How To Get Medical Bills Off My Credit Report

How To Get Medical Bills Off My Credit Report: A Friendly Guide

Dealing with unexpected medical bills is stressful enough without the added headache of watching your credit score plummet. If you're asking yourself, "How To Get Medical Bills Off My Credit Report?" you are definitely not alone. Millions of Americans face this exact challenge every year, but the good news is that the rules have changed significantly in your favor recently.

We understand that navigating the intersection of healthcare, insurance, and credit reporting can feel like a minefield. This comprehensive, step-by-step guide will break down the strategies and recent regulatory changes you need to know to clean up your credit report and move forward.

Understanding Medical Debt and Your Credit Report

Unlike credit card debt, medical debt often involves complex insurance delays and high balance surprises. When a medical bill goes unpaid for too long—typically several months—the provider may sell it to a third-party collection agency.

Once a debt hits collections, the collection agency can report it to the major credit bureaus (Experian, Equifax, and TransUnion). These collection entries are incredibly damaging, sometimes dropping your score by 100 points or more, depending on your prior credit history.

The Critical 180-Day Waiting Period

One major protection instituted in recent years is the 180-day grace period. This rule mandates that medical debt cannot be reported to your credit file until 180 days after the debt was first placed into collections.

This critical half-year buffer gives you ample time to sort out insurance payments, negotiate with the provider, or dispute the charge before it harms your score. If you catch a bill early, you have time to prevent it from ever showing up.

Step 1: Verification and Dispute (The Crucial First Move)

Before you pay a single dollar, your first action must be to verify the accuracy of the debt. Medical billing is notoriously prone to errors, which means the debt might not even be yours or might be misreported.

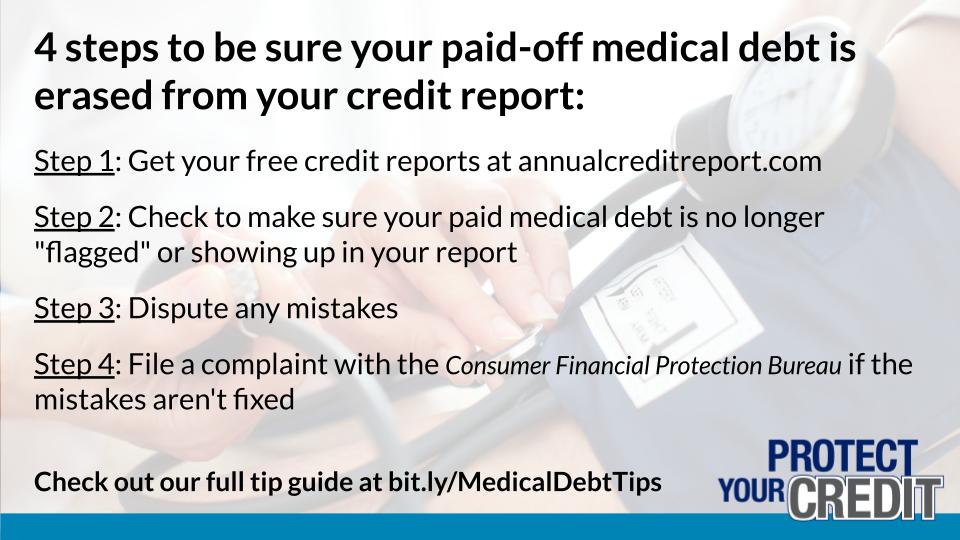

Start by pulling copies of your credit reports from all three bureaus through the official AnnualCreditReport.com website. Look closely at the entry listed for the medical collection. Does the amount match what you owe? Is the date correct?

