Should You Get Gap Insurance

Should You Get Gap Insurance? The Essential Guide to Protecting Your Investment

Buying a new car is exciting, but it often comes with a hefty price tag and, usually, a loan. You've secured your standard auto insurance—that's great. But have you thought about the dreaded "gap"? This is where the crucial question comes in: Should You Get Gap Insurance?

If you finance or lease a vehicle, the answer is often a resounding yes. Gap insurance is designed to protect you from financial disaster if your new car is totaled or stolen early in your ownership period. Without it, you could be left making payments on a car you no longer drive.

In this comprehensive guide, we'll break down exactly what GAP insurance is, who needs it most, and how to get the best deal, ensuring you make a smart financial decision for your automotive investment.

What Exactly is GAP Insurance, Anyway?

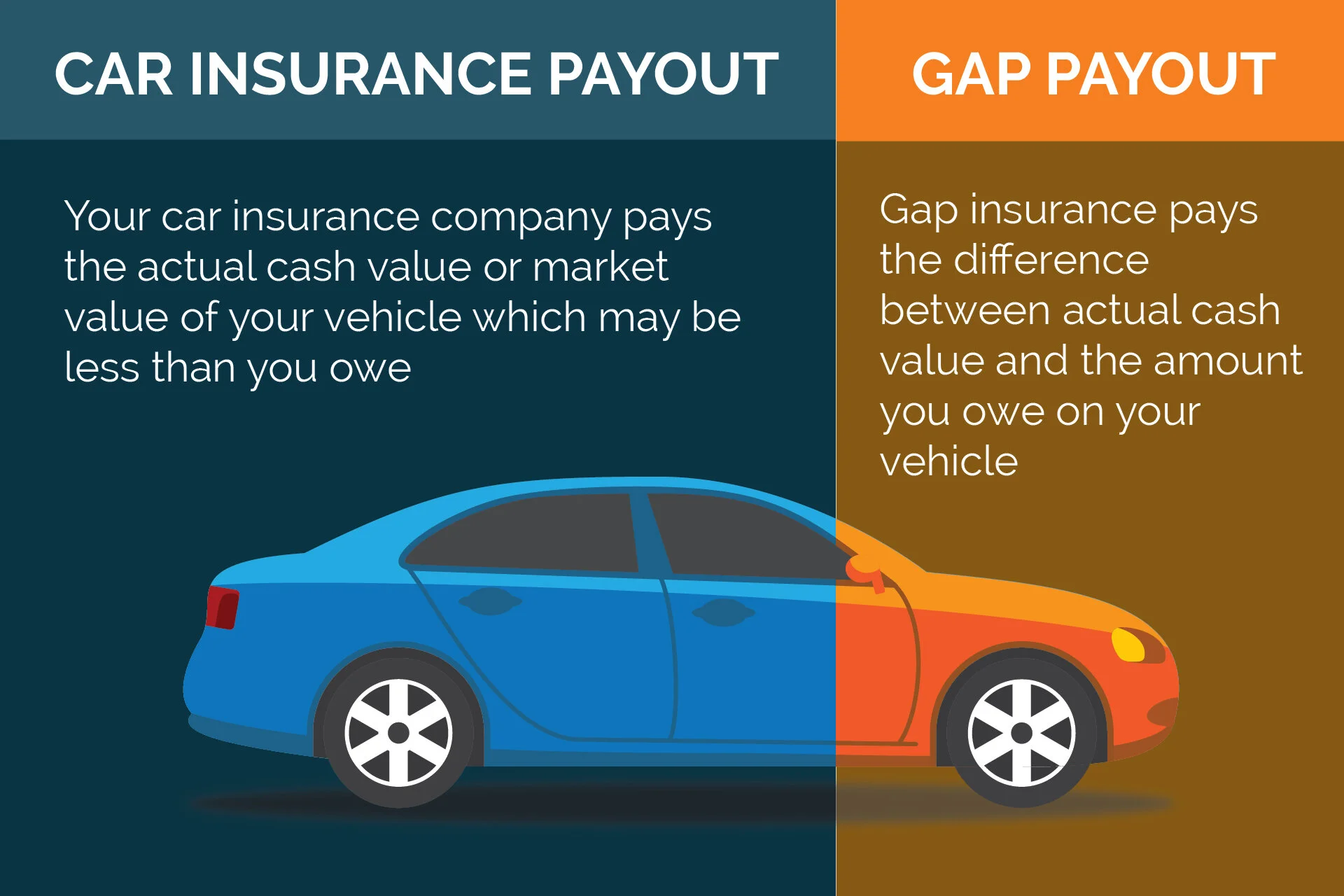

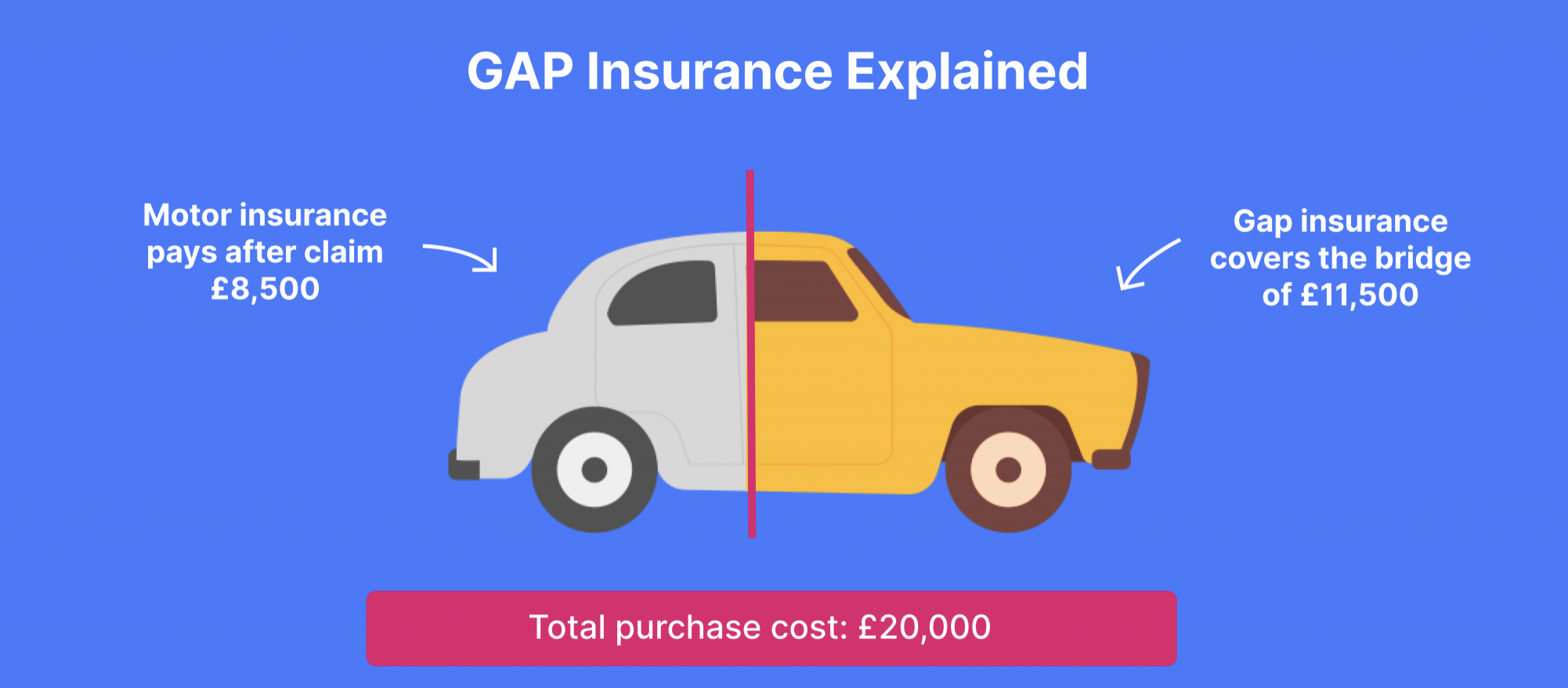

GAP stands for Guaranteed Auto Protection. It's an optional coverage that applies specifically to leased or financed vehicles. Standard auto insurance (collision and comprehensive) will only pay out the Actual Cash Value (ACV) of your vehicle if it is deemed a total loss.

