How To Get A Debt Off Your Credit Report

How To Get A Debt Off Your Credit Report

Seeing a negative debt entry on your credit report can feel incredibly frustrating. It drags down your score, limits your financial options, and can feel like a permanent black mark. If you're asking yourself, "How To Get A Debt Off Your Credit Report?"—you're in the right place. The good news is that you have options, and sometimes, those nasty entries aren't supposed to be there at all.

Getting rid of debt entries is a tactical game that requires patience and precision. We're going to walk through the most effective strategies, from disputing errors to negotiating with collectors, so you can start clearing up your financial future today.

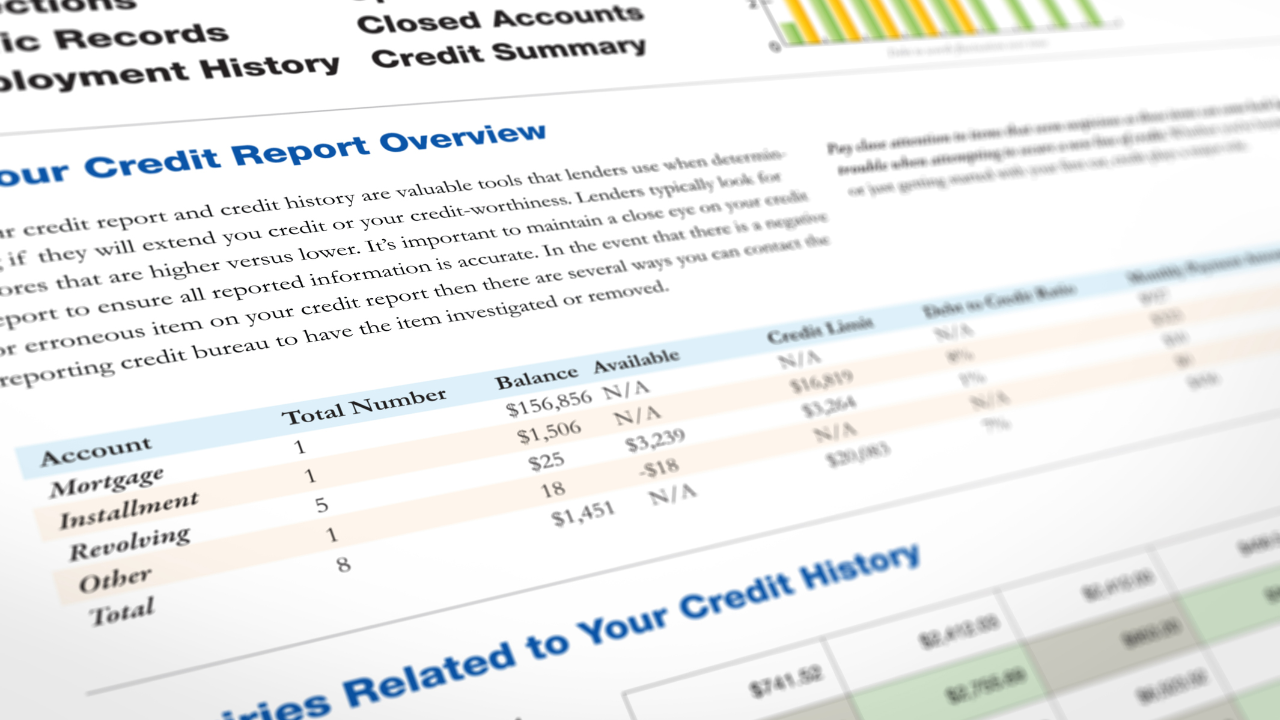

Understanding Your Credit Report

Before you can remove debt, you need to understand how it landed there in the first place. Your credit report is managed by three major credit bureaus: Experian, Equifax, and TransUnion. When you miss payments or default on a loan, the creditor reports this negative information to these bureaus.

