Get Business Credit Line

Get Business Credit Line: The Ultimate Guide to Funding Your Dreams

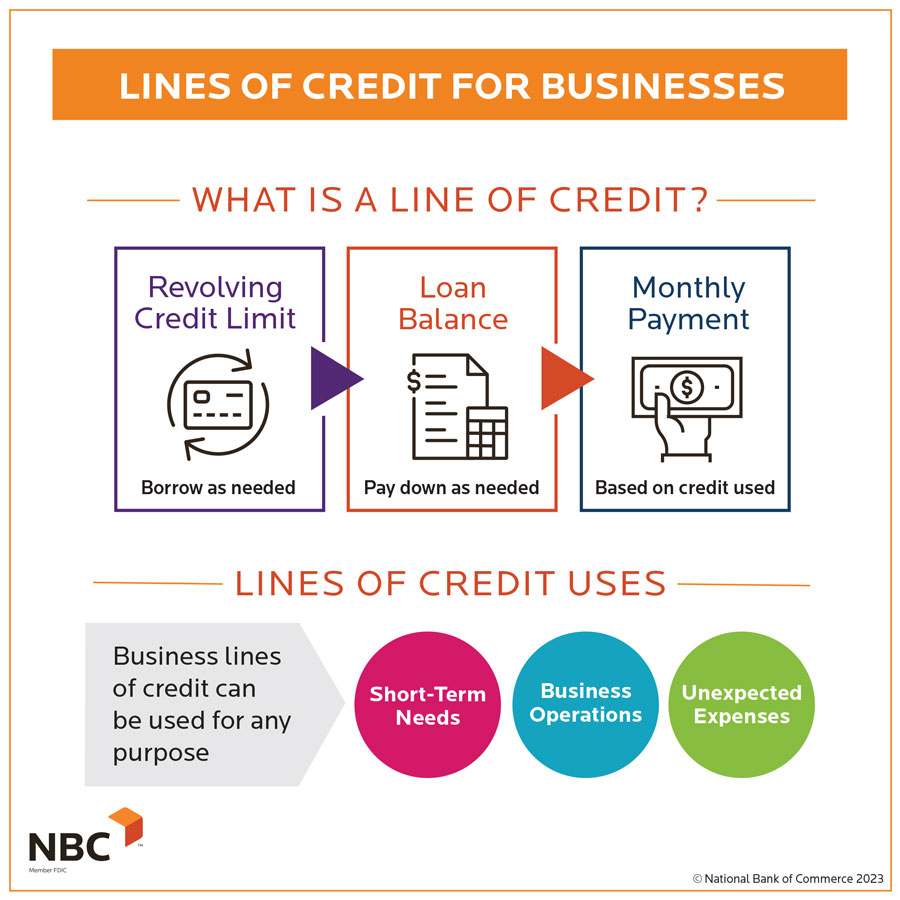

Are you a business owner looking for flexible financing to cover unexpected expenses, manage cash flow gaps, or seize new growth opportunities? If so, learning how to Get Business Credit Line approval should be high on your priority list. Unlike traditional term loans, a business credit line offers the flexibility of revolving credit, allowing you to borrow and repay funds as needed, up to a set limit.

Securing this type of financing might seem complicated, but with the right preparation and strategy, it is entirely achievable. This comprehensive guide will walk you through everything you need to know, from preparation steps to choosing the right type of credit line for your company.

Why You Need a Business Credit Line

Think of a business credit line as a financial safety net and a powerful tool for strategic growth. It provides immediate access to capital without the rigid structure of installment payments you get with a standard loan. It's perfect for situations where timing is critical.

For small businesses, especially startups or those in seasonal industries, maintaining healthy liquidity is crucial. A line of credit ensures you have funds ready without having to apply for a new loan every time an expense pops up. Here are the primary reasons why this funding tool is essential:

- Cash Flow Management: Cover gaps between invoicing customers and receiving payments. This is often the most common use case.

- Emergency Funds: Handle unexpected equipment repairs or staffing shortages without disrupting operations.

- Inventory Stocking: Purchase inventory in bulk when you spot a deep discount, increasing profit margins.

- Seizing Opportunities: Quickly fund short-term projects or marketing campaigns that promise high returns.

