How To Get A Loan At Wells Fargo

How To Get A Loan At Wells Fargo: Your Step-by-Step Guide

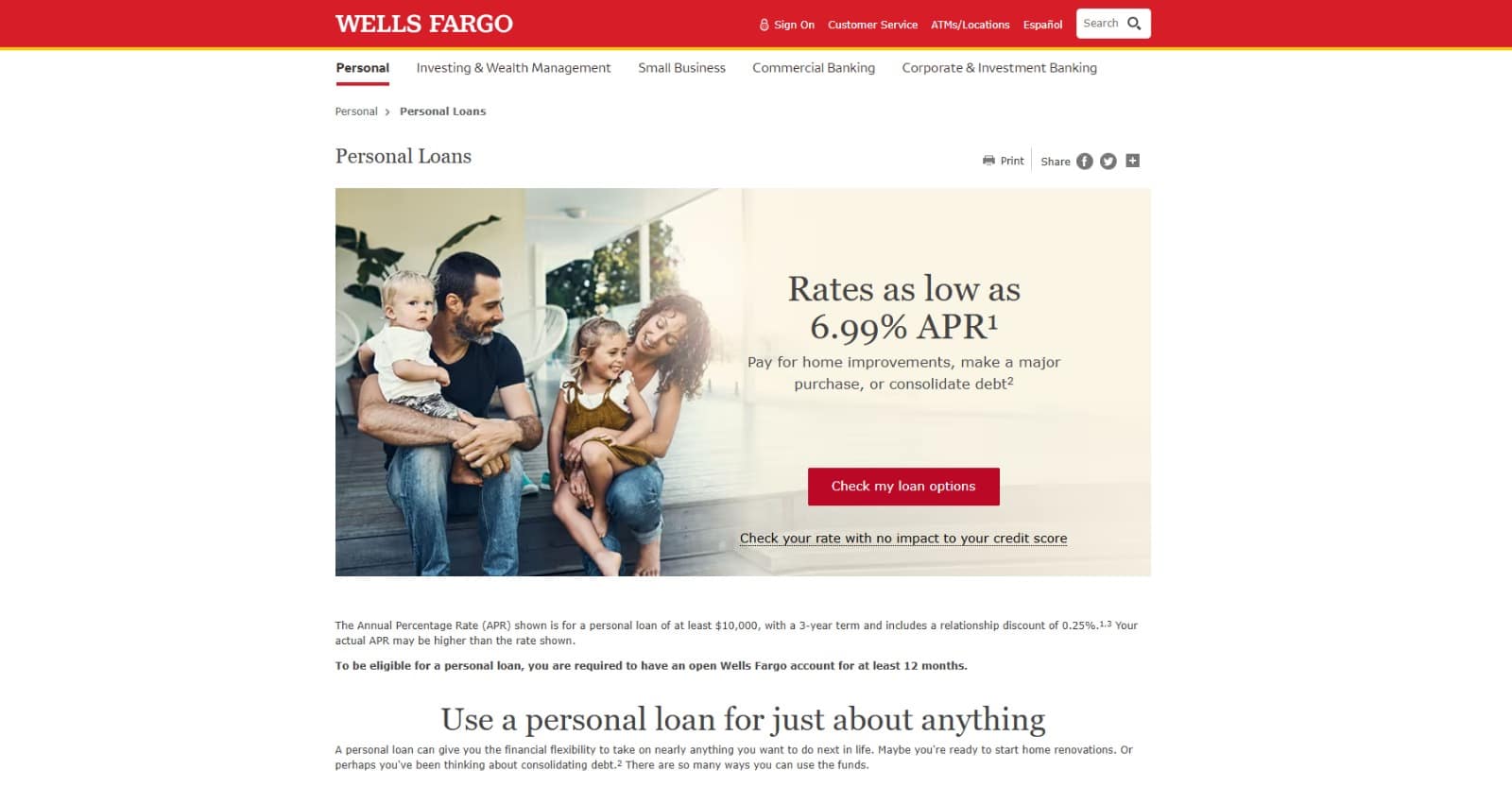

Are you considering a major purchase, consolidating high-interest debt, or tackling an unexpected expense? Getting a personal loan can often be the perfect solution. If you bank with Wells Fargo or are looking for a reliable national lender, understanding How To Get A Loan At Wells Fargo is your first important step.

Don't worry, the process doesn't have to be intimidating. This comprehensive guide breaks down everything from preparation and required documentation to the final funding of your loan. We'll walk you through the specifics so you can approach your application with confidence and clarity.

