How To Get Flood Insurance

How To Get Flood Insurance: Your Comprehensive and Easy Guide

Hey there! If you're reading this, you're probably thinking about protecting your biggest investment from the unpredictable nature of water. We totally get it—floods are the most common and costly natural disaster globally, and they can strike anywhere, not just in high-risk zones.

Knowing How To Get Flood Insurance is absolutely critical, because relying solely on your standard homeowner's policy is a recipe for disaster. Flood damage is almost always excluded from those standard policies. Don't wait until the next weather forecast sounds ominous; let's dive into the simple steps you need to take to secure your peace of mind.

We're going to walk you through the options available, the steps to follow, and the common myths you need to ignore so you can easily figure out how to get the right flood protection.

Why Flood Insurance Isn't Always Included in Your Standard Policy

This is the first piece of information everyone needs to internalize: standard home insurance covers sudden water events like burst pipes or wind-driven rain, but it specifically excludes damage caused by flooding, which is typically defined as a general and temporary condition of partial or complete inundation of two or more acres of normally dry land area or two or more properties.

Insurance companies view flooding as a catastrophic and widespread event, making it too expensive to include in basic policies. That's why flood coverage must be purchased separately. Think of it as a specialized umbrella designed for a specific kind of storm.

Understanding Your Options: NFIP vs. Private Market

When you set out to figure out How To Get Flood Insurance, you really have two main avenues to explore. Both options offer robust protection, but they differ significantly in terms of coverage limits, pricing, and claims processing.

The key is determining which option best fits your home's value, your flood risk zone, and your budget. Let's break down the two major players.

Navigating the NFIP: The National Flood Insurance Program

The NFIP is administered by the Federal Emergency Management Agency (FEMA) and is the most common way to secure flood coverage. It's essentially backed by the federal government and is typically sold through private insurance carriers (like State Farm or Allstate) who are known as Write Your Own (WYO) companies.

The great thing about the NFIP is that it's available to anyone living in a community that participates in the program, regardless of their specific flood risk. However, coverage limits are standardized and capped.

Here are the NFIP coverage limits you should be aware of:

- Up to $250,000 for building coverage (the physical structure).

- Up to $100,000 for contents coverage (your possessions).

- There is typically a 30-day waiting period before the policy takes effect.

Exploring Private Flood Insurance Options

In recent years, the private market for flood insurance has grown significantly. Private policies are offered by independent insurance carriers and can often provide flexibility and higher coverage limits that the NFIP cannot match. If you own a high-value home, this might be a better fit.

The benefits of exploring private options include:

- Higher Limits: You can often get coverage well over the NFIP's $250,000 cap.

- Faster Claim Payouts: Some private carriers have streamlined claims processes.

- Broader Coverage: Policies can sometimes include coverage for things like living expenses after a flood, which NFIP does not.

However, private policies are also subject to market risks, and premiums can fluctuate based on detailed, hyper-local risk models.

Step-by-Step Guide: How To Get Flood Insurance

Whether you choose the NFIP route or a private insurer, the process of obtaining coverage generally follows the same practical steps. Don't worry, it's not as complicated as it sounds!