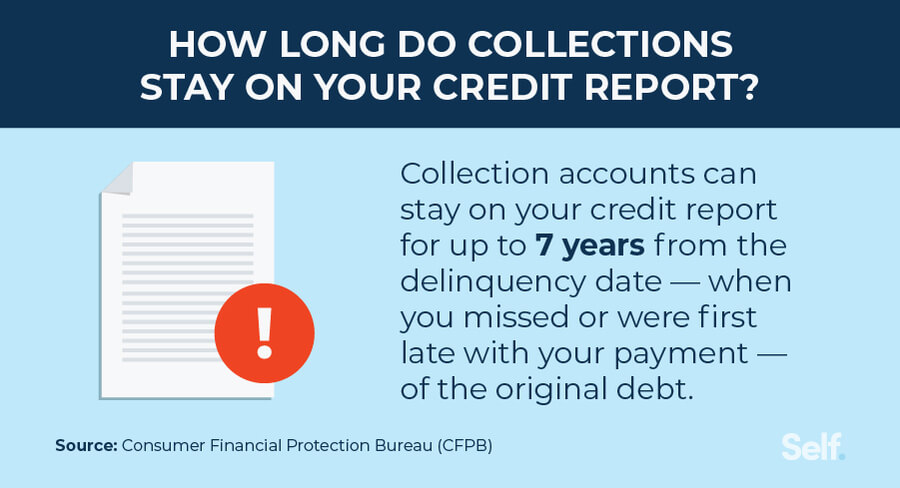

These negative marks typically stay on your report for up to seven years from the date of the first missed payment, even if you eventually pay the debt. This timeframe includes late payments, collections, charge-offs, and settled accounts. Understanding this limit is key to knowing which debts are worth fighting and which are set to expire soon.

Your first crucial step is pulling all three reports. The information may vary slightly between the bureaus, which gives you more leverage if you find inconsistencies. You can get a free copy of each report once every 12 months via AnnualCreditReport.com.

The Most Effective Strategies to Remove Debt

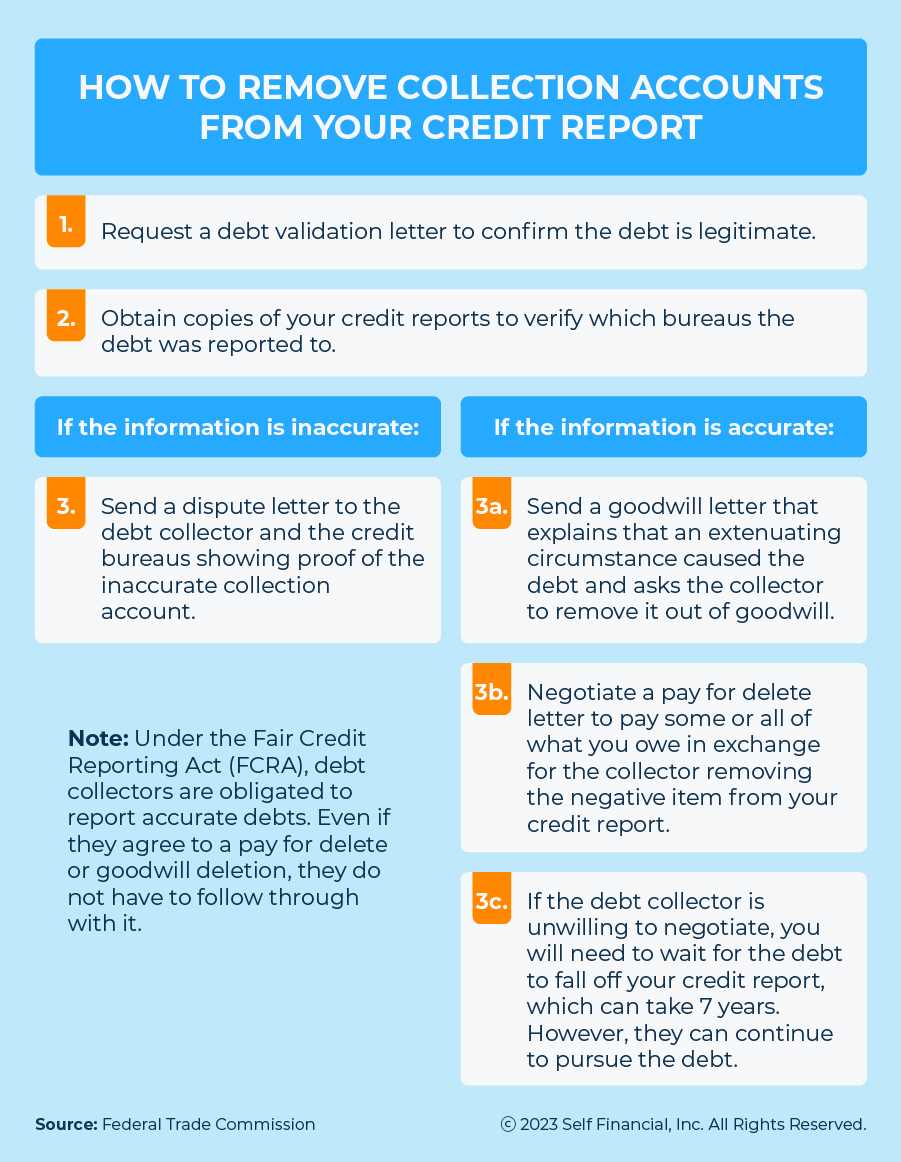

There are two primary paths to removing negative debt entries: negotiation and dispute. Which one you choose depends entirely on whether the debt is factually correct or contains errors.

