Get Extension On Taxes

Get Extension On Taxes: A Stress-Free Guide to Filing Later

Tax deadlines loom large, often causing unnecessary stress and panic. If you are feeling the pressure and know you won't be able to submit your return on time, take a deep breath. The IRS is prepared for situations just like yours, and the option to Get Extension On Taxes is readily available.

Filing an extension is a completely standard procedure. It grants you crucial extra time to gather all your necessary documents, accurately report your income, and ensure you are claiming all eligible deductions and credits.

This comprehensive guide will walk you through everything you need to know about how to officially Get Extension On Taxes, what the deadlines mean, and how to avoid potential pitfalls.

Why You Might Need to Get Extension On Taxes

Life happens. Sometimes, despite our best intentions, the annual tax filing deadline sneaks up on us, or unexpected circumstances prevent us from focusing on complex financial paperwork. Recognizing when you need more time is the first step toward smart tax planning.

The penalty for filing late is often significantly higher than the penalty for not paying your tax liability on time—especially if you file late without having requested an extension first. If you anticipate any delay in finalizing your return, requesting an extension is always the safest course of action.

Common Reasons for Delay

There are many valid reasons why you might not meet the April deadline. The key is communicating this to the IRS before the deadline passes. Here are a few common scenarios that lead taxpayers to Get Extension On Taxes:

- You are waiting for late or corrected tax documents (like 1099s or K-1s) that you haven't received yet.

- You have complex financial situations, such as investments, business transactions, or international income, requiring more detailed review.

- A major life event occurred—such as a death in the family, relocation, or a serious illness—that has disrupted your time.

- You are currently traveling internationally or serving abroad and cannot easily access necessary financial records.

- Your tax professional is overwhelmed with clients and needs more time to properly prepare your return.

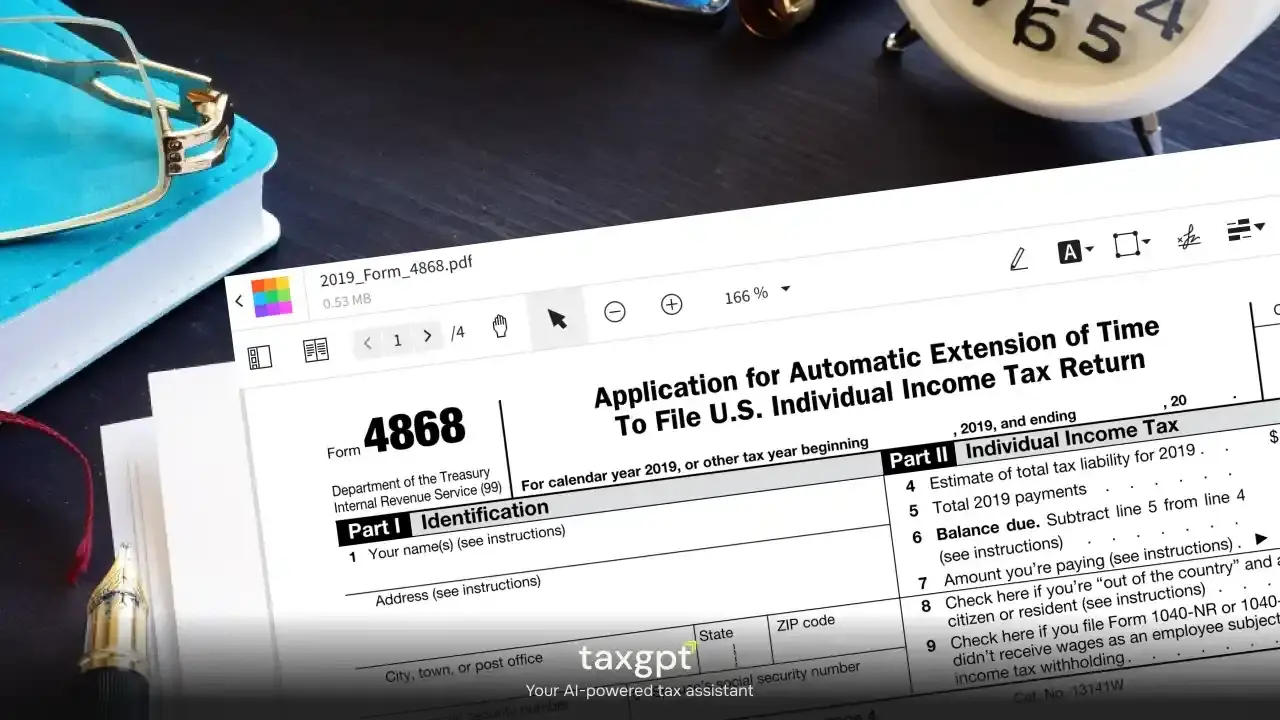

How to Officially Get Extension On Taxes (Form 4868)

