How To Get Federal Loan

How To Get Federal Loan: Your Complete Step-by-Step Guide

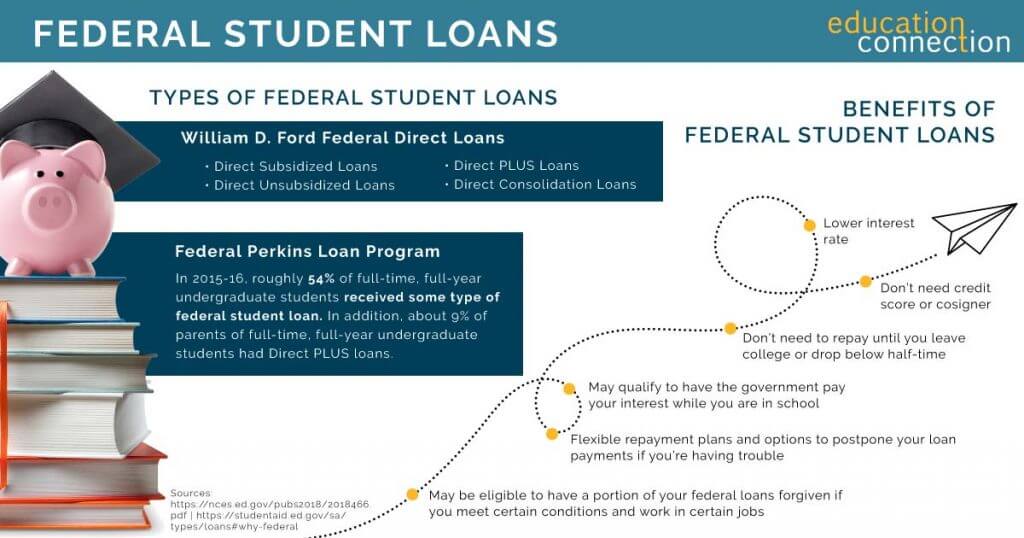

If you're looking to fund your education or secure financial assistance, federal loans are often the best route. They typically offer lower interest rates, flexible repayment options, and benefits that private loans simply cannot match. You've come to the right place if you're wondering exactly How To Get Federal Loan funding without pulling your hair out. We're going to break down the entire process, making it as clear and simple as possible.

Applying for federal assistance might seem like navigating a complex maze, but we promise it's simpler than you think once you know the required steps. The key is preparation and understanding the documentation you'll need. We'll cover everything from the basic application to the types of aid available, ensuring you feel confident in your pursuit of financial support.

Let's dive into the specifics so you can successfully apply for the aid you deserve.

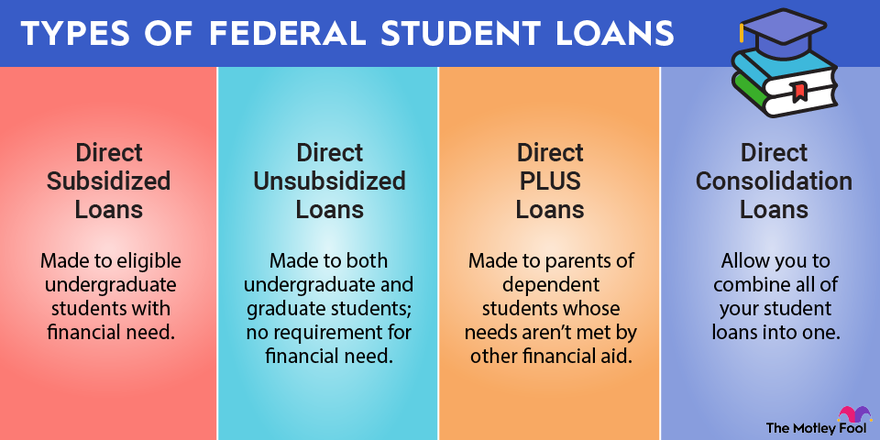

Understanding the Types of Federal Loans

Before you jump into the application process, it's important to know what kind of federal assistance you might qualify for. These loans are primarily designed to help students pay for postsecondary education. Understanding the differences is crucial, as eligibility and interest benefits vary significantly between loan types.