Strategy 1: The Pay for Delete Agreement

If you know the debt is yours and accurate, negotiating directly with the creditor or collection agency is your best bet for removal. A "Pay for Delete" agreement means you agree to pay the debt (or a negotiated portion of it) in exchange for the creditor agreeing to remove the negative entry entirely from your credit report.

Collection agencies often prefer a lump sum payment and may be more willing to agree to this than the original creditor. Remember, they are often purchasing the debt for pennies on the dollar, so any recovery is profit for them.

Here are the essential steps for a successful Pay for Delete negotiation:

- Verify the Debt: Before paying anything, send a debt validation letter. This forces the collector to prove the debt is legitimate and that they have the legal right to collect it.

- Make an Offer: Offer to pay less than the full amount (e.g., 50-70%), contingent upon the deletion of the entire account from all three credit bureaus.

- Get It in Writing: This is non-negotiable. Do NOT pay a single dime until you receive a signed, written agreement stating that they will completely delete the negative entry upon receipt of payment. Phone agreements are worthless.

- Pay and Follow Up: Once the agreement is signed, make the payment. Wait 30-45 days and check your credit reports to ensure the entry has been removed.

Strategy 2: Dispute Inaccuracies and Errors (The Factual Approach)

If the debt entry contains errors, you have legal grounds to demand its removal under the Fair Credit Reporting Act (FCRA). This strategy doesn't require payment; it relies purely on factual accuracy.

Mistakes are incredibly common in credit reporting. Collectors frequently update information incorrectly, misdate the delinquency, or report the wrong balance. If any data point is wrong, you can file a dispute.

You must send your dispute letter directly to the credit bureau reporting the error (Experian, Equifax, or TransUnion) via certified mail. The bureaus then have 30 days to investigate the claim with the creditor. If the creditor cannot verify the information within that window, the entry must be deleted.

What Information Can You Dispute?

Anything that looks even slightly suspicious should be challenged. The more details you dispute, the harder it is for the creditor to verify quickly. Look closely for these common errors:

- Incorrect dates of last activity or first delinquency (crucial for the 7-year clock).

- Incorrect debt balance or account status (e.g., listed as "open" when it should be "closed").

- Misspellings of your name, wrong address, or incorrect social security number listed.

- Duplicate accounts (the debt is listed multiple times under different names or account numbers).

- Account reported by a collection agency that lacks validation evidence.

If your dispute is successful, the debt must be removed. This is often the fastest and most impactful way to clear up your credit report.

Strategy 3: Dealing with Old or Expired Debt (Statute of Limitations)

While negative information generally drops off after seven years, the Statute of Limitations (SOL) determines how long a creditor can legally sue you to collect the debt. The SOL varies by state, usually ranging from three to six years.

If the debt is past the SOL, collectors cannot take legal action against you. However, the debt can still legally remain on your credit report until the seven-year mark is reached.

Here is a critical warning: If you make a partial payment on an old debt, or even formally acknowledge the debt in writing, you can potentially "re-age" the debt. This resets the SOL clock, giving the collector a new legal window to sue you. Be extremely cautious when dealing with very old debt; your goal should be deletion, not just payment.

What to Do After the Debt is Removed

Once you successfully complete the process of how to get a debt off your credit report, the immediate improvement to your credit score can be significant. However, your work isn't done yet. You need to focus on rebuilding and maintenance.

First, always monitor your credit reports for at least six months to ensure the collection agency doesn't attempt to re-report the debt or sell it to another collector. If this happens, you have even stronger grounds for dispute since you have written proof of removal.

Second, focus on positive credit habits moving forward. This includes:

- Maintaining very low credit utilization (ideally below 10%).

- Paying all current debts on time, every time.

- Considering a secured credit card or a small credit builder loan if you need to establish a new, positive payment history.

Conclusion

The journey of how to get a debt off your credit report requires diligence, but it is entirely achievable. Whether you choose the path of negotiation through a "Pay for Delete" agreement or the factual approach of disputing inaccuracies under the FCRA, being organized and persistent is key.

Do not let collection agencies intimidate you into paying before you have a plan. Always demand written validation and written agreements for deletion. By taking these methodical steps, you are taking control back over your financial narrative and paving the way for a much healthier credit score. Start reviewing those reports today; your future self will thank you.

Frequently Asked Questions (FAQ)

- Can I remove a paid debt from my credit report?

- Not automatically. Paying a debt only changes the status from "Unpaid" to "Paid" or "Settled." This status remains for seven years. The only way to guarantee removal is through a "Pay for Delete" negotiation before you make the final payment.

