Credit Repair Software Business

How to Build a Lucrative Credit Repair Software Business: Strategy and Compliance

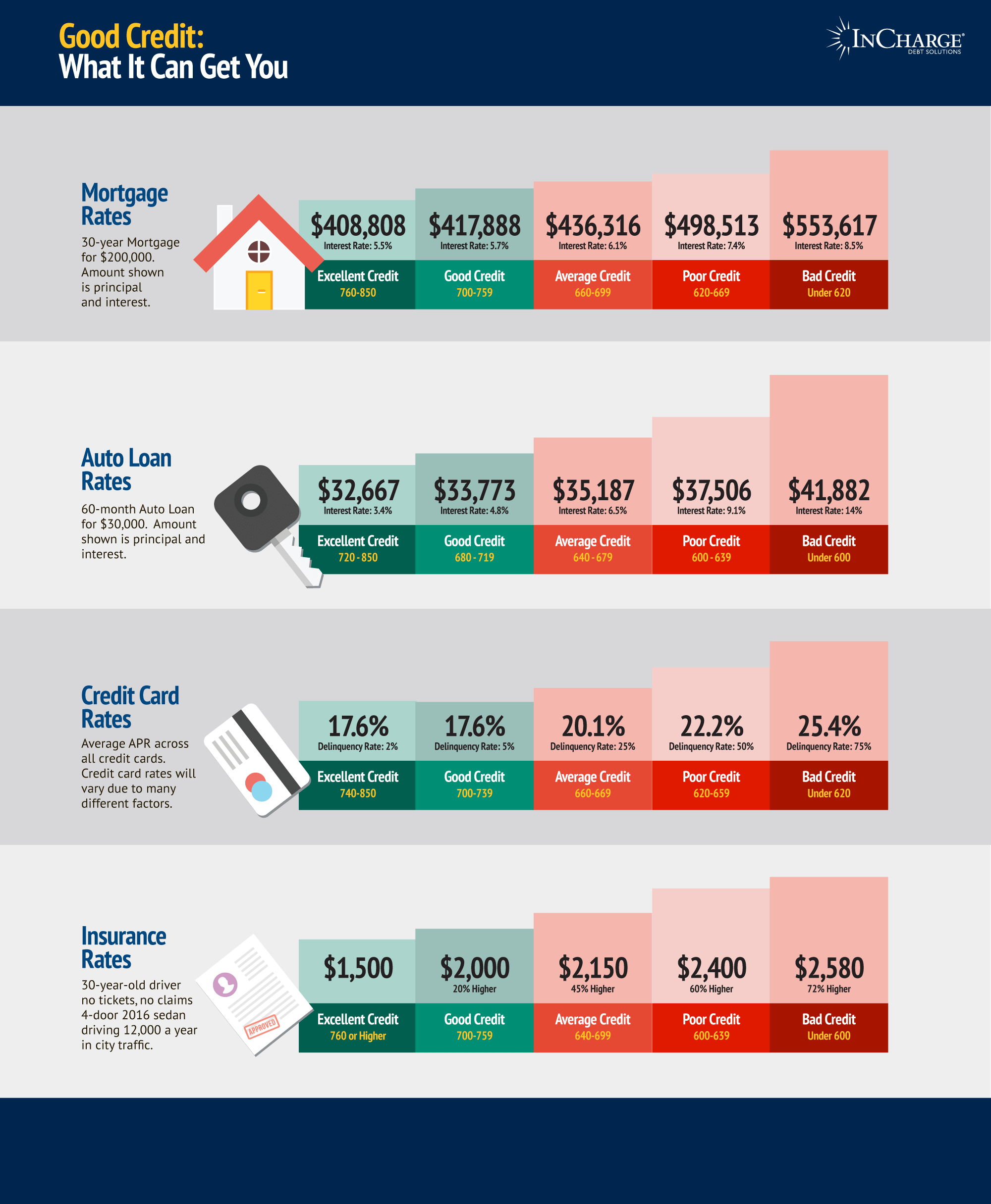

The consumer credit landscape is vast and often confusing. Millions of people struggle with poor credit scores, and while many seek professional help, the process is labor-intensive. This is where opportunity knocks. Starting a **Credit Repair Software Business** is not just about building a tool; it's about providing a scalable, efficient solution to a massive, ongoing financial problem.

