How To Get Something Taken Off Your Credit Report

How To Get Something Taken Off Your Credit Report: Your Ultimate Guide

Seeing negative items on your credit report can be frustrating, especially if they are dragging down your score and hurting your chances of getting approved for loans or new credit cards. If you are wondering how to get something taken off your credit report, you've come to the right place. The good news is that you have options, whether the item is an error or a legitimate debt. Taking control of your financial health starts here, and we're going to walk you through the process step-by-step, ensuring you understand exactly how to challenge and remove damaging entries.

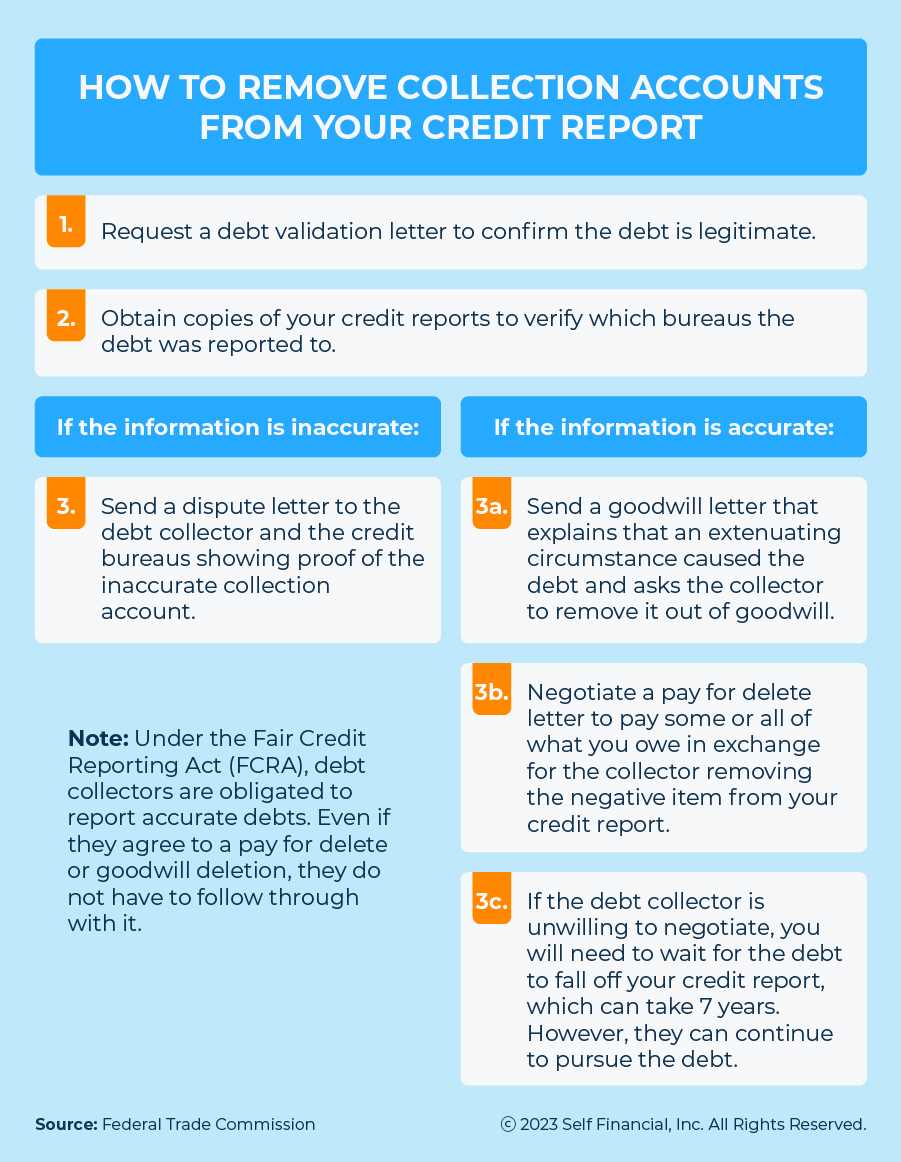

The key to successful removal is understanding the difference between errors and accurate negative accounts, and then deploying the correct strategy for each situation. This process requires patience and meticulous documentation, but the reward—a healthier credit score—is absolutely worth the effort.

Understanding Your Credit Report and Why Errors Happen

Before you start the process of challenging items, you need to know exactly what is listed. Your credit report contains information gathered by three main bureaus: Equifax, Experian, and TransUnion. Sometimes, items appear on one report but not the others, adding complexity to the situation.

Errors are surprisingly common. They often occur due to simple data entry mistakes, identity theft, or miscommunication between the creditor and the bureau. Identifying these errors is the first and easiest step toward successfully removing them.