Determining Your Coverage Needs and Risk Assessment

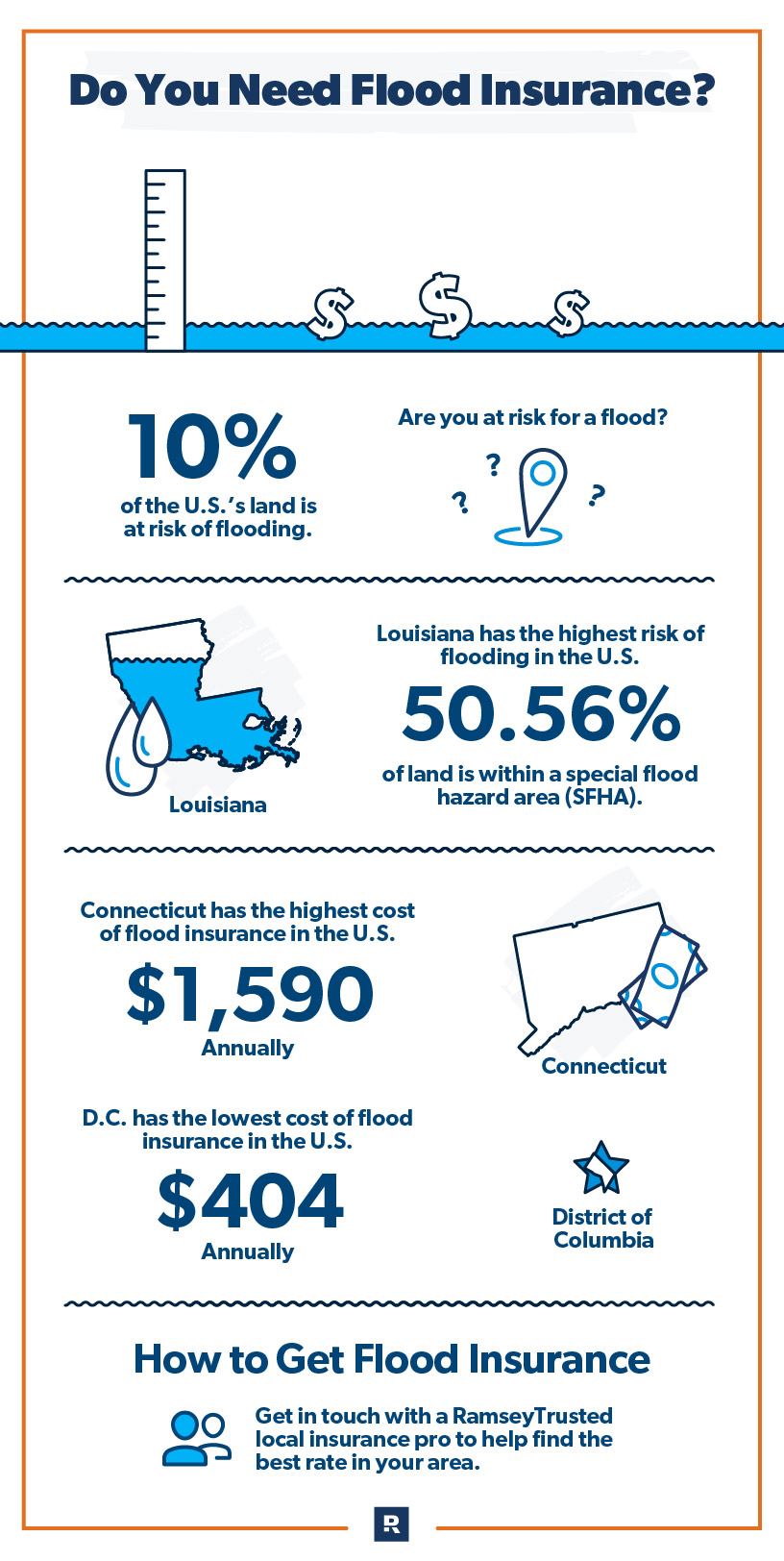

The very first thing you need to do is understand your risk. Even if your lender doesn't mandate flood insurance, FEMA statistics show that 25% of all flood claims come from low-to-moderate risk areas. So, assume you are at risk.

Next, calculate how much coverage you actually need. Remember, flood insurance generally covers two things: the building structure and your contents. Unlike standard homeowner's insurance, NFIP usually requires you to purchase contents coverage separately, so factor in the replacement cost of your furniture, electronics, and clothing.

If you live in a high-risk area (Zone A or V), you will need an Elevation Certificate to get accurate premium calculations. This certificate details your home's elevation relative to the base flood elevation.

Getting Quotes and Choosing a Policy

The best way to figure out How To Get Flood Insurance that suits your needs is by working with a licensed insurance agent. They can compare both NFIP rates and private market options simultaneously.

When you are shopping around, make sure you compare apples to apples. Look at deductibles, coverage limits for both structure and contents, and any exclusion zones specified in the private policies. Don't forget that 30-day waiting period! You must purchase the policy well in advance of a major weather event.

Common Misconceptions About Flood Insurance

There are several myths that prevent homeowners from getting the protection they need. Let's clear up a few of the most common ones right now.

- Myth: Federal Disaster Aid Will Cover Me. Fact: Disaster aid (FEMA grants) are usually loans that must be repaid, or small grants meant to help with immediate needs, not fully restore your home.

- Myth: I Don't Live Near Water, So I'm Safe. Fact: Floods can be caused by rapid accumulation of rainfall, poor drainage, or dam breaks. Any property is technically at risk.

- Myth: My Standard Home Policy Covers Everything. Fact: As we've established, standard policies almost universally exclude flood damage.

- Myth: Flood insurance is only for high-risk zones. Fact: Premiums are cheaper in low-risk zones, making it an excellent investment for maximum peace of mind.

What Flood Insurance Typically Does NOT Cover

It's important to set realistic expectations for what your policy covers. Flood insurance is designed to cover direct physical loss caused by flood. It generally does not cover:

Damage caused by moisture, mildew, or mold that could have been avoided by the property owner; the loss of currency, precious metals, or valuable papers; and damage to property outside the home like landscaping, septic systems, or swimming pools.