Fortunately, the process to Get Extension On Taxes is surprisingly simple. For most individual taxpayers, this is handled by filing IRS Form 4868, officially called the "Application for Automatic Extension of Time to File U.S. Individual Income Tax Return."

The best news? This extension is automatic. As long as you submit Form 4868 correctly and on time, the IRS automatically grants you an extra six months to file your return. This shifts your deadline from April to October 15th (or the next business day if October 15th falls on a weekend).

Key Steps to Submit Your Extension

You can submit Form 4868 electronically or by mail. Using tax software or filing online is generally the fastest and most reliable method. Here are the simple steps required:

- Estimate Your Tax Liability: The most critical step. Though you don't need to file your full return, you must make a reasonable estimate of the tax you owe for the year.

- Determine Payment: Based on your estimate, determine if you owe the IRS money. If you do, you must pay this estimated amount by the original April deadline to avoid penalties and interest on that amount.

- Submit Form 4868: Electronically file Form 4868 through a reputable tax software provider or directly through the IRS Free File program. You can also mail a paper copy, but e-filing is highly recommended.

- Include Payment (If Applicable): If you are paying any estimated taxes owed, you can submit this payment along with the electronic filing of Form 4868.

Remember, the IRS will not send you a confirmation letter or an approval notice if you file electronically. Your receipt of the extension is automatic upon proper filing.

What Happens After You File the Extension?

Once you successfully submit Form 4868, you have secured the extra time to file until October 15th. This means the pressure is off regarding the filing deadline.

However, you must treat this time wisely. Use the six months to organize your documents, consult with professionals, and complete your tax return accurately. Don't let the new deadline become another crisis point.

Important Facts About Tax Extensions

While the extension process is helpful, there is a major misconception that often trips taxpayers up. Understanding the fundamental difference between "time to file" and "time to pay" is absolutely essential when you Get Extension On Taxes.

Failing to grasp this distinction can lead to avoidable interest and penalty charges, even if you filed Form 4868 correctly.

The Difference Between Time to File and Time to Pay

When you file Form 4868, you are requesting an extension of time to file your tax forms. You are NOT requesting an extension of time to pay any tax due.

Tax payments are always due by the original April deadline, regardless of whether you file an extension. If you estimate that you owe $5,000 in taxes, you must pay as much of that $5,000 as possible by April, even if you are waiting until October to submit the final paperwork.

If you fail to pay your estimated balance by the original deadline, the IRS will begin charging interest and potential penalties on the unpaid amount immediately after the deadline passes.

Penalties and Interest Explained

There are typically two main penalties related to tax filings: the Failure-to-File penalty and the Failure-to-Pay penalty. An extension protects you from the first one, but not the second.

The Failure-to-File penalty is substantial—usually 5% of the unpaid taxes for each month or part of a month that a tax return is late, maxing out at 25%. Filing Form 4868 eliminates this high penalty.

However, the Failure-to-Pay penalty is much smaller, generally 0.5% of the unpaid taxes for each month. While filing an extension does not prevent this penalty or the accrued interest, filing Form 4868 still helps immensely because it avoids the much larger Failure-to-File charge.

The bottom line: Pay what you can afford by April. Then, use your extended time to properly calculate the final amount due by October.

Conclusion: Utilize Your Time Wisely

If you need more time, the ability to Get Extension On Taxes using Form 4868 is a lifesaver. It buys you six months of peace of mind to prepare a thorough and accurate tax return, which is far better than rushing and making costly mistakes.

Remember this golden rule: An extension is an extension of time to file, not an extension of time to pay. Ensure you make a good faith estimate of your tax liability and pay that amount by the April deadline to minimize any interest or penalties that may apply.

By following these steps, you can turn a stressful deadline into a manageable task, ensuring you remain in good standing with the IRS.

Frequently Asked Questions (FAQ) About Tax Extensions

- Can I get a tax extension if I expect a refund?

