How To Get Rid Of A Car With A Loan

How To Get Rid Of A Car With A Loan: Your Stress-Free Guide

So, you've decided it's time to move on from your current car, but there's one big hurdle: you still have an outstanding loan. This is a very common situation, and trust us, you are not stuck! Deciding How To Get Rid Of A Car With A Loan requires careful planning, but it is entirely manageable.

Whether you need a different vehicle, can no longer afford the payments, or simply want a change, the key is understanding your options before you make a move. We're here to walk you through the process step-by-step, ensuring you make a smart financial decision.

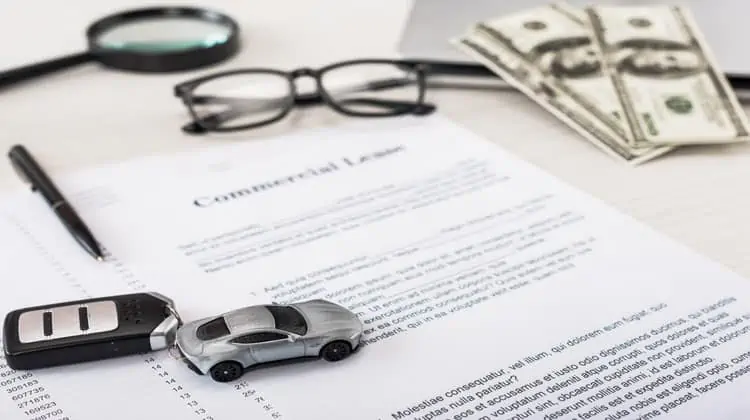

Understanding Your Financial Position

The very first step in figuring out How To Get Rid Of A Car With A Loan is determining your financial standing with that vehicle. This means comparing its current market value to the remaining balance on your loan. This comparison defines whether you have positive equity or negative equity (often called being "underwater").

Calculating Your Equity

To start, you need two numbers. First, contact your lender and get your loan payoff amount. This is the exact dollar figure required to close the loan today. Second, determine your car's market value using resources like Kelley Blue Book (KBB) or Edmunds. Look up the private party sale price, as this is usually the highest achievable number.

Subtract the loan payoff amount from the car's current value:

- Positive Equity: If the value is higher than the loan, congratulations! You will profit from the sale, and this process will be relatively easy.

- Negative Equity (Underwater): If the loan is higher than the value, you owe money even after selling the car. This requires more creative solutions.

Knowing this difference is crucial because it dictates which strategies for getting rid of the car are viable for you.

Best Strategies for Getting Rid of Your Car While Keeping Your Loan Intact

Once you know your equity status, you can explore the best methods for transferring ownership and satisfying your debt. Here are the two most common pathways.

Selling the Car Privately

Selling privately usually yields the highest sale price, making it the preferred method if you have minimal positive equity or moderate negative equity. However, it requires more effort and involves managing the title transfer.

The Process with a Lienholder

- Contact Your Lender: Inform them you plan to sell the car. Ask specifically how they handle the payoff from a private buyer.

- Arrange Payment: The buyer typically pays the full sale price. If you have positive equity, the buyer pays the lender the payoff amount, and the lender sends you the remainder.

- Handling Negative Equity: If you are underwater, you must pay the difference to the lender immediately before the lender will release the title to the buyer.

- Title Transfer: Once the lender receives the full payoff, they release the title (or lien release) to you, which you then transfer to the buyer. This step is critical for finalizing the sale legally.

Make sure the buyer is fully aware that the title is held by the lienholder and that the process may take a few days for the paperwork to clear.

Trading It In at a Dealership

The easiest and fastest way to get rid of a car with a loan is usually trading it in. Dealerships handle all the paperwork, including paying off your existing loan and obtaining the title.

However, dealerships often offer less than the private sale value. If you have positive equity, this is convenient but costly. If you have negative equity, the dealership will simply roll the outstanding loan balance into the financing for your new car.

The Risks of Rolling Over Negative Equity

While rolling over the debt makes the transaction simple, it increases the total amount of your new loan significantly. This means you start the new loan "underwater" immediately, making it much harder to reach positive equity down the road. Use this option cautiously, especially if the negative equity amount is large.

Advanced Options for Negative Equity

If you find yourself significantly underwater, simply selling or trading in may not solve your problem entirely. These strategies require you to address the debt directly.

Refinancing the Loan

If your primary goal is reducing payment stress, refinancing your existing loan may be the solution, rather than getting rid of the car entirely. If your credit score has improved since you first took out the loan, you might qualify for a lower interest rate.

Lower interest rates mean more of your payment goes towards the principal balance, helping you build equity faster. Alternatively, extending the term might lower your monthly payment, freeing up cash flow.

Using a Personal Loan to Cover the Gap

This is a strategy for those who absolutely must sell their current car, even if they owe more than it is worth. After selling the car for market value, you will have a deficit (the negative equity).

Instead of rolling that debt into a new car loan, you can take out an unsecured personal loan to pay off the remaining balance of the old auto loan. This separates the old debt from the new vehicle purchase, allowing you to start fresh on the new car purchase without being underwater immediately.

Voluntary Repossession (The Last Resort)

If you can no longer afford the payments and all other options have failed, some people consider voluntary repossession. This involves giving the car back to the lender.

Be warned: This is devastating to your credit score. The lender will sell the car at auction, and if the sale price doesn't cover the loan balance, they will pursue you for the remaining debt, known as a deficiency balance. Avoid this option unless it is absolutely the only way to prevent defaulting on the loan.

Preparing for the Next Steps

Regardless of which method you choose, a little preparation goes a long way in maximizing your profit and simplifying the process.

