Get Paycheck Advance

Get Paycheck Advance: Your Ultimate Guide to Fast Cash Solutions

Life has a funny way of throwing unexpected expenses our way. Maybe your car broke down, or an emergency medical bill just arrived—and payday is still a week away. When you're caught between a financial rock and a hard place, you might find yourself frantically searching for ways to Get Paycheck Advance.

If you're looking for a quick, short-term financial bridge, a paycheck advance could be exactly what you need. This guide will walk you through what paycheck advances are, how they work, the different options available, and crucial factors to consider before you commit. We're here to help you make an informed decision and avoid common financial traps.

What Exactly Does It Mean to Get Paycheck Advance?

Simply put, a paycheck advance (or salary advance) allows you to borrow a portion of the money you have already earned but haven't yet been paid. It is essentially an early withdrawal of your upcoming paycheck. This mechanism is designed to cover financial gaps between paydays, helping you deal with immediate needs without waiting for your scheduled deposit.

Unlike traditional bank loans that often require extensive credit checks and lengthy application processes, the qualification process for a paycheck advance is generally much faster and focuses primarily on your verifiable employment and income history. The idea is to provide relief quickly, often within minutes or hours.

Understanding the Key Mechanics of a Paycheck Advance

When you decide to get a paycheck advance, the funds are not based on your credit score, but rather on proof of consistent income. Providers typically require access to your bank account or payroll information to confirm your employment status and earnings schedule.

Repayment is usually automated. When your actual payday arrives, the advance amount—plus any associated fees or membership costs—is automatically deducted from your bank account or payroll. This ensures that the lender is repaid quickly and minimizes the risk of default.

The Different Ways to Get Paycheck Advance

The marketplace for obtaining an advance has significantly evolved. Today, you have several avenues available, each with different cost structures and repayment expectations.

Here are the three most common ways to secure an advance:

- Employer-Sponsored Programs: Some forward-thinking companies offer advances directly through their HR department or through partnerships with financial wellness platforms. These are often the lowest-cost option, sometimes even fee-free, as they are a benefit offered by your employer.

- Fintech Advance Apps: Companies like Earnin, Dave, or Brigit offer apps that connect directly to your bank account and payroll. They often charge a small monthly subscription fee, optional "tips," or express funding fees, but generally avoid high interest rates associated with traditional loans.

- Traditional Payday Lenders (Use Caution): While technically offering an advance on income, these lenders are often associated with extremely high APRs and dangerous debt cycles. We generally recommend exploring employer programs or apps first before resorting to high-interest payday loans.

