Bitcoin tumbles to 2026 low of $85,200 as gold reverses big gains, Microsoft leads Nasdaq lower

Bitcoin Tumbles to 2026 Low of $85,200 as Gold Reverses Big Gains, Microsoft Leads Nasdaq Lower

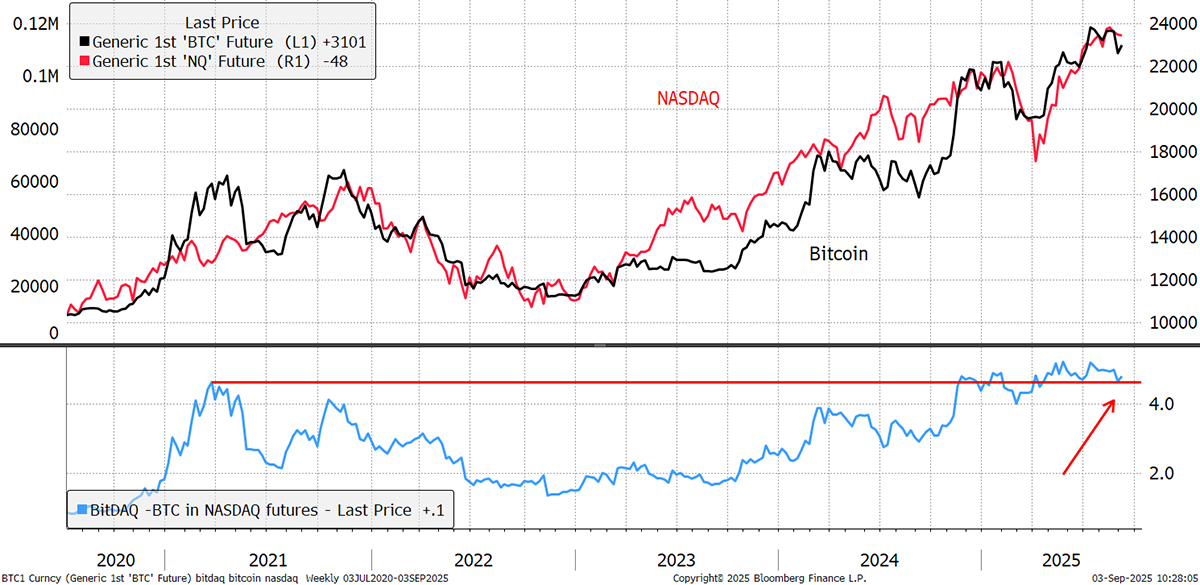

The financial markets entered a state of extreme flux this week, signaling a sharp, coordinated "risk-off" environment that spared virtually no asset class. Digital currency investors woke up to devastating news as Bitcoin (BTC) plummeted past critical support levels, registering a staggering 2026 low of $85,200. This seismic shift in crypto was mirrored, paradoxically, in traditional safe havens and high-growth stocks, confirming the widespread market panic.

Just last month, many analysts, myself included, saw $100,000 as a psychological floor for Bitcoin. I remember speaking with a portfolio manager who was confidently rebalancing his funds, shifting capital *into* BTC based on long-term institutional adoption metrics. His confidence, and the confidence of thousands of retail investors who followed suit, evaporated in less than 48 hours. This swift, brutal correction underscores one essential truth: when central banks sneeze, the entire global market catches a cold—regardless of asset type.