Whether you aim to service other credit repair organizations (B2B SaaS model) or power your own in-house operations (B2C hybrid), understanding the core technological and regulatory requirements is paramount. This comprehensive guide breaks down the essential steps to launching and scaling a compliant, profitable software venture in this niche market.

Understanding the Market Dynamics and Opportunity

Before writing a single line of code, you must deeply analyze the market. The need for credit repair is recession-resistant. Whenever economic pressure mounts, credit profiles suffer, increasing the addressable market size for your software solution.

Why Credit Repair Services are in High Demand

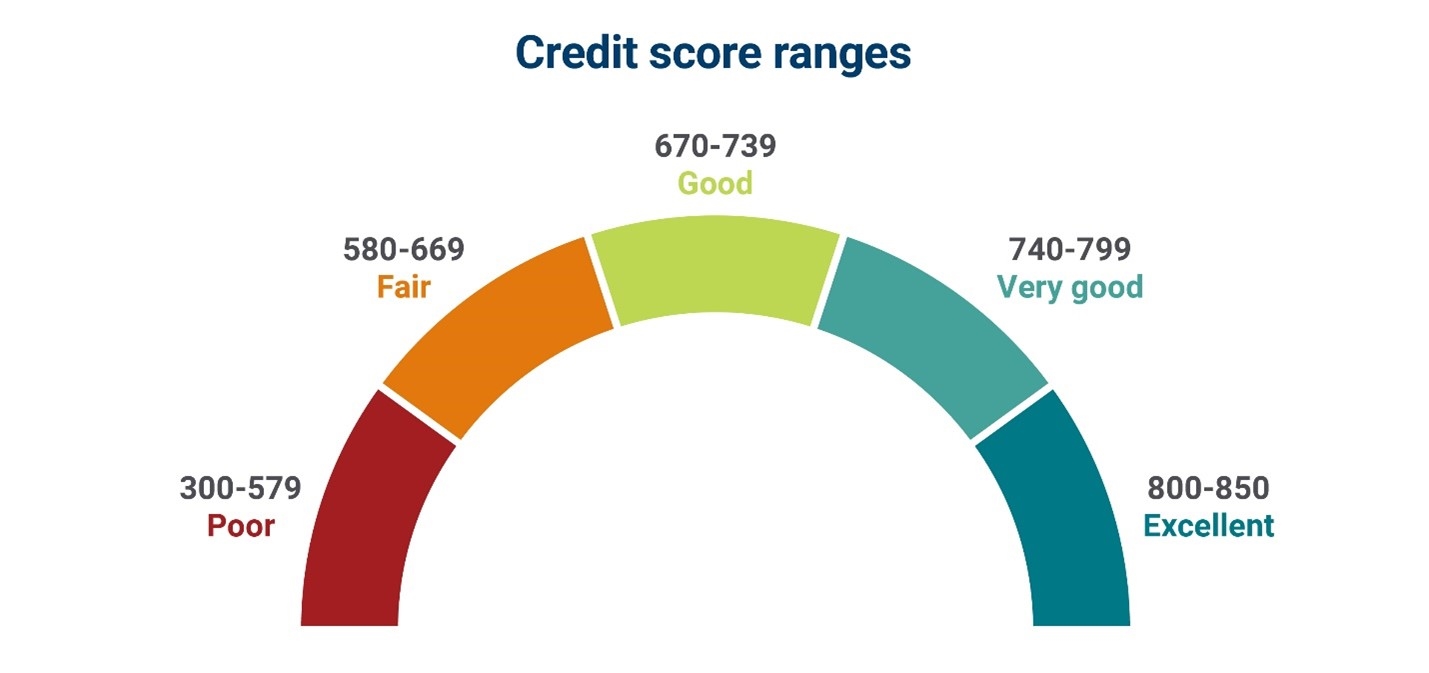

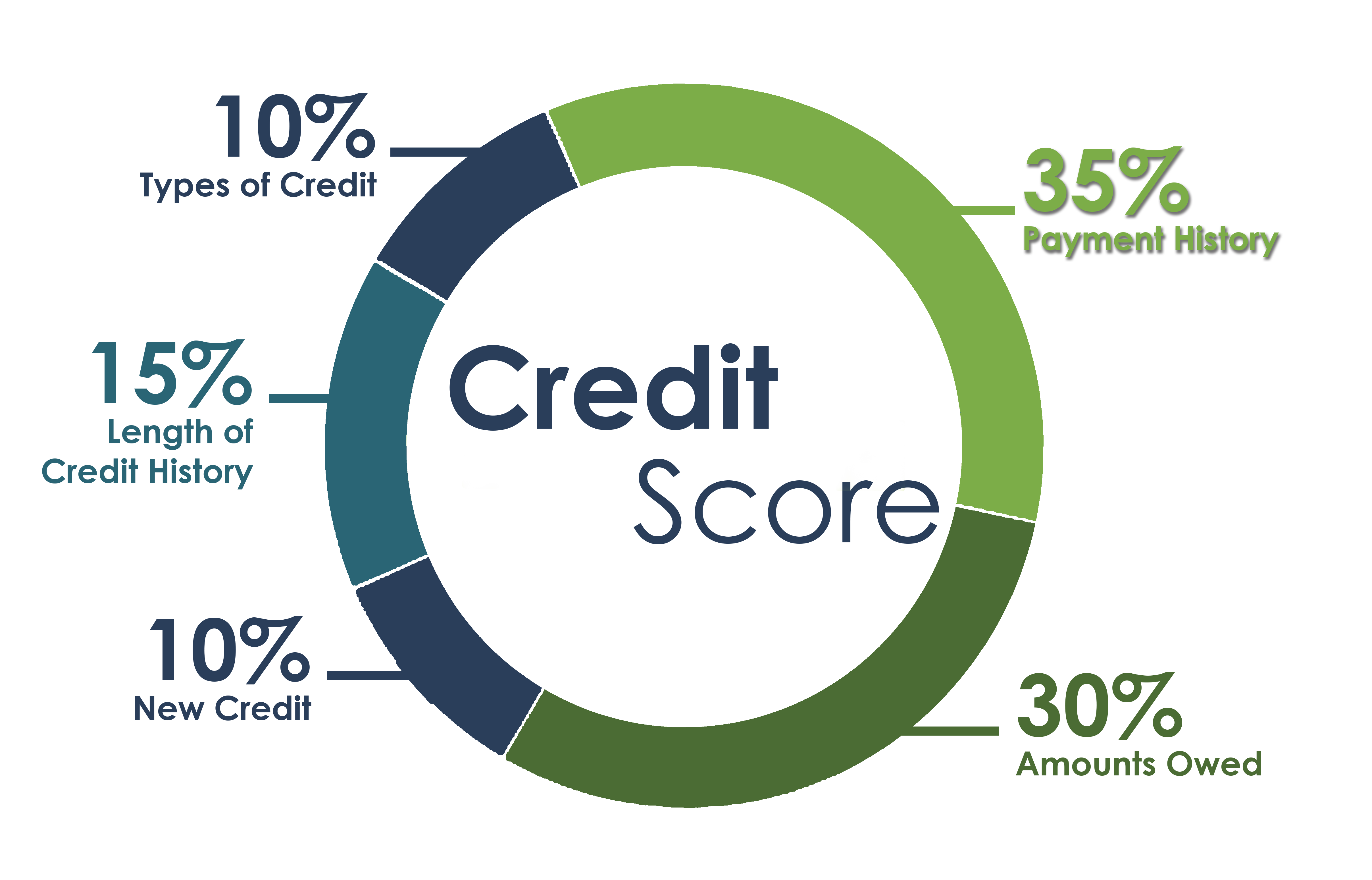

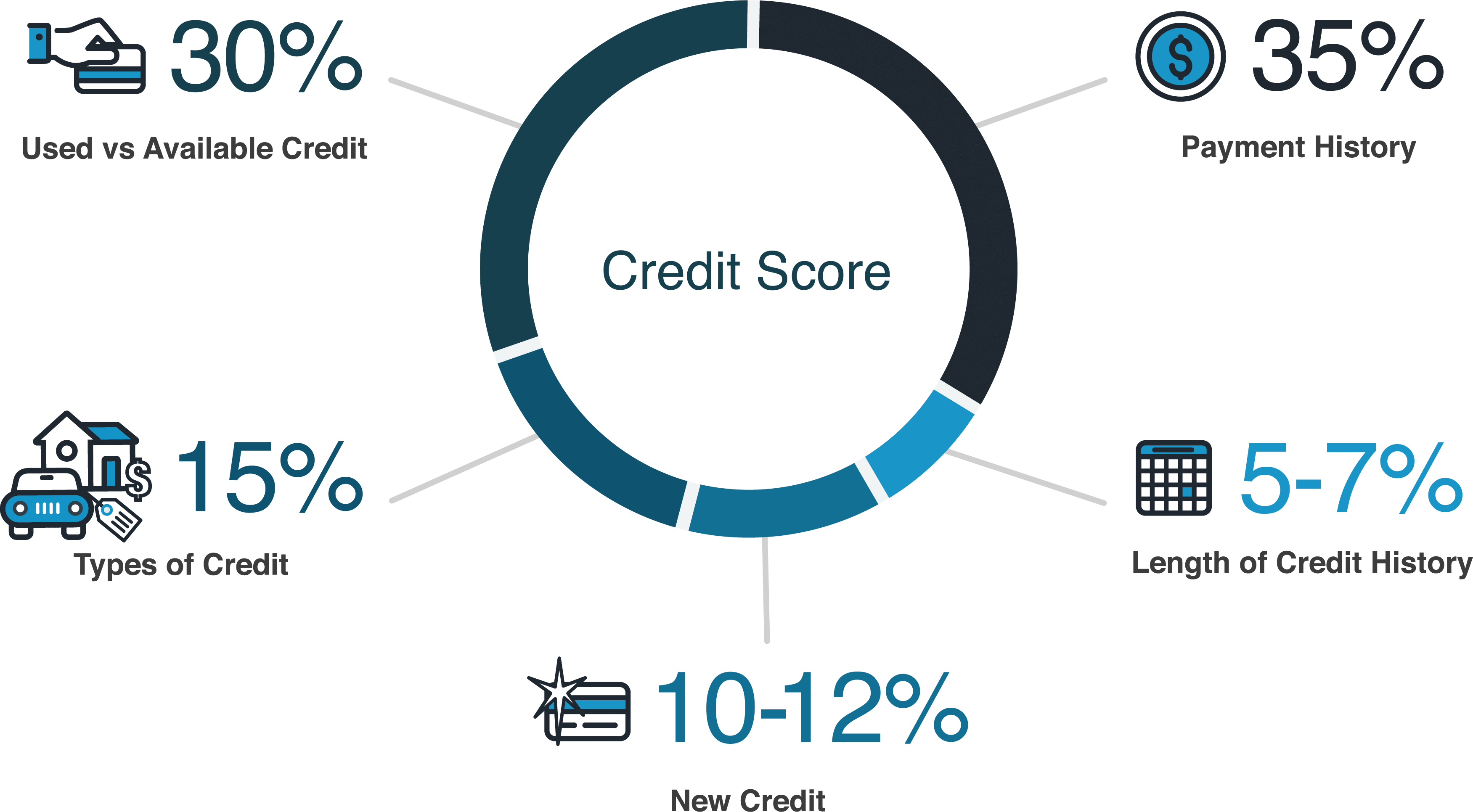

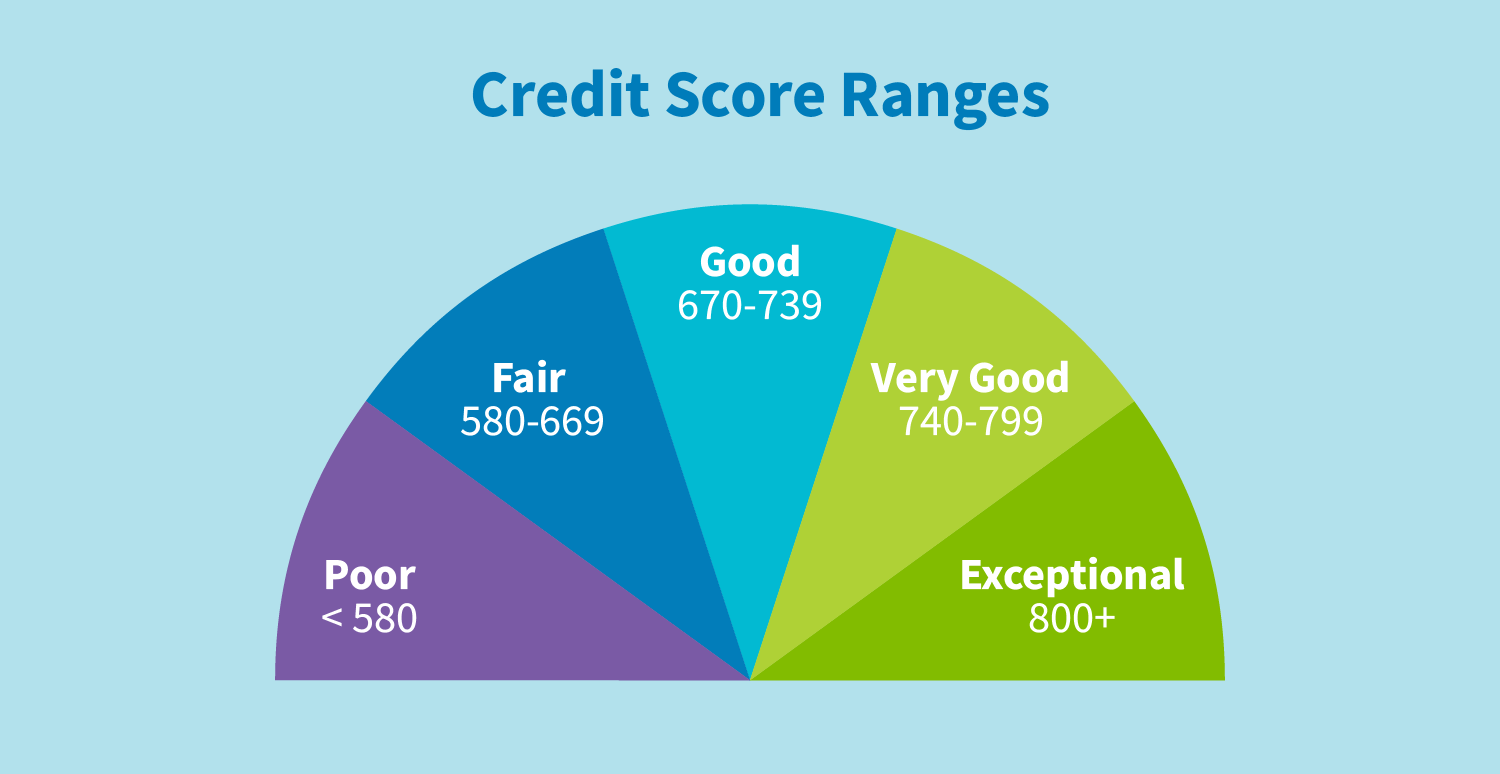

The FICO scoring system is complex, and errors are common. Consumers often lack the time or expertise to navigate the formal dispute process with credit bureaus (Experian, Equifax, and TransUnion). This complexity creates consistent demand for streamlined services, and ultimately, for robust software to manage those services efficiently.

Your software needs to transform a tedious, document-heavy process into a high-volume, automated system. The ability to manage hundreds or thousands of active client cases simultaneously is your software's primary value proposition.

The Regulatory Landscape: CROA and Compliance

Trustworthiness (T) and Expertise (E) in this business hinge entirely on compliance. The Credit Repair Organizations Act (CROA) is the backbone of federal regulation in this space. Your software must be designed to facilitate, not violate, these laws.

Key CROA mandates include specific contract disclosures, prohibiting upfront fees (receiving payment before services are rendered), and ensuring clients have the right to cancel without penalty. Failure to integrate these safeguards into your platform's client onboarding and billing structure is a critical business risk.

For detailed guidance on consumer protection requirements, always refer directly to official government sources. Reviewing the Federal Trade Commission's (FTC) guidelines is non-negotiable for establishing legitimacy and authority in your operation. Read More: FTC's Guide to CROA Compliance.

Core Pillars of a Successful Credit Repair Software Business

Successful software platforms are built around efficiency, security, and exceptional client management. If your platform cannot handle the heavy lifting of documentation and communication, it will fail to attract serious business users.

