‘Don’t Chase This Gamble,’ Says Top Investor About Tesla Stock

'Don't Chase This Gamble,' Says Top Investor About Tesla Stock

The electric vehicle (EV) giant, Tesla (TSLA), has long been the darling of the retail investment community. Its meteoric rise defined the post-pandemic market, turning average traders into overnight millionaires. But the narrative is shifting dramatically.

In a powerful statement shaking institutional confidence, one of Wall Street's most respected veterans has issued a sharp, almost unprecedented warning: stop viewing Tesla stock as a guaranteed growth asset and recognize it for what it truly is—a high-stakes, speculative gamble.

"If you are chasing the short-term volatility hoping for the next big jump, you are engaging in speculation, not investing," the investor stated in a recent closed-door briefing, the sentiment quickly leaking and spreading fear across the financial landscape. The advice is stark: for many investors, the current valuation simply does not justify the risk.

We analyze the core arguments behind this dramatic warning, dissect the current state of TSLA valuation, and explore why even its groundbreaking technology may no longer secure its premium market position.

The Shocking Declaration: Why TSLA's Valuation Worries the Pros

For years, the argument supporting Tesla's staggering valuation relied on two key pillars: the overwhelming dominance of the EV market and the promise of disruptive technology (AI, FSD, robotics). Today, those pillars are eroding under increasing scrutiny and stiff global competition.

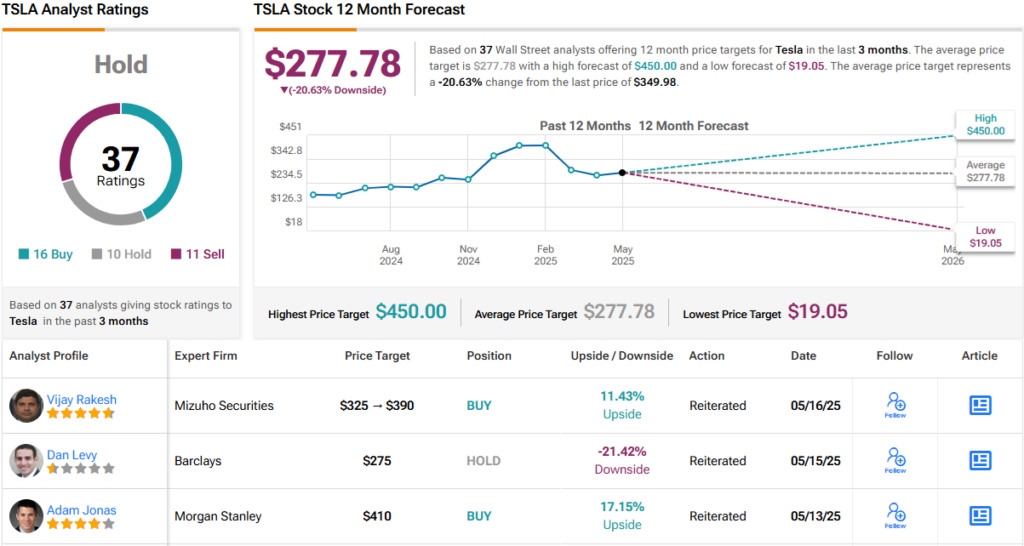

The warning to "Don't chase this gamble" focuses squarely on the disconnect between Tesla's financial fundamentals and its market capitalization. While Tesla is certainly a highly profitable company, analysts argue that its stock price demands flawless execution and exponential future growth that seems increasingly unlikely in a saturated market.

"The stock is priced for perfection, and perfection is non-existent in the automotive industry," notes one prominent hedge fund manager specializing in long-term growth stocks. This consensus among professional investors highlights a critical fear: any slip-up—a quarterly delivery miss, a product recall, or a delay in FSD rollout—could trigger a massive correction.

The Problem of the P/E Ratio

Traditional metrics underscore the investor's anxiety. Tesla's Price-to-Earnings (P/E) ratio continues to dwarf that of every major competitor. While Ford, GM, and even established tech giants often trade at P/E ratios well below 30, TSLA regularly commands multiples far higher, sometimes triple or quadruple the industry average. This elevated P/E ratio implies that investors are betting on future earnings that must grow at an impossible rate to justify the current price.

This is where the speculation comes in. Investors aren't buying the company as it is today; they are buying a highly optimistic future vision. The top investor's warning serves as a cold splash of reality, urging caution against paying 10 years of predicted growth upfront.