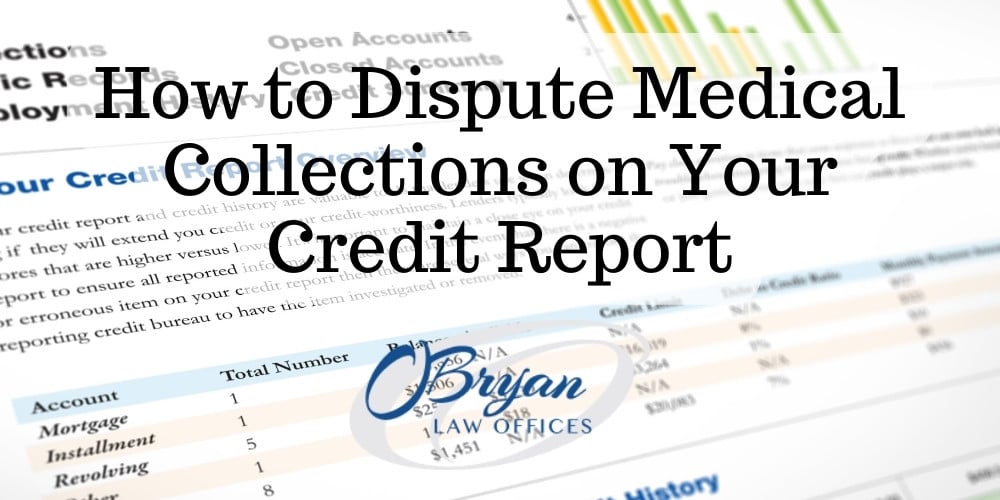

Disputing Inaccurate Information

If you find an error, you must dispute it directly with the credit bureau reporting the information. They have 30 days to investigate your claim.

You should also send a separate dispute letter directly to the collection agency, detailing why the bill is inaccurate. This dual approach maximizes your chance of a successful removal.

Here are common reasons for disputing medical debt:

- The bill was already paid by your insurance provider.

- The amount is incorrect or inflated due to billing errors.

- The bill belongs to someone else (identity mix-up).

- The debt is older than seven years and should be removed (statute of limitations).

Leveraging New Regulatory Changes to Your Advantage

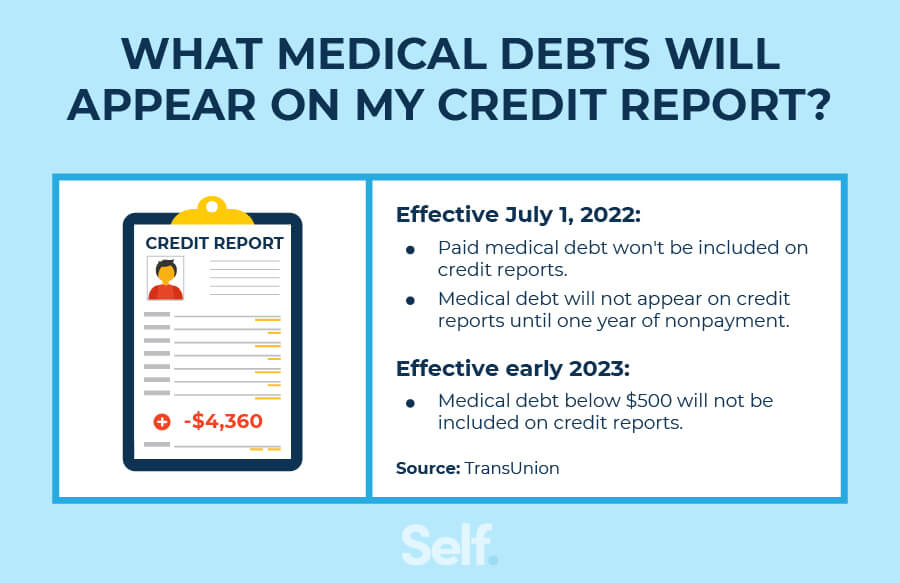

The rules governing medical debt reporting changed dramatically in 2022 and 2023. These changes make it much easier to figure out how to get medical bills off my credit report and minimize long-term damage.

The $500 Threshold Rule (Effective 2023/2024)

One of the most impactful changes is the exclusion of smaller medical collections. As of early 2024, medical collection debts under $500 will not appear on your credit report at all.

If your specific collection debt is less than this amount, it should be automatically removed by the credit bureaus. If you see an entry under $500, you should file a dispute immediately to ensure compliance with this new rule.

Step 2: Pay the Bill, Remove the Entry (The Power of Zero Balance)

Traditionally, paying off a collection account wouldn't remove it from your credit report; it would simply update the status to "Paid Collection." This update still looked bad to lenders.

