Loan Service Software

Tired of Manual Loan Servicing? How Modern Loan Service Software Drives Efficiency

Let's be honest: managing a portfolio of loans can feel like juggling chainsaws while riding a unicycle. The sheer volume of payments, escrow accounts, regulatory changes, and borrower communications is enough to overwhelm even the most seasoned financial institution.

But here's the good news: the days of relying on outdated spreadsheets and clunky legacy systems are over. Welcome to the era of sophisticated Loan Service Software—the essential technology that doesn't just manage loans, but actively optimizes and scales your entire lending operation.

If your goal is to reduce operational costs, minimize compliance risk, and deliver a superior borrower experience, understanding the power of a dedicated Loan Service Software platform is your next critical step.

The Core Value Proposition: Why Loan Service Software is Non-Negotiable

In today's competitive landscape, borrowers demand speed and transparency, while regulators demand precision. This dual pressure makes manual processes unsustainable. Loan service software steps in as the bridge between profitability and compliance.

Think about the sheer time wasted on mundane, repetitive tasks. Calculating amortization schedules, generating statements, or manually tracking late payments eats into staff productivity. By automating these tasks, LSS frees your team to focus on complex problem-solving and nurturing client relationships.

A Shift from Reactive to Proactive Servicing

Traditional servicing is often reactive—you wait for a payment to be late, or a regulation to change, and then you react. Modern software uses sophisticated analytics and triggers to anticipate issues. For example, it can flag a borrower showing early signs of financial distress, allowing your team to offer forbearance or modification options proactively, minimizing default risk.

This proactive approach significantly improves the borrower journey, often referred to as Customer Experience (CX), which is increasingly vital in the financial sector. Understanding the basics of lending operations highlights why efficient servicing is the key to maintaining asset quality.

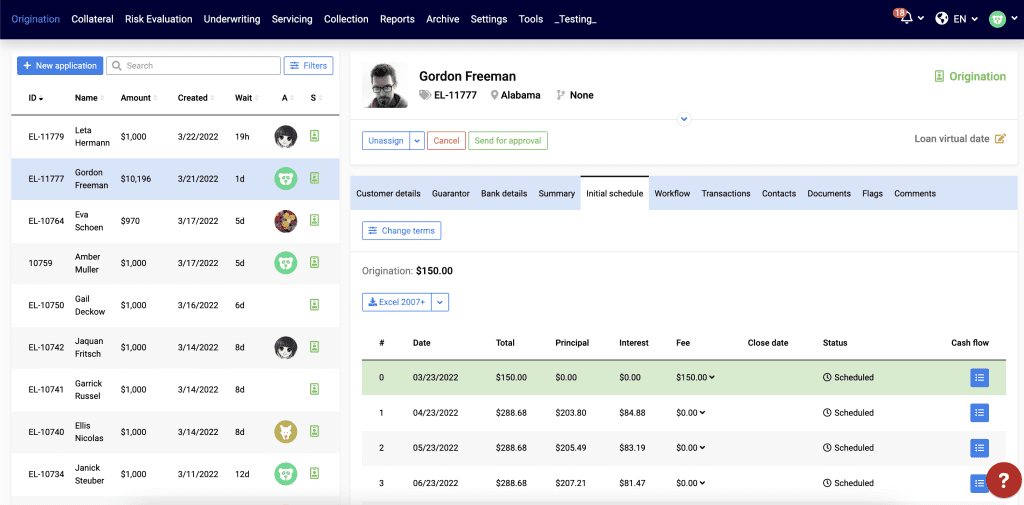

Essential Features of Top-Tier Loan Service Software

Not all platforms are created equal. When evaluating potential Loan Service Software solutions, you must look beyond basic payment processing. The real power lies in integrated features that handle the entire servicing lifecycle seamlessly.

