How To Get Auto Insurance Before Buying A Car

How To Get Auto Insurance Before Buying A Car: Your Ultimate Pre-Purchase Checklist

Buying a new car is incredibly exciting. You've likely spent hours researching models, test driving, and maybe even haggling over the price. But before you sign on the dotted line and take ownership, there is one crucial step you absolutely cannot skip: getting your auto insurance sorted out.

If you're wondering How To Get Auto Insurance Before Buying A Car, you've come to the right place. Many people assume they can wait until the last minute, but driving uninsured—even for a few minutes—is illegal and extremely risky. This guide breaks down exactly what you need to do to ensure you're covered the moment you drive your new vehicle off the lot.

Why Insurance Must Come First (Legality and Practicality)

In nearly every state, auto insurance is mandatory. You need proof of coverage before you can legally register a vehicle. Moreover, if you are financing the car, the lender will require full coverage (comprehensive and collision) to protect their investment before they release the funds.

Waiting until you arrive at the dealership can be a stressful mistake. If you try to purchase insurance right there and then, you might end up paying more because you haven't shopped around. Having insurance set up in advance ensures a smooth transaction and guarantees you are protected from liability the moment the key is in your hand.

Essential Steps on How To Get Auto Insurance Before Buying A Car

The process of securing coverage is straightforward, even if you don't yet own the vehicle. The key is providing your insurance agent with enough preliminary information to generate accurate quotes and a binder (a temporary proof of coverage).

Step 1: Gather Your Personal Information

Insurance companies base your premium largely on who you are and where you live. Before reaching out for quotes, make sure you have all the necessary personal data organized. This speeds up the process considerably.

You will need the following details for all drivers who will be on the policy:

- Full names and dates of birth.

- Driver's license numbers.

- Current address (where the car will be garaged).

- Driving history (including any past accidents, tickets, or claims).

- Details of your current insurance policy, if applicable (this can often qualify you for a multi-policy discount).

Step 2: Research the Car You Plan to Buy (The Hypothetical Vehicle)

The type of car you choose significantly impacts your insurance rate. Sports cars, high-end luxury vehicles, and models with poor safety records typically cost more to insure than standard sedans or family SUVs.

If you haven't finalized the exact vehicle yet, provide the agent with the closest specifications you can. Knowing the general make, model, year, and trim level allows them to calculate a very accurate estimate. Once you have the final Vehicle Identification Number (VIN), you can update the policy, but the initial quote can be based on the specifics you know.

Step 3: Get and Compare Quotes

This is where the real savings happen. Don't rely solely on your current insurance provider, especially if you are adding a second vehicle or switching coverage types. Insurance rates vary wildly between companies.

When requesting quotes, ensure you are comparing apples to apples. This means using the exact same coverage limits, deductibles, and endorsements for every quote. You should aim to get quotes from at least three different carriers—including both major national companies and smaller regional ones.

Focus on these key coverage points:

- **Liability Limits:** Ensure the limits meet or exceed state minimums (and preferably are much higher for better protection).

- **Collision and Comprehensive:** Required if you have a loan. Choose a deductible you can afford.

- **Uninsured/Underinsured Motorist Coverage:** Protects you if the other driver lacks sufficient insurance.

Understanding the "Grace Period" and Proof of Coverage

If you already have an existing auto policy, you might benefit from a built-in "grace period." Many insurance companies offer automatic coverage for a newly acquired vehicle for a short duration (usually 7 to 30 days) under the terms of your existing policy.

However, relying solely on this grace period is risky. The coverage limits applied will only be the minimum coverage you have on your existing vehicle, which might not meet the financing requirements for your new, more expensive car. It is far safer to proactively call your agent and update the policy before driving the car home.