Federal loans are generally classified based on whether or not the government pays the interest while you are in school or during grace periods. This factor alone can save you thousands of dollars over the life of the loan. Knowing the distinctions will help you decide which offers to accept once you receive your aid package.

Direct Subsidized and Unsubsidized Loans

These are the most common federal loans offered to undergraduate students. They are called "Direct Loans" because they are made directly by the Department of Education.

- Direct Subsidized Loans: These are need-based. The Department of Education pays the interest while you are in school (at least half-time), during the grace period (six months after leaving school), and during periods of deferment. This is the best type of loan to get, as it keeps your balance lower.

- Direct Unsubsidized Loans: These are available to both undergraduate and graduate students regardless of financial need. The key difference here is that you are responsible for paying all the interest that accrues during all periods, including while you are in school. If you choose not to pay the interest, it will be capitalized (added to your principal balance).

PLUS Loans (Grad/Parent)

PLUS Loans are aimed at covering costs that exceed the amount covered by other financial aid. They are slightly different because, unlike Direct Subsidized and Unsubsidized Loans, eligibility is contingent on a credit check.

Parent PLUS Loans are taken out by parents of dependent undergraduate students. Meanwhile, Grad PLUS Loans are available to graduate or professional degree students. While they offer federal protections, they often have higher interest rates than the standard Direct Loans, so they should be considered secondary options after maximizing your eligibility for the other loan types.

The Crucial First Step: Filling Out the FAFSA

If you want to know How To Get Federal Loan funds, the answer always starts with one acronym: FAFSA. The Free Application for Federal Student Aid (FAFSA) is the single gateway to nearly all federal student aid, including grants, work-study, and, crucially, federal loans. You must complete the FAFSA every year you plan to enroll in school.

Filing the FAFSA is free, and it determines your Expected Family Contribution (EFC) or Student Aid Index (SAI), which schools use to calculate your eligibility. Filing early is highly recommended, as some state and institutional aid is distributed on a first-come, first-served basis. Don't delay—the opening date is usually October 1st for the upcoming academic year.

Gathering Necessary Documents

Preparation is key to making the FAFSA process smooth. Before you sit down to fill out the form, make sure you have all your essential documents readily available. Having everything organized prevents frustrating delays and ensures accuracy.

Here is a checklist of common items you'll need:

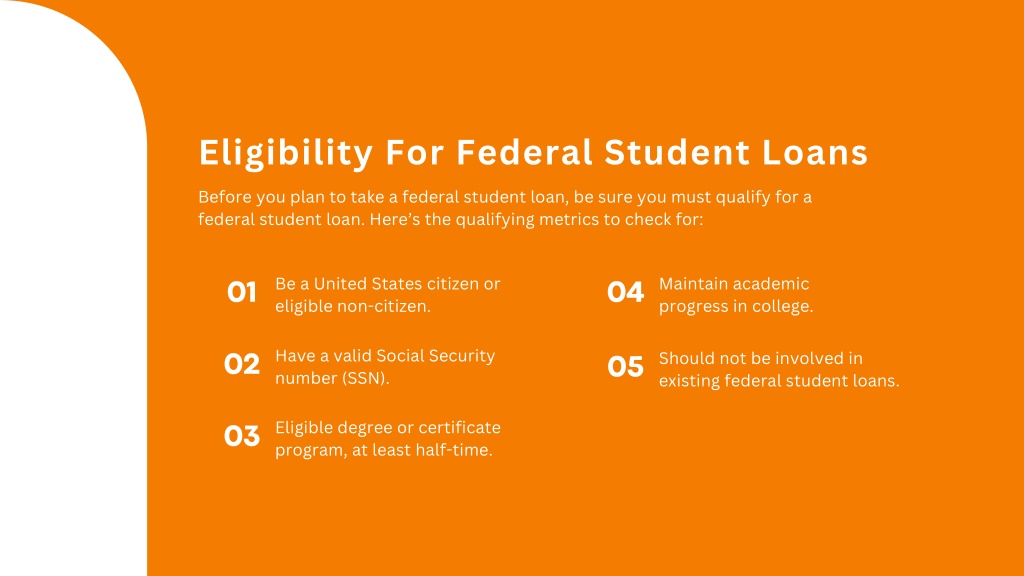

- Your Social Security Number (and parent's, if applicable).

- Your Federal Student Aid (FSA) ID, which serves as your electronic signature.

- Your driver's license number, if you have one.

- Federal tax returns, W-2s, and records of any other money earned for the relevant tax year.

- Records of other income, such as child support received.

- Records of cash, savings, checking account balances, and investments.

Pro tip: Most users can link their FAFSA directly to the IRS Data Retrieval Tool (DRT), which automatically imports the necessary tax information, making this step much easier!

Submitting Your Application

Once you've gathered your documents and started inputting information online, double-check every field for errors. Mistakes can lead to delays or the need for verification, which slows down the entire financial aid process. Pay close attention to the list of schools you include, as they must receive your information to prepare an aid package.

When you finish filling out the form, you and your parent (if you are a dependent student) must sign it electronically using your FSA IDs. After successful submission, you will receive a confirmation page and an email indicating your application has been processed. This typically takes three to five days.

What Happens After FAFSA Submission?

After the Department of Education processes your FAFSA, you will receive a Student Aid Report (SAR). This document summarizes the data you submitted and shows your SAI. Review the SAR carefully and correct any errors immediately.

Your SAR data is sent to the colleges you listed. The schools will then use your SAI and the cost of attendance at their institution to create a customized financial aid offer for you. This is the moment where you finally see what aid you are eligible for, including those vital federal loans.

Reviewing Your Financial Aid Offer

When reviewing your aid offer, focus on distinguishing between grants (which don't need to be repaid) and loans (which do). The offer will clearly detail the specific types of federal loans you've been offered—Subsidized, Unsubsidized, or PLUS Loans—along with the amounts.

Be a smart borrower! Only accept the amount of federal loan money you absolutely need to cover educational costs. Remember, even though federal loans are generally excellent, they still represent a debt you must repay. If you need less than the school offered, you have the right to accept a reduced amount.

Accepting and Disbursement

Once you decide which loans to accept, you must typically complete two additional steps before the funds are released. These steps ensure you understand the terms of your borrowing agreement.

First, you must sign a Master Promissory Note (MPN). This is a legal document in which you promise to repay your loan and any accrued interest and fees to the Department of Education. Second, if you are a first-time federal student loan borrower, you must complete entrance counseling. This mandatory online session explains your responsibilities as a borrower and teaches you about managing your education expenses.

After these steps are finalized, the funds are usually sent directly to your school to cover tuition, fees, and housing. Any remaining funds are then disbursed to you as a refund to cover other necessary expenses, such as books and supplies.

Conclusion: Your Path to Federal Funding

Successfully figuring out How To Get Federal Loan funding hinges entirely on the FAFSA and timely communication with your school's financial aid office. By completing your FAFSA early, reviewing your aid package carefully, and only accepting the necessary loan amounts, you position yourself for financial stability during your education. Federal loans are a fantastic resource that provide essential protections and manageable repayment plans—use them wisely to achieve your educational goals!

