Where To Get Workmans Comp Insurance

Where To Get Workmans Comp Insurance: A Friendly Guide for Business Owners

If you're running a business, protecting your employees—and your company's financial health—is paramount. That's exactly why workers' compensation insurance exists. It's a non-negotiable requirement for most employers across the United States. But once you realize you need it, the big question looms: Where to get Workmans Comp Insurance?

Navigating the insurance world can feel like walking through a complex maze, especially when terms like "state fund," "broker," and "PEO" are thrown around. Don't worry, we're here to break down the best avenues available to secure the right coverage for your team, keeping things simple and straightforward.

We'll explore every option, from traditional brokers to modern online solutions, ensuring you feel confident in making your choice. Let's get started on finding the perfect Workmans Comp Insurance policy for your business.

Understanding Your Legal Obligations

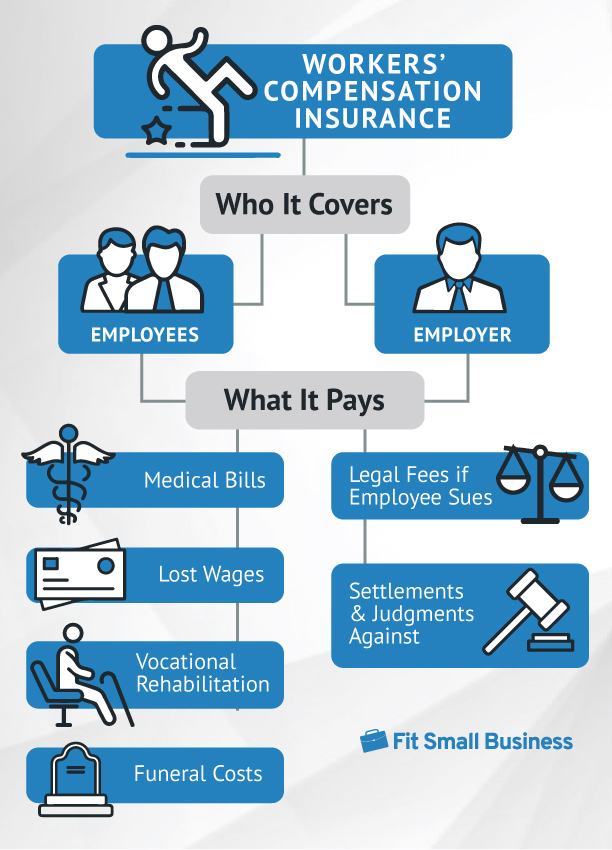

Before you jump into shopping, it's vital to understand why this insurance is mandatory. Workers' compensation provides wage replacement and medical benefits to employees injured in the course of employment. In exchange, the employee typically forfeits the right to sue the employer for negligence.

Nearly every state requires businesses with one or more employees (sometimes more, depending on the state) to carry this coverage. Failure to comply can result in severe financial penalties, fines, and even criminal charges. Understanding these obligations is the first step in knowing where to get Workmans Comp Insurance.

State Requirements: It Varies!

The rules for securing coverage are highly dependent on your state. Some states operate on an open market, meaning you buy exclusively from private insurers. Other states operate a monopolistic State Fund, requiring certain businesses to purchase directly from the state.

It's essential to confirm whether your state allows private carriers or mandates the use of a state fund. Always check with your state's Department of Labor or Workers' Compensation Board first to understand your legal purchasing options.

Traditional Routes: Where to Start Looking

For decades, businesses have relied on established methods to acquire their insurance needs. These methods still offer the most personalized support and comprehensive service, especially for complex operations.

The Power of Independent Insurance Agents

One of the most popular answers to the question "where to get Workmans Comp Insurance" is through an independent insurance agent or broker. These professionals work for you, not a single insurance company.

They can shop your policy among dozens of different carriers, comparing rates, coverage levels, and financial stability. If you are unsure about risk classifications or need specialized coverage, an agent is often your best advocate.

Key advantages of using an independent agent include:

- Personalized advice tailored to your specific industry risk.

- Access to multiple quotes from various private carriers.

- Assistance with claims processing and audits.

- Guidance on risk management strategies to lower premiums over time.

Direct from Insurance Carriers

You can always bypass the middleman and go directly to a carrier. Large national insurance companies often have dedicated small business departments that can issue policies directly. This might streamline the process if you already have other business policies (like property or general liability) with that company.

While this approach can sometimes save on broker fees, you miss out on comparative shopping. If you choose this route, be sure to request detailed quotes from at least three different major carriers to ensure competitiveness.

Modern Solutions and Specialized Options

The insurance landscape has changed significantly in recent years. Today, technology offers fast comparison tools, and specialized services can bundle HR and payroll with insurance needs.