However, under the new rules, once a medical collection debt is paid off, it must be completely removed from your credit report. This is a game-changer and provides a clear path forward for those trying to repair their credit quickly.

Negotiating a Settlement

If the debt is valid and you decide to pay it, you should first try to negotiate the total amount. Collection agencies often buy debt for pennies on the dollar, so they are usually willing to accept less than the full amount.

Aim to settle for 50% to 75% of the original balance. Importantly, you must get the settlement agreement in writing before sending any payment. This documentation proves the debt is satisfied once paid.

When negotiating, keep these tips in mind:

- Always communicate in writing (certified mail is best).

- Do not admit guilt or promise future payments in phone calls.

- Reference the fact that the entry must be removed entirely once paid, as per new regulations.

The Pay-for-Delete Strategy (Use with Caution)

Before the rule change, "Pay-for-Delete" was the gold standard for removing medical debt. This is an agreement where the collector agrees to remove the entry entirely in exchange for payment.

While this is now the automatic result for paid medical debt, if you are negotiating a settlement, specifically request that they confirm in writing that they will notify the credit bureaus of the full removal upon receipt of payment.

Long-Term Credit Recovery Strategies

Once you've successfully figured out how to get medical bills off my credit report, the next phase is building positive credit history. Removing collections is vital, but maintaining good habits ensures a high score in the future.

Focus on the two most important factors in credit scoring: payment history and credit utilization.

Steps for rebuilding:

- **Maintain Zero Balances:** Keep your credit card balances as low as possible (ideally below 10% utilization).

- **Pay on Time, Every Time:** Set up automatic payments for all outstanding debt.

- **Monitor Regularly:** Check your credit report every few months to ensure no new errors or collections appear.

Remember, medical collections often result from a lack of communication or timing issues, not financial irresponsibility. By taking proactive steps, you can rapidly restore your financial health.

Conclusion: The Path to a Clean Credit Report

The days when medical debt lingered indefinitely on your credit report are largely over thanks to new consumer protections. If you have active medical collections, the strategy is clear: first, verify the debt and dispute any inaccuracies.

Second, if the debt is legitimate, pay it off—especially if it is under the critical $500 threshold, or if it has passed the 180-day mark. Because paid medical collections must now be removed completely, settling the debt is the fastest, most effective answer to "How To Get Medical Bills Off My Credit Report." Take advantage of these rules to clean up your profile quickly and efficiently.

Frequently Asked Questions (FAQ)

- Can medical bills appear on my credit report immediately?

- No. Under the new rules, a collection agency must wait 180 days before reporting the medical debt to the credit bureaus. This grace period is designed to allow time for insurance processing.

- Will paying the medical collection debt automatically remove it from my report?

- Yes! Since 2022/2023, the major credit bureaus have agreed to remove all medical collection accounts once they are paid in full or settled to a zero balance. This removal should happen automatically, but you can file a dispute if it takes longer than 30 days.

- What if my medical bill is less than $500?

- Medical collection debts under $500 are no longer included on consumer credit reports. If you see one under this amount, dispute it immediately, as it violates current credit reporting standards.

- Should I deal with the original hospital or the collection agency?

- If the bill has just been sent to collections (within the last few weeks), try negotiating directly with the original provider first. If it has been fully sold to a third party, you must deal with the collection agency, but always verify the debt before paying.

How To Get Medical Bills Off My Credit Report

How To Get Medical Bills Off My Credit Report Wallpapers

Collection of how to get medical bills off my credit report wallpapers for your desktop and mobile devices.