Storytelling: Remembering the Dot-Com Bubble

I recall speaking with a retired portfolio manager who lived through the exuberance of the late 1990s. He drew parallels between the hype surrounding TSLA today and the overvaluation of countless tech stocks during the dot-com era. Companies with incredible vision, but negligible current profitability, were priced into the stratosphere. "The air eventually comes out of those balloons," he cautioned. "It's never a matter of if, but when, fundamentals reassert themselves." This historical context fuels the current institutional skepticism around TSLA's sky-high valuation.

The core concerns voiced by seasoned investors boil down to three immediate risk factors:

- Regulatory Volatility: Unpredictable policy shifts affecting global EV subsidies.

- Key Man Risk: The company's value remains inextricably linked to its charismatic CEO, amplifying volatility.

- Dilution Risk: Potential share dilution to fund ambitious future projects like Optimus or Cybertruck production scaling.

Deciphering the Tesla Premium: Is Innovation Enough to Justify the Price Tag?

For the bulls, the Tesla Premium is justified by its leadership in technology—specifically its battery tech, vertical integration, and Full Self-Driving (FSD) capabilities. They argue Tesla should be valued alongside software companies, not auto manufacturers. However, the gap is closing rapidly, impacting *long-term growth* projections.

The Brutal Reality of EV Market Competition

The global EV market is no longer a monopoly. The influx of serious competitors, particularly from Asia, is pressuring Tesla's margins. Companies like BYD in China are achieving scale faster and offering compelling products at highly competitive prices. Legacy automakers like Volkswagen, Mercedes, and Hyundai are finally ramping up their electric platforms, providing robust, reliable alternatives.

This increased competition means Tesla can no longer dictate price unchallenged. Recent price cuts, while boosting volume, directly impact profit margins—a critical metric for a stock valued on future profitability. The market is demanding higher volume alongside maintained margin, a balancing act becoming harder to manage.

The investor warns that Wall Street is starting to calculate TSLA's value based on automotive industry averages, which dramatically changes the equation. If TSLA is valued like an automaker, its stock price must fall significantly.

FSD and the Robotics Bet

The speculative element of the stock relies heavily on future revenue streams from FSD software licensing and the long-term potential of the humanoid robot, Optimus. These technologies offer immense *upside potential*, but their commercial viability and timescale are highly uncertain.

FSD has faced repeated regulatory hurdles and remains an unproven product globally. Basing current *TSLA valuation* on revenue that might materialize years from now, and may face unforeseen competition from tech rivals, is the essence of the "gamble" the top investor is warning against.

The experts acknowledge the technological superiority but stress that investment decisions must be anchored in current cash flow and realistic projected earnings, not just revolutionary ideas.

The factors currently suppressing profitability and heightening risk include:

- Slowing global demand for premium EVs due to higher interest rates.

- Increased capital expenditure required for factory expansions (Gigafactories).

- Sustained supply chain challenges, though easing, still impacting production consistency.

What Smart Money Is Doing Now: Rebalancing the Portfolio for Long-Term Growth

The institutional warning is not an instruction to panic sell, but a directive to reassess *risk assessment* and portfolio exposure. Smart money is reducing its outsized bets on TSLA and reallocating capital into investments that offer better value based on current earnings and clearer growth trajectories.

The objective of the top investor's statement is to differentiate between genuine investment and speculative trading. For long-term investors focused on capital preservation and steady returns, the current volatility of Tesla stock makes it an inappropriate holding.

Focusing on Intrinsic Value

Investors are urged to calculate the intrinsic value of TSLA based solely on its current automotive business and near-term profitability—ignoring the speculative moonshots. When analyzed this way, many find the current share price far exceeds a conservative valuation.

This doesn't mean exiting the EV sector entirely. Instead, professionals are diversifying their exposure across the EV supply chain—battery manufacturers, raw material producers, and specialized software providers—where growth is more predictable and valuations are more reasonable.

For retail investors who remain bullish on the future of electric mobility, the advice is clear: diversification is paramount. Do not let TSLA dominate your portfolio. Recognize that the stock is now highly sensitive to macroeconomic shifts and requires constant vigilance.

The Key Takeaway for Retail Investors

When the giants of the financial world use words like "gamble" to describe a market leader, it is time to listen. Their message is simple: While Tesla remains an innovative company, its stock price has been inflated by emotion and unprecedented optimism.

The days of easy, assured gains from buying and holding TSLA appear to be over. Investors must now apply rigorous fundamental analysis. The top investor's warning is a clear signal that the market environment has shifted from embracing reckless growth to demanding profitability and value. Proceed with extreme caution.

Reassess your portfolio holdings today, prioritize diversification, and heed the advice: don't chase this gamble.

'Don't Chase This Gamble,' Says Top Investor About Tesla Stock

'Don't Chase This Gamble,' Says Top Investor About Tesla Stock Wallpapers

Collection of 'don't chase this gamble,' says top investor about tesla stock wallpapers for your desktop and mobile devices.