Professional Employer Organizations (PEOs) – The All-in-One Solution

If you're a small to medium-sized business struggling with HR, payroll, and benefits, a PEO might be your answer. PEOs operate under a co-employment model, essentially grouping your employees with thousands of others under their master policy. This is a very common answer to where to get Workmans Comp Insurance for startups.

Because they buy coverage in bulk, PEOs can often offer lower rates than you could secure on your own. Furthermore, their services handle compliance, payroll auditing, and sometimes even claims management, significantly reducing your administrative burden.

Online Marketplaces and Comparison Tools

The digital age has brought forth insurance comparison platforms. These tools allow you to input your business details once and receive instant, competitive quotes from multiple carriers. This method offers speed and efficiency, perfect for busy owners.

While convenient, remember that these tools often rely on standard classification codes. If your business has unique risks or exposures, you may still need follow-up assistance from an agent to finalize the best policy details.

Assigned Risk Pools (For hard-to-insure businesses)

What if you're operating in a high-risk industry, or your company has a history of many claims? Private carriers might deny you coverage. In this scenario, your state provides an "Assigned Risk Pool" (sometimes called the "insurer of last resort").

While premiums in the assigned risk pool are usually higher, they ensure that every legally required business can access coverage. You typically apply for this coverage through an authorized insurance agent who specializes in these challenging placements.

Key Factors Affecting Your Choice

Choosing the right source for your policy isn't just about finding the lowest price. It's about securing a reliable partner who will be there when a claim occurs. Here are the critical factors to evaluate when determining where to get Workmans Comp Insurance:

- Carrier Financial Rating: Always check the A.M. Best rating of the carrier. A high rating (A- or better) ensures the company has the financial stability to pay out large claims.

- Claims Handling Service: How quickly and professionally does the carrier or PEO handle employee claims? Slow or complicated claims can lead to litigation and higher future costs.

- Audit Requirements: Workmans comp premiums are often estimated and finalized later via an audit. Understand the audit process and how easy it is to communicate your payroll data to the carrier.

- Total Cost vs. Deductibles: Look beyond the headline premium. Factor in deductibles, installment fees, and any potential safety/loss control services offered by the provider.

- Industry Specialization: Does the agent or carrier specialize in your industry (e.g., construction, healthcare, or tech)? Specialization usually means better pricing and risk advice.

We recommend getting quotes from at least two different sources—for example, an independent agent and a PEO—to compare pricing structures and service levels side-by-side.

Conclusion

Securing workers' compensation insurance is a fundamental pillar of running a compliant and responsible business. The good news is that you have several excellent options for where to get Workmans Comp Insurance, whether you prefer the personalized touch of an independent agent, the bundled services of a PEO, or the efficiency of an online comparison tool.

Start by understanding your state's specific mandates, then collect quotes from different reliable sources. By focusing on financial stability and strong claims service—not just the lowest premium—you can protect your workers and ensure your business can weather any unexpected workplace injury.

Frequently Asked Questions (FAQ) About Workmans Comp Insurance

- Can I skip getting Workmans Comp Insurance if I have only part-time employees?

- Generally, no. Most states count part-time employees, full-time employees, and sometimes even subcontractors when determining if coverage is legally required. Always check your state laws, but it is rarely based purely on hours worked.

- Is it cheaper to go through a PEO or a private carrier?

- It depends entirely on your risk profile and size. For small businesses, PEOs are often cheaper because they group you with thousands of others, accessing lower group rates. Larger, low-risk businesses might find better rates going directly to a private carrier or using a specialized broker.

- How does my premium for Workmans Comp Insurance get calculated?

- Premiums are calculated based on three primary factors: (1) Employee payroll (per $100), (2) Employee classification code (risk level), and (3) Your Experience Modification Rate (E-MOD), which reflects your company's past claims history compared to the industry average. If your E-MOD is high, your premium will be higher.

- If I am the only employee (owner), do I need Workmans Comp?

- In many states, owners, sole proprietors, partners, and corporate officers can legally exclude themselves from coverage. However, if you have any employees besides yourself, coverage is required. Even if you don't legally need it, purchasing a policy is often wise for your own financial protection if you work in a high-risk role.

Where To Get Workmans Comp Insurance

Where To Get Workmans Comp Insurance Wallpapers

Collection of where to get workmans comp insurance wallpapers for your desktop and mobile devices.

