifax, and TransUnion.

This comprehensive guide will walk you through the simplest, most legitimate methods to access your reports, explain why checking all three is non-negotiable, and show you exactly what to look for when you finally open those documents. Let's dive in and demystify the process!

Why Checking All 3 Bureaus Matters

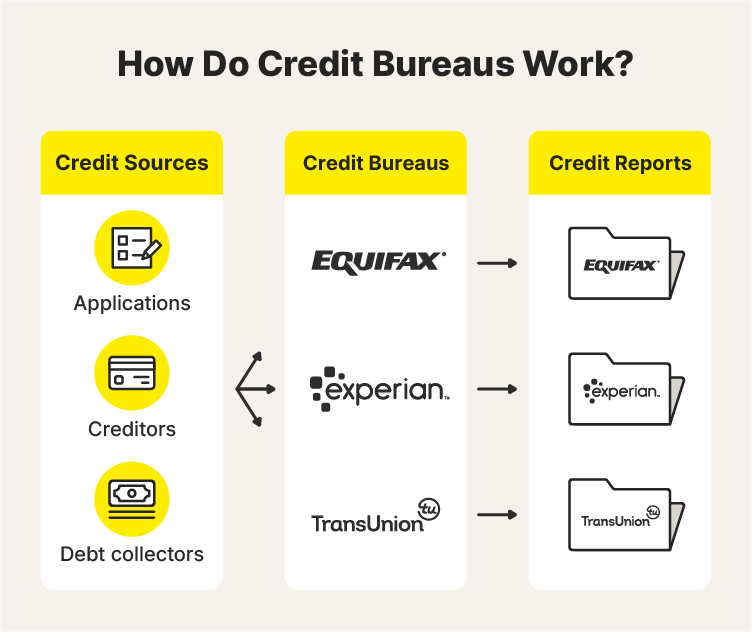

You might assume that if your credit score is good with one bureau, it will be the same across the board. Unfortunately, that's often not the case. Credit reporting agencies rely on creditors and lenders to submit data, and sometimes, those lenders don't report to all three agencies simultaneously—or they may make reporting errors.

This inconsistency means that a significant negative item—like a late payment or a collection account—might appear on your Experian report but be missing entirely from your TransUnion report, or vice versa. If a potential lender pulls only the report missing the negative information, you might receive a different interest rate or loan terms than if they pulled the full picture.

Furthermore, checking all three is your best defense against identity theft. If a fraudulent account is opened in your name, it might only show up on one bureau initially. Regularly monitoring all three helps you spot and stop identity theft much faster.

The Big Three: Who Are They?