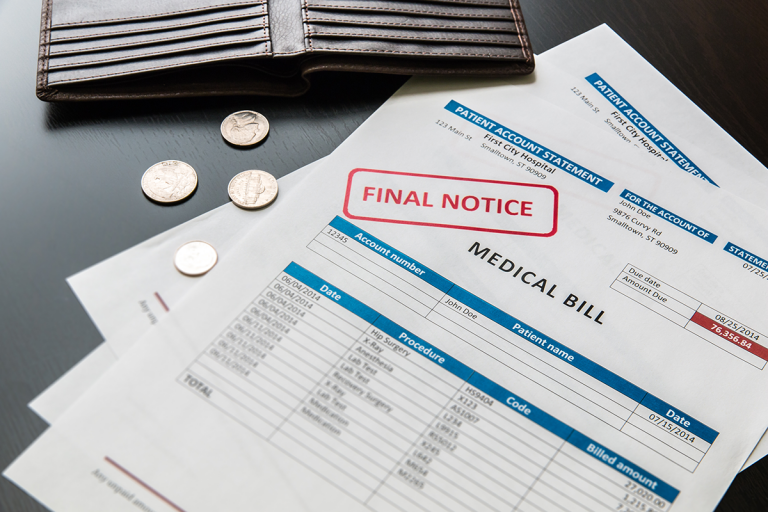

Amazing How To Get Medical Bills Off My Credit Report Wallpaper in HD

Transform your screen with this vivid how to get medical bills off my credit report artwork, a true masterpiece of digital design.

Lush How To Get Medical Bills Off My Credit Report Moment Concept

This gorgeous how to get medical bills off my credit report photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Dynamic How To Get Medical Bills Off My Credit Report Photo in 4K

This gorgeous how to get medical bills off my credit report photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Serene How To Get Medical Bills Off My Credit Report Background Photography

Discover an amazing how to get medical bills off my credit report background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Artistic How To Get Medical Bills Off My Credit Report Scene for Mobile

Find inspiration with this unique how to get medical bills off my credit report illustration, crafted to provide a fresh look for your background.

Crisp How To Get Medical Bills Off My Credit Report Wallpaper Collection

A captivating how to get medical bills off my credit report scene that brings tranquility and beauty to any device.

Crisp How To Get Medical Bills Off My Credit Report Artwork Illustration

Find inspiration with this unique how to get medical bills off my credit report illustration, crafted to provide a fresh look for your background.

Crisp How To Get Medical Bills Off My Credit Report Moment Illustration

Find inspiration with this unique how to get medical bills off my credit report illustration, crafted to provide a fresh look for your background.

Lush How To Get Medical Bills Off My Credit Report Picture for Desktop

This gorgeous how to get medical bills off my credit report photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Amazing How To Get Medical Bills Off My Credit Report Design Concept

Explore this high-quality how to get medical bills off my credit report image, perfect for enhancing your desktop or mobile wallpaper.

Stunning How To Get Medical Bills Off My Credit Report Abstract in HD

A captivating how to get medical bills off my credit report scene that brings tranquility and beauty to any device.

Spectacular How To Get Medical Bills Off My Credit Report Moment Illustration

A captivating how to get medical bills off my credit report scene that brings tranquility and beauty to any device.

Lush How To Get Medical Bills Off My Credit Report Design Art

Immerse yourself in the stunning details of this beautiful how to get medical bills off my credit report wallpaper, designed for a captivating visual experience.

Vivid How To Get Medical Bills Off My Credit Report Abstract for Your Screen

Experience the crisp clarity of this stunning how to get medical bills off my credit report image, available in high resolution for all your screens.

High-Quality How To Get Medical Bills Off My Credit Report Capture Digital Art

Experience the crisp clarity of this stunning how to get medical bills off my credit report image, available in high resolution for all your screens.

High-Quality How To Get Medical Bills Off My Credit Report Image in 4K

Discover an amazing how to get medical bills off my credit report background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Lush How To Get Medical Bills Off My Credit Report Landscape for Mobile

This gorgeous how to get medical bills off my credit report photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

High-Quality How To Get Medical Bills Off My Credit Report Design in 4K

Experience the crisp clarity of this stunning how to get medical bills off my credit report image, available in high resolution for all your screens.

Beautiful How To Get Medical Bills Off My Credit Report Moment Illustration

Transform your screen with this vivid how to get medical bills off my credit report artwork, a true masterpiece of digital design.

Serene How To Get Medical Bills Off My Credit Report Artwork for Desktop

Discover an amazing how to get medical bills off my credit report background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Download these how to get medical bills off my credit report wallpapers for free and use them on your desktop or mobile devices.