The problem is that cars depreciate quickly—sometimes drastically the moment you drive them off the lot. If an accident occurs shortly after purchase, the amount your insurer pays out might be less than what you still owe to the lender. GAP insurance covers this difference.

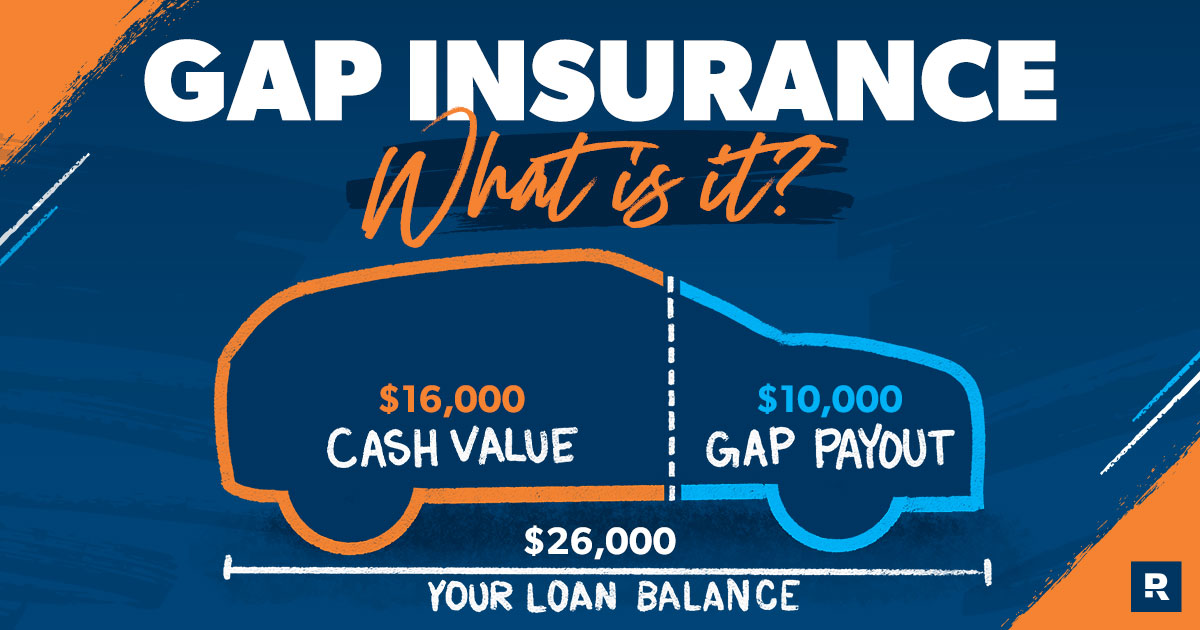

The 'Gap' Explained: Depreciation and Debt

Imagine you buy a car for $30,000 and finance the entire amount. Six months later, it's totaled in an accident. Due to depreciation, your car's ACV might only be $24,000, but you still owe $28,000 on your loan.

Your standard insurance pays the lender $24,000. That leaves a $4,000 "gap" that you are legally obligated to pay out of pocket—plus, you still need a down payment for your next car. This scenario perfectly illustrates why many experts agree that you Should You Get Gap Insurance when purchasing a new vehicle.

Transition words like "Therefore" or "Consequently" highlight the necessity of this coverage. Ultimately, GAP insurance ensures that your loan is completely wiped out, giving you a fresh start.

Who Truly Needs GAP Coverage?

