Loans Management Software

Stop Losing Money: The Essential Guide to Choosing Loans Management Software

In today's fast-paced financial world, lending institutions—whether banks, credit unions, or alternative lenders—face relentless pressure to be fast, accurate, and compliant. If your current processes still rely heavily on spreadsheets, manual data entry, and outdated core systems, you are not just inefficient; you are actively losing money.

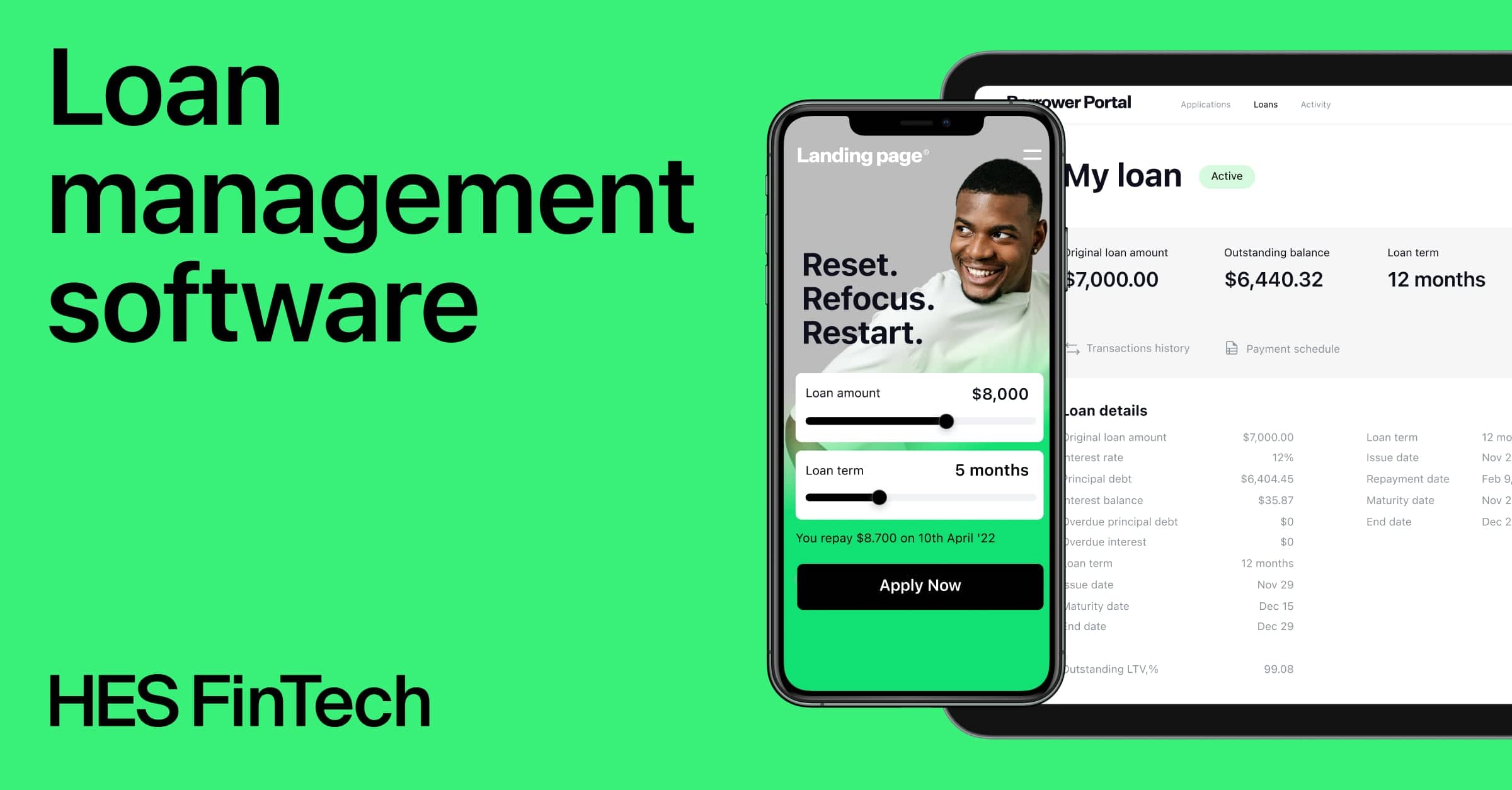

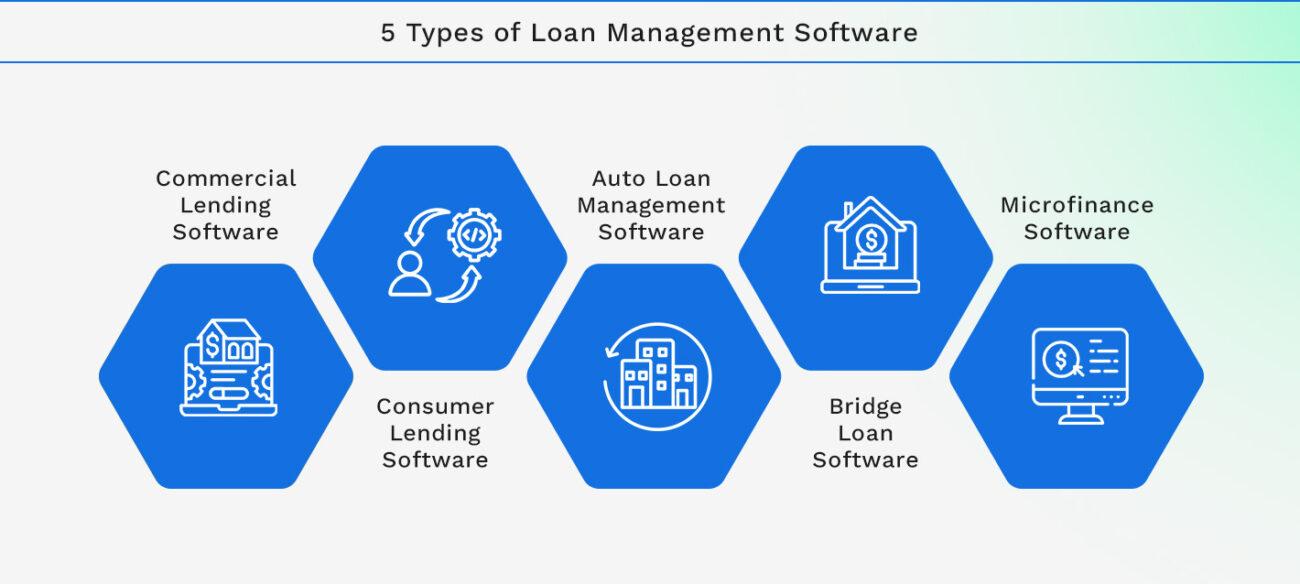

This is where robust Loans Management Software (LMS) steps in. We are moving beyond basic loan tracking. Modern LMS is the technological backbone that automates the entire loan lifecycle, from initial application and underwriting to servicing, collections, and final reporting.

This deep dive, written by experienced industry professionals, will explore exactly what makes a world-class LMS, how to calculate its true Return on Investment (ROI), and the vital steps to ensure successful implementation. Let's make sure your lending operation is future-proof.

Why Traditional Lending Processes Are Failing (The Pain Points)

Many legacy institutions operate with fragmented systems. The origination department uses one piece of software, the servicing team uses another, and compliance relies on manual audits. This fragmentation creates significant operational weaknesses that a unified LMS is designed to solve.

Operational Inefficiency

Manual processes are slow, which means slower time-to-decision for applicants. In competitive lending, speed is everything. Delays not only frustrate customers but also dramatically increase the cost-to-serve (CTS) for every loan. Think about the time spent manually reconciling payments or chasing missing documentation—it adds up quickly.

Regulatory Compliance Nightmares

The regulatory landscape is constantly shifting, especially concerning consumer lending and data privacy (like GDPR or CCPA). Attempting to manually update policies and ensure every loan adheres to the latest standards is not just a headache; it's a massive risk. A single compliance error can result in hefty fines and damage to institutional trust.

Modern LMS solutions are designed with built-in audit trails and automated compliance checks, reducing the human error factor dramatically. For deeper reading on the global standards governing banking technology, see this reference on the Basel Accords: Wikipedia: Basel Accords.

What Defines a Great Loans Management Software? (Core Features)