Common credit report errors include:

- Accounts that belong to someone else with a similar name (mixed files).

- Duplicate entries for the same debt.

- Accounts marked as late or unpaid when they were actually paid on time.

- Incorrect dates of last activity or inaccurate balances.

- Identity theft resulting in fraudulent accounts being opened in your name.

Always pull your reports from all three bureaus annually via AnnualCreditReport.com to ensure accuracy and consistency across the board. You need a complete picture before you decide how to get something taken off your credit report.

The Direct Approach: Disputing Errors with Credit Bureaus

If you find an item that you believe is inaccurate, the Fair Credit Reporting Act (FCRA) gives you the right to dispute it. This is usually the quickest and most effective answer to the question of how to get something taken off your credit report if that item is an outright mistake.

You can file disputes online, by phone, or by mail. While filing online is faster, mailing a certified letter provides a paper trail, which is often recommended for serious disputes.

Step-by-Step Guide to Filing a Dispute

Filing a formal dispute requires precision. You need to clearly state why you believe the item is incorrect and provide compelling evidence.

- Gather Your Evidence: Collect copies of canceled checks, payment receipts, court documents (if applicable), or documentation proving identity theft. Highlight the inaccurate item on your credit report.

- Write a Formal Dispute Letter: Address the letter to the specific credit bureau (Equifax, Experian, or TransUnion). Include your full name, address, Social Security number, and the specific account number you are disputing. Clearly explain why the information is wrong and request its removal or correction.

- Send via Certified Mail: Send the letter and copies of your documentation (never originals!) via certified mail with a return receipt requested. This proves the bureau received your dispute, establishing a clear start date for the investigation period.

- Optional: Notify the Creditor: You can also send a similar dispute letter directly to the creditor or collection agency. Under the FCRA, they are also required to investigate the accuracy of the information they provided.

What Happens After You File a Dispute?

Once the bureau receives your dispute, they typically have 30 days (sometimes 45 days, depending on circumstances) to investigate. They will contact the creditor or furnisher of the information to verify the account details. This is when the magic happens!

If the furnisher cannot verify the item as accurate within the mandated timeframe, or if they agree it is an error, the credit bureau must remove the item from your report. If the item is verified, it will remain, but you will receive documentation explaining the findings.

Dealing with Accurate but Negative Items

Sometimes, the negative item—like a late payment or a collection account—is 100% accurate. You cannot legally dispute accurate information. However, this doesn't mean you are stuck waiting seven years for it to vanish. There are still creative negotiation techniques to explore when tackling the issue of how to get something taken off your credit report.

Pay-for-Delete Strategy (Pricy but Effective)

The "Pay-for-Delete" method involves negotiating directly with a collection agency or creditor. Since collection agencies are focused on recovering money, they might be willing to remove the negative entry from your credit report in exchange for you paying off the debt, or a negotiated portion of it.

Crucially, you must get this agreement in writing before you make any payment. If you pay the debt without a written agreement, they are only obligated to update the status to "Paid," but the negative history remains on your report. A written Pay-for-Delete agreement guarantees that they will request the removal from the credit bureaus.

Statute of Limitations and Expiration Dates

Every negative item has a shelf life. Even if you don't succeed in getting the account removed through dispute or negotiation, the FCRA dictates how long negative information can legally remain on your report. This is a crucial timeline to track. The clock usually starts ticking from the date of your first missed payment (Date of First Delinquency or DOFD).

When Do Negative Items Fall Off Naturally?

Understanding these timelines is essential for monitoring your reports and ensuring old debt isn't being illegally retained.

- Late Payments, Collections, and Charge-Offs: These typically remain for up to seven years from the Date of First Delinquency (DOFD).

- Chapter 13 Bankruptcy: Stays on your report for seven years from the filing date.

- Chapter 7 Bankruptcy: Stays on your report for 10 years from the filing date.

- Paid Tax Liens: Must be removed within seven years from the payment date. Unpaid tax liens are removed after 10 years.

If you see an item remaining on your report past its mandated expiration date, you can dispute it immediately, citing the FCRA's time restrictions.

Getting Professional Help

If you have multiple errors, a complex case of identity theft, or simply feel overwhelmed by the process, credit repair companies or consumer attorneys can help. These professionals specialize in credit law and know exactly how to leverage the FCRA to force investigations and removals.

While they come at a cost, a reputable service can significantly speed up the removal process and manage the constant paperwork, especially if creditors are being uncooperative. Always research companies carefully to avoid scams, and ensure they are compliant with the Credit Repair Organizations Act (CROA).