- Yes, absolutely. If you expect a refund, you should still file Form 4868 to avoid the Failure-to-File penalty just in case your final calculations show you actually owe money. If you file an extension while expecting a refund, you simply delay receiving that refund until you file your complete return.

- Do I need a reason to Get Extension On Taxes?

- No. For individuals, the extension provided by Form 4868 is automatic. You do not need to provide a justification or special reason to the IRS; simply submit the form correctly before the original deadline.

- What if I can't afford to pay my estimated tax due by April?

- Even if you cannot pay, you should still file Form 4868 and pay as much as possible by April. Filing the extension prevents the severe Failure-to-File penalty. If you still owe money in October, you can explore payment plans (such as the Offer in Compromise or Installment Agreements) directly with the IRS.

- Is there an additional cost to file Form 4868?

- The Form 4868 itself has no official IRS fee. However, if you use a third-party tax preparation software to file the form electronically, that software provider may charge a small service fee for processing the extension.

- Will an extension increase my chances of being audited?

- Generally, no. Filing an extension is a common procedure and is not known to increase your audit risk. The factors that trigger audits relate more to the complexities and inconsistencies within the actual data reported on the return, not the timing of its submission.

Get Extension On Taxes

Get Extension On Taxes Wallpapers

Collection of get extension on taxes wallpapers for your desktop and mobile devices.

High-Quality Get Extension On Taxes View for Mobile

Explore this high-quality get extension on taxes image, perfect for enhancing your desktop or mobile wallpaper.

Exquisite Get Extension On Taxes Picture Digital Art

Find inspiration with this unique get extension on taxes illustration, crafted to provide a fresh look for your background.

Spectacular Get Extension On Taxes Moment Collection

This gorgeous get extension on taxes photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Dynamic Get Extension On Taxes Picture for Your Screen

Find inspiration with this unique get extension on taxes illustration, crafted to provide a fresh look for your background.

Stunning Get Extension On Taxes Capture in 4K

This gorgeous get extension on taxes photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Breathtaking Get Extension On Taxes Image for Mobile

Explore this high-quality get extension on taxes image, perfect for enhancing your desktop or mobile wallpaper.

Breathtaking Get Extension On Taxes View Digital Art

Discover an amazing get extension on taxes background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Crisp Get Extension On Taxes Photo for Desktop

Find inspiration with this unique get extension on taxes illustration, crafted to provide a fresh look for your background.

Beautiful Get Extension On Taxes Capture Concept

Explore this high-quality get extension on taxes image, perfect for enhancing your desktop or mobile wallpaper.

Spectacular Get Extension On Taxes Photo for Mobile

Find inspiration with this unique get extension on taxes illustration, crafted to provide a fresh look for your background.

Serene Get Extension On Taxes Wallpaper Collection

Explore this high-quality get extension on taxes image, perfect for enhancing your desktop or mobile wallpaper.

Captivating Get Extension On Taxes Design in HD

Find inspiration with this unique get extension on taxes illustration, crafted to provide a fresh look for your background.

Vivid Get Extension On Taxes View Concept

Discover an amazing get extension on taxes background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Gorgeous Get Extension On Taxes Artwork Concept

Find inspiration with this unique get extension on taxes illustration, crafted to provide a fresh look for your background.

Artistic Get Extension On Taxes Wallpaper for Mobile

Find inspiration with this unique get extension on taxes illustration, crafted to provide a fresh look for your background.

Captivating Get Extension On Taxes Scene in HD

Immerse yourself in the stunning details of this beautiful get extension on taxes wallpaper, designed for a captivating visual experience.

Mesmerizing Get Extension On Taxes Moment Nature

Explore this high-quality get extension on taxes image, perfect for enhancing your desktop or mobile wallpaper.

Stunning Get Extension On Taxes Background Photography

Find inspiration with this unique get extension on taxes illustration, crafted to provide a fresh look for your background.

Dynamic Get Extension On Taxes Background for Your Screen

Immerse yourself in the stunning details of this beautiful get extension on taxes wallpaper, designed for a captivating visual experience.

Dynamic Get Extension On Taxes Design for Mobile

Find inspiration with this unique get extension on taxes illustration, crafted to provide a fresh look for your background.

Download these get extension on taxes wallpapers for free and use them on your desktop or mobile devices.