Before You Start: Understanding Your Needs and Eligibility

Before you even click "Apply," it's crucial to understand what kind of loan fits your situation and whether you meet Wells Fargo's basic qualifications. Preparation here saves significant time later.

What Kind of Loan Do You Need?

Wells Fargo offers various lending products, and the application specifics depend heavily on the type of financing you are seeking. Knowing the purpose of your funds dictates which product you should target.

Consider these popular options:

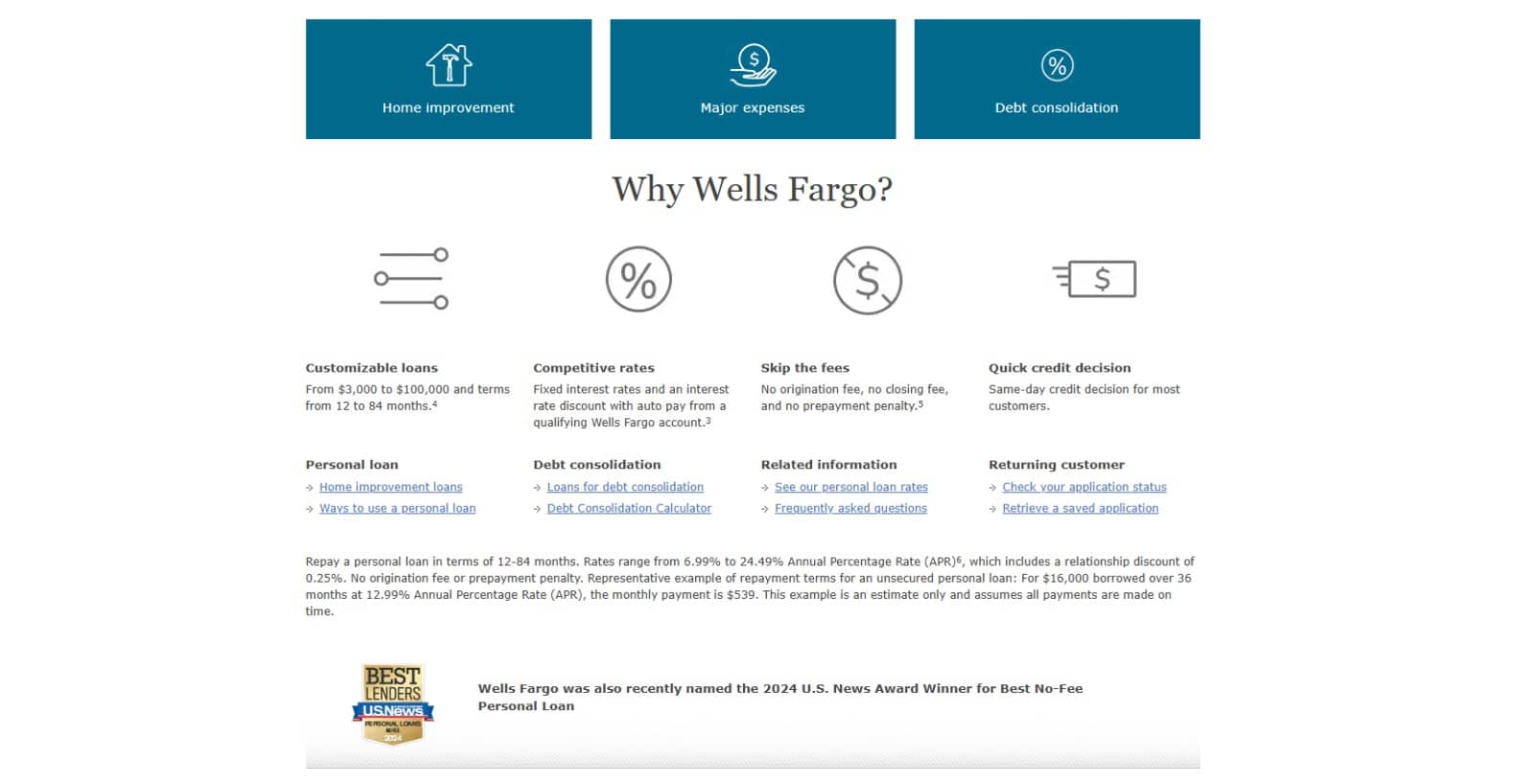

- Personal Loans (Unsecured): These are generally used for debt consolidation, major purchases, or weddings. They don't require collateral, but typically demand a better credit profile.

- Auto Loans: Specific financing reserved for purchasing a new or used vehicle. The vehicle acts as the collateral.

- Mortgages and Home Equity Loans: Used for home purchases or leveraging existing home equity. These are much more complex application processes.

- Business Loans: Designed for financing business operations, equipment, or expansion.