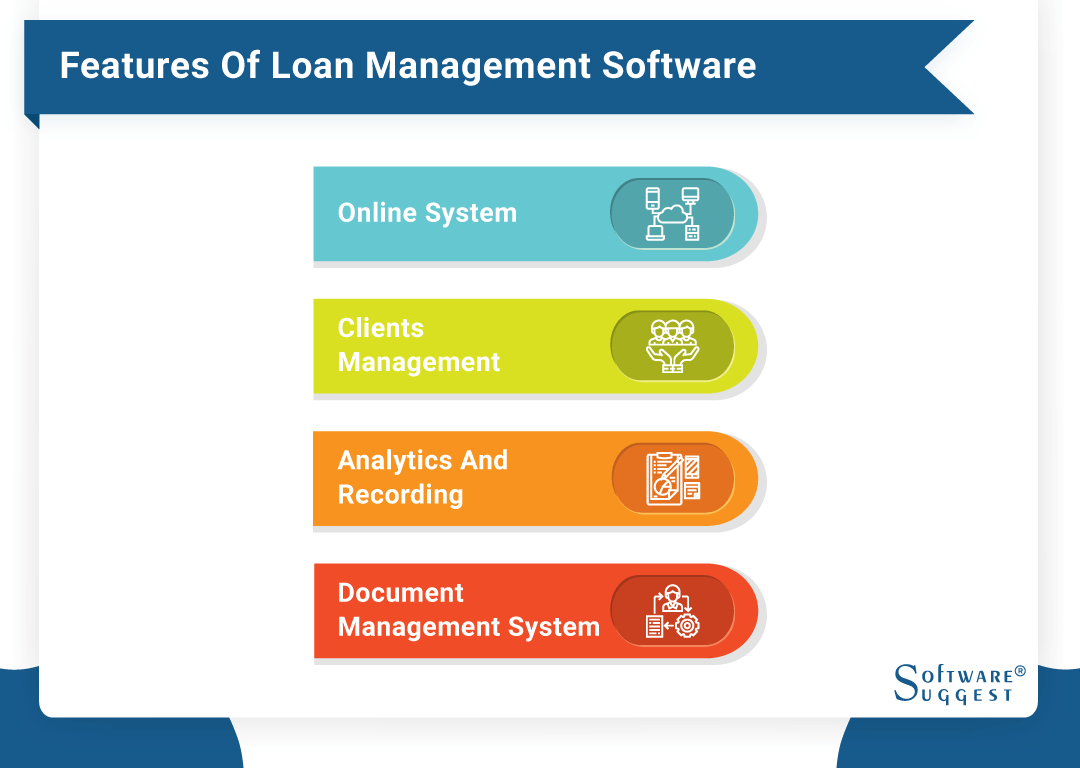

When evaluating potential vendors for your new Loans Management Software solution, focus on systems that offer full lifecycle support. The best software isn't just about managing existing debt; it's about optimizing future debt acquisition and mitigating portfolio risk.

Automation Capabilities

True efficiency is found in automation. This includes automated loan decisioning (using predefined criteria and algorithms), automated document generation (contracts, disclosure forms), and, crucially, automated servicing tasks like payment reminders, late fee application, and escrow management.

Robust Risk Assessment and Analytics

A superior LMS provides real-time data analytics, allowing lenders to visualize portfolio health, identify early warning signs of default, and fine-tune lending criteria. Look for features that support credit scoring integrations, scenario testing, and detailed portfolio segmentation.

This analytical power moves your organization from reactive management (reacting to defaults) to proactive strategic planning (forecasting risk exposure).

Seamless Integration (API First)

No LMS exists in a vacuum. It must communicate flawlessly with your core banking system, CRM, General Ledger, and external data sources (credit bureaus, verification services). Always prioritize a platform built with an API-first approach, ensuring future flexibility and reduced integration headaches.

[Baca Juga: Strategi Implementasi API dalam Fintech]

Calculating ROI: The Business Case for Loans Management Software

Implementing comprehensive Loans Management Software is a significant investment. Proving the ROI requires looking beyond simple cost savings and examining three key areas: operational efficiency, risk mitigation, and revenue growth.

The table below outlines common benefits that translate directly into financial returns:

| Metric Improvement | Direct Financial Benefit | Impact Category |

|---|---|---|

| Reducing application processing time by 60% | Lower Cost-to-Serve (CTS) per loan | Operational Efficiency |

| Decreased default rate by 5% | Reduced provisioning for bad debt | Risk Mitigation |

| Increase loan portfolio volume by 15% | Higher net interest income | Revenue Growth |

| 99.9% compliance adherence | Avoidance of hefty regulatory fines | Risk Mitigation |

Implementation: Best Practices and Avoiding Pitfalls

The transition to a new LMS is often more about change management than technology. A poorly planned rollout can negate all the potential benefits.

Data Migration Strategy

This is frequently the biggest hurdle. You must have a meticulous strategy for cleaning, validating, and transferring legacy loan data into the new system. Work closely with your vendor to establish clear data mapping rules and perform multiple rounds of testing before the final cutover.

Customization vs. Configuration

While some tailoring is necessary, excessive customization can create a maintenance burden and block future upgrades. A modern LMS should offer strong configuration options—the ability to change rules and workflows without altering the core code—rather than deep, expensive customization.

The goal is standardization where possible, allowing you to benefit from the vendor's continuous improvements.

Security, Data Integrity, and E-E-A-T Compliance

For any software dealing with sensitive financial data, security and integrity are paramount. This is a core component of establishing Trust (T) in the E-E-A-T framework.

Ask prospective vendors about their security certifications (e.g., ISO 27001, SOC 2 Type II). The software must provide multi-factor authentication, granular user permissions, and comprehensive encryption, both in transit and at rest.

Furthermore, look for strong disaster recovery protocols and documented business continuity plans. In the event of a system failure, how quickly can lending operations resume? This information is critical for maintaining borrower trust and regulatory standing.