Essential Software Features (The Tech Stack)

A competitive credit repair solution requires more than basic CRM functions. It demands specific tools tailored to the dispute lifecycle. The goal is automation (A) and accurate tracking.

- Dispute Letter Generation: Automated creation of personalized dispute letters based on the credit report analysis, correctly formatted for all three major bureaus.

- Client Portal: A secure login area where clients can upload identity documents, view real-time dispute statuses, and track credit score changes. This vastly improves UX.

- Credit Report Integration: Secure APIs (like those offered by third-party aggregators) to import and analyze client credit reports directly. Data security is paramount here, requiring robust encryption.

- Audit Trail and Compliance Log: A full chronological record of all communications, disputes sent, and bureau responses for legal protection and transparency.

- Billing & Payment Processing: Compliant integration that adheres to CROA's payment restrictions (e.g., ensuring no payment is automatically processed until services are verifiably delivered).

Choosing Between SaaS vs. Licensed Models

When launching your **Credit Repair Software Business**, you face a critical decision regarding deployment and pricing:

- SaaS (Software as a Service): Monthly subscription fees, cloud-hosted, easy updates. This offers predictable recurring revenue and lower upfront cost for the user, maximizing your recurring revenue stream.

- Licensed/On-Premise: Users buy the software outright or pay a large installation fee. While this generates immediate large revenue, it complicates maintenance and scalability.

The modern, scalable business model strongly favors SaaS due to the speed of deployment, easier scaling, and ability to push necessary regulatory updates immediately to all users. This approach also allows for faster iteration based on market feedback. [Baca Juga: Scaling Your B2B SaaS Business Strategy]

Startup Costs and Scaling Your Operation

Launching a specialized software business requires significant initial investment, primarily in development, compliance infrastructure, and legal consultation.

The investment required varies dramatically based on whether you develop the software in-house or outsource development to a specialized agency. Below is an approximate breakdown of typical costs for a Minimum Viable Product (MVP) launch:

| Cost Component | Estimated Initial Cost (USD) | Recurring Monthly Cost (USD) |

|---|---|---|

| Software Development (MVP) | $50,000 – $150,000 | N/A |

| Legal & Compliance Audit (CROA/Data) | $5,000 – $15,000 | $500 – $1,500 |

| API Access & Hosting (AWS/Azure) | $1,000 – $3,000 | $500 – $2,500 |

| Marketing & Sales Infrastructure | $5,000 – $10,000 | $1,000 – $5,000+ |

Staffing and Operational Workflow

Even though the software is automated, the business requires specialized human expertise (Expertise). You will need technical talent (developers, security specialists) and regulatory talent (compliance officers or legal counsel) to stay ahead of changing financial regulations.

Consider the need for ongoing education and monitoring. The Consumer Financial Protection Bureau (CFPB) often issues new rules affecting how data is handled and how consumers interact with credit reporting agencies. Your team must constantly adapt the software to these changes. CFPB Compliance Resources for Credit Reporting.

Marketing Your Software: Positioning and Pricing

Marketing for a credit repair software platform must focus heavily on trust and scalability. Your primary target audience (if B2B) is credit repair entrepreneurs who prioritize efficiency and regulatory safety.

Positioning: Highlight Compliance and Automation

Your unique selling proposition (USP) must be centered on making the user's life easier and legally safer. Use case studies to demonstrate how your software reduces manual hours and mitigates compliance risk. Instead of selling "features," sell "results" (e.g., "Reduce dispute processing time by 80%").

Transparency about data security (E-E-A-T) is also a major selling point. Demonstrate how your platform utilizes industry-standard encryption and adheres to privacy laws, addressing consumer concerns about sharing sensitive financial data.

Pricing Strategy for Sustainability

In the SaaS model, tiered pricing is standard:

- Starter Tier: Low-cost, limited client capacity (e.g., up to 50 active clients). Perfect for solo entrepreneurs.

- Professional Tier: Increased capacity, advanced features like affiliate tracking or advanced analytics.

- Enterprise Tier: Unlimited clients, dedicated support, API access for integration.

