Intel stock plunges 13% on soft guidance, concerns about chip production

Intel Stock Plunges 13% After Dismal Q1 Guidance Raises Serious Concerns About Chip Production and Execution Risk

The market opened today to a chilling sight: Intel Corporation (INTC) shares tanking dramatically. The chip giant saw its stock price fall by a devastating 13% in after-hours trading, wiping billions off its market capitalization. This immediate fiscal carnage was triggered not solely by the recent earnings report, but by profoundly disappointing forward-looking guidance that signaled deep-seated operational struggles.

As a seasoned market observer who has tracked the turbulent semiconductor industry for years, I've witnessed many earnings calls that miss the mark. Yet, few announcements have delivered such a simultaneous punch of underwhelming near-term forecasts coupled with structural strategic worries. The plunge wasn't just a reaction to slightly missed revenue targets; it was a crisis of confidence fueled by "soft guidance" and persistent fears surrounding Intel's ability to execute its ambitious manufacturing roadmap.

Investors were particularly spooked by the revenue projections for the first quarter of the year. While CEO Pat Gelsinger and the leadership team attempted to tout resilience and long-term strategic progress in the face of macro uncertainty, the outlook for Q1 2024 fell dramatically below analyst consensus. This immediate financial pain is amplifying long-term skepticism regarding their competitive standing against rivals like AMD and the critical challenge of catching up in advanced semiconductor manufacturing.

The market's reaction makes one thing clear: patience is wearing thin. Intel's expensive, multi-year turnaround effort, known as the IDM 2.0 strategy, is facing a major reality check. The costs are high, the execution challenges are severe, and the payback period appears to be stretching further into the future.

The Shockwave: Q1 Forecasts Fall Far Short of Wall Street Expectations

Intel's latest earnings report delivered a painful truth: the immediate financial future looks significantly weaker than the market had priced in. Despite reporting revenues that met general expectations for the last quarter of the previous year, the Q1 2024 financial guidance overshadowed all strategic optimism and sent institutional investors fleeing.

The company forecast first-quarter revenue to land between $12.2 billion and $13.2 billion. This range sits significantly below the $14.2 billion average expected by Wall Street analysts. Similarly, the projected adjusted earnings per share (EPS) of $0.13 to $0.18 disappointed profoundly, signaling intense margin pressure as the company continues to spend heavily on building out new capacity and developing next-generation process nodes.

The primary contributors to this highly cautious outlook are multi-faceted, touching upon nearly every segment of Intel's complex operation:

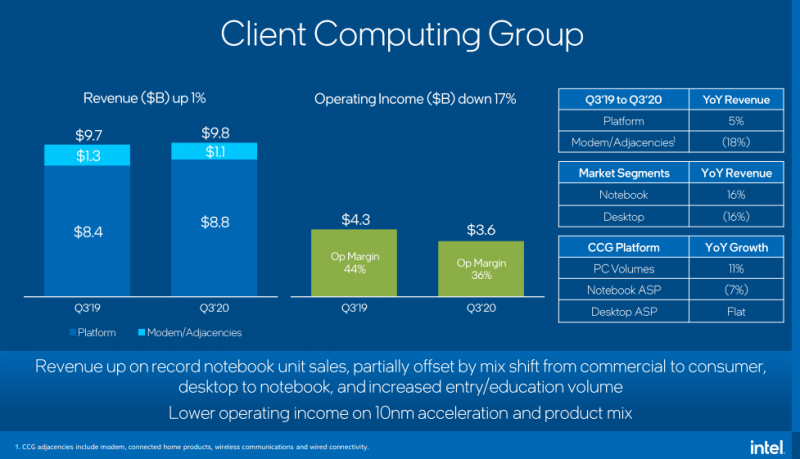

- Client Computing Group (CCG) Weakness: While the broader PC market has stabilized following the post-pandemic slump, demand remains patchy. Intel's core revenue driver is showing signs of lingering softness, particularly in the lower-end consumer and commercial segments, suggesting slower inventory normalization than hoped.

- Data Center and AI Group (DCAI) Uncertainty: This critical growth area is struggling intensely against the meteoric rise of specialized AI accelerators from competitors like Nvidia and specialized chips from cloud providers themselves. Though Intel is investing heavily in its Gaudi chips and next-generation Xeon CPUs, the immediate revenue impact is not enough to offset competitive losses and market transition costs.

- Inventory Adjustments: Management noted that customers are continuing to adjust existing chip inventories, leading to decreased immediate orders for Intel's products, a common but prolonged headache across the entire semiconductor supply chain.

- Foundry Services Lag: The fledgling Intel Foundry Services (IFS) division, while strategically crucial for the long term, is currently a significant cost center. The required investments in new infrastructure and talent are weighing heavily down on overall profitability, a necessary evil that is proving costly in the near term.

The market interpretation is unified: the company is taking longer to achieve profitability on its manufacturing transformation than anticipated. Analysts pointed out that the lower-than-expected revenue guidance suggests core business stabilization isn't happening fast enough to support the massive capital expenditures Intel is currently undertaking.

