How To Get Something Off Your Credit Report

How To Get Something Off Your Credit Report: Your Step-by-Step Guide

Finding a negative item on your credit report can feel like hitting a massive financial roadblock. Whether it's an old collection, a late payment, or worse, something you don't even recognize, these dings can severely impact your ability to get loans, rent an apartment, or even land certain jobs. The good news? You are not helpless. You have specific rights and actions you can take to challenge and potentially remove these items.

If you are wondering exactly how to get something off your credit report, you've come to the right place. We are going to walk through the entire process, starting with the easiest fixes (errors) and moving toward the trickier situations (valid, but dated, negative accounts). Let's dive into taking control of your financial future!

First Steps: Reviewing Your Credit Report Thoroughly

Before you can remove anything, you need to know exactly what's there. You are entitled to a free copy of your credit report from each of the three major credit bureaus—Experian, Equifax, and TransUnion—once every 12 months via AnnualCreditReport.com. It is crucial to check all three reports, as sometimes information only shows up on one or two.

Take your time and look for anything that seems inaccurate, outdated, or outright unfamiliar. This foundational step will determine your strategy for successfully removing negative entries and is key to knowing how to get something off your credit report.

Identifying Errors vs. Valid Negative Items

This distinction is critical because it dictates your next course of action. Errors are usually much easier to remove than items you genuinely owe.

What Constitutes an Error?

Credit reporting agencies are required by law to report accurate information. If they fail to do so, you can dispute the entry under the Fair Credit Reporting Act (FCRA). Common errors include:

- Accounts that don't belong to you (due to identity theft or mixed files).

- Incorrect reporting of payment status (e.g., reported as late when paid on time).

- Duplicate accounts (the same debt listed multiple times).

- Incorrect balances or credit limits.

- Accounts that are past the legal reporting limit (usually seven years).

Conversely, a "valid negative item" is something you genuinely defaulted on or paid late. While these are harder to remove immediately, there are still techniques we can use.

Tackling Errors: The Formal Dispute Process

When you find an error, the fastest and most effective route is filing a formal dispute with the credit bureau that reported it (Experian, Equifax, or TransUnion). You can do this online, but many experts recommend doing it via certified mail for better documentation.

Gathering Your Documentation

The success of your dispute hinges on the evidence you provide. You must show the credit bureau *why* the item is inaccurate. Don't rely solely on their investigation; give them proof upfront.

Essential documents often include:

- A copy of your credit report highlighting the error.

- Copies of account statements or canceled checks proving timely payment.

- A copy of your driver's license or utility bill to verify your identity and address.

- A detailed explanation of why the entry is incorrect.

Sending the Dispute Letter

Send your dispute letter via certified mail with return receipt requested. This provides a legal paper trail, ensuring the bureau received your complaint. By law, the credit bureau typically has 30 days (sometimes 45 days, depending on circumstances) to investigate the claim and provide a response.

If they verify the information is inaccurate or cannot verify it within that timeframe, the negative item must be removed. This is one of the most reliable ways to successfully figure out how to get something off your credit report.