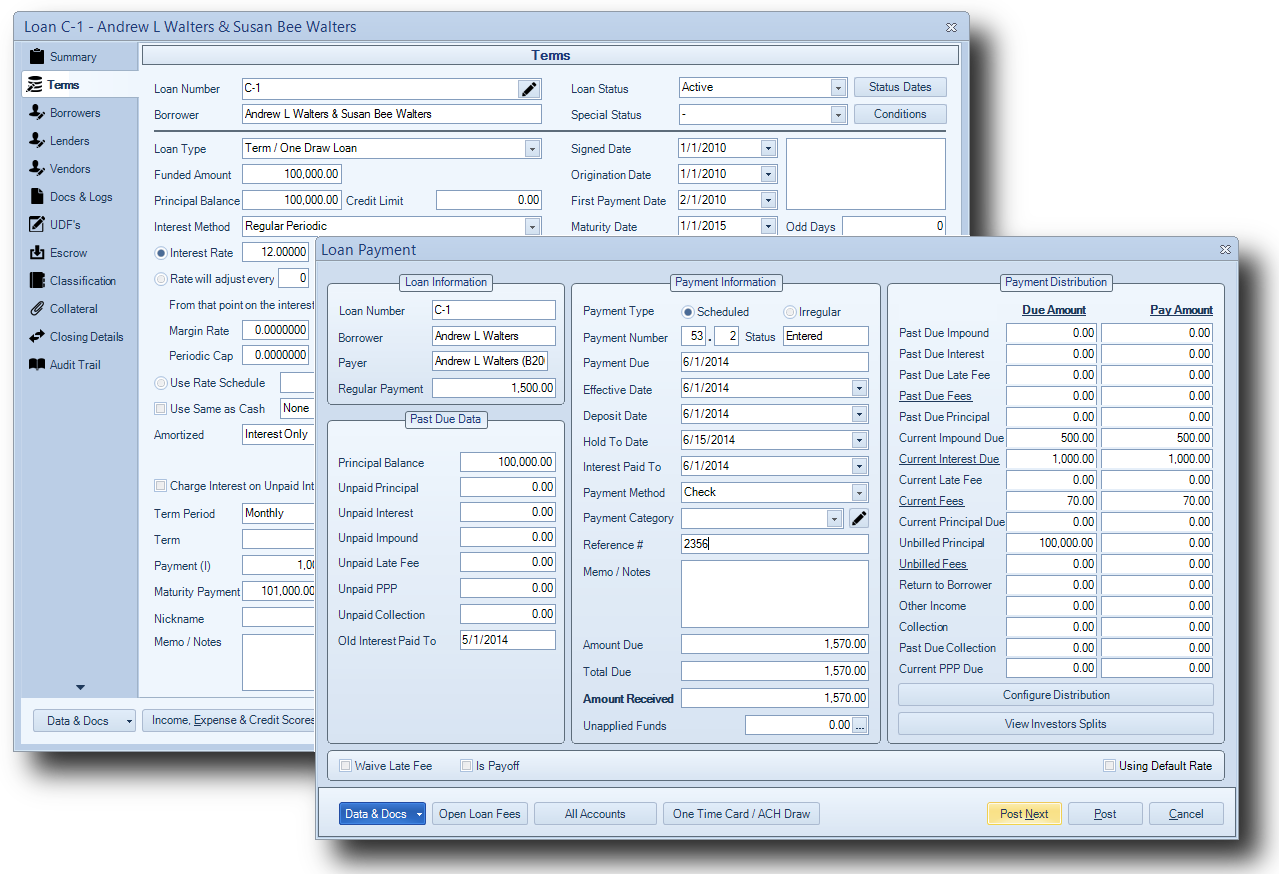

1. Robust Payment Processing and Accounting

The foundation of any good system. It must support multiple payment methods (ACH, cards, wire transfers), complex escrow management, and automatically handle principal, interest, taxes, and insurance (PITI) calculations with zero errors. Look for real-time reconciliation capabilities.

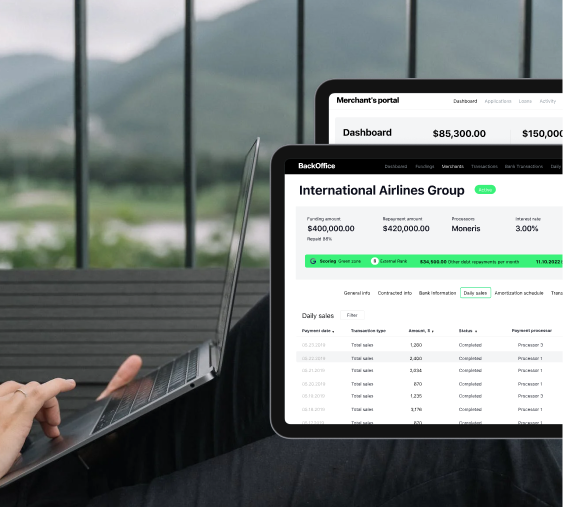

2. Dynamic Borrower Portals

Modern borrowers expect self-service. A high-quality portal allows clients to check balances, review statements, download tax documents, schedule payments, and submit modification requests—all without calling a representative. This dramatically reduces call center volume and enhances satisfaction.