Captivating Where To Get Workmans Comp Insurance Moment Illustration

This gorgeous where to get workmans comp insurance photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

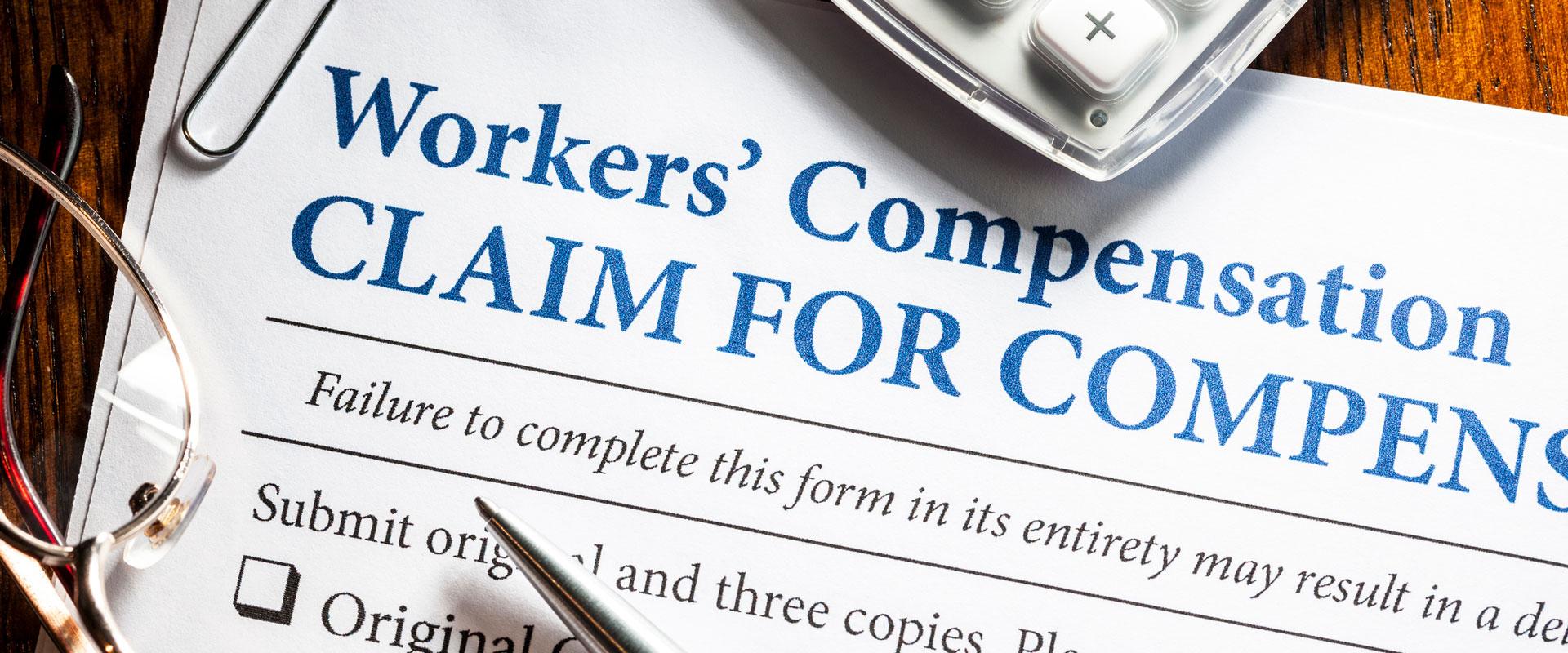

Crisp Where To Get Workmans Comp Insurance Background Concept

Immerse yourself in the stunning details of this beautiful where to get workmans comp insurance wallpaper, designed for a captivating visual experience.

Exquisite Where To Get Workmans Comp Insurance Picture Nature

Immerse yourself in the stunning details of this beautiful where to get workmans comp insurance wallpaper, designed for a captivating visual experience.