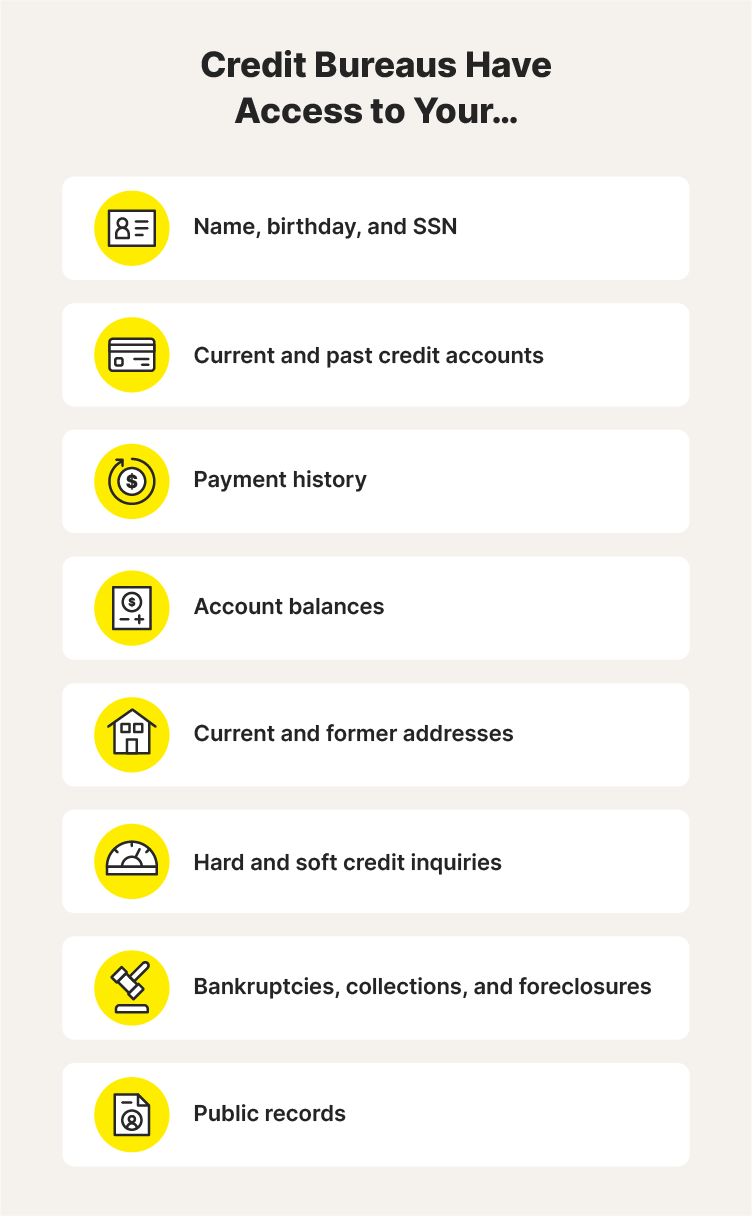

The three major nationwide Consumer Reporting Agencies (CRAs) are massive, multinational companies that collect and aggregate data about how you use credit. Understanding their specific roles is the first step in mastering your financial data:

- Experian: Often known for its detailed credit educational tools and identity theft protection services.

- Equifax: This bureau is one of the oldest and provides comprehensive data reporting used heavily in mortgage lending.

- TransUnion: Frequently used for consumer reports beyond just credit, such as rental background checks and insurance quotes.

While they all perform the same essential function—collecting data—the resulting reports and scores can differ based on which lenders choose to report to them, and which scoring models (like FICO or VantageScore) are used for calculation.

The Easiest Way to Get Your Reports for Free

When you are ready to Get Credit Report From All 3 Bureaus, the federal government has made the process straightforward and free. You should always use the official, federally mandated source.

That source is AnnualCreditReport.com. This is the only authorized website for obtaining your free reports mandated by the Fair Credit Reporting Act (FCRA). Beware of other websites that promise free reports but sneakily enroll you in paid monitoring services.

Understanding Your Annual Free Report Right

Under normal circumstances, the FCRA entitles every consumer to one free copy of their credit report from each of the three nationwide credit reporting agencies every 12 months. However, due to the COVID-19 pandemic, all three bureaus offered weekly free reports through AnnualCreditReport.com for a long period.

While the weekly free access has been a huge benefit, the standard requirement is annual access. Savvy consumers often use this right strategically: instead of pulling all three reports at once, they might pull one report every four months (e.g., Experian in January, Equifax in May, and TransUnion in September) to maintain year-round monitoring.

What to Do If You've Used Your Free Report

If you have already used your free annual reports, don't panic. There are several other scenarios where you are legally entitled to receive another free report:

- Adverse Action: If you are denied credit, insurance, or employment based on information in your credit report, the lender must notify you. You are entitled to a free report from the bureau they used within 60 days of that action.

- Unemployment Status: If you are unemployed and plan to seek employment within 60 days.

- Fraud Alert: If you have placed a fraud alert on your file due to identity theft or suspect fraud.

- State Requirements: Some states (like Colorado, Georgia, Maine, and Massachusetts) have laws that require credit bureaus to provide additional free reports each year.

- Purchasing Directly: If none of the above apply, you can purchase a copy of your report directly from each bureau for a small statutory fee, usually under $15.

Decoding Your Reports: What to Look For

Once you successfully Get Credit Report From All 3 Bureaus, the real work begins: analysis. Credit reports can be dense, but they generally contain five major sections you must scrutinize. Checking these reports isn't just a compliance exercise; it's quality control for your financial reputation.