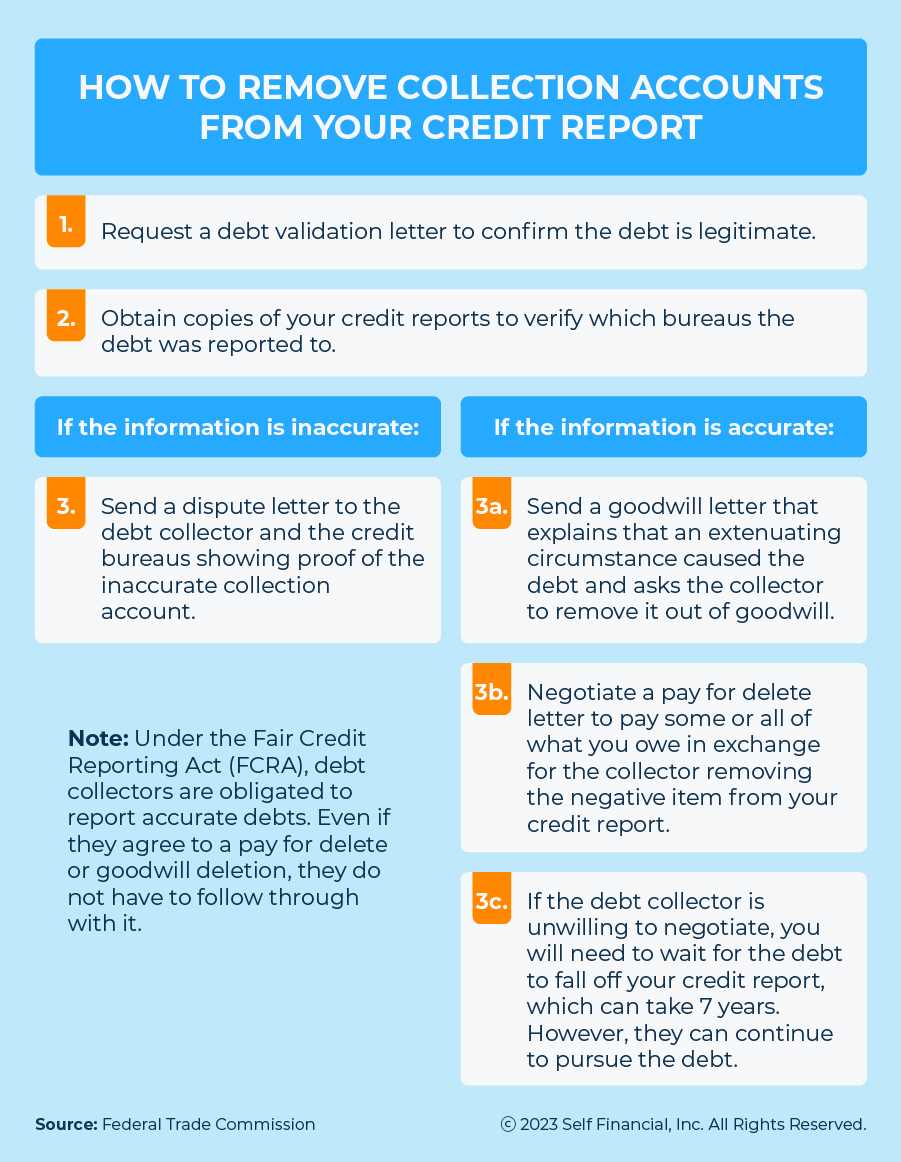

Dealing with Valid Negative Items (The Harder Fixes)

So, what if the item is correct? You did pay late, or you did default on that old credit card. While the credit bureaus are allowed to keep accurate information on your report for up to seven years (and bankruptcy for up to 10), there are still a couple of effective negotiation strategies.

The Pay for Delete Strategy

The "Pay for Delete" strategy is often used when dealing with collection accounts. Here's the premise: you agree to pay the outstanding balance (or a negotiated settlement amount) in exchange for the collector agreeing to remove the negative entry entirely from your credit report.

It's important to know that collection agencies are not legally obligated to agree to this, but many will, especially if they are trying to close the file quickly. Always, always get this agreement in writing before you send any payment. If you pay first and then ask for removal, you lose your leverage.

Writing a Goodwill Letter for Late Payments

If you have one or two isolated late payments (30 or 60 days late) on an otherwise perfect account history, a goodwill letter might be your best bet. This strategy is exclusively for original creditors (like credit card companies or banks), not third-party collectors.

In the letter, you politely explain the reason for the late payment—perhaps a medical emergency or a brief unemployment spell—and ask for leniency, requesting that they remove the late mark as a gesture of goodwill. Highlight your excellent payment history before and after the incident to show you are a responsible customer. While success is not guaranteed, it costs nothing but time to try, and sometimes, the creditor is willing to help out a loyal customer.

When Items Naturally Fall Off Your Credit Report

Sometimes, the best strategy is simply patience. The FCRA dictates how long negative information can remain on your credit report. It's important to know these deadlines, especially if an item is nearing its expiration date.

The general reporting period for most negative items is seven years from the date of the first delinquency. This includes:

- Late payments, foreclosures, and settlements.

- Collection accounts and charge-offs.

There are exceptions, of course. For instance, Chapter 7 bankruptcy can remain for 10 years. If an item is older than the legal reporting period, it should be disputed immediately, as it is considered outdated and must be removed.

Understanding these timeframes is vital to mastering how to get something off your credit report without unnecessary effort. Why fight hard to remove something that is scheduled to disappear in three months?

Conclusion: Taking Charge of Your Credit Health

Learning how to get something off your credit report requires diligence and persistence, but it is entirely manageable. Start by pulling your reports and identifying whether the negative item is an error or a valid debt. Errors should always be disputed formally using certified mail and strong documentation.