- How long does it take for a negative item to be removed after a dispute?

- Under the FCRA, credit bureaus typically have 30 days (sometimes 45 days, depending on circumstances) from the date they receive your dispute to investigate and respond. If the debt cannot be verified within that time, it must be removed.

- What is the difference between "Settled" and "Paid in Full" on my credit report?

- Both are better than "Unpaid," but "Paid in Full" indicates you paid 100% of the owed balance. "Settled" means the creditor agreed to accept less than the full amount. While "Paid in Full" looks slightly better to new lenders, both still constitute a negative mark if the account was past due or sent to collections.

- Should I use a credit repair company?

- Credit repair companies often perform the same actions you can do yourself (disputing errors and negotiating). If you have the time and organizational skills, handling the process yourself saves money. If your situation is complex or overwhelming, a reputable company might be a useful investment, but always confirm their reputation first.

How To Get A Debt Off Your Credit Report

How To Get A Debt Off Your Credit Report Wallpapers

Collection of how to get a debt off your credit report wallpapers for your desktop and mobile devices.

Gorgeous How To Get A Debt Off Your Credit Report Background Illustration

This gorgeous how to get a debt off your credit report photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Vibrant How To Get A Debt Off Your Credit Report Picture for Your Screen

Explore this high-quality how to get a debt off your credit report image, perfect for enhancing your desktop or mobile wallpaper.

Spectacular How To Get A Debt Off Your Credit Report Scene in HD

This gorgeous how to get a debt off your credit report photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Gorgeous How To Get A Debt Off Your Credit Report View for Mobile

A captivating how to get a debt off your credit report scene that brings tranquility and beauty to any device.

Crisp How To Get A Debt Off Your Credit Report Capture Nature

This gorgeous how to get a debt off your credit report photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Vivid How To Get A Debt Off Your Credit Report Design for Mobile

Transform your screen with this vivid how to get a debt off your credit report artwork, a true masterpiece of digital design.

Gorgeous How To Get A Debt Off Your Credit Report View Digital Art

Immerse yourself in the stunning details of this beautiful how to get a debt off your credit report wallpaper, designed for a captivating visual experience.

Breathtaking How To Get A Debt Off Your Credit Report Moment in HD

Discover an amazing how to get a debt off your credit report background image, ideal for personalizing your devices with vibrant colors and intricate designs.

:max_bytes(150000):strip_icc()/remove-debt-collections-from-your-credit-report-960376_FINAL-5ae6517517024613885ec46df1e58ecd.png)

Exquisite How To Get A Debt Off Your Credit Report Artwork Photography

Immerse yourself in the stunning details of this beautiful how to get a debt off your credit report wallpaper, designed for a captivating visual experience.

:max_bytes(150000):strip_icc()/digging-out-of-debt_final-b14f7e15866443b3a3b87745ea178ef8.png)

Dynamic How To Get A Debt Off Your Credit Report Image Photography

This gorgeous how to get a debt off your credit report photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Dynamic How To Get A Debt Off Your Credit Report View Collection

This gorgeous how to get a debt off your credit report photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Detailed How To Get A Debt Off Your Credit Report Wallpaper Illustration

Discover an amazing how to get a debt off your credit report background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Captivating How To Get A Debt Off Your Credit Report Image Digital Art

Immerse yourself in the stunning details of this beautiful how to get a debt off your credit report wallpaper, designed for a captivating visual experience.

Lush How To Get A Debt Off Your Credit Report View for Your Screen

A captivating how to get a debt off your credit report scene that brings tranquility and beauty to any device.

Mesmerizing How To Get A Debt Off Your Credit Report Picture Illustration

Transform your screen with this vivid how to get a debt off your credit report artwork, a true masterpiece of digital design.

High-Quality How To Get A Debt Off Your Credit Report Picture Illustration

Discover an amazing how to get a debt off your credit report background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Captivating How To Get A Debt Off Your Credit Report Artwork Art

Find inspiration with this unique how to get a debt off your credit report illustration, crafted to provide a fresh look for your background.

Serene How To Get A Debt Off Your Credit Report Scene Photography

Experience the crisp clarity of this stunning how to get a debt off your credit report image, available in high resolution for all your screens.

Breathtaking How To Get A Debt Off Your Credit Report Photo Digital Art

Discover an amazing how to get a debt off your credit report background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Vibrant How To Get A Debt Off Your Credit Report Image Concept

Transform your screen with this vivid how to get a debt off your credit report artwork, a true masterpiece of digital design.

Download these how to get a debt off your credit report wallpapers for free and use them on your desktop or mobile devices.

0 Response to "How To Get A Debt Off Your Credit Report"

Post a Comment