Ensure your pricing aligns with the value proposition—saving time and preventing costly compliance errors. [Baca Juga: Best Practices for SaaS Pricing Models]

Conclusion

Launching a **Credit Repair Software Business** is a capital-intensive endeavor that requires meticulous attention to detail, especially regarding federal compliance. By focusing on automating key regulatory hurdles (CROA), providing a superior user experience (UX) through features like client portals, and building a foundation of transparency and trust, your platform can capture a significant share of this high-demand market.

The future of credit repair lies in efficiency. The software that wins will be the one that combines cutting-edge technology with unwavering adherence to consumer protection laws, providing a powerful, ethical solution for financial recovery.

Frequently Asked Questions (FAQ)

- Is the Credit Repair Software Business legal?

Yes, provided the services and the software strictly adhere to the Credit Repair Organizations Act (CROA). The software itself must facilitate compliant operations, ensuring proper disclosures and avoiding illegal upfront charging practices.

- What is the typical startup timeline for a Credit Repair Software MVP?

Developing a Minimum Viable Product (MVP) with core features (dispute generation, client portal, basic reporting) generally takes 6 to 12 months, assuming you have dedicated technical resources and regulatory guidance.

- Do I need specialized legal counsel to operate this business?

Absolutely. Due to the high regulatory scrutiny of the credit repair industry, legal counsel specializing in consumer financial law is essential to draft compliant contracts, review feature sets, and navigate evolving federal and state laws. Consult with a firm that understands both CROA and the specific regulations enforced by the CFPB.

- How can the software ensure data security for client reports?

High-level encryption (AES-256), adherence to data privacy standards (like SOC 2 compliance for SaaS providers), and secure API connections for credit report aggregation are mandatory. Client data must never be stored or transmitted without robust protection protocols.

— End of Article —

Credit Repair Software Business

Credit Repair Software Business Wallpapers

Collection of credit repair software business wallpapers for your desktop and mobile devices.

High-Quality Credit Repair Software Business Design Illustration

Transform your screen with this vivid credit repair software business artwork, a true masterpiece of digital design.

Mesmerizing Credit Repair Software Business Moment Illustration

Transform your screen with this vivid credit repair software business artwork, a true masterpiece of digital design.

Exquisite Credit Repair Software Business Image for Your Screen

Immerse yourself in the stunning details of this beautiful credit repair software business wallpaper, designed for a captivating visual experience.

Amazing Credit Repair Software Business View in HD

Discover an amazing credit repair software business background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Dynamic Credit Repair Software Business Artwork for Desktop

Find inspiration with this unique credit repair software business illustration, crafted to provide a fresh look for your background.

Exquisite Credit Repair Software Business Background Digital Art

Immerse yourself in the stunning details of this beautiful credit repair software business wallpaper, designed for a captivating visual experience.

Crisp Credit Repair Software Business View for Your Screen

This gorgeous credit repair software business photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Exquisite Credit Repair Software Business Wallpaper Digital Art

This gorgeous credit repair software business photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Beautiful Credit Repair Software Business Wallpaper for Desktop

Transform your screen with this vivid credit repair software business artwork, a true masterpiece of digital design.

Captivating Credit Repair Software Business Abstract Photography

This gorgeous credit repair software business photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Amazing Credit Repair Software Business View in 4K

Transform your screen with this vivid credit repair software business artwork, a true masterpiece of digital design.

Lush Credit Repair Software Business Picture Concept

Find inspiration with this unique credit repair software business illustration, crafted to provide a fresh look for your background.

Vivid Credit Repair Software Business Wallpaper Collection

Explore this high-quality credit repair software business image, perfect for enhancing your desktop or mobile wallpaper.

Vivid Credit Repair Software Business Image for Your Screen

Explore this high-quality credit repair software business image, perfect for enhancing your desktop or mobile wallpaper.

Vivid Credit Repair Software Business Capture for Your Screen

Explore this high-quality credit repair software business image, perfect for enhancing your desktop or mobile wallpaper.

Gorgeous Credit Repair Software Business Capture in HD

This gorgeous credit repair software business photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

High-Quality Credit Repair Software Business Moment for Your Screen

Transform your screen with this vivid credit repair software business artwork, a true masterpiece of digital design.

Vivid Credit Repair Software Business Design for Mobile

Experience the crisp clarity of this stunning credit repair software business image, available in high resolution for all your screens.

0 Response to "Credit Repair Software Business"

Post a Comment