For the purpose of this guide on How To Get A Loan At Wells Fargo, we will focus primarily on unsecured personal loans, as they are the most common starting point for individual borrowers.

Key Eligibility Requirements

Lenders like Wells Fargo evaluate several key factors to determine if you are a low-risk borrower. Meeting these criteria is essential for a smooth approval process.

While requirements can vary slightly depending on the loan amount and type, generally you will need:

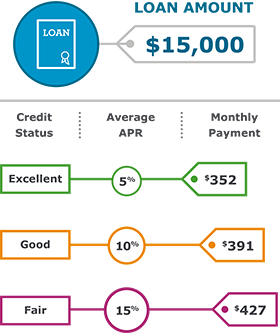

- Good Credit Score: Wells Fargo often prefers applicants with a FICO score in the good range (typically 670+) for unsecured personal loans. A higher score translates to lower interest rates.

- Stable Income: You must demonstrate a reliable income stream sufficient to cover the loan payments, in addition to your existing monthly financial obligations.

- Low Debt-to-Income (DTI) Ratio: Your total monthly debt payments should ideally be less than 40% of your gross monthly income.

- Existing Relationship (Optional but Helpful): Being an existing Wells Fargo customer, particularly having a checking or savings account, can sometimes expedite the review process.

The Step-by-Step Process for Wells Fargo Loan Application

Once you've assessed your needs and pre-checked your eligibility, it's time to move into the practical steps of applying. This is the core of understanding How To Get A Loan At Wells Fargo successfully.

Step 1: Gathering Necessary Documentation

Speed up the process significantly by having all required documents ready before you begin the application. Wells Fargo will need to verify your identity, residence, and financial health.

Required items generally include:

- Government-issued photo identification (Driver's license or passport).

- Proof of residence (Utility bill or lease agreement).

- Proof of income (Recent pay stubs, W-2 forms, or tax returns if self-employed).

- Social Security Number.

- Information regarding your current assets and liabilities.

Make sure all documents are current and clear. Inconsistencies or missing paperwork are the primary causes of application delays.

Step 2: Choosing Your Application Method

Wells Fargo offers several convenient ways to apply, catering to different comfort levels and needs. You can choose between the speed of an online application or the personal touch of an in-branch meeting.

Applying Online: Speed and Convenience

Applying through the Wells Fargo website or mobile app is generally the quickest route. This method is ideal if you are a current customer and have strong, straightforward financial documentation.

Simply navigate to the personal loan section, use your banking login (if applicable), and fill out the detailed digital form. You will be prompted to upload digital copies of your supporting documents. This process often takes less than an hour, and pre-approval decisions can sometimes be immediate.

Applying In-Branch: Personalized Support

If your financial situation is complex, or if you simply prefer talking to a human being, making an appointment with a Wells Fargo personal banker is highly recommended. The banker can guide you through the forms, answer specific questions about interest rates, and ensure you apply for the exact product you need.

Make sure to bring all your physical documentation with you to the appointment. While it may take longer than the online application, the personalized assistance can be invaluable.

What Happens After You Apply?

Once your application is submitted, Wells Fargo begins the underwriting process. This is where they thoroughly review your credit history, income, and debt levels to confirm you meet all requirements.

Understanding the Approval Process Timeline

The waiting period varies widely. For existing customers applying for small personal loans with strong credit, approval can happen almost instantly or within one business day. However, for larger loans or complex situations (like mortgages), the process can take several weeks.

If Wells Fargo requires additional information—perhaps clarification on an employment gap or an unusual expense—they will contact you directly. Responding promptly to these requests is key to keeping the timeline short.

Finalizing and Funding Your Loan

Congratulations, you've received approval! The final step involves reviewing and signing the loan agreement. Make sure you read the fine print carefully, paying attention to the Annual Percentage Rate (APR), repayment schedule, and any associated fees.

Once the document is signed, Wells Fargo will disburse the funds. For personal loans, funds are typically transferred directly into your designated Wells Fargo bank account, often within one business day of final document signing. If you use the funds for debt consolidation, the bank may send payments directly to your creditors.

Conclusion: Your Path to Financial Goals

Learning How To Get A Loan At Wells Fargo requires organization and attention to detail, but it is a straightforward process when you approach it correctly. By preparing your documentation, ensuring your credit profile is strong, and choosing the right application method, you significantly boost your chances of approval.

Whether you need funds for a new car or simply want to simplify your existing debt, Wells Fargo offers various options to meet your goals. Take that first preparatory step today, and move closer to achieving your financial aims.

Frequently Asked Questions (FAQ) About Wells Fargo Loans

- What is the minimum credit score needed for a Wells Fargo personal loan?