3. Integrated Collections Management

Effective collections requires a segmented, automated approach. The software should allow you to set up customized dunning processes, automatically assign accounts to collectors based on risk profile, and log all communications for compliance purposes.

4. Seamless Third-Party Integrations

Your LSS needs to talk to the rest of your tech stack. This includes integration with general ledger (GL) systems, CRMs (Customer Relationship Management), credit reporting agencies, and document management systems. API flexibility is crucial for futureproofing.

To help visualize the complexity handled by these systems, here is a quick overview of core modules:

| Module | Primary Function | Key Benefit |

|---|---|---|

| Payment Engine | Automating PITI calculations, late fee assessment, and payment application. | Ensures accuracy and compliance; zero manual errors. |

| Escrow/T&I | Managing property taxes and insurance disbursements. | Mitigates risk of lapsed coverage and regulatory fines. |

| Reporting & Audit | Generating regulatory reports (e.g., HMDA, FDCPA logs) and custom portfolio health reports. | Supports C-suite decision-making and ensures audit readiness. |

[Baca Juga: Optimizing Your Digital Loan Origination Platforms]

Compliance, Risk, and the Regulatory Landscape

In the financial world, risk management is paramount. A major benefit of investing in high-quality Loan Service Software is the built-in compliance assurance. The regulatory landscape—from Truth in Lending Act (TILA) requirements to state-specific licensing—is a minefield for manual operations.

Good software constantly monitors changes in federal and state laws and automatically updates its parameters. This means your system is always generating compliant documentation and following legally mandated timelines for disclosures, foreclosures, and collections.

For example, rules set by bodies like the Consumer Financial Protection Bureau (CFPB) regarding servicing transfers or loss mitigation require meticulous record-keeping. LSS provides an immutable audit trail, automatically timestamping every action and communication, making regulatory audits far less stressful.

Handling Complex Loan Products

Whether you deal with variable interest rates, interest-only payments, or complex construction loans, the software must be flexible enough to model these unique terms accurately. Look for systems that handle diverse financial instruments, not just standard fixed-rate mortgages or personal loans. Adaptability here is key to expanding your product offerings without increasing compliance risk.

Choosing the Right Platform: Implementation & Scalability

Selecting a Loan Service Software vendor is a massive commitment. It's not just about features; it's about partnership, implementation strategy, and future scalability. You need a system that can grow with you, whether you're planning to double your portfolio or enter new lending markets.

The Implementation Challenge

Data migration is often the trickiest part of implementation. Ensure the vendor has a proven, structured migration plan for transferring historical data from your old system to the new platform. A smooth transition minimizes operational downtime and reduces the chance of data integrity issues.

Cloud vs. On-Premise

While some institutions still prefer the control of on-premise installations, the industry is rapidly shifting to cloud-based LSS. Cloud solutions offer superior scalability, quicker updates, and significantly lower IT overhead, aligning more closely with modern finance industry trends, as reported by institutions like the Federal Reserve (resource placeholder).

Total Cost of Ownership (TCO)

Don't just look at the licensing fee. Evaluate the TCO, which includes implementation costs, training fees, ongoing maintenance, and the cost of necessary integrations. A slightly more expensive platform with better automation capabilities will almost always yield a lower TCO over five years due to reduced staffing needs and lower error rates.

[Baca Juga: Fintech Security Best Practices for Digital Lending]

Conclusion: The Future is Automated and Optimized

Investing in cutting-edge Loan Service Software is no longer a luxury—it's a competitive necessity. It transforms a costly, risk-prone back-office function into a streamlined, customer-centric operation. By prioritizing automation, strong compliance tools, and a superior digital borrower experience, you not only protect your bottom line but also position your institution for sustainable growth in the dynamic world of lending.

The transition requires careful planning, but the rewards—faster service, reduced risk, and happier borrowers—are undeniable.