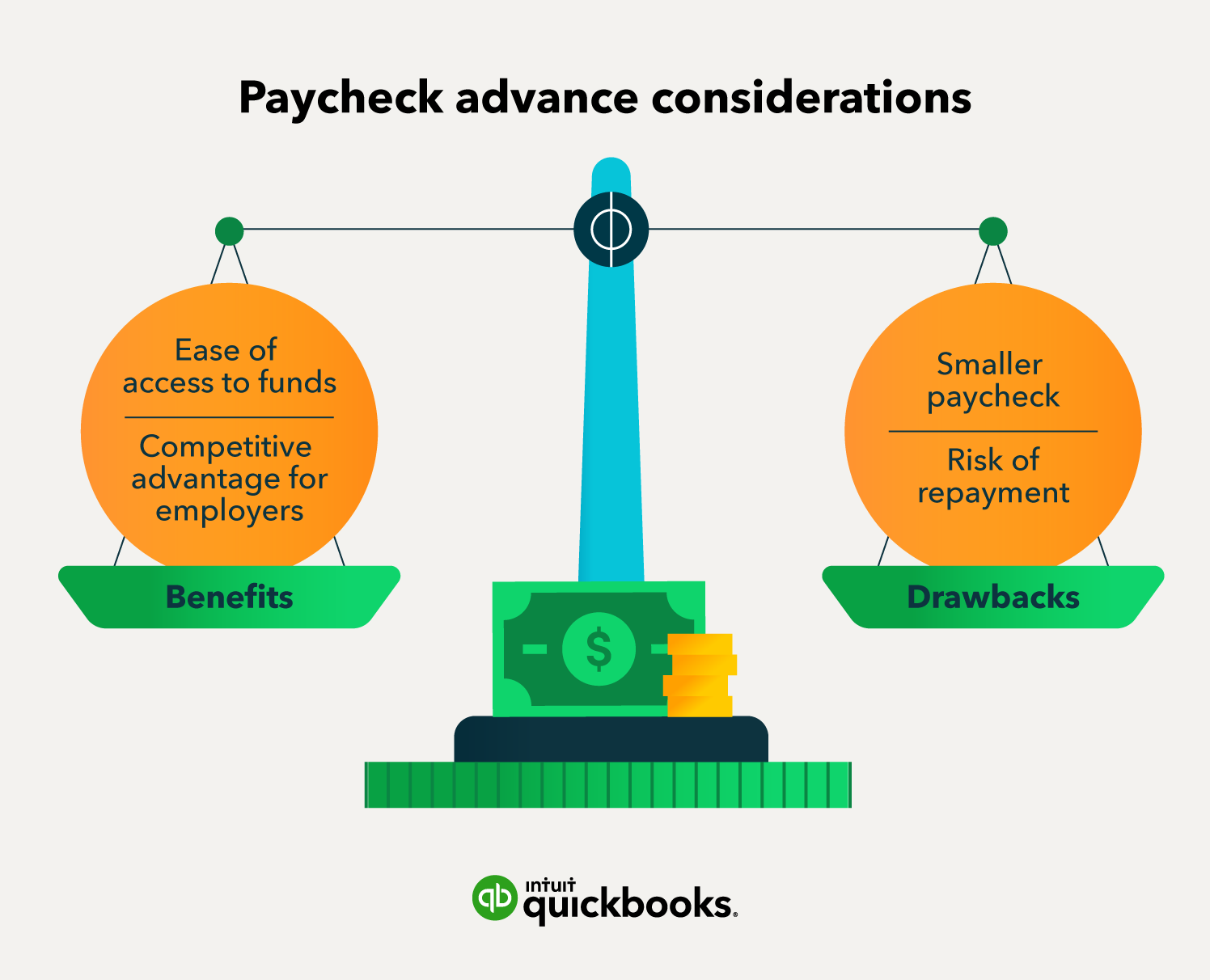

Pros and Cons: Is a Paycheck Advance Right for You?

Before you rush to Get Paycheck Advance, it's crucial to weigh the benefits against the potential downsides. While they offer immediate relief, they are not a long-term solution to structural budget problems.

The Top Benefits of Seeking a Paycheck Advance

The primary attraction of these services lies in their speed and accessibility. For those facing an emergency, these advantages can be life-saving.

- Speed of Funding: Many apps or employer programs can transfer funds to your account almost instantly, or within one business day, which is essential for true emergencies.

- Avoids Overdraft Fees: Using a small advance to cover a pending transaction is almost always cheaper than incurring multiple $35 overdraft fees from your bank.

- No Hard Credit Check: Since the advance is secured by your earned wages, providers rarely run a hard inquiry on your credit report, protecting your credit score.

- Lower Cost (Compared to Payday Loans): Modern advance apps generally operate on fees or subscriptions, which are significantly less expensive than the exorbitant interest rates found on traditional payday loans.

Potential Drawbacks and Risks to Consider

While convenient, utilizing these advances too frequently can lead to problems. It's vital to understand that borrowing from your next check makes that next check smaller.

This reduction in your next paycheck creates a potential cycle of reliance. If you borrow $100 this week, you only have $900 of your normal $1000 paycheck next week. If your budget is already tight, this shortage might force you to borrow again immediately, trapping you in a continuous borrowing loop.

Also, be mindful of the "tipping" mechanism used by some apps. While presented as optional, users can often feel pressured to tip, increasing the overall cost of the advance. Always calculate the true cost (fees + tips) as a percentage of the amount borrowed to understand the effective APR.

How to Choose the Best Service When You Need to Get Paycheck Advance

Not all advance services are created equal. Taking a few moments to evaluate your options can save you money and headaches in the long run. Focus on transparency, cost, and reliability.

Key Factors to Evaluate Before Signing Up

When selecting a provider, you must look beyond the initial promise of fast cash. Dig into the fine print concerning fees and repayment.

Consider the following aspects:

- Fee Structure: Is it a flat fee, a voluntary tip, a monthly subscription, or an interest rate? Opt for services with clear, predictable costs.

- Repayment Flexibility: Do they offer a grace period, or is repayment mandatory on payday? Flexibility can be crucial if your paycheck is delayed.

- Advance Limit: How much of your paycheck are they willing to advance? Most services cap the amount at 50% or less of your earned wages to prevent financial distress.

- Security and Privacy: Since you are linking your bank account, ensure the provider uses strong encryption and follows strict data privacy protocols.

Step-by-Step Guide to Getting Your Advance

If you have chosen an app-based solution, the process is generally streamlined and easy to follow:

Here is how you typically Get Paycheck Advance through an app:

- Download and Register: Install the chosen app and create an account using basic personal information.

- Link Your Bank Account: Connect the bank account where your paychecks are deposited. This allows the app to verify your income and schedule.

- Verify Employment (If required): Some apps might require uploading a recent pay stub or confirming details through your employer's payroll system.

- Request the Advance: Once approved, the app will show you the maximum amount you are eligible to borrow based on how many hours you've worked. Select the amount you need.

- Confirm Fees/Repayment: Review the withdrawal date and any associated costs (fees, express charge, or tip). Confirm the request.

- Receive Funds: The money is deposited into your bank account.

