Can I Get A Loan With 500 Credit Score

Can I Get A Loan With 500 Credit Score? The Realistic Guide

If you've been asking yourself, Can I Get A Loan With 500 Credit Score, you are certainly not alone. Life happens, and sometimes financial setbacks cause serious damage to your credit rating. Having a FICO score hovering around 500 places you firmly in the "Poor" category, making traditional lending paths feel impossible.

The short answer is yes, getting a loan with a 500 credit score is possible, but it comes with caveats. You won't be strolling into your local bank expecting prime interest rates. Instead, you need a smart, strategic approach. This guide will walk you through the realistic options and help you secure the financing you need without falling into predatory traps.

Let's dive into what lenders actually look for and where you should focus your search.

The Reality Check: What Does a 500 Credit Score Mean?

A credit score of 500 falls within the FICO range of 300 to 579, which is considered "Poor." This score indicates that you are a high-risk borrower in the eyes of most mainstream financial institutions. Lenders see a significant history of missed payments, defaults, or possibly bankruptcy.

Because of this high risk, lenders willing to approve you will charge significantly higher interest rates (APRs) and often require additional security, such as collateral or a co-signer. Your primary challenge isn't finding a lender, but finding one that offers terms that won't make your financial situation worse in the long run.

Understanding this reality is the first step toward finding a viable loan solution.

Where To Look: Lenders Who Work With Low Credit Scores

Traditional banks like Chase or Bank of America typically won't approve unsecured personal loans for applicants with scores below 620. Therefore, you need to turn your attention to lenders who specialize in subprime financing. These institutions often look beyond just the credit score and analyze other factors, like your current income and employment stability.

Secured Loans: Using Collateral to Your Advantage

If you have assets, a secured loan is often the easiest and cheapest way to borrow money when your credit is poor. Secured loans require collateral—something of value the lender can seize if you default.

Collateral significantly reduces the lender's risk, which means they are far more likely to approve you, even if you have a 500 credit score. Common examples include auto title loans (using your car title) or home equity loans (using your home's value).

The main benefit here is that the interest rates are typically much lower than unsecured bad credit loans. However, remember the risk: if you fail to repay, you lose your asset.

No Credit Check Loans (Proceed with Caution!)

Many online lenders market "No Credit Check Loans." While these definitely approve borrowers regardless of their FICO score, they are generally predatory, often manifesting as payday loans or car title loans with extremely short repayment terms and triple-digit Annual Percentage Rates (APRs). We strongly advise against these unless it is an absolute emergency.

If you must explore this route, ensure you fully understand the repayment terms and verify that you can pay the loan back completely by the due date.

Credit Unions and Community Banks

Don't overlook local credit unions. Unlike major banks, credit unions are non-profit and membership-based, often prioritizing the financial well-being of their members over massive profits. They are generally more flexible when reviewing loan applications from those with poor credit.

If you are already a member or qualify to join one, ask about their Payday Alternative Loans (PALs). These are small loans designed specifically to compete with high-cost payday lenders, typically offering lower interest rates and fairer terms.

Loan Options Available for a 500 Credit Score

While the prospect of securing a substantial personal loan with a FICO score of 500 is challenging, you do have a few specific product types that cater to your situation.

Payday Loans vs. Installment Loans (The Major Difference)

When searching online, you will encounter two main structures. Understanding the difference is critical:

- Payday Loans: Small amounts, extremely high fees, due entirely on your next payday (usually 2-4 weeks). These trap many borrowers in debt cycles.

- Installment Loans: Larger amounts, structured with fixed monthly payments over a longer term (e.g., 6 months to 5 years). Though interest is high for bad credit, the predictable schedule is far more manageable.

Always opt for an installment loan if possible, as it provides a clear pathway to repayment and often reports your good payment history to the credit bureaus, helping you rebuild your score.

Personal Loans for Bad Credit (What to Expect)

Specialized online lenders often pre-approve applicants with scores as low as 500. They focus heavily on two factors: income verification and your Debt-to-Income (DTI) ratio. If your income is stable and your DTI is relatively low, you have a solid chance of approval.

However, be prepared for high costs. An APR in the 25% to 36% range is standard for a borrower seeking financing with a 500 credit score. Always compare offers from multiple lenders to find the lowest rate possible.

Finding a Cosigner: A Smart Strategy

One of the best ways to improve your odds and lower your rate is by finding a creditworthy cosigner. A cosigner is legally obligated to pay the debt if you cannot.