Ultimately, having access to a business credit line gives you peace of mind and the agility to make quick financial decisions when they matter most.

Essential Steps to Get Business Credit Line Approval

Lenders look for stability and reliability. To maximize your chances of approval, preparation is key. You need to present your business as a minimal risk investment. Following these three steps will put you miles ahead of the competition when you decide to apply.

Tidy Up Your Business Finances

The first step toward securing financing is proving that your business is a separate, functioning entity. If you are still running everything through your personal bank account, stop immediately. Lenders need clear insight into business-only income and expenses.

Make sure you have a dedicated business bank account and that all your financial statements (Profit & Loss, Balance Sheet) are up-to-date and professionally compiled. Furthermore, ensure you have established an Employer Identification Number (EIN) and have completed all necessary registrations for your business structure.

Know Your Credit Scores (Personal and Business)

For most small business loans and lines of credit, lenders heavily scrutinize both your personal and business credit profiles. Your personal credit history often acts as a proxy for the reliability of your young business.

Before applying, pull reports from the three major consumer bureaus (Experian, Equifax, TransUnion) and the major business credit bureaus (Dun & Bradstreet, Experian Commercial, Equifax Business). Aim to pay down any existing high-interest debt and resolve any discrepancies on these reports. A strong credit score significantly improves your terms and the amount you can borrow.

Prepare Your Documentation

The application process requires substantial documentation to verify your business's health and legitimacy. Having these documents organized and ready will streamline the application process and show the lender you are serious and professional.

Required documents typically include:

- Business plan detailing how the credit line will be used.

- Bank statements (last 6-12 months).

- Financial statements (P&L and Balance Sheet).

- Tax returns (business and personal, typically 2 years).

- Legal entity documents (Articles of Incorporation, licenses).

- Personal guarantee and collateral documentation (if applicable).

Types of Business Credit Lines Available

When you seek to Get Business Credit Line financing, you will encounter different structural options. Understanding these differences is key to choosing the product that best fits your business model and risk tolerance.

Secured vs. Unsecured Credit Lines

This is the most fundamental difference. Secured lines of credit require collateral—such as real estate, equipment, or accounts receivable—to back the borrowing limit. Because the lender has security, these lines typically offer larger limits and lower interest rates.

Unsecured lines of credit, conversely, require no collateral. They rely purely on the strength of your business revenue, cash flow, and creditworthiness. While convenient, they often come with higher interest rates and lower borrowing limits, as the risk to the lender is higher.

Revolving vs. Non-Revolving Credit Lines

Most business lines of credit are revolving, meaning that as you pay down the balance, the funds become available again for you to draw upon (much like a credit card). This flexibility is highly valued by businesses dealing with fluctuating working capital needs.

Non-revolving lines of credit are less common for general business financing. They allow you to borrow funds up to a set limit within a specific timeframe, but once the money is repaid, the funds are not automatically replenished. If you need more money later, you must apply for a new line.

Avoiding Common Pitfalls When Applying

Even the most prepared applicant can sometimes slip up. Knowing the common mistakes can help you navigate the process smoothly and increase the probability of a positive outcome.

One major mistake is applying everywhere at once. Multiple hard inquiries on your credit report in a short period can damage your scores, signaling desperation to potential lenders. Choose two or three likely lenders and focus your efforts there first.

Key Mistakes to Sidestep:

- Underestimating Funding Needs: Requesting too little may force you to reapply sooner, while requesting too much makes the lender wary. Calculate your need accurately.

- Ignoring the Fine Print: Always review the terms related to draw fees, annual fees, and renewal fees. These charges can significantly increase the total cost of borrowing.

- Lack of Business History: If your business is less than six months old, many traditional banks won't even consider you. Seek out alternative online lenders who specialize in newer businesses, or focus on building business credit first.

Remember that even if you are approved, you only pay interest on the funds you actually use. Don't be afraid to accept a larger limit than you need, provided the annual fees are reasonable, as this secures capital for future growth.

Conclusion

A business credit line is an indispensable financial tool that offers unmatched flexibility and stability for entrepreneurs. The path to successfully Get Business Credit Line approval lies in meticulous preparation: separating personal and business finances, maintaining excellent credit profiles, and ensuring all your documentation is complete and verifiable.