Remember that this process relies on accurate and consistent income data. If you have an irregular work schedule or frequently change jobs, qualifying might be harder.

Conclusion: Get Paycheck Advance Responsibly

When used sparingly and for genuine emergencies, the ability to Get Paycheck Advance can be a powerful tool for maintaining financial stability. It provides a safer and often cheaper alternative to high-interest debt like payday loans or maxing out credit cards for short-term needs.

Ultimately, treat a paycheck advance as a bridge, not a permanent solution. Always confirm the total cost of the advance and ensure that the repayment amount will not leave you short on funds in the following pay cycle. By carefully choosing your provider and understanding the repayment terms, you can successfully navigate financial bumps without derailing your long-term goals.

Frequently Asked Questions (FAQ)

- What is the typical limit when I get a paycheck advance?

- The limit often depends on your monthly income and the provider, but most apps start users at $100 to $250 per pay cycle. As you demonstrate reliable repayment history, this limit may increase, usually capping around $500 to $1,000.

- Will getting a paycheck advance affect my credit score?

- Generally, no. Most modern paycheck advance apps do not perform hard credit inquiries because the advance is secured by your earned wages, not your credit history. They also typically do not report late payments to major credit bureaus.

- Are paycheck advances the same as payday loans?

- No, they are fundamentally different. Paycheck advance apps generally operate on low fees or voluntary tips and do not charge high interest (APR), making them much safer. Payday loans, on the other hand, are high-interest installment loans often associated with extreme APRs that can lead to debt cycles.

- What happens if I can't repay the advance on my payday?

- If you use an employer program or an app, they usually won't charge NSF fees but may restrict you from taking another advance until the current one is repaid. If you used a traditional payday lender, failure to repay will trigger substantial fees and potentially aggressive collections attempts.

- Can I get a paycheck advance if I am self-employed?

- Most traditional paycheck advance services require proof of W-2 employment with regular direct deposits. Self-employed individuals or gig workers might need to look for alternative financing options or apps specifically designed for tracking and advancing irregular income, which may have different qualification requirements.

Get Paycheck Advance

Get Paycheck Advance Wallpapers

Collection of get paycheck advance wallpapers for your desktop and mobile devices.

Vibrant Get Paycheck Advance Wallpaper Illustration

Explore this high-quality get paycheck advance image, perfect for enhancing your desktop or mobile wallpaper.

Crisp Get Paycheck Advance Design Collection

A captivating get paycheck advance scene that brings tranquility and beauty to any device.

Captivating Get Paycheck Advance Scene Collection

Find inspiration with this unique get paycheck advance illustration, crafted to provide a fresh look for your background.

Lush Get Paycheck Advance Abstract Nature

Find inspiration with this unique get paycheck advance illustration, crafted to provide a fresh look for your background.

Amazing Get Paycheck Advance Picture for Desktop

Transform your screen with this vivid get paycheck advance artwork, a true masterpiece of digital design.

Vibrant Get Paycheck Advance View Collection

Experience the crisp clarity of this stunning get paycheck advance image, available in high resolution for all your screens.

Vibrant Get Paycheck Advance Landscape Nature

Discover an amazing get paycheck advance background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Serene Get Paycheck Advance Scene in HD

Transform your screen with this vivid get paycheck advance artwork, a true masterpiece of digital design.

Mesmerizing Get Paycheck Advance Capture Collection

Discover an amazing get paycheck advance background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Beautiful Get Paycheck Advance Image Photography

Discover an amazing get paycheck advance background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Crisp Get Paycheck Advance Capture Photography

This gorgeous get paycheck advance photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Amazing Get Paycheck Advance Picture Art

Transform your screen with this vivid get paycheck advance artwork, a true masterpiece of digital design.

Beautiful Get Paycheck Advance Scene in 4K

Experience the crisp clarity of this stunning get paycheck advance image, available in high resolution for all your screens.

Serene Get Paycheck Advance Scene for Mobile

Experience the crisp clarity of this stunning get paycheck advance image, available in high resolution for all your screens.

Captivating Get Paycheck Advance Scene Concept

This gorgeous get paycheck advance photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Dynamic Get Paycheck Advance Landscape in HD

Find inspiration with this unique get paycheck advance illustration, crafted to provide a fresh look for your background.

Breathtaking Get Paycheck Advance Photo for Your Screen

Experience the crisp clarity of this stunning get paycheck advance image, available in high resolution for all your screens.

Serene Get Paycheck Advance Wallpaper for Desktop

Transform your screen with this vivid get paycheck advance artwork, a true masterpiece of digital design.

Artistic Get Paycheck Advance Wallpaper for Desktop

A captivating get paycheck advance scene that brings tranquility and beauty to any device.

Amazing Get Paycheck Advance View for Mobile

Experience the crisp clarity of this stunning get paycheck advance image, available in high resolution for all your screens.

Download these get paycheck advance wallpapers for free and use them on your desktop or mobile devices.