When you apply with a cosigner who has a good or excellent score (700+), the lender primarily assesses their financial profile. This drastically reduces the risk and can turn a denial into an approval, potentially saving you hundreds or thousands of dollars in interest over the life of the loan. Just remember that this person is taking a major risk for you, so ensure you meet every single payment obligation.

Prepare Yourself: What Lenders Will Require

Regardless of the specific loan product, being organized will speed up the process and show the lender you are a serious applicant. Before you apply anywhere, gather the following essential documentation:

- Proof of Income: Recent pay stubs (last 2-3 months), W-2s, or tax returns if you are self-employed. Lenders need confirmation that you can handle the monthly payment.

- Proof of Residence: Utility bills or a lease agreement.

- Government ID: Driver's license or passport.

- Banking Information: Account numbers for direct deposit of the loan funds and automatic repayment setup.

- Existing Debt Summary: A list of your current monthly debts (this helps them calculate your DTI).

Always pre-qualify with multiple lenders before officially applying. Pre-qualification uses a soft credit pull, which doesn't hurt your 500 credit score. Only proceed with a full application (which triggers a hard inquiry) once you have chosen the best rate.

Getting Financing with a 500 Score: Your Next Steps

The core question, Can I Get A Loan With 500 Credit Score, has a resounding, qualified "Yes." However, securing that loan requires careful navigation of the lending landscape. Your strategy must prioritize finding a manageable loan structure that also serves as a stepping stone to improving your credit score.

Start with secured loans or local credit unions for the best rates. If those options aren't available, carefully research online lenders specializing in bad credit installment loans. Never take out a loan that you cannot confidently repay. Use this opportunity to start rebuilding your financial health today—every successful, on-time payment you make will push that 500 score higher.

Frequently Asked Questions (FAQ) About Loans with a 500 Credit Score

- What interest rate can I expect with a 500 credit score?

- For an unsecured personal loan, you should generally expect an Annual Percentage Rate (APR) between 25% and 36%. If you use collateral or a co-signer, the rate may drop significantly.

- Is it better to get a personal loan or a secured credit card to rebuild credit?

- Both help, but they serve different purposes. A personal loan provides a lump sum of cash for immediate needs. A secured credit card is better for daily purchasing and is generally the most effective tool for rapid credit score improvement, provided you keep the balance low and pay it off monthly.

- Will applying for multiple loans hurt my 500 credit score?

- Applying for multiple loans results in multiple hard inquiries, which slightly lower your score. However, FICO scoring models recognize "rate shopping." If you apply for similar loan types within a concentrated window (usually 14 to 45 days), they are typically counted as a single inquiry. Use pre-qualification tools first to minimize hard inquiries.

