How To Get Insurance To Cover Ozempic

How To Get Insurance To Cover Ozempic: Your Ultimate Guide

If you or a loved one has been prescribed Ozempic (semaglutide), you know the sticker shock can be real. This revolutionary medication, whether used for managing Type 2 Diabetes or for weight management (where it's often used off-label or in its specialized sibling form, Wegovy), is incredibly effective but often carries a hefty price tag if not covered. So, how exactly do you navigate the complex world of healthcare plans to figure out How To Get Insurance To Cover Ozempic? It's a challenge, but with the right strategy and documentation, it's absolutely possible. Think of this guide as your detailed roadmap.

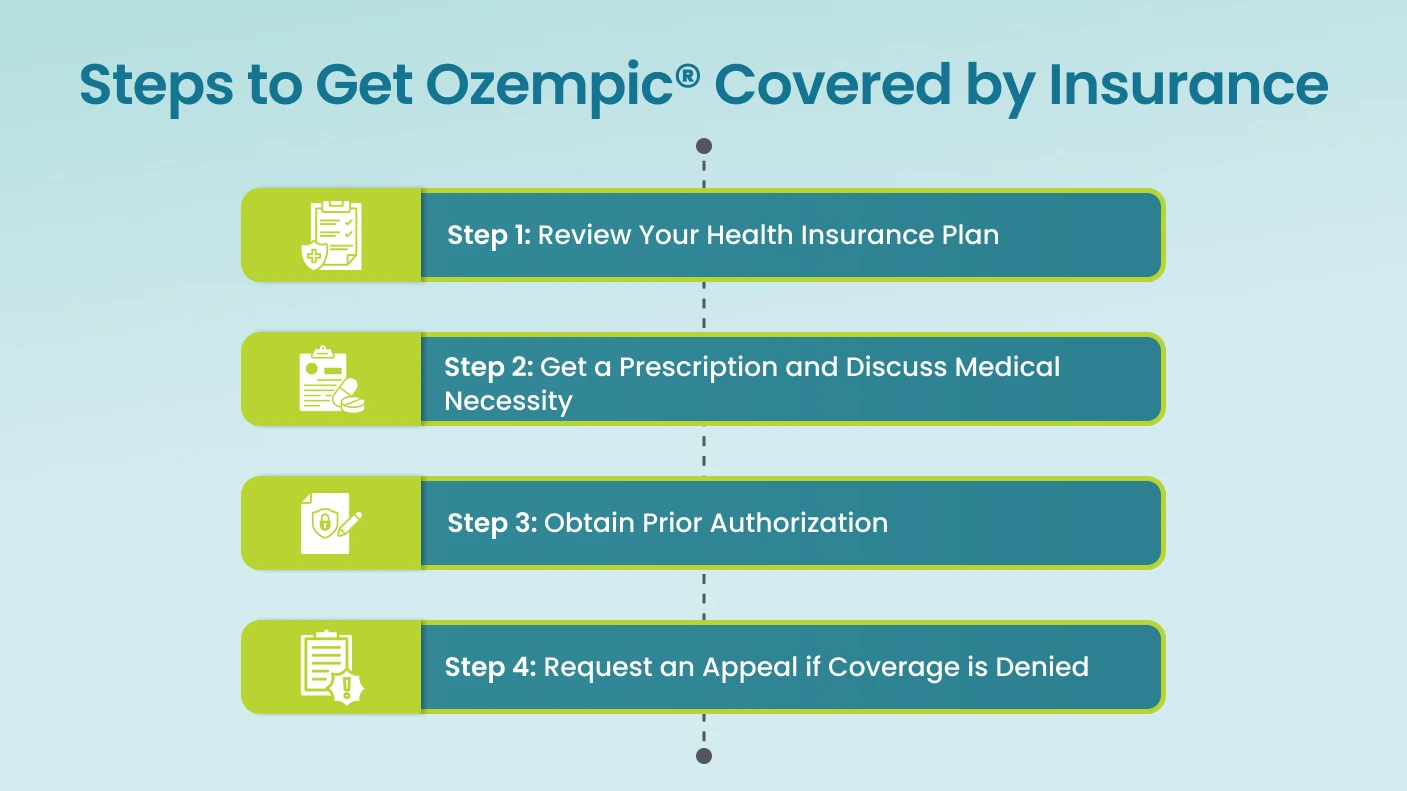

Getting approval is usually a multi-step process that requires patience and close collaboration with your prescribing physician. Insurance companies are strict about covering high-cost specialty drugs, meaning you have to prove medical necessity. Let's break down exactly what you need to do to maximize your chances of approval.

Understanding Your Insurance Policy: The Crucial First Step

Before you or your doctor even submit a prescription, you must understand the specific rules of your insurance plan. Many people confuse health insurance coverage with prescription coverage; these are often handled by separate departments or PBMs (Pharmacy Benefit Managers).

Your first move should always be to call your insurance provider directly. Ask specific questions about your pharmaceutical benefits, specifically focusing on specialty drugs and injectable medications. This initial call will save you a lot of time and frustration down the line.