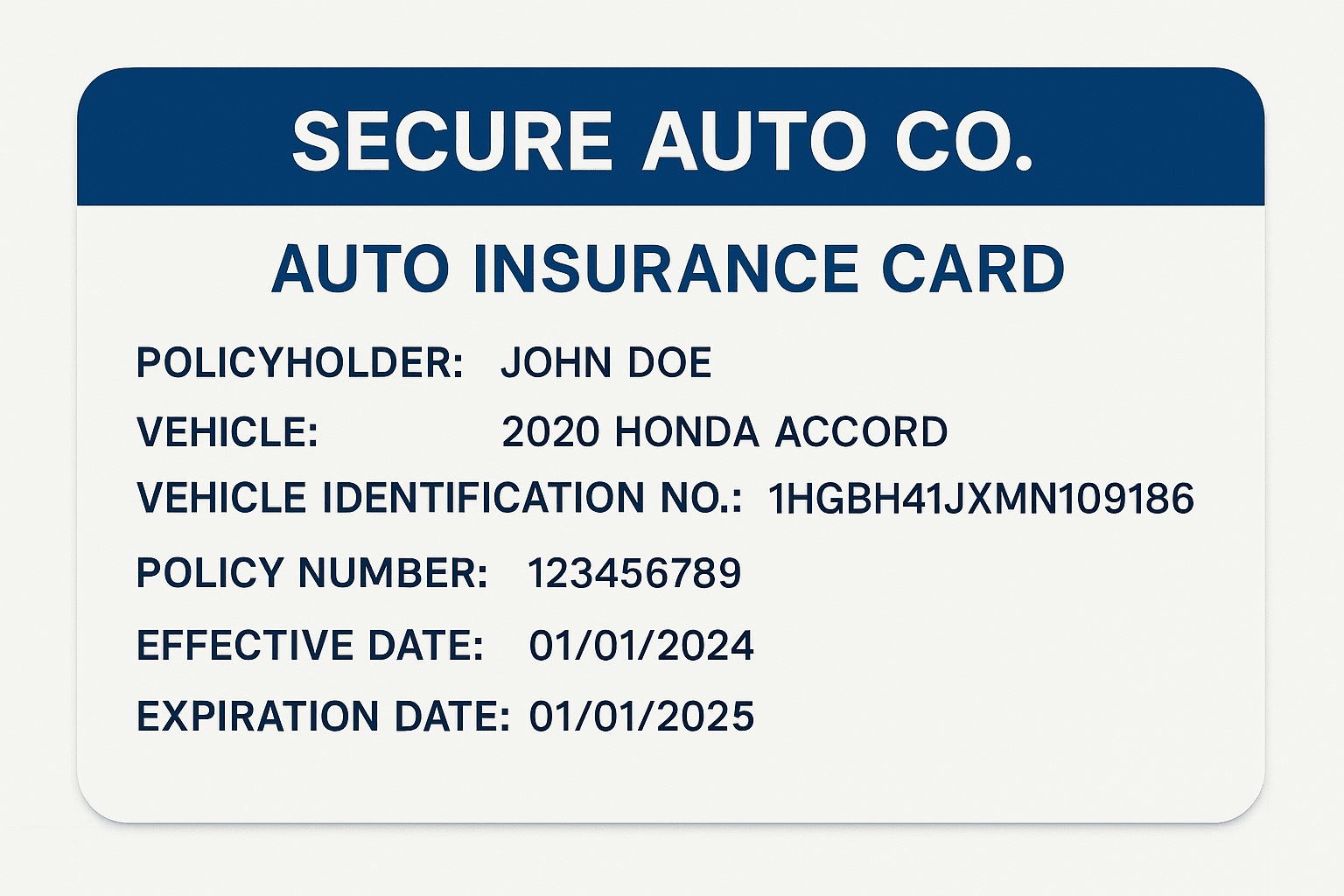

The Binder vs. the Policy

Once you've chosen an insurer and accepted a quote, you need immediate proof that coverage is active. This proof is often called an insurance binder.

A binder is a temporary contract that confirms your insurance coverage is in force until the official policy documents are issued. It's what you present to the dealership or seller to finalize the purchase. Make sure your agent emails or faxes this document to you and, if necessary, to the dealership or lender.

What to Do on Purchase Day

Before leaving the dealership or meeting with the private seller, you must confirm that the insurance coverage is fully active and transferred to the new VIN. Even if you activated the policy the day before, double-check everything.

If you purchased the car from a dealership, they will usually require the insurance binder or card before they hand over the keys. If you are buying privately, ensure you have the coverage confirmation ready, as you are responsible for immediate coverage the moment the title is transferred.

Finalizing the Policy Details

If you are financing the car, you must notify your insurance provider of the lender's name and address. The lender will be listed as the "loss payee" or "additional insured" on your policy. This ensures that if the car is totaled, the lender is paid first.

Once you have the final VIN, mileage, and date of purchase, call your agent one last time. They will issue the final policy documents and insurance cards, confirming that your new car is perfectly covered.

Conclusion

Learning How To Get Auto Insurance Before Buying A Car is not just about following the law; it's about smart financial planning. By gathering your personal details, researching the vehicle specifications, and comparing quotes well in advance, you ensure that you receive the best rates and avoid any stressful delays at the point of sale.

Remember, coverage should be secured *before* you drive the car off the lot. A few hours of preparation can save you thousands of dollars and give you true peace of mind as you enjoy your new ride.

Frequently Asked Questions (FAQ)

- Can I get car insurance without a VIN?

- Yes, absolutely! Insurance companies can usually generate a very accurate quote based on the car's year, make, model, and trim level. You will need to provide the final VIN once the purchase is complete to finalize the policy.