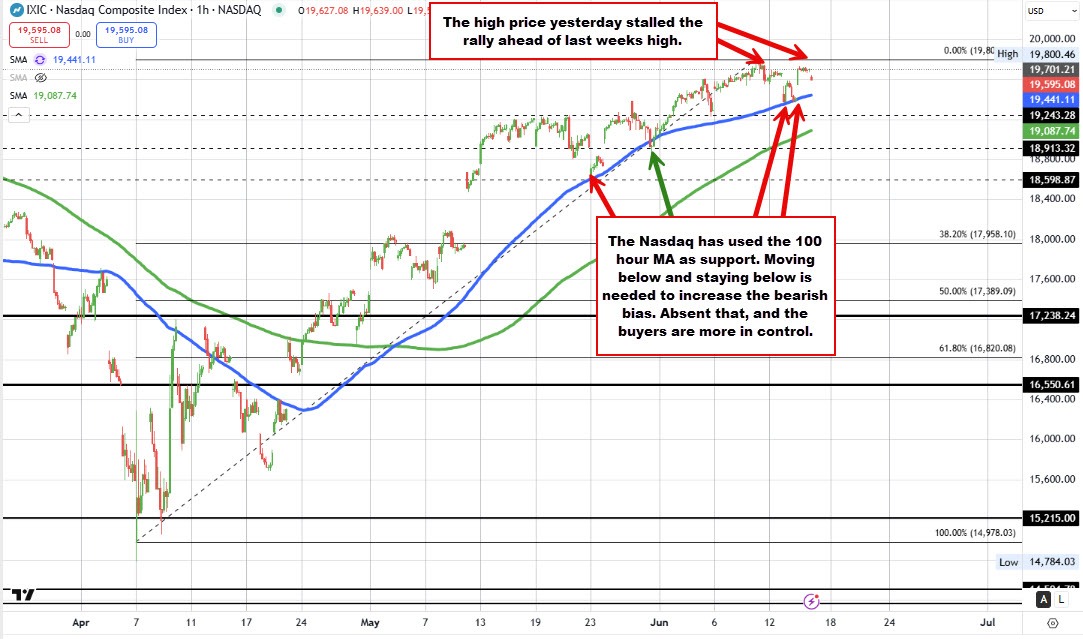

The sheer velocity of the crypto decline was alarming, wiping out over $500 billion from the total market capitalization. Simultaneously, the precious metals market, which had initially rallied on inflation fears, saw gold price movements sharply reverse, shedding nearly 5% of its recent gains. Compounding the misery, the technology sector led the charge lower on Wall Street, with Microsoft stock showing significant weakness and contributing disproportionately to the Nasdaq Composite's steepest one-day drop in two years. This is not just a crypto crash; it is a synchronized global repricing event.

The Cryptocurrency Contagion: Why $85,200 Is the New Floor

Bitcoin's dramatic descent to $85,200 has shattered analyst projections and initiated a new phase of intense scrutiny across the digital asset landscape. The decline wasn't gradual; it was a cascading liquidation event triggered by increasingly aggressive rhetoric from the Federal Reserve regarding sustained quantitative tightening (QT) and higher-for-longer interest rates.

When risk-free assets (like US Treasury bonds) start offering increasingly attractive yields, the calculus for holding volatile, non-yielding assets like Bitcoin quickly changes. Institutional investors, needing to de-risk and meet margin calls elsewhere in their portfolios, often sell their most liquid holdings first, and BTC falls squarely into that category.

Several factors coalesced to drive this deep market washout:

- Derivatives Market Flush: The initial move below $90,000 triggered massive forced liquidations in the leveraged futures and perpetual swaps markets, accelerating the downward momentum far beyond what organic selling pressure might have achieved.

- Macroeconomic Overhang: Continued fears of a global recession dampened speculative appetite across the board. Bitcoin, despite claims of being 'digital gold,' continues to trade as a high-beta risk asset.

- Regulatory Uncertainty: Renewed pushes for stricter regulatory frameworks globally, particularly in major economic jurisdictions, added a layer of systemic fear among institutional whales.

- Miner Capitulation: As profitability drops alongside price, smaller, less efficient mining operations are forced to sell their holdings to cover operational costs, adding supply pressure to the already stressed market.

This price point—$85,200—was established during the peak trading frenzy of the last cycle and represents a psychological breakdown point. If the market cannot quickly stabilize above this level, analysts warn that the next major support zone may not be found until the mid-$70,000s, suggesting the volatility crisis is far from over.