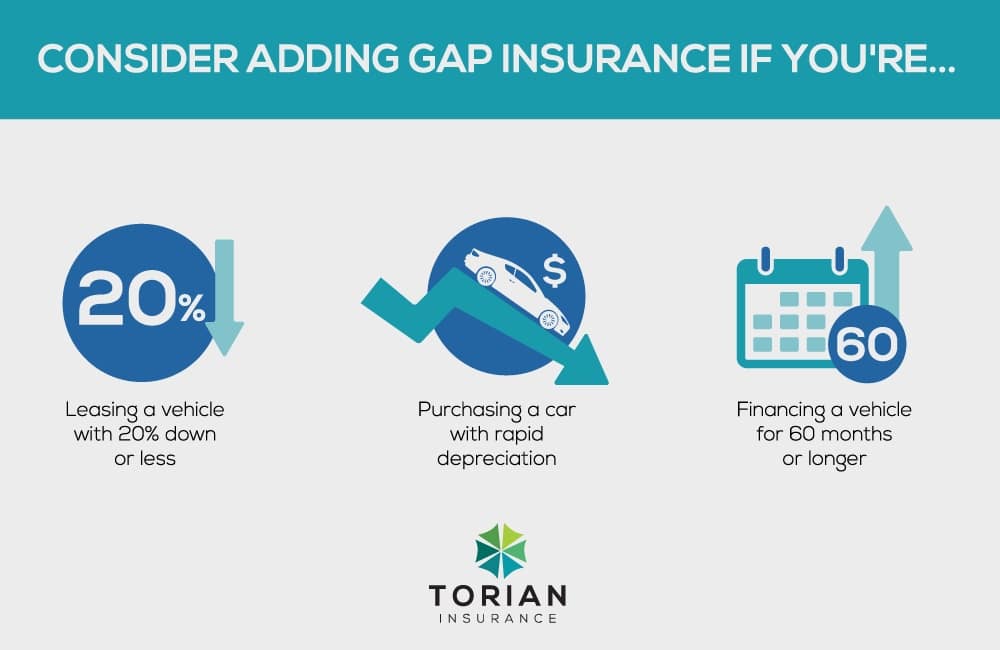

While GAP coverage is beneficial for anyone with a loan, it becomes absolutely essential for specific types of buyers. If you fall into one of the following categories, you should seriously consider adding this protection to your policy.

Generally speaking, the greater the disparity between the car's value and the amount you owe, the more vital GAP insurance becomes. Think critically about your financial situation and your loan terms.

Key Factors That Make GAP Insurance a Must-Have

If any of these situations describe your car purchase, then the answer to Should You Get Gap Insurance is almost certainly yes:

- You made a small down payment (less than 20%).

- You financed for a very long term (60 months or more).

- You included previous debt (like negative equity from a trade-in) into your new car loan.

