How To Get Out Of Student Debt

How To Get Out Of Student Debt: Your Ultimate Guide to Financial Freedom

Hey there. If you're reading this, you probably feel the heavy weight of student loans pressing down on you. It's totally understandable. Student debt is a massive burden, but here's the good news: you are not stuck. Getting out of student debt is absolutely possible, and we're here to walk you through the practical steps.

This isn't just about making minimum payments; it's about developing a strategic battle plan. We will cover everything from understanding your loans to leveraging forgiveness programs. Ready to learn exactly How To Get Out Of Student Debt and finally reclaim your financial future? Let's dive in.

Phase 1: Understanding Your Debt Landscape

You can't win a war without knowing the enemy. The very first step in figuring out How To Get Out Of Student Debt is compiling all the facts about your loans. This means getting organized and facing the numbers head-on.

Tally Up the Damage (The Basics)

Grab a spreadsheet or a notebook. You need a centralized view of your debt. This organization step makes the entire process feel less overwhelming.

For every single loan you hold, document the following:

- The principal balance remaining.

- The interest rate (this is critical!).

- The loan servicer (who you pay).

- The minimum monthly payment required.

- The loan type (Federal or Private).

Once you see everything laid out, you can prioritize which high-interest loans need to be tackled first. Transparency is key to financial freedom.

Knowing Your Loan Types (Federal vs. Private)

The rules for Federal loans (like Stafford or Perkins) are vastly different from those for Private loans. Knowing the difference determines what strategies are available to you.

Federal loans often come with benefits like forbearance, deferment, and income-driven repayment plans. Private loans, typically issued by banks, offer much less flexibility but might be eligible for refinancing.

Phase 2: Strategic Repayment Options

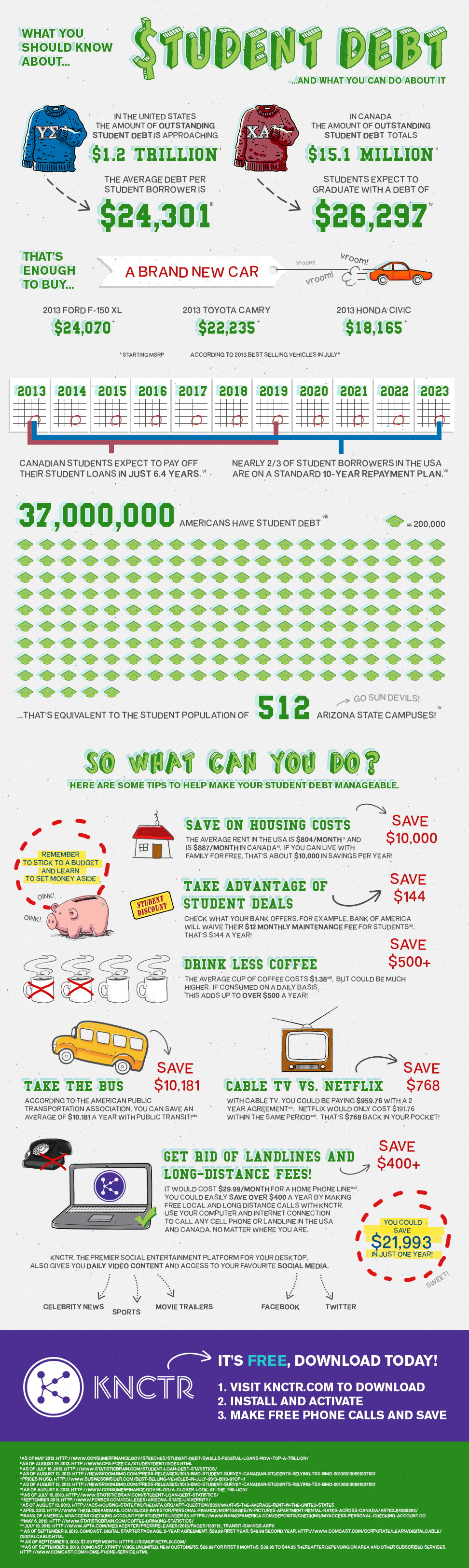

If the standard 10-year repayment plan is crushing your budget, it's time to explore alternative options. These methods are designed to make your monthly obligations manageable, freeing up cash flow to attack the principal.