Gold's Sudden Retreat and the Flight to Safety Paradox

In theory, when high-risk assets like Bitcoin and tech stocks crumble, traditional safe-haven assets, especially gold (XAU/USD), should surge. However, this market cycle presented a stark paradox: after initially surging past the $2,500 mark on inflation worries, gold prices abruptly reversed course, confusing many veteran traders.

The primary driver behind gold's unexpected capitulation was the overwhelming strength of the US Dollar Index (DXY). As global investors sought true safety amidst the panic, many defaulted to holding US Dollars, viewing it as the ultimate store of value during times of intense global economic stress.

When the US Dollar strengthens dramatically, it makes dollar-denominated assets, including gold, more expensive for holders using foreign currencies, thus suppressing demand and triggering profit-taking. Furthermore, the rising real yields on US government bonds provided an alternative, yield-bearing safety asset that challenged gold's appeal.

The swift reversal highlights a shift in investor focus: the market is less concerned with inflation right now and more concerned with immediate liquidity and potential sovereign default risk. The traditional inverse relationship between gold and equity volatility seems to have temporarily broken down, replaced by a universal demand for cash.

Analysts are watching the behavior of central banks closely. Historically, central bank purchasing helps buoy gold during periods of intense volatility. If this purchasing slows, further downside pressure could develop, transforming gold's reversal from a minor correction into a prolonged slump.

Tech Titans Under Pressure: Microsoft and the Nasdaq Nosedive

The pain was not confined to decentralized finance or precious metals. The equity markets, particularly the US technology sector, suffered severe contractions, with the Nasdaq Composite index witnessing its worst week in years. Leading the downturn among the mega-cap stocks was Microsoft (MSFT), whose stock price decline was magnified by concerns over future corporate IT spending.

Microsoft, often considered a bellwether for enterprise health due to its dominant position in cloud computing (Azure) and enterprise software, saw its valuation metrics adjust harshly. Concerns are mounting that the aggressive monetary policy tightening by the Federal Reserve is finally filtering into the real economy, leading CFOs globally to curtail spending on new technological infrastructure.

This reduction in forecasted growth for the technology giants, coupled with high initial valuations, makes them extremely susceptible to aggressive selling during a recessionary fear cycle.

Key headwinds facing the tech sector include:

- Slowing Cloud Adoption Rate: While still growing, the pace of hyper-growth seen during the pandemic era for cloud services like Azure and AWS is stabilizing, leading to dampened earnings forecasts.

- Increased Cost of Capital: Higher interest rates make borrowing more expensive, impacting future project financing and decreasing the present value of future earnings—a major factor for growth stocks.

- Wage Inflation: Competition for top-tier engineering talent continues to put pressure on operating margins, affecting profitability even for giants like Microsoft.

- Portfolio Rebalancing: Massive hedge funds and institutional players are rotating out of perceived high-risk, high-growth names and into defensive sectors, triggering heavy sell-offs in market leaders.

The fact that a stable, cash-generating giant like Microsoft is leading the index lower suggests the market's concerns are fundamental, moving beyond short-term jitters into deep structural concerns about the near-term economic outlook.

What's Driving the Global Risk-Off Sentiment?

The common denominator linking the $85,200 Bitcoin crash, the gold reversal, and the Nasdaq slump is the fear surrounding aggressive monetary policy action aimed at curbing persistent inflation.

Central banks are signaling they are prepared to induce economic pain (a recession) to bring inflation under control. This aggressive stance effectively removes the "Fed Put"—the expectation that the Federal Reserve will step in to cushion market declines—which had supported asset prices for over a decade.

When the world's central banks prioritize fighting inflation over supporting asset valuations, capital flight becomes a universal theme. Investors are moving toward highly liquid, short-term instruments, awaiting clarity on inflation trends and the trajectory of future rate hikes.