Deciphering the Formulary List

The formulary is essentially your insurer's list of preferred drugs. If Ozempic is on the list, that's great news! However, it usually falls into a high tier, meaning your co-pay will be significant, or it might be subject to utilization management.

If Ozempic is not on the formulary, or if another GLP-1 medication (like Trulicity or Victoza) is listed as a preferred drug, your insurance will likely require you to try and fail those alternatives first. This is called 'Step Therapy.' If you cannot tolerate or see therapeutic results from the preferred alternatives, your doctor can then argue for an exception for Ozempic.

The Dreaded Prior Authorization (PA)

Prior Authorization (PA) is the biggest roadblock when you are learning How To Get Insurance To Cover Ozempic. A PA is a requirement that your doctor must submit detailed medical documentation proving that Ozempic is medically necessary and is the most appropriate treatment for you.

This process is handled entirely by your doctor's office, but you must make sure they are submitting the necessary information. A typical PA request requires specific blood work results, documented history of diabetes or related conditions, and evidence of failed previous treatments.

The Strategic Approach to Physician Advocacy

Your doctor is your strongest ally in this fight. Insurance companies typically only approve Ozempic if you meet very strict clinical criteria. Your physician must frame the prescription request to align perfectly with these criteria.

Make an appointment to discuss the prescription coverage issue specifically, not just your treatment plan. Ask your doctor how much experience their office has with successful Ozempic PAs.

Diagnoses That Help Coverage (Type 2 vs. Weight Loss)

Here is where the core issue usually lies. Ozempic is FDA-approved primarily for Type 2 Diabetes management. Wegovy (which uses the same active ingredient, semaglutide) is FDA-approved for chronic weight management.

Most insurance plans strictly cover Ozempic only if you have a documented diagnosis of Type 2 Diabetes and meet specific blood sugar targets (like an elevated A1C). If you are only seeking Ozempic for weight loss, coverage is significantly harder, if not impossible, unless your policy specifically includes anti-obesity medications.

Your doctor must use the correct ICD-10 code corresponding to Type 2 Diabetes, along with evidence that other, cheaper diabetes medications (like Metformin) have failed to adequately control your blood sugar.

Documentation is Key

For a successful Prior Authorization, your medical chart must be impeccable. The evidence needs to be clear, robust, and undeniable. Be proactive and ensure your doctor's office has these items ready:

- **Current Lab Work:** Specifically A1C levels showing inadequate control (typically above 7.0%).

- **History of Failed Medications:** Documentation proving you have tried and failed at least one or two formulary alternatives (Step Therapy proof).

- **Comorbidities:** Any other health conditions related to your diabetes or obesity (e.g., high blood pressure, high cholesterol) that Ozempic could treat.

- **Specific Justification:** A letter of medical necessity written by your physician detailing why Ozempic is superior to other treatments for your unique case.

Remember, the insurance company isn't trying to deny treatment; they are confirming you meet their utilization guidelines. Providing overwhelming evidence is the best way to move past this step when learning How To Get Insurance To Cover Ozempic.

What If the Initial Claim Is Denied?

Don't panic! A denial often means the Prior Authorization paperwork was incomplete, or the utilization criteria were not fully met. This is rarely the end of the road. There are still actionable steps you can take.

Navigating the Internal Appeals Process

Every insurance provider has an established internal appeals process. You generally have the right to appeal a coverage denial within a specific timeframe (usually 60 to 180 days). The appeal should be handled by your doctor's office, but you should track its progress.

The key to a successful appeal is providing *new* information or clarifying the initial submission. For example, if the initial PA didn't clearly document that you suffered severe side effects from Metformin, the appeal should highlight that critical information. If the internal appeal fails, you can generally move to an external review handled by an independent third party in your state.

Exploring Patient Assistance Programs (PAPs)

If all avenues of coverage fail, financial assistance is still available. Novo Nordisk, the manufacturer of Ozempic, offers a comprehensive Patient Assistance Program. These programs are typically designed for patients who are uninsured or underinsured and meet specific income requirements.

Additionally, Novo Nordisk often provides co-pay savings cards for commercially insured patients. These cards can dramatically reduce your out-of-pocket costs, sometimes bringing the monthly cost down to as low as $25, even if your plan doesn't fully cover the drug. However, beware: these co-pay cards usually cannot be used if you are covered by government programs like Medicare or Medicaid.

Conclusion: Perseverance Pays Off

Navigating the insurance maze to learn How To Get Insurance To Cover Ozempic requires diligent planning, clear communication with your medical team, and a lot of persistence. Start by scrutinizing your policy's formulary and preparing for the Prior Authorization process. Ensure your physician provides undeniable documentation of your Type 2 Diabetes diagnosis and the necessity of this medication.

If you face a denial, utilize the appeals process immediately. Even if full coverage isn't achieved, look into co-pay cards and Patient Assistance Programs to make the treatment affordable. Taking control of this process is the best way to ensure you receive the medication you need without breaking the bank.

Frequently Asked Questions About Ozempic Coverage

- Can I get Ozempic covered if I only need it for weight loss?