- While Wells Fargo does not publish a strict minimum, competitive rates for unsecured personal loans generally require a good credit score, typically 670 or higher. Applicants with scores below this may still qualify but might face higher interest rates or require collateral.

- How long does it take to get a final decision on a Wells Fargo loan?

- If you are an existing customer with strong financials, pre-approval might be instant, and funding can occur within 1-3 business days after document signing. For complex applications or non-customers, the underwriting process may take up to a week or more.

- Can I apply for a loan if I am not a Wells Fargo customer?

- Yes, absolutely. Wells Fargo serves both existing customers and non-customers. However, existing customers may benefit from streamlined processes and faster verification times, as the bank already has access to some of their financial history.

- Is there a penalty for paying off my loan early?

- Most Wells Fargo personal loans do not include prepayment penalties. Always confirm this detail in your specific loan agreement before signing, as avoiding prepayment penalties allows you to save money on interest.

- Does checking my rate affect my credit score?

- If you use an online tool to pre-qualify or check potential rates (a "soft inquiry"), it generally does not harm your credit score. However, submitting a formal application for a loan requires a "hard inquiry," which can temporarily lower your score by a few points.

How To Get A Loan At Wells Fargo

How To Get A Loan At Wells Fargo Wallpapers

Collection of how to get a loan at wells fargo wallpapers for your desktop and mobile devices.

Vivid How To Get A Loan At Wells Fargo Capture Nature

Discover an amazing how to get a loan at wells fargo background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Amazing How To Get A Loan At Wells Fargo Landscape in 4K

Explore this high-quality how to get a loan at wells fargo image, perfect for enhancing your desktop or mobile wallpaper.

Artistic How To Get A Loan At Wells Fargo Design for Your Screen

Find inspiration with this unique how to get a loan at wells fargo illustration, crafted to provide a fresh look for your background.

Crisp How To Get A Loan At Wells Fargo Moment Collection

A captivating how to get a loan at wells fargo scene that brings tranquility and beauty to any device.

Captivating How To Get A Loan At Wells Fargo Landscape in HD

Find inspiration with this unique how to get a loan at wells fargo illustration, crafted to provide a fresh look for your background.

Crisp How To Get A Loan At Wells Fargo Background for Your Screen

Immerse yourself in the stunning details of this beautiful how to get a loan at wells fargo wallpaper, designed for a captivating visual experience.

Detailed How To Get A Loan At Wells Fargo Picture Illustration

Discover an amazing how to get a loan at wells fargo background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Artistic How To Get A Loan At Wells Fargo Artwork Collection

This gorgeous how to get a loan at wells fargo photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Spectacular How To Get A Loan At Wells Fargo Artwork Photography

Find inspiration with this unique how to get a loan at wells fargo illustration, crafted to provide a fresh look for your background.

Mesmerizing How To Get A Loan At Wells Fargo Capture in 4K

Explore this high-quality how to get a loan at wells fargo image, perfect for enhancing your desktop or mobile wallpaper.

Mesmerizing How To Get A Loan At Wells Fargo Image for Your Screen

Transform your screen with this vivid how to get a loan at wells fargo artwork, a true masterpiece of digital design.

Exquisite How To Get A Loan At Wells Fargo Capture in 4K

Immerse yourself in the stunning details of this beautiful how to get a loan at wells fargo wallpaper, designed for a captivating visual experience.

Mesmerizing How To Get A Loan At Wells Fargo Moment Art

Discover an amazing how to get a loan at wells fargo background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Serene How To Get A Loan At Wells Fargo Capture for Desktop

Discover an amazing how to get a loan at wells fargo background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Serene How To Get A Loan At Wells Fargo View in 4K

Explore this high-quality how to get a loan at wells fargo image, perfect for enhancing your desktop or mobile wallpaper.

Serene How To Get A Loan At Wells Fargo Capture Digital Art

Experience the crisp clarity of this stunning how to get a loan at wells fargo image, available in high resolution for all your screens.

Lush How To Get A Loan At Wells Fargo View Illustration

This gorgeous how to get a loan at wells fargo photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Mesmerizing How To Get A Loan At Wells Fargo Picture in 4K

Discover an amazing how to get a loan at wells fargo background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Stunning How To Get A Loan At Wells Fargo Artwork for Desktop

A captivating how to get a loan at wells fargo scene that brings tranquility and beauty to any device.

Crisp How To Get A Loan At Wells Fargo Wallpaper Illustration

This gorgeous how to get a loan at wells fargo photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Download these how to get a loan at wells fargo wallpapers for free and use them on your desktop or mobile devices.