How To Get Out A Bad Car Loan

How To Get Out A Bad Car Loan: Your Step-by-Step Escape Plan

If you are reading this, chances are you are stuck. Maybe you bought a car when your credit wasn't great, or perhaps you just didn't read the fine print closely enough. Dealing with a high interest rate, long repayment term, or negative equity—that dreaded "bad car loan"—can feel overwhelming and financially draining. But take a deep breath; you are not trapped. This guide will walk you through exactly How To Get Out A Bad Car Loan using practical, step-by-step strategies.

We understand that facing this kind of debt is stressful, but there are powerful methods available to lighten the load and get your finances back on track. We're going to break down your options, from refinancing to selling, so you can choose the best escape route for your specific situation.

First Step: Understanding Your Bad Car Loan Situation

Before you can find a solution, you need to know exactly what you are fighting against. A bad car loan usually means you are paying significantly more than the car is worth (negative equity) or that your Annual Percentage Rate (APR) is unreasonably high, costing you thousands over the loan term. Getting clear on the numbers is crucial before exploring How To Get Out A Bad Car Loan.

Start by gathering all your original loan documents. This isn't just about knowing your monthly payment; it's about seeing the total picture. Understanding these details will give you leverage when negotiating or applying for new financing.

Key Numbers You Need to Know

Write down these specific details. They are the essential ingredients for creating your escape plan:

- Current Principal Balance: How much do you still owe the lender?

- Current APR: What is your interest rate? If it's above 8% (depending on your credit score), you likely have room for improvement.

- Car's Current Market Value (KBB/Edmunds): How much is your car actually worth if you were to sell it today?

- Loan Term Remaining: How many months are left on the loan?

If your Current Principal Balance is higher than the car's Market Value, you are "upside down" or have negative equity. This is the primary hurdle most people face when trying to figure out How To Get Out A Bad Car Loan.

Actionable Strategies: How To Get Out A Bad Car Loan

Now that you have your facts straight, let's explore the most effective routes for exiting your current debt agreement. These strategies prioritize reducing your interest expense and lowering your monthly obligations.

Strategy 1: Refinancing – The Most Common Path

Refinancing means securing a brand new loan to pay off your old, expensive loan. This is often the simplest and least disruptive method for tackling a bad car loan, especially if your credit score has improved since you first purchased the vehicle.

If you can secure a lower interest rate, you save money over the life of the loan and reduce your monthly payment. Always shop around; don't just stick with your current bank. Look at credit unions, online lenders, and national banks to compare offers.

Tips for Successful Refinancing

Keep these factors in mind when applying for a new loan:

- Improve Your Credit First: Even a slight bump in your score can drastically lower your offered APR. Pay down credit card debt before applying.

- Shorten the Term: Try to keep the new loan term shorter than the remaining term of your current loan, if possible. This minimizes the total interest paid, even if the monthly payment increases slightly.

- Watch Out for Fees: Some lenders charge origination or application fees. Make sure the savings from the lower APR outweigh these initial costs.