Income-Driven Repayment (IDR) Plans (for Federal Loans)

If your federal loan payments are too high compared to your current income, an IDR plan could be a lifesaver. These plans cap your monthly payment at a percentage of your discretionary income. Furthermore, after 20 or 25 years of consistent payments, any remaining balance is forgiven (though this balance may be taxable).

Common IDR plans include:

- SAVE Plan (Secure Act of 2.0): The newest and often most generous plan, calculated to drastically lower payments for many borrowers.

- PAYE (Pay As You Earn): Payments are generally 10% of discretionary income.

- IBR (Income-Based Repayment): Payments are 10% or 15% of discretionary income, depending on when you took out the loans.

If you are struggling financially, contact your loan servicer immediately to discuss which IDR plan best fits your situation. Don't let your loans go into default; proactive communication is crucial to How To Get Out Of Student Debt successfully.

The Power of Refinancing (for Private Loans)

Refinancing means taking out a new private loan to pay off your existing loans. This is primarily useful for private student debt or high-interest federal debt you are comfortable forfeiting federal benefits for.

The goal of refinancing is simple: secure a lower interest rate. If you have improved your credit score since graduation or have a steady income, you could save thousands over the life of the loan. Shop around with multiple private lenders to find the best rate.

Phase 3: Turbocharging Your Payoff

Lowering your payment is step one. Step two is accelerating your payoff timeline. This requires discipline and focused effort, but it slashes the total interest you pay.

The Debt Snowball vs. Avalanche Method

These two popular strategies dictate how you apply extra payments:

The **Avalanche Method** saves you the most money overall. You list all your loans by interest rate, highest to lowest. You pay the minimum on everything, but all extra money goes toward the loan with the highest interest rate. Once that loan is gone, you move to the next highest interest rate.

The **Snowball Method** is great for motivation. You list your loans by balance, smallest to largest. You attack the smallest debt first. When it's paid off, you take that minimum payment amount and 'snowball' it onto the next smallest debt. This method builds psychological momentum quickly, helping you stay focused on How To Get Out Of Student Debt.

Boosting Income and Cutting Costs

The fastest way to pay off debt is to increase the gap between what you earn and what you spend. Every extra dollar you dedicate to the principal accelerates your freedom date.

Consider these actions:

- Get a side hustle: Utilize skills like writing, driving, or consulting for extra cash.

- Negotiate a raise: If you've been doing great work, advocate for higher pay.

- Slash non-essential spending: Cut back on eating out, subscription services, and expensive habits temporarily.

- Apply windfalls: Direct tax refunds, bonuses, or unexpected gifts straight to your highest-interest loan.

Phase 4: Exploring Forgiveness and Relief

Sometimes, your profession or location offers a direct path to reducing or eliminating your debt entirely. These programs are often overlooked, but they can be game-changers for those asking How To Get Out Of Student Debt without having to pay every penny back.

Public Service Loan Forgiveness (PSLF)

If you work full-time for a government organization (federal, state, local, or tribal) or a qualifying non-profit organization, you may be eligible for PSLF. This program forgives the remaining balance on your Direct Loans after you have made 120 qualifying monthly payments while working for a qualifying employer.

It is absolutely essential that you confirm your eligibility and submit employment certification forms yearly. PSLF rules can be complex, so staying organized is key.

State and Profession-Specific Programs

Many states, particularly those looking to attract workers to specific fields or underserved areas, offer loan repayment assistance programs (LRAPs). These are especially common for nurses, doctors, dentists, and teachers.

For example, a state might offer $20,000 in loan repayment if you agree to work in a critical-shortage area for three years. Do thorough research on programs specific to your profession and the state where you live or plan to move.

Conclusion: Taking Control of Your Financial Narrative

It's time to stop feeling paralyzed by your student loan balances. Learning How To Get Out Of Student Debt is a journey that requires knowledge, organization, and dedication, but every single step forward is a victory.

Start by assessing your current debt load and understanding your loan types. Next, leverage federal IDR plans or private refinancing to manage payments. Finally, implement an aggressive payoff strategy like the Debt Avalanche, and don't forget to explore forgiveness options like PSLF or state LRAPs. You have the tools now; the only thing left is to take action. Financial freedom awaits!

Frequently Asked Questions (FAQ)

- Can I refinance federal student loans?