Until investors see concrete evidence that inflation is sustainably moderating, allowing central banks to pivot to a less restrictive stance, market volatility is expected to remain exceptionally high. The synchronized nature of this downturn suggests that diversification benefits are vanishing, underscoring a high-correlation environment driven entirely by overarching macroeconomic policy decisions. Investors should brace for continued turbulence as the markets digest this new reality of economic tightening and global uncertainty.

Bitcoin tumbles to 2026 low of $85,200 as gold reverses big gains, Microsoft leads Nasdaq lower

Bitcoin tumbles to 2026 low of $85,200 as gold reverses big gains, Microsoft leads Nasdaq lower Wallpapers

Collection of bitcoin tumbles to 2026 low of $85,200 as gold reverses big gains, microsoft leads nasdaq lower wallpapers for your desktop and mobile devices.

Serene Bitcoin Tumbles To 2026 Low Of $85,200 As Gold Reverses Big Gains, Microsoft Leads Nasdaq Lower Artwork Concept

Explore this high-quality bitcoin tumbles to 2026 low of $85,200 as gold reverses big gains, microsoft leads nasdaq lower image, perfect for enhancing your desktop or mobile wallpaper.

Detailed Bitcoin Tumbles To 2026 Low Of $85,200 As Gold Reverses Big Gains, Microsoft Leads Nasdaq Lower Picture Digital Art

Explore this high-quality bitcoin tumbles to 2026 low of $85,200 as gold reverses big gains, microsoft leads nasdaq lower image, perfect for enhancing your desktop or mobile wallpaper.

Breathtaking Bitcoin Tumbles To 2026 Low Of $85,200 As Gold Reverses Big Gains, Microsoft Leads Nasdaq Lower Abstract Photography

Explore this high-quality bitcoin tumbles to 2026 low of $85,200 as gold reverses big gains, microsoft leads nasdaq lower image, perfect for enhancing your desktop or mobile wallpaper.

High-Quality Bitcoin Tumbles To 2026 Low Of $85,200 As Gold Reverses Big Gains, Microsoft Leads Nasdaq Lower Landscape Digital Art

Discover an amazing bitcoin tumbles to 2026 low of $85,200 as gold reverses big gains, microsoft leads nasdaq lower background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Crisp Bitcoin Tumbles To 2026 Low Of $85,200 As Gold Reverses Big Gains, Microsoft Leads Nasdaq Lower Picture in HD

Find inspiration with this unique bitcoin tumbles to 2026 low of $85,200 as gold reverses big gains, microsoft leads nasdaq lower illustration, crafted to provide a fresh look for your background.

Beautiful Bitcoin Tumbles To 2026 Low Of $85,200 As Gold Reverses Big Gains, Microsoft Leads Nasdaq Lower Image Collection

Discover an amazing bitcoin tumbles to 2026 low of $85,200 as gold reverses big gains, microsoft leads nasdaq lower background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Vibrant Bitcoin Tumbles To 2026 Low Of $85,200 As Gold Reverses Big Gains, Microsoft Leads Nasdaq Lower Background in HD

Experience the crisp clarity of this stunning bitcoin tumbles to 2026 low of $85,200 as gold reverses big gains, microsoft leads nasdaq lower image, available in high resolution for all your screens.

Detailed Bitcoin Tumbles To 2026 Low Of $85,200 As Gold Reverses Big Gains, Microsoft Leads Nasdaq Lower Landscape Nature

Transform your screen with this vivid bitcoin tumbles to 2026 low of $85,200 as gold reverses big gains, microsoft leads nasdaq lower artwork, a true masterpiece of digital design.

Amazing Bitcoin Tumbles To 2026 Low Of $85,200 As Gold Reverses Big Gains, Microsoft Leads Nasdaq Lower Background Art

Explore this high-quality bitcoin tumbles to 2026 low of $85,200 as gold reverses big gains, microsoft leads nasdaq lower image, perfect for enhancing your desktop or mobile wallpaper.