Deepening Worries Over Chip Production, Yield Rates, and Competitive Pressure

Beyond the immediate financial figures, the fundamental concern driving the 13% sell-off relates directly to Intel's core identity: manufacturing superiority. For decades, Intel benefited from being the undisputed leader in process technology. Today, that lead has vanished, and the ambitious plan to regain technological parity—the "four nodes in five years" strategy—is under intense scrutiny, particularly regarding the viability of the crucial Intel 20A and Intel 18A process nodes.

Wall Street is increasingly worried about "execution risk." Can Intel deliver on its promise to roll out these critical advanced process nodes on time, and more importantly, at scale with competitive yield rates? Any significant manufacturing delays or sustained low yield challenges could cripple the company's ability to compete effectively in the high-performance computing market against industry behemoths.

This challenge is magnified by the intensifying competitive landscape. Rival Advanced Micro Devices (AMD) continues to aggressively gain market share across both the CPU and server segments, particularly with its competitive EPYC processors. Furthermore, the reliance on external, dedicated foundries like Taiwan Semiconductor Manufacturing Company (TSMC) by competitors allows them to maintain incredible flexibility and leverage the most advanced manufacturing processes without bearing the colossal capital expenditures Intel must fund internally.

The effort to stand up Intel Foundry Services (IFS) is undeniably essential for future diversification and national chip security, yet it requires unprecedented, multi-billion dollar capital spending. The recent earnings commentary highlighted the intense financial drag caused by these heavy investments, which includes the construction of massive new fabrication plants (fabs) in Arizona, Ohio, and Germany.

One prominent technology analyst summed up the dilemma: "Intel is asking investors to fund a multi-year manufacturing catch-up campaign while simultaneously navigating intense competition in their core business. The soft guidance signals that the transition period will be prolonged, increasing the capital risk significantly, especially if global chip demand remains muted."

The complexity of these global projects adds layers of geopolitical and logistical risk to the equation. Every delay, every setback in achieving high yields on next-generation silicon, translates directly into lost market share to nimble, fabless competitors who can simply contract out to the best existing foundry services. The technological gap means that Intel must not only innovate but must flawlessly execute large-scale construction and complex engineering shifts simultaneously—a task proving immensely difficult to manage financially in the short term.

Investor Sentiment Shifts: Patience Wears Thin Despite the Long-Term Vision

The swift market reaction—a stark 13% drop—is less about panic and more about the fundamental recalibration of expectations. Many long-term investors bought into Intel based on CEO Pat Gelsinger's ambitious vision of restoring technological leadership by 2025. This soft guidance suggests that the finish line is further away than anticipated, testing the patience of even the most dedicated shareholders who understand the cyclical nature of the chip industry.

Wall Street firms responded swiftly following the guidance release, with several major banks downgrading Intel's price target. The central theme across analyst notes was the risk associated with the slow return on investment in the nascent foundry business and the sustained competitive pressure in the high-margin data center market.

The company's survival and eventual recovery hinge on several strategically important pillars, all of which require flawless execution:

- Accelerated Process Node Development: Successfully deploying 20A and 18A to attract external foundry customers and re-establish technology leadership over rival manufacturers.

- Hybrid Manufacturing Model: Utilizing both internal fabs and external foundry capacity (like TSMC) to manage complexity, spread risk, and control costs while the internal structure is overhauled.

- AI Integration: Ensuring Intel's CPU and GPU offerings are deeply integrated with next-generation AI capabilities to remain relevant against specialized AI hardware that currently dominates the market.

- Government Subsidies and Geographic Diversification: Successfully leveraging government grants (such as the US CHIPS Act funding) to help finance new domestic manufacturing facilities and mitigate the huge capital costs.

Despite the painful Q1 guidance, Gelsinger and his leadership team reaffirmed their commitment to the long-term strategic transformation, emphasizing that the company is making necessary, foundational sacrifices now to position itself for sustained, long-term growth. They argue these near-term financial headwinds are a necessary byproduct of turning the giant ship around.

However, the skepticism remains palpable. The immediate future requires tangible proof points—not just projections—that Intel can meet complex production timelines and that its new products, particularly in the server and high-end PC markets, can effectively claw back share lost to highly competitive offerings from AMD.

For investors, the next few quarters will serve as a crucial litmus test. They will be watching closely for improved yields on upcoming process nodes, concrete evidence of competitive success in the AI segment, and signs that Intel Foundry Services can attract major, non-Intel clients beyond its initial anchor contracts. Until then, the stock price remains a reflection of the high-risk, high-reward nature of this semiconductor transformation.

In summary, the 13% drop in Intel stock is a clear, stark signal that the market requires faster execution and more robust financial forecasts to justify the company's multi-billion-dollar transformation effort. While Intel holds a vital and strategic position in global semiconductor supply, the coming year represents a critical juncture where strategic vision must finally translate into demonstrable manufacturing excellence and competitive growth.

The road to recovery is paved with immense capital expenditure and intense rivalry. Only flawless execution, coupled with a stronger economic environment, can bring investors back from the precipice.