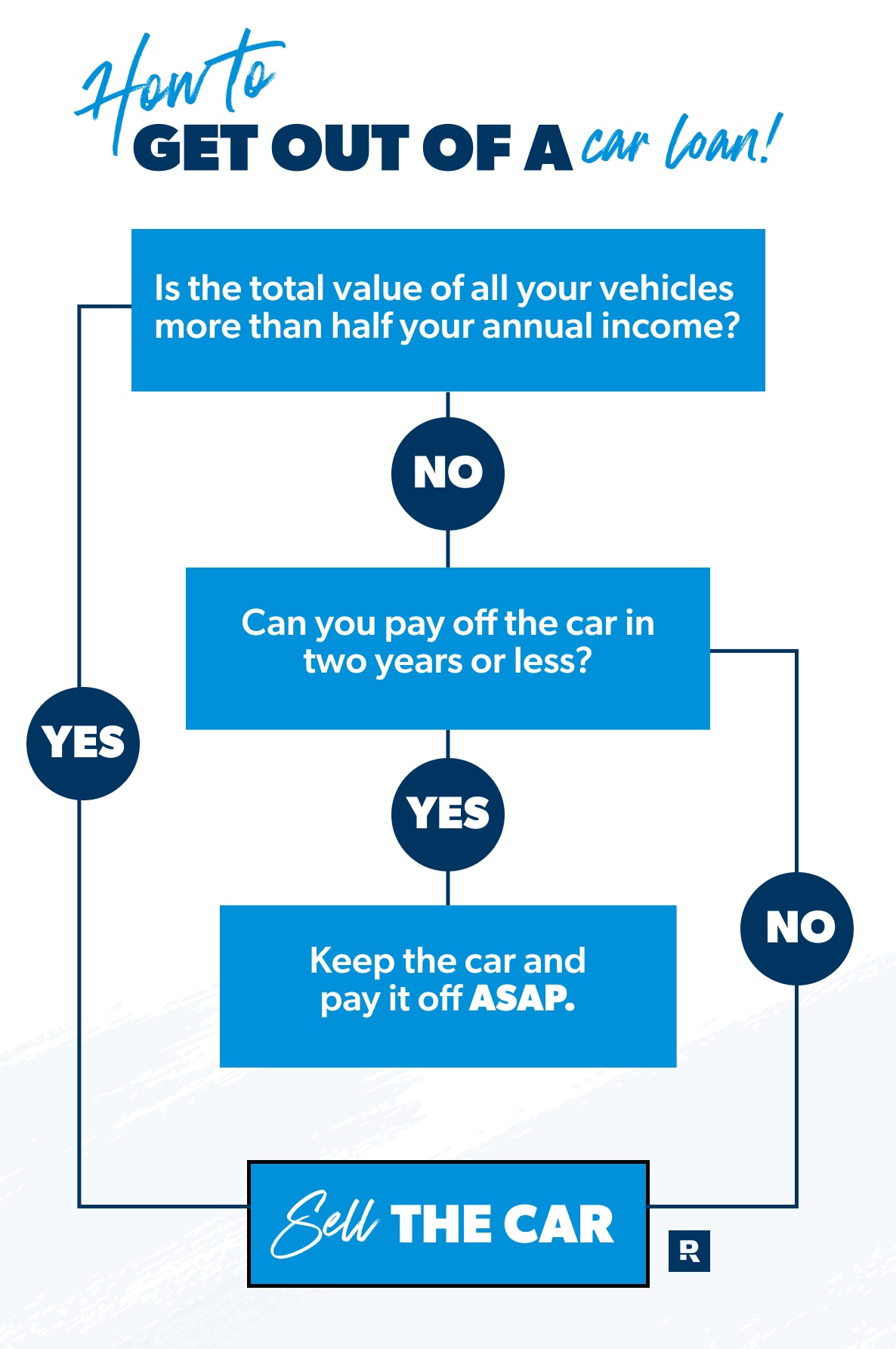

Strategy 2: Selling the Car (Even If You're Upside Down)

If refinancing isn't an option—maybe your car is too old, or you have too much negative equity—selling the car might be the necessary step to fully get out of the bad loan. Selling privately usually yields the highest price, helping you minimize your remaining debt.

When you sell the car, the proceeds immediately go towards paying off the current loan. Any remaining balance is debt free from the car, and you can focus on paying off that final negative equity amount quickly.

How to Handle Negative Equity

Negative equity is the major stumbling block when selling. If you owe $15,000 but the car only sells for $12,000, you have $3,000 in negative equity. You have a few options for covering this gap:

The best scenario is covering the difference with cash. This clears the title immediately and completely removes the loan obligation. If cash isn't immediately available, you can try:

- Personal Loan: Take out a small personal loan to cover the gap. Personal loans often have slightly higher interest rates than car loans, but since the balance is much smaller, you can pay it off much faster.

- Dealer Roll-Over: If you buy a cheaper, new car, a dealership might allow you to "roll over" the negative equity into the new car loan. While this doesn't fully answer How To Get Out A Bad Car Loan (it just transfers the debt), if done carefully with a highly reliable and affordable vehicle, it might offer a better overall interest rate. Be extremely cautious with this route, as it can deepen your debt hole.

Alternative and Less Conventional Methods

Sometimes, traditional refinancing or selling isn't feasible. In these cases, you might consider negotiating directly with your current lender or exploring more drastic measures.

Lenders do not want to deal with default or repossession. They may be willing to temporarily adjust your terms if you demonstrate genuine financial hardship. Call your lender and ask about loan modifications, forbearance, or deferment options. Be prepared to explain your situation clearly.

Trading In or Voluntary Repossession?

Trading in your car works similarly to selling, but you typically receive less for the car's value, which increases your negative equity. Only trade in if the new vehicle you are purchasing is significantly cheaper and offers better financial terms, helping to absorb the rollover debt faster.

Voluntary repossession should be considered an absolute last resort. While it avoids the shame and cost of involuntary repossession, it still severely damages your credit score (often for up to seven years) and you will still be responsible for the remaining balance (the deficiency balance) after the car is sold at auction.

Do not use voluntary repossession as an easy answer for How To Get Out A Bad Car Loan. Only consider this if default is imminent and you have exhausted every other avenue.

Conclusion: Taking Control of Your Car Loan

Getting out of a bad car loan requires patience, research, and proactive steps. The most critical action is knowing your numbers and exploring refinancing options first, especially if your financial health has improved recently. If refinancing fails, selling the vehicle—even with negative equity—allows you to replace secured, high-interest debt with smaller, manageable unsecured debt.