- Coverage for weight loss alone is rare. Most insurance policies exclude anti-obesity medications. If your plan does not cover obesity treatment, you will likely need to explore the specific FDA-approved version for weight loss, Wegovy, or utilize patient savings programs.

- What is the difference between Ozempic and Wegovy coverage?

- While both contain semaglutide, Ozempic is primarily covered for Type 2 Diabetes. Wegovy is specifically approved and marketed for weight loss. Coverage depends entirely on whether your specific insurance plan offers benefits for Type 2 Diabetes treatment versus anti-obesity treatment.

- How long does the Prior Authorization (PA) process take?

- The typical PA review period ranges from 7 to 14 business days. However, delays in submission from the doctor's office or requests for additional information can extend this timeline significantly. Always follow up with your doctor's office and insurance provider after one week.

- If my plan denies coverage, does that mean I can use the Novo Nordisk Savings Card?

- Yes, if you have commercial insurance (not Medicare, Medicaid, or TriCare), you are generally eligible for the manufacturer's savings card, which can often reduce your co-pay significantly, even if the medication is not fully covered by your primary plan. Always check the current terms and conditions of the card.

How To Get Insurance To Cover Ozempic

How To Get Insurance To Cover Ozempic Wallpapers

Collection of how to get insurance to cover ozempic wallpapers for your desktop and mobile devices.

Mesmerizing How To Get Insurance To Cover Ozempic Moment Photography

Explore this high-quality how to get insurance to cover ozempic image, perfect for enhancing your desktop or mobile wallpaper.

Artistic How To Get Insurance To Cover Ozempic Picture Concept

A captivating how to get insurance to cover ozempic scene that brings tranquility and beauty to any device.

Vivid How To Get Insurance To Cover Ozempic Picture for Your Screen

Explore this high-quality how to get insurance to cover ozempic image, perfect for enhancing your desktop or mobile wallpaper.

Gorgeous How To Get Insurance To Cover Ozempic Picture for Desktop

This gorgeous how to get insurance to cover ozempic photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Amazing How To Get Insurance To Cover Ozempic Artwork Illustration

Experience the crisp clarity of this stunning how to get insurance to cover ozempic image, available in high resolution for all your screens.

Beautiful How To Get Insurance To Cover Ozempic Moment Digital Art

Experience the crisp clarity of this stunning how to get insurance to cover ozempic image, available in high resolution for all your screens.

Crisp How To Get Insurance To Cover Ozempic Moment in HD

Immerse yourself in the stunning details of this beautiful how to get insurance to cover ozempic wallpaper, designed for a captivating visual experience.

Crisp How To Get Insurance To Cover Ozempic Picture Concept

Immerse yourself in the stunning details of this beautiful how to get insurance to cover ozempic wallpaper, designed for a captivating visual experience.

Vibrant How To Get Insurance To Cover Ozempic Image Concept

Transform your screen with this vivid how to get insurance to cover ozempic artwork, a true masterpiece of digital design.

Crisp How To Get Insurance To Cover Ozempic Moment Art

Immerse yourself in the stunning details of this beautiful how to get insurance to cover ozempic wallpaper, designed for a captivating visual experience.

Spectacular How To Get Insurance To Cover Ozempic Capture Nature

Find inspiration with this unique how to get insurance to cover ozempic illustration, crafted to provide a fresh look for your background.

Gorgeous How To Get Insurance To Cover Ozempic Background in HD

This gorgeous how to get insurance to cover ozempic photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Dynamic How To Get Insurance To Cover Ozempic View for Mobile

Find inspiration with this unique how to get insurance to cover ozempic illustration, crafted to provide a fresh look for your background.

Mesmerizing How To Get Insurance To Cover Ozempic Scene for Mobile

Explore this high-quality how to get insurance to cover ozempic image, perfect for enhancing your desktop or mobile wallpaper.

Amazing How To Get Insurance To Cover Ozempic View in HD

Explore this high-quality how to get insurance to cover ozempic image, perfect for enhancing your desktop or mobile wallpaper.

Lush How To Get Insurance To Cover Ozempic Artwork Concept

This gorgeous how to get insurance to cover ozempic photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Vivid How To Get Insurance To Cover Ozempic Capture Photography

Experience the crisp clarity of this stunning how to get insurance to cover ozempic image, available in high resolution for all your screens.

Vivid How To Get Insurance To Cover Ozempic Background Photography

Explore this high-quality how to get insurance to cover ozempic image, perfect for enhancing your desktop or mobile wallpaper.

Breathtaking How To Get Insurance To Cover Ozempic Abstract Photography

Explore this high-quality how to get insurance to cover ozempic image, perfect for enhancing your desktop or mobile wallpaper.

Vibrant How To Get Insurance To Cover Ozempic Photo Photography

Transform your screen with this vivid how to get insurance to cover ozempic artwork, a true masterpiece of digital design.

Download these how to get insurance to cover ozempic wallpapers for free and use them on your desktop or mobile devices.

0 Response to "How To Get Insurance To Cover Ozempic"

Post a Comment