Frequently Asked Questions About Federal Loans

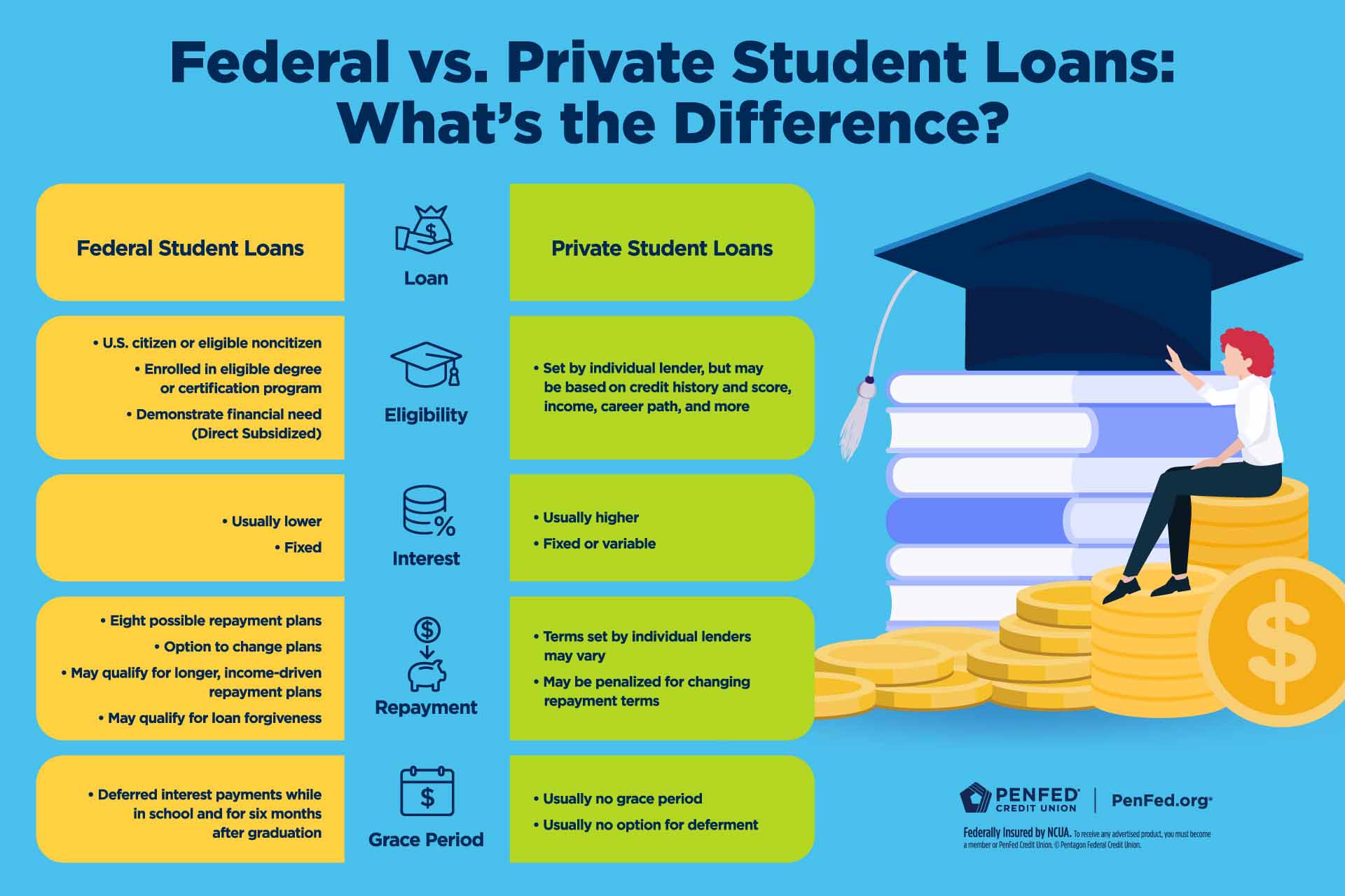

- What is the difference between a federal loan and a private loan?