Conclusion: Securing Your Peace of Mind

Figuring out How To Get Flood Insurance doesn't have to be a complicated puzzle. Whether you go with the federally backed NFIP or the flexible private market, the goal remains the same: protecting your family and financial future from the potentially devastating effects of water damage.

Remember that essential 30-day waiting period. The time to secure your policy is today, while the sky is clear. Connect with a reputable insurance agent, compare your options carefully, and ensure you have adequate coverage for both your home's structure and its contents. Taking this step is one of the smartest investments you can make in your homeownership journey.

Frequently Asked Questions (FAQ) About Flood Insurance

- Can I purchase NFIP insurance directly from FEMA?

- No. While the NFIP is managed by FEMA, you must purchase the policy through an insurance company or agent that participates in the NFIP's Write Your Own (WYO) Program.

- Is flood insurance mandatory?

- Flood insurance is only mandatory if you have a federally backed mortgage (like FHA or VA) and your property is located in a Special Flood Hazard Area (SFHA). However, it is highly recommended for all homeowners, regardless of mandatory requirements.

- How long does it take for flood insurance to go into effect?

- Typically, there is a 30-day waiting period from the date of purchase before an NFIP policy becomes effective. There are rare exceptions, such as if the policy is required due to a loan closing.

- Does flood insurance cover the basement?

- NFIP policies provide very limited coverage for basements and areas below the lowest elevated floor. Coverage typically includes essential services like the furnace, water heater, and foundation elements, but generally excludes finished walls, carpeting, and personal contents stored there.

How To Get Flood Insurance

How To Get Flood Insurance Wallpapers

Collection of how to get flood insurance wallpapers for your desktop and mobile devices.

Vivid How To Get Flood Insurance Landscape Digital Art

Discover an amazing how to get flood insurance background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Crisp How To Get Flood Insurance View in HD

Find inspiration with this unique how to get flood insurance illustration, crafted to provide a fresh look for your background.

Beautiful How To Get Flood Insurance Scene for Your Screen

Explore this high-quality how to get flood insurance image, perfect for enhancing your desktop or mobile wallpaper.

Lush How To Get Flood Insurance Moment Illustration

A captivating how to get flood insurance scene that brings tranquility and beauty to any device.

Dynamic How To Get Flood Insurance Capture Digital Art

This gorgeous how to get flood insurance photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Mesmerizing How To Get Flood Insurance Artwork Art

Experience the crisp clarity of this stunning how to get flood insurance image, available in high resolution for all your screens.

Gorgeous How To Get Flood Insurance Design in 4K

A captivating how to get flood insurance scene that brings tranquility and beauty to any device.

Beautiful How To Get Flood Insurance Wallpaper Illustration

Transform your screen with this vivid how to get flood insurance artwork, a true masterpiece of digital design.

Mesmerizing How To Get Flood Insurance Abstract for Your Screen

Experience the crisp clarity of this stunning how to get flood insurance image, available in high resolution for all your screens.

Detailed How To Get Flood Insurance Artwork Collection

Experience the crisp clarity of this stunning how to get flood insurance image, available in high resolution for all your screens.

Lush How To Get Flood Insurance Wallpaper Illustration

This gorgeous how to get flood insurance photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Captivating How To Get Flood Insurance Image Nature

A captivating how to get flood insurance scene that brings tranquility and beauty to any device.

Beautiful How To Get Flood Insurance Design for Mobile

Explore this high-quality how to get flood insurance image, perfect for enhancing your desktop or mobile wallpaper.

Spectacular How To Get Flood Insurance Landscape for Desktop

This gorgeous how to get flood insurance photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Mesmerizing How To Get Flood Insurance Photo Illustration

Experience the crisp clarity of this stunning how to get flood insurance image, available in high resolution for all your screens.

Captivating How To Get Flood Insurance Moment Photography

A captivating how to get flood insurance scene that brings tranquility and beauty to any device.

Dynamic How To Get Flood Insurance Landscape Photography

Find inspiration with this unique how to get flood insurance illustration, crafted to provide a fresh look for your background.

Spectacular How To Get Flood Insurance Moment Collection

Find inspiration with this unique how to get flood insurance illustration, crafted to provide a fresh look for your background.

:max_bytes(150000):strip_icc()/flood-insurance_v4-0129507a12b24aaea4fafee0eb9ed1f6.png)

Exquisite How To Get Flood Insurance Scene for Mobile

Immerse yourself in the stunning details of this beautiful how to get flood insurance wallpaper, designed for a captivating visual experience.

Serene How To Get Flood Insurance Design Nature

Explore this high-quality how to get flood insurance image, perfect for enhancing your desktop or mobile wallpaper.

Download these how to get flood insurance wallpapers for free and use them on your desktop or mobile devices.

0 Response to "How To Get Flood Insurance"

Post a Comment