Frequently Asked Questions (FAQ) about LSS

Q: What is the main difference between Loan Origination Software (LOS) and Loan Service Software (LSS)?

A: LOS handles the front-end process: application, underwriting, and closing the loan. LSS handles the back-end process: managing the loan portfolio after funding, including payment processing, collections, escrow, and reporting until the loan is paid off.

Q: Can Loan Service Software handle multiple asset classes (e.g., mortgages, personal loans, auto loans)?

A: Yes, modern LSS platforms are designed to be product-agnostic and handle diverse asset types. However, verify that the specific platform you choose has robust functionality built for the complexity of your primary loan types (e.g., specific mortgage escrow rules).

Q: How long does it typically take to implement new Loan Service Software?

A: Implementation timelines vary significantly based on portfolio size and complexity. For small to mid-sized lenders, it can take 3 to 6 months, primarily dedicated to data mapping, migration, integration testing, and staff training. Large enterprise migrations can take 12 months or more.

Q: Is LSS crucial for small, non-bank lenders (Fintechs)?

A: Absolutely. While traditional banks use LSS for scale, Fintechs rely on it for agility, lower operational costs, and the ability to rapidly iterate on unique loan products without being bottlenecked by manual processes.

Loan Service Software

Loan Service Software Wallpapers

Collection of loan service software wallpapers for your desktop and mobile devices.

Stunning Loan Service Software Picture for Mobile

Find inspiration with this unique loan service software illustration, crafted to provide a fresh look for your background.