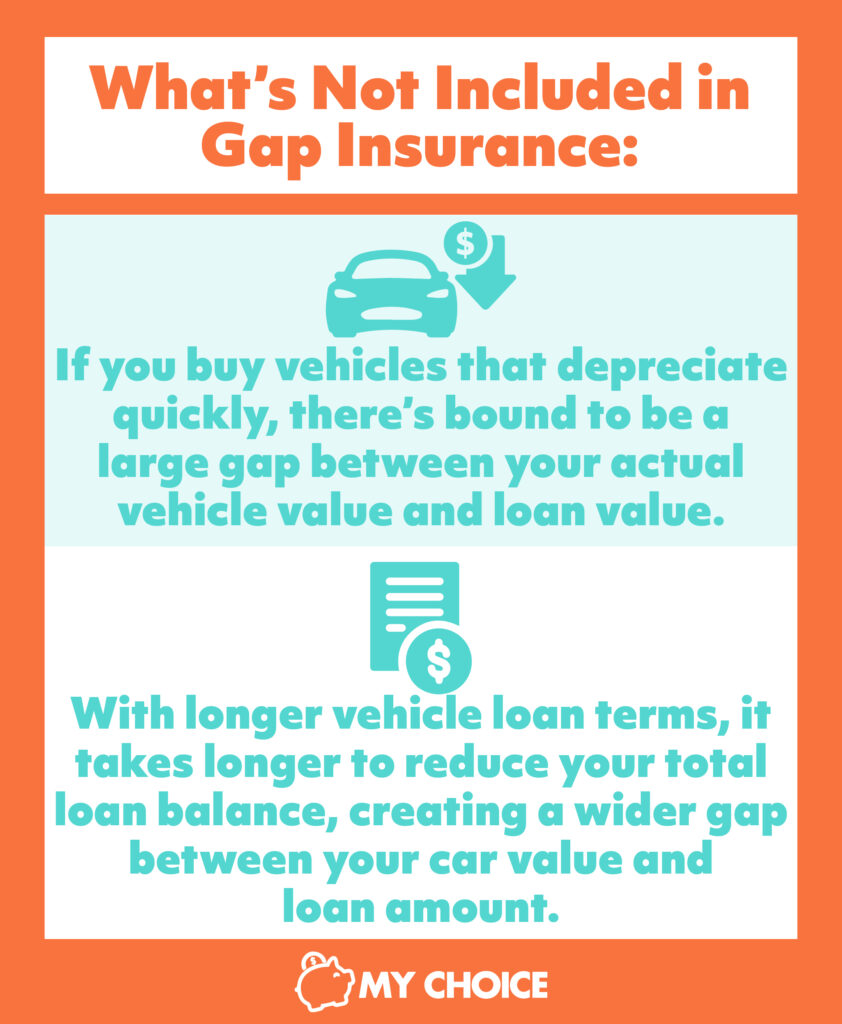

- You bought a vehicle that depreciates faster than average.

High Loan-to-Value Ratio (LTV)

Your LTV is the ratio between your outstanding loan balance and the market value of your vehicle. A high LTV means you owe significantly more than the car is worth. This usually happens when you put little or no money down, increasing your immediate debt exposure.

Furthermore, if you rolled negative equity from an old trade-in into the new loan, your LTV is instantly elevated. This greatly increases your risk of being underwater right from day one, emphasizing the need for GAP coverage.

Extended Loan Terms (60+ Months)

Lenders often offer loan terms spanning 72 or even 84 months to make monthly payments look more affordable. While this seems helpful, it drastically slows down how fast you pay off the principal.

The slower you pay down your loan, the longer you remain "upside down," meaning the car depreciates faster than you pay off the debt. For these longer loans, GAP insurance is practically non-negotiable for the first few years.

Where Can You Buy GAP Insurance (and How to Save Money)?

You have a few options for purchasing GAP insurance, and choosing the right source can save you hundreds of dollars. The two primary places are the dealership and independent insurers or credit unions.

Remember, the goal is financial protection, but you shouldn't overpay for peace of mind. Comparison shopping is essential for this type of coverage.

Dealership vs. Third-Party Providers

The most common place people purchase GAP coverage is directly from the dealership. While convenient, the dealership often marks up the premium significantly—sometimes by several hundred percent.

A smarter approach is checking with external providers. Your current auto insurance company, credit unions, or specialty GAP insurance providers usually offer the same coverage for a fraction of the cost. Here are some quick comparison tips:

- Dealership: Often costs $500–$1,000 (often rolled into the loan principal, meaning you pay interest on it).

- Insurance Company: Typically costs $20–$60 per year, added as an endorsement to your existing policy.

- Credit Union/Bank: Often available as a one-time flat fee or a low annual charge.

Always ask your primary auto insurer first. Since they already cover the ACV, adding the GAP portion is usually the most economical option.

When Can You Skip GAP Insurance? (The Exceptions)

While GAP insurance is highly recommended for many financed purchases, it's not always necessary. There are situations where you can safely pass on this optional coverage, saving yourself the extra premium.

If your situation ensures that you are unlikely to be underwater on the loan, then GAP coverage offers little value.

You probably don't need GAP coverage if:

- You bought the car outright with cash. (No loan means no gap!)

- You made a very large down payment (25% or more). A big down payment ensures your equity exceeds the depreciation curve for a long time.

- You have a short loan term (36 months or less). With aggressive principal payments, you quickly reach positive equity.

- You purchase a used car that has low depreciation. Be cautious here, but older used cars often depreciate slower than new ones.

If you reach the point where you owe less than the car's actual value, you should contact your insurance provider immediately to cancel your GAP coverage and stop paying the premium. There is no point paying for protection you no longer need.

Conclusion: So, Should You Get Gap Insurance?

The decision of Should You Get Gap Insurance hinges entirely on your financing structure and the vehicle's depreciation rate. For the majority of people financing a brand-new car with less than 20% down, GAP insurance is an essential shield against financial setback.

If your vehicle is totaled early in the loan term, GAP insurance prevents you from owing thousands of dollars on a car you can no longer drive. Think of it as a low-cost safety net that protects your financial future and allows you to move on quickly after an unexpected loss.

Before signing the final papers, always compare the price offered by the dealership against the rate from your current insurance company or credit union. Protect your investment the smart way.