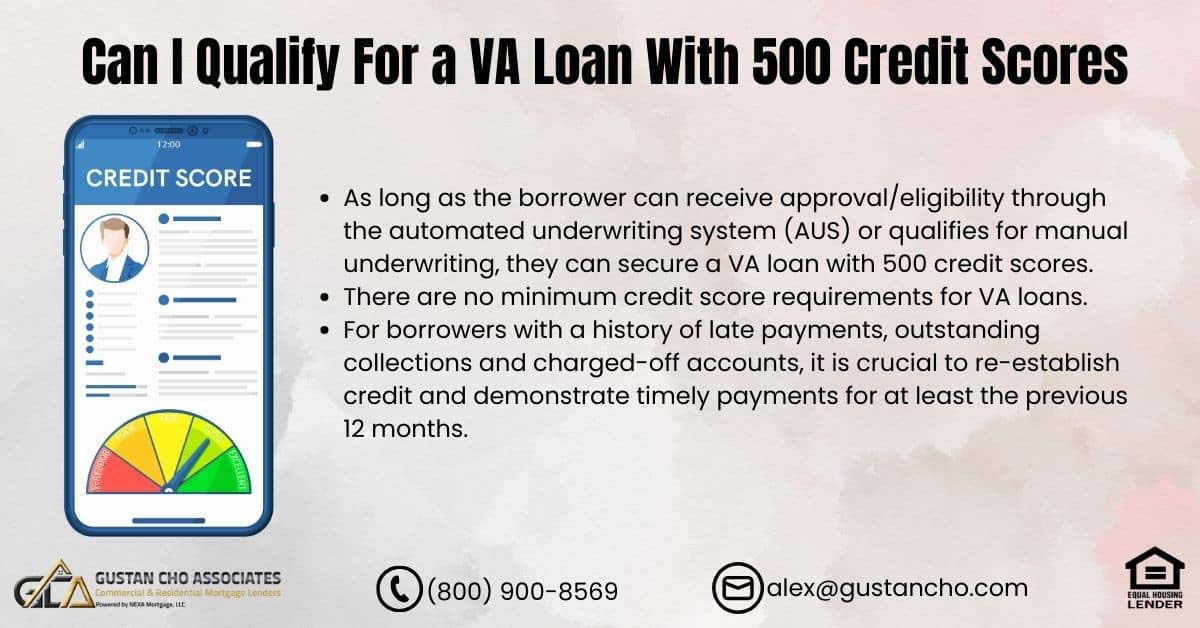

- What is the minimum credit score required for an FHA loan?

- FHA loans are government-backed mortgages often used by people with lower scores. Technically, you can qualify with a FICO score as low as 500, but only if you can provide a 10% down payment. For a standard 3.5% down payment, most FHA lenders require a minimum score of 580.

Can I Get A Loan With 500 Credit Score

Can I Get A Loan With 500 Credit Score Wallpapers

Collection of can i get a loan with 500 credit score wallpapers for your desktop and mobile devices.

Detailed Can I Get A Loan With 500 Credit Score View Photography

Experience the crisp clarity of this stunning can i get a loan with 500 credit score image, available in high resolution for all your screens.

Serene Can I Get A Loan With 500 Credit Score Picture Digital Art

Experience the crisp clarity of this stunning can i get a loan with 500 credit score image, available in high resolution for all your screens.

Breathtaking Can I Get A Loan With 500 Credit Score Capture Digital Art

Explore this high-quality can i get a loan with 500 credit score image, perfect for enhancing your desktop or mobile wallpaper.

Spectacular Can I Get A Loan With 500 Credit Score Capture in HD

A captivating can i get a loan with 500 credit score scene that brings tranquility and beauty to any device.

High-Quality Can I Get A Loan With 500 Credit Score Abstract for Desktop

Experience the crisp clarity of this stunning can i get a loan with 500 credit score image, available in high resolution for all your screens.

High-Quality Can I Get A Loan With 500 Credit Score Wallpaper Photography

Discover an amazing can i get a loan with 500 credit score background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Dynamic Can I Get A Loan With 500 Credit Score Background Nature

A captivating can i get a loan with 500 credit score scene that brings tranquility and beauty to any device.

Beautiful Can I Get A Loan With 500 Credit Score Image Art

Experience the crisp clarity of this stunning can i get a loan with 500 credit score image, available in high resolution for all your screens.

Stunning Can I Get A Loan With 500 Credit Score Moment for Your Screen

Find inspiration with this unique can i get a loan with 500 credit score illustration, crafted to provide a fresh look for your background.

Beautiful Can I Get A Loan With 500 Credit Score Scene in 4K

Discover an amazing can i get a loan with 500 credit score background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Artistic Can I Get A Loan With 500 Credit Score Landscape Nature

Find inspiration with this unique can i get a loan with 500 credit score illustration, crafted to provide a fresh look for your background.

Lush Can I Get A Loan With 500 Credit Score Abstract Digital Art

Immerse yourself in the stunning details of this beautiful can i get a loan with 500 credit score wallpaper, designed for a captivating visual experience.

High-Quality Can I Get A Loan With 500 Credit Score Artwork Concept

Experience the crisp clarity of this stunning can i get a loan with 500 credit score image, available in high resolution for all your screens.

Vibrant Can I Get A Loan With 500 Credit Score Moment Nature

Discover an amazing can i get a loan with 500 credit score background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Artistic Can I Get A Loan With 500 Credit Score Picture for Your Screen

A captivating can i get a loan with 500 credit score scene that brings tranquility and beauty to any device.

Lush Can I Get A Loan With 500 Credit Score View in 4K

Immerse yourself in the stunning details of this beautiful can i get a loan with 500 credit score wallpaper, designed for a captivating visual experience.

Gorgeous Can I Get A Loan With 500 Credit Score Abstract for Mobile

This gorgeous can i get a loan with 500 credit score photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Lush Can I Get A Loan With 500 Credit Score Background Art

This gorgeous can i get a loan with 500 credit score photo offers a breathtaking view, making it a perfect choice for your next wallpaper.