Whether you choose a secured or unsecured option, the key is finding a financial partner that understands your business needs. By following the steps outlined in this guide and avoiding common pitfalls, you can secure the funding necessary to manage short-term costs and strategically invest in your company's future growth.

Frequently Asked Questions (FAQ)

- What is the minimum credit score needed to get a business credit line?

- The minimum score varies significantly by lender and type of line. Traditional banks often look for a personal credit score of 680 or higher. Online lenders may accept scores as low as 600, especially if the business shows strong revenue, but expect higher interest rates in those cases.

- How long does it take to get approved?

- If you apply through a traditional bank, the process can take anywhere from a few weeks to several months. Online lenders, which specialize in speed, can often provide approval and funding within 24 hours to 7 days, assuming all documentation is submitted quickly.

- Does getting a business credit line affect my personal credit?

- Yes, typically it does. Most lenders require a personal guarantee for a business line of credit, especially for smaller businesses. This means they will perform a hard inquiry on your personal credit report during the application, and the resulting debt may be reported on your personal credit if the business defaults.

- Can a startup with no revenue still get a business credit line?

- It is extremely difficult. Lenders want to see evidence of repayment ability, usually through revenue or significant assets/collateral. Startups should generally look at building business credit through vendor financing first, or rely on securing a small personal line of credit guaranteed by the owner.

Get Business Credit Line

Get Business Credit Line Wallpapers

Collection of get business credit line wallpapers for your desktop and mobile devices.

Mesmerizing Get Business Credit Line Capture Digital Art

Transform your screen with this vivid get business credit line artwork, a true masterpiece of digital design.

Amazing Get Business Credit Line Background for Your Screen

Discover an amazing get business credit line background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Mesmerizing Get Business Credit Line Scene Collection

Discover an amazing get business credit line background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Crisp Get Business Credit Line Photo in HD

Find inspiration with this unique get business credit line illustration, crafted to provide a fresh look for your background.

Dynamic Get Business Credit Line Moment Nature

A captivating get business credit line scene that brings tranquility and beauty to any device.

Spectacular Get Business Credit Line Image Concept

A captivating get business credit line scene that brings tranquility and beauty to any device.

Detailed Get Business Credit Line Background Digital Art

Transform your screen with this vivid get business credit line artwork, a true masterpiece of digital design.

Amazing Get Business Credit Line Picture Collection

Experience the crisp clarity of this stunning get business credit line image, available in high resolution for all your screens.

Crisp Get Business Credit Line Moment Collection

A captivating get business credit line scene that brings tranquility and beauty to any device.

Crisp Get Business Credit Line Scene for Desktop

Find inspiration with this unique get business credit line illustration, crafted to provide a fresh look for your background.

Vivid Get Business Credit Line Background for Your Screen

Experience the crisp clarity of this stunning get business credit line image, available in high resolution for all your screens.

High-Quality Get Business Credit Line Abstract Art

Experience the crisp clarity of this stunning get business credit line image, available in high resolution for all your screens.

Vibrant Get Business Credit Line Wallpaper Art

Transform your screen with this vivid get business credit line artwork, a true masterpiece of digital design.

Mesmerizing Get Business Credit Line Landscape Photography

Explore this high-quality get business credit line image, perfect for enhancing your desktop or mobile wallpaper.

Crisp Get Business Credit Line Scene Photography

Immerse yourself in the stunning details of this beautiful get business credit line wallpaper, designed for a captivating visual experience.

Vibrant Get Business Credit Line Abstract for Your Screen

Transform your screen with this vivid get business credit line artwork, a true masterpiece of digital design.

Serene Get Business Credit Line Background Digital Art

Explore this high-quality get business credit line image, perfect for enhancing your desktop or mobile wallpaper.

High-Quality Get Business Credit Line Scene Illustration

Explore this high-quality get business credit line image, perfect for enhancing your desktop or mobile wallpaper.

Beautiful Get Business Credit Line Picture for Desktop

Transform your screen with this vivid get business credit line artwork, a true masterpiece of digital design.

Spectacular Get Business Credit Line Design in HD

This gorgeous get business credit line photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Download these get business credit line wallpapers for free and use them on your desktop or mobile devices.