Conclusion

Learning how to get something taken off your credit report is a vital skill for maximizing your financial potential. The pathway to a cleaner report involves two main strategies: aggressively disputing errors backed by strong documentation, and strategically negotiating the removal of accurate, negative items (like using pay-for-delete). Be persistent, keep meticulous records, and remember that every piece of negative information has an expiration date. By taking these proactive steps, you can significantly improve your credit standing and unlock better financial opportunities.

Frequently Asked Questions (FAQ)

- Can I remove an accurate late payment entry?

- Removing an accurate late payment is difficult through the dispute process, as the creditor can verify the information. Your best bet is writing a goodwill letter to the original creditor, explaining the circumstances (e.g., job loss, medical emergency) and requesting a one-time courtesy removal.

- How long does the dispute process usually take?

- By law, the credit bureaus must investigate your dispute and respond to you within 30 to 45 days of receiving your documentation.

- Should I pay a collection agency if I plan to dispute the debt?

- If you plan to dispute the debt based on inaccuracy or error, do not pay it yet, as paying it validates the debt. If the debt is accurate and you are negotiating, only pay after you have a written "Pay-for-Delete" agreement in hand.

- If an item is removed from my Experian report, will it automatically be removed from Equifax and TransUnion?

- No. The credit bureaus operate independently. You must file a separate dispute with each bureau that reports the inaccurate item. Sometimes, the investigation results of one bureau might influence the others, but it is not guaranteed.

How To Get Something Taken Off Your Credit Report

How To Get Something Taken Off Your Credit Report Wallpapers

Collection of how to get something taken off your credit report wallpapers for your desktop and mobile devices.

Artistic How To Get Something Taken Off Your Credit Report Moment Collection

Immerse yourself in the stunning details of this beautiful how to get something taken off your credit report wallpaper, designed for a captivating visual experience.

Gorgeous How To Get Something Taken Off Your Credit Report Moment Digital Art

Find inspiration with this unique how to get something taken off your credit report illustration, crafted to provide a fresh look for your background.

Spectacular How To Get Something Taken Off Your Credit Report Scene in HD

This gorgeous how to get something taken off your credit report photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Exquisite How To Get Something Taken Off Your Credit Report Wallpaper Digital Art

Find inspiration with this unique how to get something taken off your credit report illustration, crafted to provide a fresh look for your background.

Serene How To Get Something Taken Off Your Credit Report Design for Desktop

Explore this high-quality how to get something taken off your credit report image, perfect for enhancing your desktop or mobile wallpaper.

Dynamic How To Get Something Taken Off Your Credit Report View Collection

This gorgeous how to get something taken off your credit report photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Spectacular How To Get Something Taken Off Your Credit Report Image Photography

Immerse yourself in the stunning details of this beautiful how to get something taken off your credit report wallpaper, designed for a captivating visual experience.

:max_bytes(150000):strip_icc()/remove-debt-collections-from-your-credit-report-960376_FINAL-5ae6517517024613885ec46df1e58ecd.png)

Dynamic How To Get Something Taken Off Your Credit Report Picture for Your Screen

This gorgeous how to get something taken off your credit report photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Vibrant How To Get Something Taken Off Your Credit Report Picture for Your Screen

Explore this high-quality how to get something taken off your credit report image, perfect for enhancing your desktop or mobile wallpaper.

Exquisite How To Get Something Taken Off Your Credit Report Abstract for Mobile

A captivating how to get something taken off your credit report scene that brings tranquility and beauty to any device.

Beautiful How To Get Something Taken Off Your Credit Report Background Illustration

Explore this high-quality how to get something taken off your credit report image, perfect for enhancing your desktop or mobile wallpaper.

Beautiful How To Get Something Taken Off Your Credit Report Photo for Desktop

Transform your screen with this vivid how to get something taken off your credit report artwork, a true masterpiece of digital design.

Captivating How To Get Something Taken Off Your Credit Report Photo Collection

Immerse yourself in the stunning details of this beautiful how to get something taken off your credit report wallpaper, designed for a captivating visual experience.

Exquisite How To Get Something Taken Off Your Credit Report Background Digital Art

Find inspiration with this unique how to get something taken off your credit report illustration, crafted to provide a fresh look for your background.

Gorgeous How To Get Something Taken Off Your Credit Report Photo for Mobile

This gorgeous how to get something taken off your credit report photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Captivating How To Get Something Taken Off Your Credit Report Artwork Art

Find inspiration with this unique how to get something taken off your credit report illustration, crafted to provide a fresh look for your background.

Mesmerizing How To Get Something Taken Off Your Credit Report Photo in 4K

Transform your screen with this vivid how to get something taken off your credit report artwork, a true masterpiece of digital design.

Exquisite How To Get Something Taken Off Your Credit Report Wallpaper Illustration

Find inspiration with this unique how to get something taken off your credit report illustration, crafted to provide a fresh look for your background.