Intel stock plunges 13% on soft guidance, concerns about chip production

Intel stock plunges 13% on soft guidance, concerns about chip production Wallpapers

Collection of intel stock plunges 13% on soft guidance, concerns about chip production wallpapers for your desktop and mobile devices.

Vibrant Intel Stock Plunges 13% On Soft Guidance, Concerns About Chip Production Background in HD

Transform your screen with this vivid intel stock plunges 13% on soft guidance, concerns about chip production artwork, a true masterpiece of digital design.

Dynamic Intel Stock Plunges 13% On Soft Guidance, Concerns About Chip Production Moment Illustration

Immerse yourself in the stunning details of this beautiful intel stock plunges 13% on soft guidance, concerns about chip production wallpaper, designed for a captivating visual experience.

Exquisite Intel Stock Plunges 13% On Soft Guidance, Concerns About Chip Production View for Mobile

A captivating intel stock plunges 13% on soft guidance, concerns about chip production scene that brings tranquility and beauty to any device.

Captivating Intel Stock Plunges 13% On Soft Guidance, Concerns About Chip Production Picture Photography

This gorgeous intel stock plunges 13% on soft guidance, concerns about chip production photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Amazing Intel Stock Plunges 13% On Soft Guidance, Concerns About Chip Production Image Illustration

Discover an amazing intel stock plunges 13% on soft guidance, concerns about chip production background image, ideal for personalizing your devices with vibrant colors and intricate designs.

:max_bytes(150000):strip_icc()/INTC_2024-04-26_12-22-55-f115c02498704b369cc6800b16220213.png)

Mesmerizing Intel Stock Plunges 13% On Soft Guidance, Concerns About Chip Production Capture Art

Experience the crisp clarity of this stunning intel stock plunges 13% on soft guidance, concerns about chip production image, available in high resolution for all your screens.

Serene Intel Stock Plunges 13% On Soft Guidance, Concerns About Chip Production Design for Desktop

Discover an amazing intel stock plunges 13% on soft guidance, concerns about chip production background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Beautiful Intel Stock Plunges 13% On Soft Guidance, Concerns About Chip Production Capture Art

Transform your screen with this vivid intel stock plunges 13% on soft guidance, concerns about chip production artwork, a true masterpiece of digital design.

Artistic Intel Stock Plunges 13% On Soft Guidance, Concerns About Chip Production Scene for Mobile

Immerse yourself in the stunning details of this beautiful intel stock plunges 13% on soft guidance, concerns about chip production wallpaper, designed for a captivating visual experience.

Dynamic Intel Stock Plunges 13% On Soft Guidance, Concerns About Chip Production Scene for Desktop

Find inspiration with this unique intel stock plunges 13% on soft guidance, concerns about chip production illustration, crafted to provide a fresh look for your background.

Vivid Intel Stock Plunges 13% On Soft Guidance, Concerns About Chip Production Design Illustration

Transform your screen with this vivid intel stock plunges 13% on soft guidance, concerns about chip production artwork, a true masterpiece of digital design.

Spectacular Intel Stock Plunges 13% On Soft Guidance, Concerns About Chip Production Design Illustration

Immerse yourself in the stunning details of this beautiful intel stock plunges 13% on soft guidance, concerns about chip production wallpaper, designed for a captivating visual experience.

Exquisite Intel Stock Plunges 13% On Soft Guidance, Concerns About Chip Production Landscape in HD

This gorgeous intel stock plunges 13% on soft guidance, concerns about chip production photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

High-Quality Intel Stock Plunges 13% On Soft Guidance, Concerns About Chip Production Background Concept

Explore this high-quality intel stock plunges 13% on soft guidance, concerns about chip production image, perfect for enhancing your desktop or mobile wallpaper.

High-Quality Intel Stock Plunges 13% On Soft Guidance, Concerns About Chip Production Picture for Desktop

Experience the crisp clarity of this stunning intel stock plunges 13% on soft guidance, concerns about chip production image, available in high resolution for all your screens.

Mesmerizing Intel Stock Plunges 13% On Soft Guidance, Concerns About Chip Production Artwork Art

Experience the crisp clarity of this stunning intel stock plunges 13% on soft guidance, concerns about chip production image, available in high resolution for all your screens.

Mesmerizing Intel Stock Plunges 13% On Soft Guidance, Concerns About Chip Production Scene for Mobile

Experience the crisp clarity of this stunning intel stock plunges 13% on soft guidance, concerns about chip production image, available in high resolution for all your screens.

Lush Intel Stock Plunges 13% On Soft Guidance, Concerns About Chip Production Moment Nature

A captivating intel stock plunges 13% on soft guidance, concerns about chip production scene that brings tranquility and beauty to any device.

Crisp Intel Stock Plunges 13% On Soft Guidance, Concerns About Chip Production Moment for Mobile

This gorgeous intel stock plunges 13% on soft guidance, concerns about chip production photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Dynamic Intel Stock Plunges 13% On Soft Guidance, Concerns About Chip Production Capture for Mobile

This gorgeous intel stock plunges 13% on soft guidance, concerns about chip production photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Download these intel stock plunges 13% on soft guidance, concerns about chip production wallpapers for free and use them on your desktop or mobile devices.