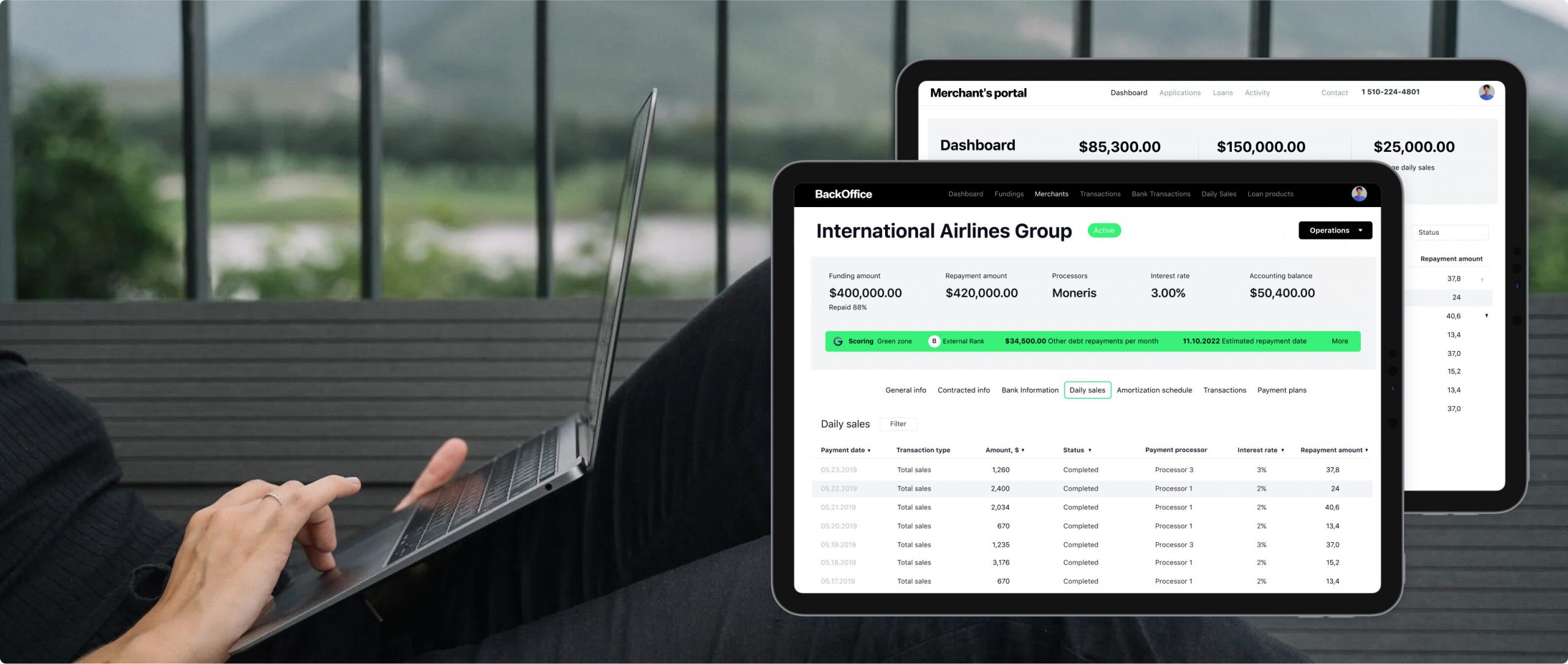

Dynamic Loan Service Software View Concept

Immerse yourself in the stunning details of this beautiful loan service software wallpaper, designed for a captivating visual experience.

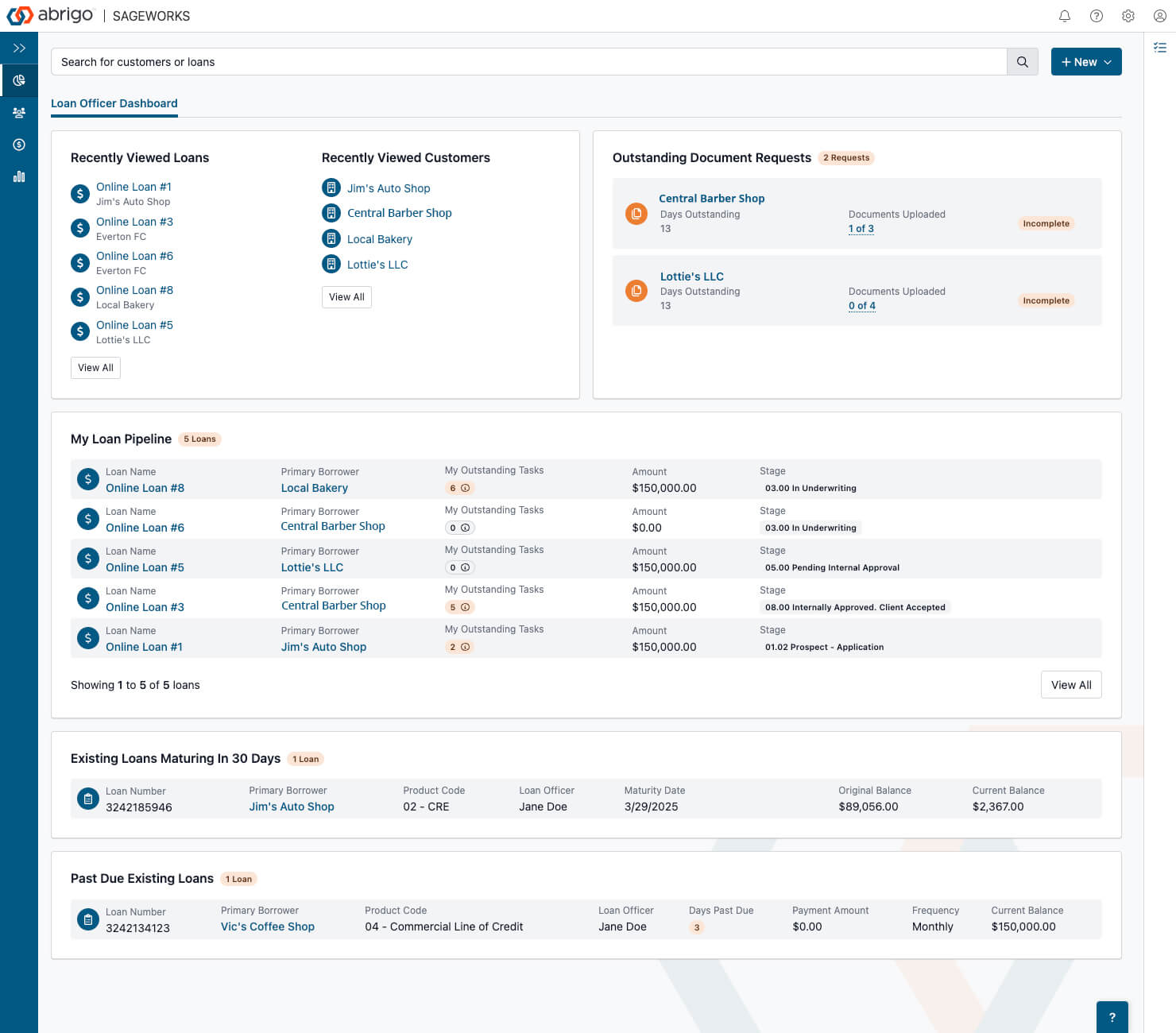

Beautiful Loan Service Software Scene for Desktop

Experience the crisp clarity of this stunning loan service software image, available in high resolution for all your screens.