- Federal loans are offered by the government and come with benefits like income-driven repayment plans, loan forgiveness options, and fixed, often lower, interest rates. Private loans are offered by banks or credit unions, usually requiring a good credit history and potentially lacking the same borrower protections.

- Do I need to start paying back my federal loan immediately?

- For most federal student loans (Direct Subsidized and Unsubsidized), you generally do not need to start making payments until after you graduate, leave school, or drop below half-time enrollment. This is known as the grace period, which typically lasts six months.

- How often do I need to complete the FAFSA?

- You must complete the FAFSA every single year you plan on enrolling in school and want to receive federal financial aid. Eligibility and financial need can change year to year, so annual renewal is mandatory.

- Can undocumented students apply for federal loans?

- Unfortunately, federal student aid is generally only available to U.S. citizens or eligible non-citizens (such as permanent residents). However, many states and individual colleges offer aid programs specifically tailored for undocumented students, so it's worth checking with your school.

How To Get Federal Loan

How To Get Federal Loan Wallpapers

Collection of how to get federal loan wallpapers for your desktop and mobile devices.

Serene How To Get Federal Loan Photo Illustration

Discover an amazing how to get federal loan background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Artistic How To Get Federal Loan Image Concept

This gorgeous how to get federal loan photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Detailed How To Get Federal Loan Capture Collection

Experience the crisp clarity of this stunning how to get federal loan image, available in high resolution for all your screens.

Exquisite How To Get Federal Loan Photo Illustration

Immerse yourself in the stunning details of this beautiful how to get federal loan wallpaper, designed for a captivating visual experience.

Stunning How To Get Federal Loan Image Nature

This gorgeous how to get federal loan photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Dynamic How To Get Federal Loan Capture for Mobile

Find inspiration with this unique how to get federal loan illustration, crafted to provide a fresh look for your background.

Crisp How To Get Federal Loan Abstract Concept

Immerse yourself in the stunning details of this beautiful how to get federal loan wallpaper, designed for a captivating visual experience.

Stunning How To Get Federal Loan Moment Art

A captivating how to get federal loan scene that brings tranquility and beauty to any device.

Crisp How To Get Federal Loan Moment Photography

Immerse yourself in the stunning details of this beautiful how to get federal loan wallpaper, designed for a captivating visual experience.

Mesmerizing How To Get Federal Loan Capture Collection

Transform your screen with this vivid how to get federal loan artwork, a true masterpiece of digital design.

Breathtaking How To Get Federal Loan Abstract in 4K

Transform your screen with this vivid how to get federal loan artwork, a true masterpiece of digital design.

Captivating How To Get Federal Loan Wallpaper Nature

Immerse yourself in the stunning details of this beautiful how to get federal loan wallpaper, designed for a captivating visual experience.

Stunning How To Get Federal Loan Picture for Desktop

A captivating how to get federal loan scene that brings tranquility and beauty to any device.

High-Quality How To Get Federal Loan Scene Concept

Explore this high-quality how to get federal loan image, perfect for enhancing your desktop or mobile wallpaper.

Lush How To Get Federal Loan Capture Collection

A captivating how to get federal loan scene that brings tranquility and beauty to any device.

Serene How To Get Federal Loan Moment in 4K

Experience the crisp clarity of this stunning how to get federal loan image, available in high resolution for all your screens.

Lush How To Get Federal Loan Scene for Desktop

This gorgeous how to get federal loan photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Beautiful How To Get Federal Loan Picture Illustration

Transform your screen with this vivid how to get federal loan artwork, a true masterpiece of digital design.

Lush How To Get Federal Loan Artwork in 4K

A captivating how to get federal loan scene that brings tranquility and beauty to any device.

Detailed How To Get Federal Loan Landscape in 4K

Explore this high-quality how to get federal loan image, perfect for enhancing your desktop or mobile wallpaper.

Download these how to get federal loan wallpapers for free and use them on your desktop or mobile devices.