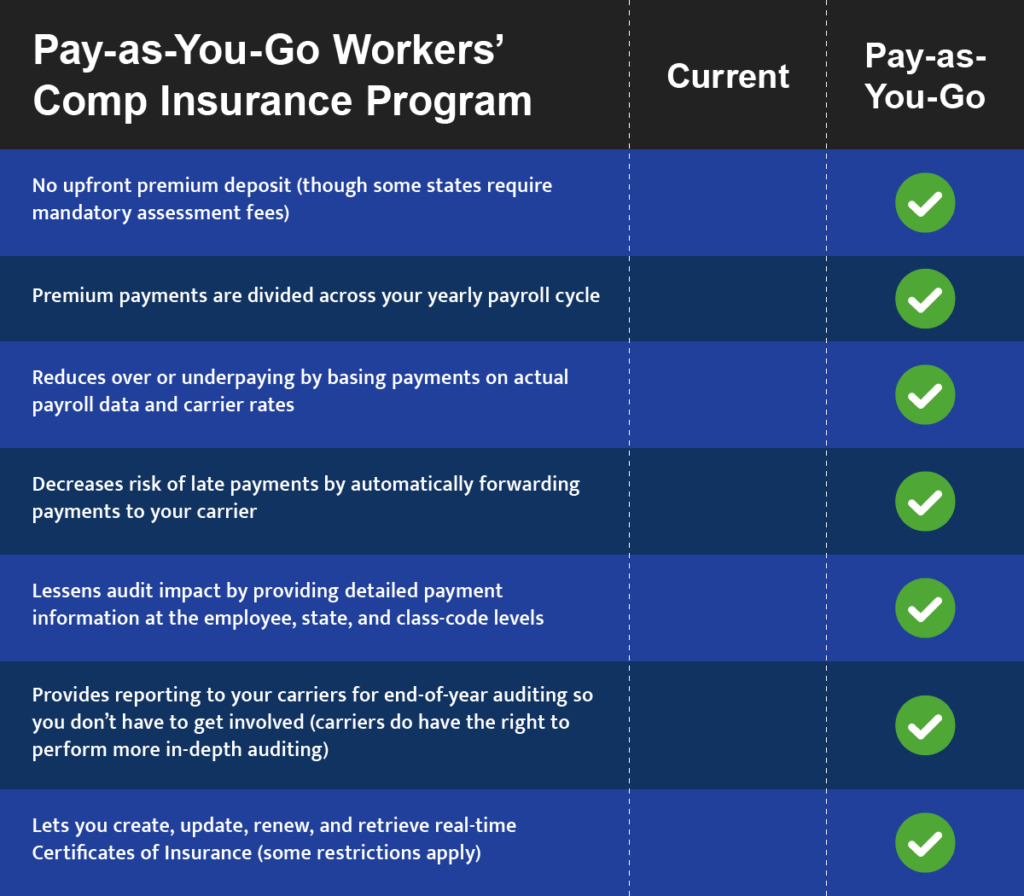

Vibrant Where To Get Workmans Comp Insurance Landscape for Mobile

Transform your screen with this vivid where to get workmans comp insurance artwork, a true masterpiece of digital design.

Vibrant Where To Get Workmans Comp Insurance Abstract for Mobile

Discover an amazing where to get workmans comp insurance background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Mesmerizing Where To Get Workmans Comp Insurance Landscape for Mobile

Explore this high-quality where to get workmans comp insurance image, perfect for enhancing your desktop or mobile wallpaper.

Dynamic Where To Get Workmans Comp Insurance Moment Concept

Immerse yourself in the stunning details of this beautiful where to get workmans comp insurance wallpaper, designed for a captivating visual experience.

Spectacular Where To Get Workmans Comp Insurance Photo Photography

Immerse yourself in the stunning details of this beautiful where to get workmans comp insurance wallpaper, designed for a captivating visual experience.

Spectacular Where To Get Workmans Comp Insurance Moment in 4K

Find inspiration with this unique where to get workmans comp insurance illustration, crafted to provide a fresh look for your background.

Gorgeous Where To Get Workmans Comp Insurance View Collection

Find inspiration with this unique where to get workmans comp insurance illustration, crafted to provide a fresh look for your background.

Artistic Where To Get Workmans Comp Insurance Landscape Photography

A captivating where to get workmans comp insurance scene that brings tranquility and beauty to any device.

Dynamic Where To Get Workmans Comp Insurance Scene Concept

A captivating where to get workmans comp insurance scene that brings tranquility and beauty to any device.

Crisp Where To Get Workmans Comp Insurance Abstract Illustration

This gorgeous where to get workmans comp insurance photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Gorgeous Where To Get Workmans Comp Insurance Landscape Collection

Find inspiration with this unique where to get workmans comp insurance illustration, crafted to provide a fresh look for your background.

Exquisite Where To Get Workmans Comp Insurance Background Collection

Find inspiration with this unique where to get workmans comp insurance illustration, crafted to provide a fresh look for your background.

Dynamic Where To Get Workmans Comp Insurance Background for Mobile

Find inspiration with this unique where to get workmans comp insurance illustration, crafted to provide a fresh look for your background.

Artistic Where To Get Workmans Comp Insurance Moment Art

This gorgeous where to get workmans comp insurance photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

High-Quality Where To Get Workmans Comp Insurance Landscape Nature

Discover an amazing where to get workmans comp insurance background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Serene Where To Get Workmans Comp Insurance Design in HD

Discover an amazing where to get workmans comp insurance background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Detailed Where To Get Workmans Comp Insurance Moment in 4K

Transform your screen with this vivid where to get workmans comp insurance artwork, a true masterpiece of digital design.

Download these where to get workmans comp insurance wallpapers for free and use them on your desktop or mobile devices.

0 Response to "Where To Get Workmans Comp Insurance"

Post a Comment