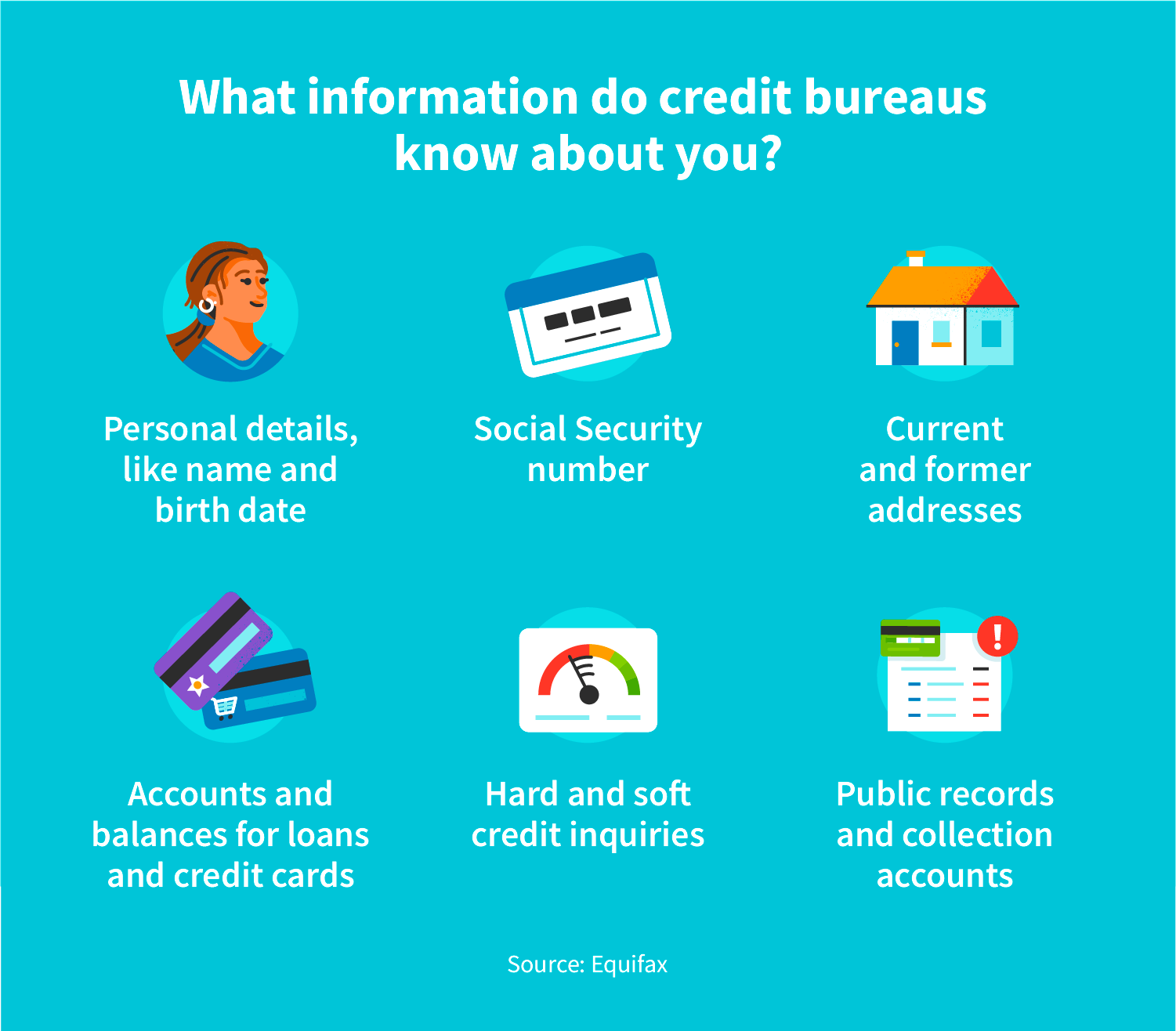

Start by verifying your personal information. Does your name, current and previous addresses, Social Security number, and employment history match up? Small errors here can sometimes lead to your file being merged with someone else's.

Common Errors and How to Spot Them

The primary goal of reviewing all three reports is to identify errors that might be dragging down your score unfairly. Be meticulous when reviewing the accounts section and public records. Look for discrepancies between the three reports.

These are the most common mistakes that harm consumers:

- Incorrect Account Status: Accounts that were paid in full still marked as outstanding, or accounts that were closed by you being marked as closed by the creditor.

- Mistaken Identity: Accounts that do not belong to you appearing on your report, often stemming from identity theft or similar names.

- Data Furnishing Errors: Late payments incorrectly reported, or the date of last activity (DOA) being wrong, which affects how long negative items remain on your report (usually 7 years).

- Duplicate Accounts (Tradelines): The same debt is being reported twice, perhaps by the original creditor and a collection agency.

- Outdated Information: Negative information remaining on your report beyond the legal maximum reporting period (typically seven years for most negative items).

The Dispute Process Explained

If you find an error, you have the right to dispute it. The dispute process is handled directly through the credit bureau where the error appears. You can typically file a dispute online, by mail, or over the phone.

When disputing, you must clearly identify the mistake and provide documentation proving your claim. The bureau is legally required to investigate the disputed item, usually within 30 days. If the furnisher of the information cannot verify the data, the item must be removed from your credit file.

Remember, if the same error appears on all three reports (which is rare but possible), you must file a separate dispute with Experian, Equifax, and TransUnion. They do not share dispute results with one another.

Conclusion: Stay Vigilant and Informed

Understanding how to Get Credit Report From All 3 Bureaus is an essential step toward financial maturity. By checking Experian, Equifax, and TransUnion regularly—and certainly before making a major purchase like a home or car—you ensure that lenders are receiving an accurate, favorable view of your creditworthiness.

Don't let errors or inconsistencies cost you money in higher interest rates. Use the free tools available to you, remain vigilant in checking for mistakes, and be proactive in disputing any misinformation. Your credit profile is one of your most valuable financial assets; treat it that way!

Frequently Asked Questions (FAQ) About Credit Reports

- Can I Get My Credit Score When I Get Credit Report From All 3 Bureaus?