Remember, the burden of a bad car loan doesn't have to define your financial future. By employing these strategies, you can minimize interest payments, reduce monthly stress, and finally answer the question of How To Get Out A Bad Car Loan effectively. Start planning today; freedom from debt is within reach.

Frequently Asked Questions (FAQ)

- Can I refinance if I have bad credit?

- It is more challenging, but possible. Look specifically for subprime lenders or credit unions that specialize in rebuilding credit. You will likely get a better rate than your original loan if you can show you have made consistent, on-time payments for the last 6-12 months.

- What is the '70/10' rule?

- The 70/10 rule is a general guideline suggesting that you should not spend more than 10% of your take-home pay on your car payment, and you should not finance the car for longer than 70 months. If your loan violates both of these, it's a strong sign you are dealing with a bad car loan.

- Will paying extra on my principal help me get out of the loan faster?

- Yes, absolutely. By paying extra directly toward the principal balance, you reduce the amount of interest accrued each month. This is one of the quickest ways to overcome negative equity and accelerate your escape from a bad car loan.

- Should I use my emergency fund to pay off the negative equity?

- Only if your emergency fund is large enough to cover the negative equity *and* still maintain three to six months of living expenses. If clearing the negative equity allows you to secure a drastically better financial situation, it can be a worthwhile investment, but never completely empty your savings.

How To Get Out A Bad Car Loan

How To Get Out A Bad Car Loan Wallpapers

Collection of how to get out a bad car loan wallpapers for your desktop and mobile devices.

Detailed How To Get Out A Bad Car Loan Landscape in 4K

Experience the crisp clarity of this stunning how to get out a bad car loan image, available in high resolution for all your screens.

Gorgeous How To Get Out A Bad Car Loan Landscape Illustration

This gorgeous how to get out a bad car loan photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Lush How To Get Out A Bad Car Loan Landscape in 4K

A captivating how to get out a bad car loan scene that brings tranquility and beauty to any device.

Captivating How To Get Out A Bad Car Loan Scene Concept

This gorgeous how to get out a bad car loan photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

High-Quality How To Get Out A Bad Car Loan Abstract Nature

Discover an amazing how to get out a bad car loan background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Vibrant How To Get Out A Bad Car Loan Abstract Collection

Experience the crisp clarity of this stunning how to get out a bad car loan image, available in high resolution for all your screens.

High-Quality How To Get Out A Bad Car Loan Design in HD

Experience the crisp clarity of this stunning how to get out a bad car loan image, available in high resolution for all your screens.

Vivid How To Get Out A Bad Car Loan Scene for Mobile

Explore this high-quality how to get out a bad car loan image, perfect for enhancing your desktop or mobile wallpaper.

Stunning How To Get Out A Bad Car Loan Design in 4K

This gorgeous how to get out a bad car loan photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Stunning How To Get Out A Bad Car Loan Picture for Your Screen

This gorgeous how to get out a bad car loan photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Amazing How To Get Out A Bad Car Loan Landscape in HD

Discover an amazing how to get out a bad car loan background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Beautiful How To Get Out A Bad Car Loan Design Art

Experience the crisp clarity of this stunning how to get out a bad car loan image, available in high resolution for all your screens.

Crisp How To Get Out A Bad Car Loan Wallpaper Art

Find inspiration with this unique how to get out a bad car loan illustration, crafted to provide a fresh look for your background.

Breathtaking How To Get Out A Bad Car Loan Image for Desktop

Discover an amazing how to get out a bad car loan background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Crisp How To Get Out A Bad Car Loan Wallpaper Illustration

Immerse yourself in the stunning details of this beautiful how to get out a bad car loan wallpaper, designed for a captivating visual experience.

Stunning How To Get Out A Bad Car Loan Artwork in HD

A captivating how to get out a bad car loan scene that brings tranquility and beauty to any device.

Dynamic How To Get Out A Bad Car Loan Scene for Mobile

This gorgeous how to get out a bad car loan photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Mesmerizing How To Get Out A Bad Car Loan Landscape for Mobile

Transform your screen with this vivid how to get out a bad car loan artwork, a true masterpiece of digital design.

Stunning How To Get Out A Bad Car Loan Background for Your Screen

Immerse yourself in the stunning details of this beautiful how to get out a bad car loan wallpaper, designed for a captivating visual experience.

Amazing How To Get Out A Bad Car Loan Abstract for Mobile

Experience the crisp clarity of this stunning how to get out a bad car loan image, available in high resolution for all your screens.

Download these how to get out a bad car loan wallpapers for free and use them on your desktop or mobile devices.