For valid debts, explore options like Pay for Delete agreements with collectors or Goodwill Letters to original creditors. Finally, keep track of the statutory seven-year limits; sometimes, waiting is the best approach. By following these steps, you can clean up your report, boost your credit score, and open the door to better financial opportunities.

Frequently Asked Questions (FAQ)

- Can I remove accurate late payments from my credit report?

- It is difficult, but not impossible. Your best strategy here is the Goodwill Letter, especially if you have an otherwise stellar payment history with that creditor. They might remove the mark as a courtesy.

- How long does a credit dispute typically take?

- By law, credit bureaus must investigate and respond to a dispute within 30 days (or 45 days if you submitted additional materials during the 30-day period). If they cannot verify the information, the item must be removed.

- If I pay a collection account, will it automatically be removed from my report?

- No. Paying a collection account will update the status to "Paid Collection" or "Settled," which is better than "Unpaid," but the negative entry generally stays for seven years from the original delinquency date. If you want it removed entirely, you must use the "Pay for Delete" strategy and get the agreement in writing before paying.

- Is using an online dispute form as effective as sending a letter via certified mail?

- While online forms are faster, sending a certified letter with a return receipt requested provides a legal paper trail. If the dispute process escalates, having physical proof of mailing and receipt can be incredibly valuable.

How To Get Something Off Your Credit Report

How To Get Something Off Your Credit Report Wallpapers

Collection of how to get something off your credit report wallpapers for your desktop and mobile devices.

Gorgeous How To Get Something Off Your Credit Report Moment Digital Art

Find inspiration with this unique how to get something off your credit report illustration, crafted to provide a fresh look for your background.

Vivid How To Get Something Off Your Credit Report Design for Mobile

Transform your screen with this vivid how to get something off your credit report artwork, a true masterpiece of digital design.

Beautiful How To Get Something Off Your Credit Report Picture Illustration

Discover an amazing how to get something off your credit report background image, ideal for personalizing your devices with vibrant colors and intricate designs.

High-Quality How To Get Something Off Your Credit Report Image for Desktop

Explore this high-quality how to get something off your credit report image, perfect for enhancing your desktop or mobile wallpaper.

Gorgeous How To Get Something Off Your Credit Report Background Illustration

This gorgeous how to get something off your credit report photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Spectacular How To Get Something Off Your Credit Report Scene in HD

This gorgeous how to get something off your credit report photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Vibrant How To Get Something Off Your Credit Report Picture for Your Screen

Explore this high-quality how to get something off your credit report image, perfect for enhancing your desktop or mobile wallpaper.

Spectacular How To Get Something Off Your Credit Report Scene Collection

This gorgeous how to get something off your credit report photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Artistic How To Get Something Off Your Credit Report Moment Collection

Immerse yourself in the stunning details of this beautiful how to get something off your credit report wallpaper, designed for a captivating visual experience.

Gorgeous How To Get Something Off Your Credit Report Photo for Mobile

This gorgeous how to get something off your credit report photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Artistic How To Get Something Off Your Credit Report Design for Desktop

A captivating how to get something off your credit report scene that brings tranquility and beauty to any device.

Beautiful How To Get Something Off Your Credit Report Background Illustration

Explore this high-quality how to get something off your credit report image, perfect for enhancing your desktop or mobile wallpaper.

Detailed How To Get Something Off Your Credit Report Wallpaper Illustration

Discover an amazing how to get something off your credit report background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Mesmerizing How To Get Something Off Your Credit Report Photo in 4K

Transform your screen with this vivid how to get something off your credit report artwork, a true masterpiece of digital design.

Dynamic How To Get Something Off Your Credit Report Landscape Photography

Find inspiration with this unique how to get something off your credit report illustration, crafted to provide a fresh look for your background.

High-Quality How To Get Something Off Your Credit Report Photo for Desktop

Explore this high-quality how to get something off your credit report image, perfect for enhancing your desktop or mobile wallpaper.

Vibrant How To Get Something Off Your Credit Report Abstract for Your Screen

Explore this high-quality how to get something off your credit report image, perfect for enhancing your desktop or mobile wallpaper.

Captivating How To Get Something Off Your Credit Report Wallpaper Art

Immerse yourself in the stunning details of this beautiful how to get something off your credit report wallpaper, designed for a captivating visual experience.