Essential Preparation Checklist

- Get a detailed, current payoff quote from your lender.

- Gather all maintenance records and documentation. Buyers appreciate proof of care.

- Clean and detail the car thoroughly—first impressions matter, especially in private sales.

- If selling privately, arrange for a secure method of payment (cashier's check or bank wire) to avoid scams.

Remember, clear communication with your lender is paramount throughout this process to ensure the lien is correctly removed and the new owner receives a clean title.

Conclusion

Figuring out How To Get Rid Of A Car With A Loan can feel overwhelming at first, but by systematically assessing your equity position and choosing the strategy that best fits your financial reality, you can successfully transition out of your current vehicle.

Whether you pay off the difference yourself, roll the debt into a new loan, or benefit from positive equity, the key is preparation and understanding the legal obligations tied to your lienholder. Take your time, weigh the pros and cons of trading vs. selling privately, and move forward confidently toward your next vehicle.

Frequently Asked Questions (FAQ)

- Can I sell a car if I haven't paid off the loan?

- Yes, but the loan must be paid off simultaneously with the sale. The lender (lienholder) holds the title until the debt is satisfied. If selling privately, you or the buyer must remit the full payoff amount to the lender before the title is released.

- What happens if the car is worth less than the loan amount (negative equity)?

- If you sell the car, you are responsible for paying the difference (the negative equity) to the lender immediately to close the loan. If you trade it in at a dealership, that debt will usually be added to the principal balance of your new car loan.

- Does selling a car with a loan affect my credit score?

- Successfully paying off the loan, either through the sale proceeds or by covering the negative equity gap, is generally positive for your credit history as it shows successful debt repayment. However, if you roll the debt into a new loan, your overall debt load increases, which could temporarily affect your credit utilization ratio.

- Should I choose trade-in or private sale?

- If speed and convenience are most important, choose a trade-in. If maximizing your profit or minimizing the negative equity burden is your priority, a private sale is usually the better option, provided you are willing to manage the extra administrative work.

How To Get Rid Of A Car With A Loan

How To Get Rid Of A Car With A Loan Wallpapers

Collection of how to get rid of a car with a loan wallpapers for your desktop and mobile devices.

Stunning How To Get Rid Of A Car With A Loan Image Art

Find inspiration with this unique how to get rid of a car with a loan illustration, crafted to provide a fresh look for your background.

Stunning How To Get Rid Of A Car With A Loan Artwork in HD

A captivating how to get rid of a car with a loan scene that brings tranquility and beauty to any device.

Vibrant How To Get Rid Of A Car With A Loan Wallpaper for Desktop

Explore this high-quality how to get rid of a car with a loan image, perfect for enhancing your desktop or mobile wallpaper.

Vibrant How To Get Rid Of A Car With A Loan Abstract Photography

Transform your screen with this vivid how to get rid of a car with a loan artwork, a true masterpiece of digital design.

Breathtaking How To Get Rid Of A Car With A Loan Background in 4K

Discover an amazing how to get rid of a car with a loan background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Exquisite How To Get Rid Of A Car With A Loan Photo Collection

This gorgeous how to get rid of a car with a loan photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Lush How To Get Rid Of A Car With A Loan Capture Collection

Find inspiration with this unique how to get rid of a car with a loan illustration, crafted to provide a fresh look for your background.

Vibrant How To Get Rid Of A Car With A Loan Wallpaper in HD

Transform your screen with this vivid how to get rid of a car with a loan artwork, a true masterpiece of digital design.

Gorgeous How To Get Rid Of A Car With A Loan Picture for Your Screen

This gorgeous how to get rid of a car with a loan photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Stunning How To Get Rid Of A Car With A Loan Background for Your Screen

This gorgeous how to get rid of a car with a loan photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Lush How To Get Rid Of A Car With A Loan Photo Digital Art

A captivating how to get rid of a car with a loan scene that brings tranquility and beauty to any device.

Beautiful How To Get Rid Of A Car With A Loan Wallpaper in HD

Transform your screen with this vivid how to get rid of a car with a loan artwork, a true masterpiece of digital design.

Crisp How To Get Rid Of A Car With A Loan Artwork Photography

Immerse yourself in the stunning details of this beautiful how to get rid of a car with a loan wallpaper, designed for a captivating visual experience.

Dynamic How To Get Rid Of A Car With A Loan Wallpaper Collection

A captivating how to get rid of a car with a loan scene that brings tranquility and beauty to any device.

High-Quality How To Get Rid Of A Car With A Loan Capture for Your Screen

Transform your screen with this vivid how to get rid of a car with a loan artwork, a true masterpiece of digital design.

Exquisite How To Get Rid Of A Car With A Loan Landscape for Your Screen

Immerse yourself in the stunning details of this beautiful how to get rid of a car with a loan wallpaper, designed for a captivating visual experience.

Stunning How To Get Rid Of A Car With A Loan Background Collection

A captivating how to get rid of a car with a loan scene that brings tranquility and beauty to any device.

Detailed How To Get Rid Of A Car With A Loan Photo for Desktop

Explore this high-quality how to get rid of a car with a loan image, perfect for enhancing your desktop or mobile wallpaper.

Amazing How To Get Rid Of A Car With A Loan Abstract Concept

Transform your screen with this vivid how to get rid of a car with a loan artwork, a true masterpiece of digital design.

Stunning How To Get Rid Of A Car With A Loan Abstract Digital Art

A captivating how to get rid of a car with a loan scene that brings tranquility and beauty to any device.

Download these how to get rid of a car with a loan wallpapers for free and use them on your desktop or mobile devices.