- How far in advance should I purchase the insurance?

- It is best to start shopping for quotes two to four weeks before you plan to buy the car. Once you know the exact date of purchase, you can ask the insurance company to activate the policy 24 hours before that time, guaranteeing coverage.

- What if I am trading in my old car?

- If you are trading in an old vehicle, your agent can seamlessly transition your coverage. They will remove the old vehicle from the policy and add the new one, often effective the exact date and time of the trade. If you are cancelling the old policy entirely, ensure the cancellation date is set *after* the purchase of the new car.

- Will my premium increase if I buy a used car?

- The premium is determined by risk, not just age. Factors like the car's repair costs, its safety rating, and its value (which affects collision coverage payouts) all play a role. Generally, a newer or more valuable used car will cost more to insure than an older, less expensive model.

How To Get Auto Insurance Before Buying A Car

How To Get Auto Insurance Before Buying A Car Wallpapers

Collection of how to get auto insurance before buying a car wallpapers for your desktop and mobile devices.

Lush How To Get Auto Insurance Before Buying A Car Wallpaper in 4K

Find inspiration with this unique how to get auto insurance before buying a car illustration, crafted to provide a fresh look for your background.

Exquisite How To Get Auto Insurance Before Buying A Car Photo for Your Screen

Find inspiration with this unique how to get auto insurance before buying a car illustration, crafted to provide a fresh look for your background.

Captivating How To Get Auto Insurance Before Buying A Car Picture Concept

Immerse yourself in the stunning details of this beautiful how to get auto insurance before buying a car wallpaper, designed for a captivating visual experience.

Mesmerizing How To Get Auto Insurance Before Buying A Car Wallpaper Photography

Experience the crisp clarity of this stunning how to get auto insurance before buying a car image, available in high resolution for all your screens.

Mesmerizing How To Get Auto Insurance Before Buying A Car Artwork Illustration

Explore this high-quality how to get auto insurance before buying a car image, perfect for enhancing your desktop or mobile wallpaper.

Vibrant How To Get Auto Insurance Before Buying A Car Moment Nature

Experience the crisp clarity of this stunning how to get auto insurance before buying a car image, available in high resolution for all your screens.

Detailed How To Get Auto Insurance Before Buying A Car Background Photography

Discover an amazing how to get auto insurance before buying a car background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Crisp How To Get Auto Insurance Before Buying A Car Abstract in 4K

A captivating how to get auto insurance before buying a car scene that brings tranquility and beauty to any device.

Vivid How To Get Auto Insurance Before Buying A Car Abstract Digital Art

Transform your screen with this vivid how to get auto insurance before buying a car artwork, a true masterpiece of digital design.

Artistic How To Get Auto Insurance Before Buying A Car Moment for Desktop

A captivating how to get auto insurance before buying a car scene that brings tranquility and beauty to any device.

Serene How To Get Auto Insurance Before Buying A Car Artwork Nature

Experience the crisp clarity of this stunning how to get auto insurance before buying a car image, available in high resolution for all your screens.

Amazing How To Get Auto Insurance Before Buying A Car Background Nature

Experience the crisp clarity of this stunning how to get auto insurance before buying a car image, available in high resolution for all your screens.

Amazing How To Get Auto Insurance Before Buying A Car Scene Nature

Experience the crisp clarity of this stunning how to get auto insurance before buying a car image, available in high resolution for all your screens.

Crisp How To Get Auto Insurance Before Buying A Car Landscape Illustration

This gorgeous how to get auto insurance before buying a car photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Serene How To Get Auto Insurance Before Buying A Car View for Mobile

Discover an amazing how to get auto insurance before buying a car background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Exquisite How To Get Auto Insurance Before Buying A Car Moment for Your Screen

Immerse yourself in the stunning details of this beautiful how to get auto insurance before buying a car wallpaper, designed for a captivating visual experience.

Spectacular How To Get Auto Insurance Before Buying A Car Capture Art

A captivating how to get auto insurance before buying a car scene that brings tranquility and beauty to any device.

Beautiful How To Get Auto Insurance Before Buying A Car Scene for Your Screen

Discover an amazing how to get auto insurance before buying a car background image, ideal for personalizing your devices with vibrant colors and intricate designs.

High-Quality How To Get Auto Insurance Before Buying A Car Moment for Your Screen

Explore this high-quality how to get auto insurance before buying a car image, perfect for enhancing your desktop or mobile wallpaper.

Amazing How To Get Auto Insurance Before Buying A Car Artwork in HD

Discover an amazing how to get auto insurance before buying a car background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Download these how to get auto insurance before buying a car wallpapers for free and use them on your desktop or mobile devices.

0 Response to "How To Get Auto Insurance Before Buying A Car"

Post a Comment