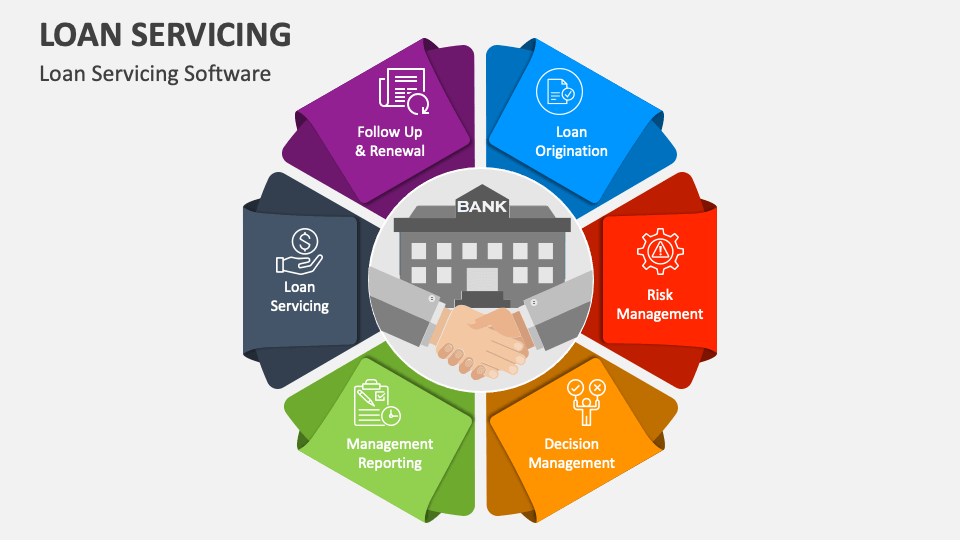

High-Quality Loan Service Software Moment Concept

Experience the crisp clarity of this stunning loan service software image, available in high resolution for all your screens.

Crisp Loan Service Software Image for Mobile

This gorgeous loan service software photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Beautiful Loan Service Software Scene Collection

Experience the crisp clarity of this stunning loan service software image, available in high resolution for all your screens.

Vivid Loan Service Software Landscape Digital Art

Explore this high-quality loan service software image, perfect for enhancing your desktop or mobile wallpaper.

Amazing Loan Service Software Capture for Desktop

Discover an amazing loan service software background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Dynamic Loan Service Software Abstract for Your Screen

This gorgeous loan service software photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Exquisite Loan Service Software Landscape for Your Screen

Immerse yourself in the stunning details of this beautiful loan service software wallpaper, designed for a captivating visual experience.

Detailed Loan Service Software Photo Collection

Explore this high-quality loan service software image, perfect for enhancing your desktop or mobile wallpaper.

Vivid Loan Service Software View Art

Experience the crisp clarity of this stunning loan service software image, available in high resolution for all your screens.

Amazing Loan Service Software Background Collection

Experience the crisp clarity of this stunning loan service software image, available in high resolution for all your screens.

Artistic Loan Service Software Abstract Concept

This gorgeous loan service software photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Breathtaking Loan Service Software Design Concept

Experience the crisp clarity of this stunning loan service software image, available in high resolution for all your screens.

Spectacular Loan Service Software Background for Desktop

A captivating loan service software scene that brings tranquility and beauty to any device.

Mesmerizing Loan Service Software Picture for Mobile

Transform your screen with this vivid loan service software artwork, a true masterpiece of digital design.

Detailed Loan Service Software Scene for Desktop

Discover an amazing loan service software background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Vibrant Loan Service Software Landscape for Mobile

Discover an amazing loan service software background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Crisp Loan Service Software Scene Nature

This gorgeous loan service software photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Download these loan service software wallpapers for free and use them on your desktop or mobile devices.