Dynamic 'don't Chase This Gamble,' Says Top Investor About Tesla Stock Wallpaper for Your Screen

Immerse yourself in the stunning details of this beautiful 'don't chase this gamble,' says top investor about tesla stock wallpaper, designed for a captivating visual experience.

Exquisite 'don't Chase This Gamble,' Says Top Investor About Tesla Stock View Concept

This gorgeous 'don't chase this gamble,' says top investor about tesla stock photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Vivid 'don't Chase This Gamble,' Says Top Investor About Tesla Stock Artwork in HD

Discover an amazing 'don't chase this gamble,' says top investor about tesla stock background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Lush 'don't Chase This Gamble,' Says Top Investor About Tesla Stock Scene Nature

A captivating 'don't chase this gamble,' says top investor about tesla stock scene that brings tranquility and beauty to any device.

Gorgeous 'don't Chase This Gamble,' Says Top Investor About Tesla Stock Image Concept

This gorgeous 'don't chase this gamble,' says top investor about tesla stock photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Mesmerizing 'don't Chase This Gamble,' Says Top Investor About Tesla Stock Photo Illustration

Transform your screen with this vivid 'don't chase this gamble,' says top investor about tesla stock artwork, a true masterpiece of digital design.

Beautiful 'don't Chase This Gamble,' Says Top Investor About Tesla Stock View Art

Explore this high-quality 'don't chase this gamble,' says top investor about tesla stock image, perfect for enhancing your desktop or mobile wallpaper.

Stunning 'don't Chase This Gamble,' Says Top Investor About Tesla Stock Artwork for Your Screen

Immerse yourself in the stunning details of this beautiful 'don't chase this gamble,' says top investor about tesla stock wallpaper, designed for a captivating visual experience.

Dynamic 'don't Chase This Gamble,' Says Top Investor About Tesla Stock Image for Mobile

Find inspiration with this unique 'don't chase this gamble,' says top investor about tesla stock illustration, crafted to provide a fresh look for your background.

Serene 'don't Chase This Gamble,' Says Top Investor About Tesla Stock Moment Art

Explore this high-quality 'don't chase this gamble,' says top investor about tesla stock image, perfect for enhancing your desktop or mobile wallpaper.

High-Quality 'don't Chase This Gamble,' Says Top Investor About Tesla Stock Image in HD

Experience the crisp clarity of this stunning 'don't chase this gamble,' says top investor about tesla stock image, available in high resolution for all your screens.

Vivid 'don't Chase This Gamble,' Says Top Investor About Tesla Stock Wallpaper in HD

Discover an amazing 'don't chase this gamble,' says top investor about tesla stock background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Beautiful 'don't Chase This Gamble,' Says Top Investor About Tesla Stock Scene in HD

Experience the crisp clarity of this stunning 'don't chase this gamble,' says top investor about tesla stock image, available in high resolution for all your screens.

Vivid 'don't Chase This Gamble,' Says Top Investor About Tesla Stock Artwork Collection

Discover an amazing 'don't chase this gamble,' says top investor about tesla stock background image, ideal for personalizing your devices with vibrant colors and intricate designs.

High-Quality 'don't Chase This Gamble,' Says Top Investor About Tesla Stock Scene in HD

Experience the crisp clarity of this stunning 'don't chase this gamble,' says top investor about tesla stock image, available in high resolution for all your screens.

Mesmerizing 'don't Chase This Gamble,' Says Top Investor About Tesla Stock Picture Digital Art

Explore this high-quality 'don't chase this gamble,' says top investor about tesla stock image, perfect for enhancing your desktop or mobile wallpaper.

Detailed 'don't Chase This Gamble,' Says Top Investor About Tesla Stock Photo Nature

Experience the crisp clarity of this stunning 'don't chase this gamble,' says top investor about tesla stock image, available in high resolution for all your screens.

Spectacular 'don't Chase This Gamble,' Says Top Investor About Tesla Stock Abstract Collection

Immerse yourself in the stunning details of this beautiful 'don't chase this gamble,' says top investor about tesla stock wallpaper, designed for a captivating visual experience.

Lush 'don't Chase This Gamble,' Says Top Investor About Tesla Stock Image Collection

A captivating 'don't chase this gamble,' says top investor about tesla stock scene that brings tranquility and beauty to any device.

Captivating 'don't Chase This Gamble,' Says Top Investor About Tesla Stock Picture Nature

Find inspiration with this unique 'don't chase this gamble,' says top investor about tesla stock illustration, crafted to provide a fresh look for your background.

Download these 'don't chase this gamble,' says top investor about tesla stock wallpapers for free and use them on your desktop or mobile devices.