Frequently Asked Questions (FAQ) About GAP Insurance

- Can I cancel GAP insurance if I pay off my loan early?

- Yes, absolutely. Once your loan balance is zero, the GAP coverage serves no purpose. If you purchased it through the dealership or bank, you may be entitled to a prorated refund for the unused premium.

- Does GAP insurance cover my deductible?

- Most standard GAP policies cover the gap between the ACV and the loan balance, but they usually do not cover your deductible. However, some premium GAP policies might include deductible coverage, so always read the fine print of your specific policy.

- Is GAP insurance mandatory?

- No, GAP insurance is generally optional, although some lenders (especially for leases) may require it as part of the financing agreement to protect their investment. Always check your loan documents.

- Is it worth getting GAP insurance for a used car?

- It can be, especially if you financed the used car for a long term (over 60 months) or if the vehicle had significantly higher mileage when purchased, accelerating initial depreciation. If you rolled negative equity into the used car loan, GAP insurance is highly recommended.

Should You Get Gap Insurance

Should You Get Gap Insurance Wallpapers

Collection of should you get gap insurance wallpapers for your desktop and mobile devices.

Crisp Should You Get Gap Insurance Moment in 4K

This gorgeous should you get gap insurance photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Stunning Should You Get Gap Insurance Picture Art

Immerse yourself in the stunning details of this beautiful should you get gap insurance wallpaper, designed for a captivating visual experience.

Spectacular Should You Get Gap Insurance Artwork Photography

A captivating should you get gap insurance scene that brings tranquility and beauty to any device.

Spectacular Should You Get Gap Insurance Moment for Mobile

Immerse yourself in the stunning details of this beautiful should you get gap insurance wallpaper, designed for a captivating visual experience.

Amazing Should You Get Gap Insurance Design Photography

Experience the crisp clarity of this stunning should you get gap insurance image, available in high resolution for all your screens.

Detailed Should You Get Gap Insurance Landscape Nature

Transform your screen with this vivid should you get gap insurance artwork, a true masterpiece of digital design.

Stunning Should You Get Gap Insurance Background for Desktop

Immerse yourself in the stunning details of this beautiful should you get gap insurance wallpaper, designed for a captivating visual experience.

High-Quality Should You Get Gap Insurance Artwork for Mobile

Transform your screen with this vivid should you get gap insurance artwork, a true masterpiece of digital design.

Gorgeous Should You Get Gap Insurance Background Digital Art

Find inspiration with this unique should you get gap insurance illustration, crafted to provide a fresh look for your background.

Detailed Should You Get Gap Insurance Wallpaper in 4K

Experience the crisp clarity of this stunning should you get gap insurance image, available in high resolution for all your screens.

Artistic Should You Get Gap Insurance Design for Your Screen

Find inspiration with this unique should you get gap insurance illustration, crafted to provide a fresh look for your background.

Amazing Should You Get Gap Insurance Picture Collection

Experience the crisp clarity of this stunning should you get gap insurance image, available in high resolution for all your screens.

Vivid Should You Get Gap Insurance Wallpaper for Mobile

Transform your screen with this vivid should you get gap insurance artwork, a true masterpiece of digital design.

Captivating Should You Get Gap Insurance Scene Nature

A captivating should you get gap insurance scene that brings tranquility and beauty to any device.

Artistic Should You Get Gap Insurance Artwork in HD

A captivating should you get gap insurance scene that brings tranquility and beauty to any device.

Amazing Should You Get Gap Insurance Scene in 4K

Explore this high-quality should you get gap insurance image, perfect for enhancing your desktop or mobile wallpaper.

Crisp Should You Get Gap Insurance Scene in HD

Find inspiration with this unique should you get gap insurance illustration, crafted to provide a fresh look for your background.

Serene Should You Get Gap Insurance Moment Art

Transform your screen with this vivid should you get gap insurance artwork, a true masterpiece of digital design.

Breathtaking Should You Get Gap Insurance Moment Collection

Discover an amazing should you get gap insurance background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Amazing Should You Get Gap Insurance Moment in 4K

Explore this high-quality should you get gap insurance image, perfect for enhancing your desktop or mobile wallpaper.

Download these should you get gap insurance wallpapers for free and use them on your desktop or mobile devices.