Captivating Bitcoin Tumbles To 2026 Low Of $85,200 As Gold Reverses Big Gains, Microsoft Leads Nasdaq Lower Wallpaper Collection

A captivating bitcoin tumbles to 2026 low of $85,200 as gold reverses big gains, microsoft leads nasdaq lower scene that brings tranquility and beauty to any device.

Mesmerizing Bitcoin Tumbles To 2026 Low Of $85,200 As Gold Reverses Big Gains, Microsoft Leads Nasdaq Lower Wallpaper Concept

Discover an amazing bitcoin tumbles to 2026 low of $85,200 as gold reverses big gains, microsoft leads nasdaq lower background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Spectacular Bitcoin Tumbles To 2026 Low Of $85,200 As Gold Reverses Big Gains, Microsoft Leads Nasdaq Lower Background Nature

Immerse yourself in the stunning details of this beautiful bitcoin tumbles to 2026 low of $85,200 as gold reverses big gains, microsoft leads nasdaq lower wallpaper, designed for a captivating visual experience.

Captivating Bitcoin Tumbles To 2026 Low Of $85,200 As Gold Reverses Big Gains, Microsoft Leads Nasdaq Lower Abstract for Desktop

This gorgeous bitcoin tumbles to 2026 low of $85,200 as gold reverses big gains, microsoft leads nasdaq lower photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Spectacular Bitcoin Tumbles To 2026 Low Of $85,200 As Gold Reverses Big Gains, Microsoft Leads Nasdaq Lower Scene Nature

This gorgeous bitcoin tumbles to 2026 low of $85,200 as gold reverses big gains, microsoft leads nasdaq lower photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Crisp Bitcoin Tumbles To 2026 Low Of $85,200 As Gold Reverses Big Gains, Microsoft Leads Nasdaq Lower Picture Art

Find inspiration with this unique bitcoin tumbles to 2026 low of $85,200 as gold reverses big gains, microsoft leads nasdaq lower illustration, crafted to provide a fresh look for your background.

Vivid Bitcoin Tumbles To 2026 Low Of $85,200 As Gold Reverses Big Gains, Microsoft Leads Nasdaq Lower Photo Concept

Experience the crisp clarity of this stunning bitcoin tumbles to 2026 low of $85,200 as gold reverses big gains, microsoft leads nasdaq lower image, available in high resolution for all your screens.

Stunning Bitcoin Tumbles To 2026 Low Of $85,200 As Gold Reverses Big Gains, Microsoft Leads Nasdaq Lower Image Illustration

Find inspiration with this unique bitcoin tumbles to 2026 low of $85,200 as gold reverses big gains, microsoft leads nasdaq lower illustration, crafted to provide a fresh look for your background.

Mesmerizing Bitcoin Tumbles To 2026 Low Of $85,200 As Gold Reverses Big Gains, Microsoft Leads Nasdaq Lower Picture Illustration

Experience the crisp clarity of this stunning bitcoin tumbles to 2026 low of $85,200 as gold reverses big gains, microsoft leads nasdaq lower image, available in high resolution for all your screens.

Artistic Bitcoin Tumbles To 2026 Low Of $85,200 As Gold Reverses Big Gains, Microsoft Leads Nasdaq Lower Photo in HD

A captivating bitcoin tumbles to 2026 low of $85,200 as gold reverses big gains, microsoft leads nasdaq lower scene that brings tranquility and beauty to any device.

Artistic Bitcoin Tumbles To 2026 Low Of $85,200 As Gold Reverses Big Gains, Microsoft Leads Nasdaq Lower Moment Photography

Find inspiration with this unique bitcoin tumbles to 2026 low of $85,200 as gold reverses big gains, microsoft leads nasdaq lower illustration, crafted to provide a fresh look for your background.

Download these bitcoin tumbles to 2026 low of $85,200 as gold reverses big gains, microsoft leads nasdaq lower wallpapers for free and use them on your desktop or mobile devices.