- When you access your reports through AnnualCreditReport.com, you receive the *report* itself, but typically not your FICO or VantageScore. Scores are considered a separate product. However, many credit card companies and banks now offer free monthly score updates.

- How often should I check all three credit reports?

- While the official annual right is the minimum, monitoring your credit reports regularly is highly recommended. Many experts suggest pulling one bureau's report every four months to maintain year-round coverage. If you are preparing for a major loan application, check all three reports 60–90 days beforehand.

- What is the difference between a credit report and a credit score?

- A credit report is a detailed record of your credit history—it lists all your accounts, payment history, public records, and inquiries. A credit score (like FICO) is a three-digit number calculated based on the data within that report, meant to predict the likelihood of you paying back debt.

- Is it safe to use AnnualCreditReport.com?

- Yes, it is the only authorized site established by federal law (FCRA) to provide consumers with their free annual credit reports. The site uses advanced security measures to protect your personal information.

Get Credit Report From All 3 Bureaus

Get Credit Report From All 3 Bureaus Wallpapers

Collection of get credit report from all 3 bureaus wallpapers for your desktop and mobile devices.

Exquisite Get Credit Report From All 3 Bureaus Wallpaper in 4K

Immerse yourself in the stunning details of this beautiful get credit report from all 3 bureaus wallpaper, designed for a captivating visual experience.

Mesmerizing Get Credit Report From All 3 Bureaus Landscape Illustration

Transform your screen with this vivid get credit report from all 3 bureaus artwork, a true masterpiece of digital design.

High-Quality Get Credit Report From All 3 Bureaus Capture Illustration

Transform your screen with this vivid get credit report from all 3 bureaus artwork, a true masterpiece of digital design.

Serene Get Credit Report From All 3 Bureaus Moment Digital Art

Experience the crisp clarity of this stunning get credit report from all 3 bureaus image, available in high resolution for all your screens.

Mesmerizing Get Credit Report From All 3 Bureaus Scene in 4K

Transform your screen with this vivid get credit report from all 3 bureaus artwork, a true masterpiece of digital design.

Vibrant Get Credit Report From All 3 Bureaus Artwork in HD

Transform your screen with this vivid get credit report from all 3 bureaus artwork, a true masterpiece of digital design.

Stunning Get Credit Report From All 3 Bureaus Landscape for Desktop

Find inspiration with this unique get credit report from all 3 bureaus illustration, crafted to provide a fresh look for your background.

Dynamic Get Credit Report From All 3 Bureaus Capture Illustration

Find inspiration with this unique get credit report from all 3 bureaus illustration, crafted to provide a fresh look for your background.

Lush Get Credit Report From All 3 Bureaus Moment Nature

Immerse yourself in the stunning details of this beautiful get credit report from all 3 bureaus wallpaper, designed for a captivating visual experience.

Beautiful Get Credit Report From All 3 Bureaus Artwork Photography

Transform your screen with this vivid get credit report from all 3 bureaus artwork, a true masterpiece of digital design.

Gorgeous Get Credit Report From All 3 Bureaus Picture Photography

A captivating get credit report from all 3 bureaus scene that brings tranquility and beauty to any device.

Beautiful Get Credit Report From All 3 Bureaus Capture Illustration

Discover an amazing get credit report from all 3 bureaus background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Detailed Get Credit Report From All 3 Bureaus Artwork Art

Transform your screen with this vivid get credit report from all 3 bureaus artwork, a true masterpiece of digital design.

Crisp Get Credit Report From All 3 Bureaus Capture Illustration

This gorgeous get credit report from all 3 bureaus photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

:max_bytes(150000):strip_icc()/credit-report-157681670-5b217f52ba61770037273880.jpg)

Detailed Get Credit Report From All 3 Bureaus Moment Digital Art

Transform your screen with this vivid get credit report from all 3 bureaus artwork, a true masterpiece of digital design.

Crisp Get Credit Report From All 3 Bureaus Wallpaper Digital Art

This gorgeous get credit report from all 3 bureaus photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Vibrant Get Credit Report From All 3 Bureaus Landscape Illustration

Transform your screen with this vivid get credit report from all 3 bureaus artwork, a true masterpiece of digital design.

Breathtaking Get Credit Report From All 3 Bureaus Image Collection

Transform your screen with this vivid get credit report from all 3 bureaus artwork, a true masterpiece of digital design.

Breathtaking Get Credit Report From All 3 Bureaus Scene Collection

Discover an amazing get credit report from all 3 bureaus background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Detailed Get Credit Report From All 3 Bureaus Scene Nature

Experience the crisp clarity of this stunning get credit report from all 3 bureaus image, available in high resolution for all your screens.

Download these get credit report from all 3 bureaus wallpapers for free and use them on your desktop or mobile devices.

0 Response to "Get Credit Report From All 3 Bureaus"

Post a Comment