- Yes, you can refinance federal student loans into a private loan. However, be extremely cautious. When you refinance federal loans, you permanently lose access to vital federal protections, such as income-driven repayment plans, forbearance, and federal forgiveness programs like PSLF. Only refinance federal loans if you are absolutely sure you won't need these benefits.

- What is the difference between deferment and forbearance?

- Both deferment and forbearance allow you to temporarily stop or reduce your monthly payments. Deferment is typically better because subsidized federal loans do not accrue interest during this period. Forbearance is easier to obtain but interest almost always continues to accrue on all types of loans, leading to a larger balance later.

- Is loan forgiveness taxable?

- It depends! Loan forgiveness granted through Public Service Loan Forgiveness (PSLF) is currently not taxed by the IRS. However, if your loan is forgiven through an Income-Driven Repayment (IDR) plan after 20 or 25 years, the forgiven amount may be treated as taxable income by the IRS unless certain exceptions apply or temporary legislation changes the rules.

- What should I do if I can't afford my minimum payment?

- Do not panic and do not ignore it. Immediately contact your loan servicer (for federal loans) and ask about enrolling in an Income-Driven Repayment (IDR) plan, which can potentially lower your payment to $0 per month. If you have private loans, call your lender to explore temporary forbearance options before missing a payment.

How To Get Out Of Student Debt

How To Get Out Of Student Debt Wallpapers

Collection of how to get out of student debt wallpapers for your desktop and mobile devices.

Artistic How To Get Out Of Student Debt Landscape Digital Art

Find inspiration with this unique how to get out of student debt illustration, crafted to provide a fresh look for your background.

Beautiful How To Get Out Of Student Debt Photo Nature

Experience the crisp clarity of this stunning how to get out of student debt image, available in high resolution for all your screens.

Crisp How To Get Out Of Student Debt Picture Collection

A captivating how to get out of student debt scene that brings tranquility and beauty to any device.

Captivating How To Get Out Of Student Debt Background in HD

Find inspiration with this unique how to get out of student debt illustration, crafted to provide a fresh look for your background.

Dynamic How To Get Out Of Student Debt Abstract Nature

This gorgeous how to get out of student debt photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Captivating How To Get Out Of Student Debt Picture for Desktop

Immerse yourself in the stunning details of this beautiful how to get out of student debt wallpaper, designed for a captivating visual experience.

Dynamic How To Get Out Of Student Debt Artwork Collection

A captivating how to get out of student debt scene that brings tranquility and beauty to any device.

Detailed How To Get Out Of Student Debt Landscape Nature

Experience the crisp clarity of this stunning how to get out of student debt image, available in high resolution for all your screens.

Stunning How To Get Out Of Student Debt Artwork Concept

Find inspiration with this unique how to get out of student debt illustration, crafted to provide a fresh look for your background.

Beautiful How To Get Out Of Student Debt Background for Mobile

Explore this high-quality how to get out of student debt image, perfect for enhancing your desktop or mobile wallpaper.

Detailed How To Get Out Of Student Debt Moment for Your Screen

Discover an amazing how to get out of student debt background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Beautiful How To Get Out Of Student Debt Scene for Your Screen

Discover an amazing how to get out of student debt background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Detailed How To Get Out Of Student Debt Moment Nature

Experience the crisp clarity of this stunning how to get out of student debt image, available in high resolution for all your screens.

Amazing How To Get Out Of Student Debt Background Illustration

Experience the crisp clarity of this stunning how to get out of student debt image, available in high resolution for all your screens.

Amazing How To Get Out Of Student Debt Scene Art

Explore this high-quality how to get out of student debt image, perfect for enhancing your desktop or mobile wallpaper.

Vibrant How To Get Out Of Student Debt Background Photography

Explore this high-quality how to get out of student debt image, perfect for enhancing your desktop or mobile wallpaper.

Captivating How To Get Out Of Student Debt Picture Photography

This gorgeous how to get out of student debt photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Breathtaking How To Get Out Of Student Debt Moment Collection

Explore this high-quality how to get out of student debt image, perfect for enhancing your desktop or mobile wallpaper.

Gorgeous How To Get Out Of Student Debt Capture for Your Screen

A captivating how to get out of student debt scene that brings tranquility and beauty to any device.

Breathtaking How To Get Out Of Student Debt Picture Art

Discover an amazing how to get out of student debt background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Download these how to get out of student debt wallpapers for free and use them on your desktop or mobile devices.