For official information regarding data integrity standards in the financial sector, consult government resources like the US Federal Reserve: Federal Reserve: Data Resources.

[Baca Juga: Memahami Keamanan Cloud untuk Lembaga Keuangan]

***

Conclusion: The Future of Lending is Automated

Choosing the right Loans Management Software is not just about upgrading technology; it's about making a strategic decision to embrace automation, mitigate risk, and drastically improve the customer experience. The era of manual, error-prone lending is over. Institutions that invest wisely in modern, API-driven LMS solutions will be better positioned to scale quickly, adapt to regulatory changes, and secure their long-term competitive edge in the market.

Start your evaluation process by defining your non-negotiable requirements (compliance, integration needs) and focusing on vendors who offer proven expertise (E-E-A-T) and clear paths to quantifiable ROI.

Frequently Asked Questions (FAQ)

Q: What is the main difference between LMS and Core Banking Systems?

A: A Core Banking System (CBS) manages all central banking functions (deposits, accounts, general ledger). LMS is specialized software focused solely on the complex workflow of the loan lifecycle (origination, servicing, collections). While integrated, the LMS handles the specialized calculations and automated processes specific to debt instruments.

Q: How long does implementation of Loans Management Software typically take?

A: Implementation timelines vary significantly based on institutional size, data cleanliness, and required integrations. A standard implementation for a medium-sized lender can take anywhere from 6 to 18 months, with careful planning for data migration being the most time-consuming phase.

Q: Is cloud-based LMS secure enough for sensitive loan data?

A: Yes, provided the vendor adheres to strict compliance and security standards (like SOC 2 and ISO certifications). Modern cloud providers (AWS, Azure) often offer security measures that exceed the capabilities of most internal, on-premise systems. Look for robust encryption and clear data residency policies.

Q: What role does AI play in modern Loans Management Software?

A: AI is increasingly used for advanced risk modeling, detecting fraudulent applications faster, and personalizing collection strategies. Machine Learning algorithms can analyze vast datasets to provide more accurate credit scoring and predict prepayment risk better than traditional statistical models.

***

Disclaimer: This article provides information for educational purposes and should not be considered professional financial or legal advice. Consult relevant experts before implementing new software systems.

Loans Management Software

Loans Management Software Wallpapers

Collection of loans management software wallpapers for your desktop and mobile devices.

Gorgeous Loans Management Software Wallpaper Illustration

This gorgeous loans management software photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Lush Loans Management Software Artwork Digital Art

Find inspiration with this unique loans management software illustration, crafted to provide a fresh look for your background.

Spectacular Loans Management Software Landscape Digital Art

Find inspiration with this unique loans management software illustration, crafted to provide a fresh look for your background.

Lush Loans Management Software Background in 4K

Find inspiration with this unique loans management software illustration, crafted to provide a fresh look for your background.

Artistic Loans Management Software Design Illustration

Find inspiration with this unique loans management software illustration, crafted to provide a fresh look for your background.

Breathtaking Loans Management Software Scene for Your Screen

Transform your screen with this vivid loans management software artwork, a true masterpiece of digital design.

Detailed Loans Management Software Photo Collection

Explore this high-quality loans management software image, perfect for enhancing your desktop or mobile wallpaper.

Dynamic Loans Management Software Landscape in 4K

A captivating loans management software scene that brings tranquility and beauty to any device.

Lush Loans Management Software Moment Art

Immerse yourself in the stunning details of this beautiful loans management software wallpaper, designed for a captivating visual experience.

Stunning Loans Management Software View Nature

A captivating loans management software scene that brings tranquility and beauty to any device.

Crisp Loans Management Software Image Nature

A captivating loans management software scene that brings tranquility and beauty to any device.

Vivid Loans Management Software Landscape Photography

Transform your screen with this vivid loans management software artwork, a true masterpiece of digital design.

Detailed Loans Management Software Abstract Concept

Discover an amazing loans management software background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Exquisite Loans Management Software Photo for Desktop

This gorgeous loans management software photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Captivating Loans Management Software Picture Photography

This gorgeous loans management software photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Gorgeous Loans Management Software View Art

Immerse yourself in the stunning details of this beautiful loans management software wallpaper, designed for a captivating visual experience.

Gorgeous Loans Management Software Image Art

This gorgeous loans management software photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Captivating Loans Management Software Scene Nature

Immerse yourself in the stunning details of this beautiful loans management software wallpaper, designed for a captivating visual experience.

Stunning Loans Management Software Scene in 4K

This gorgeous loans management software photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Gorgeous Loans Management Software Abstract Concept

Find inspiration with this unique loans management software illustration, crafted to provide a fresh look for your background.

Download these loans management software wallpapers for free and use them on your desktop or mobile devices.