Microsoft sheds $360bn in market value as AI spending spooks investors

Microsoft Sheds $360bn in Market Value as Aggressive AI Spending Spooks Investors

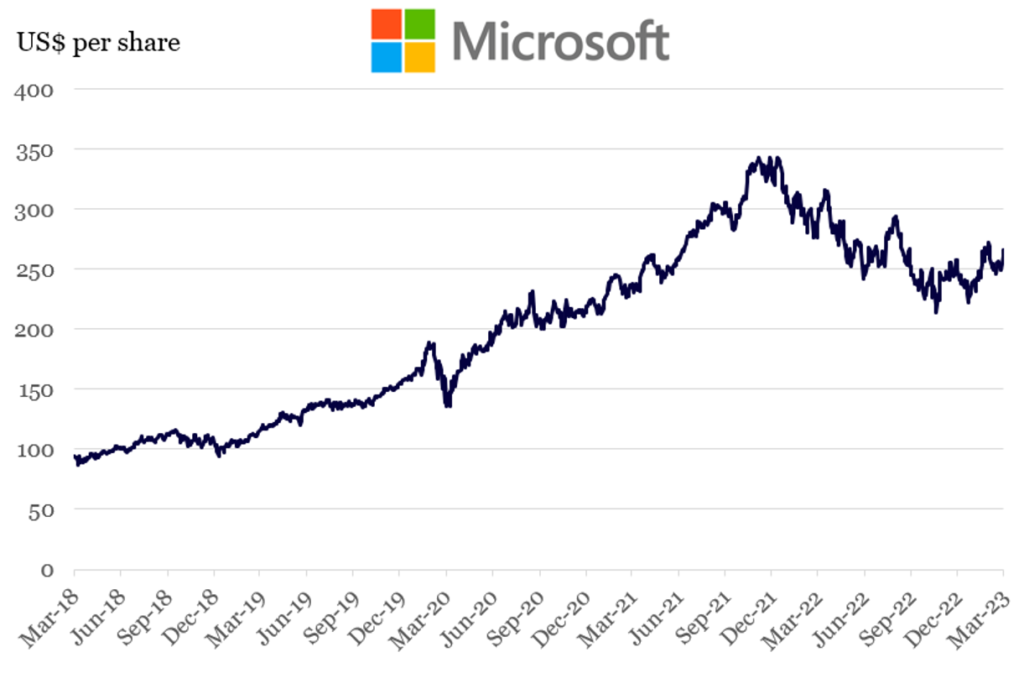

The dawn of the artificial intelligence era is proving to be immensely expensive. Microsoft, a champion of the generative AI revolution, recently saw its valuation plummet by an estimated $360 billion in a sharp post-earnings sell-off. While the company delivered generally strong quarterly results, the massive projected increase in capital expenditure (CapEx) required to fuel its AI infrastructure sent a clear, chilling message to Wall Street: the future is bright, but the upfront cost is staggering.

This dramatic stock dip highlights a growing tension across the tech sector: the conflict between delivering predictable quarterly profits and engaging in the necessary, high-risk investment required to win the global AI arms race. Investors, initially eager for AI growth, suddenly balked at the sheer scale of the investment needed to support services like Copilot and power the core Azure infrastructure.

Microsoft CEO Satya Nadella has consistently positioned the company at the vanguard of AI integration, partnering closely with OpenAI. However, the associated costs—primarily driven by procuring cutting-edge GPUs and constructing the requisite global data center footprint—are now testing investor patience and rewriting the rules of Big Tech valuation.

The immediate reaction in the market was brutal. What was meant to be a celebration of strong cloud performance quickly turned into an anxiety-driven fire sale, forcing analysts to rapidly reassess the immediate profit margins of this critical transition period.

The Azure Equation: Unprecedented CapEx and Cloud Infrastructure Costs

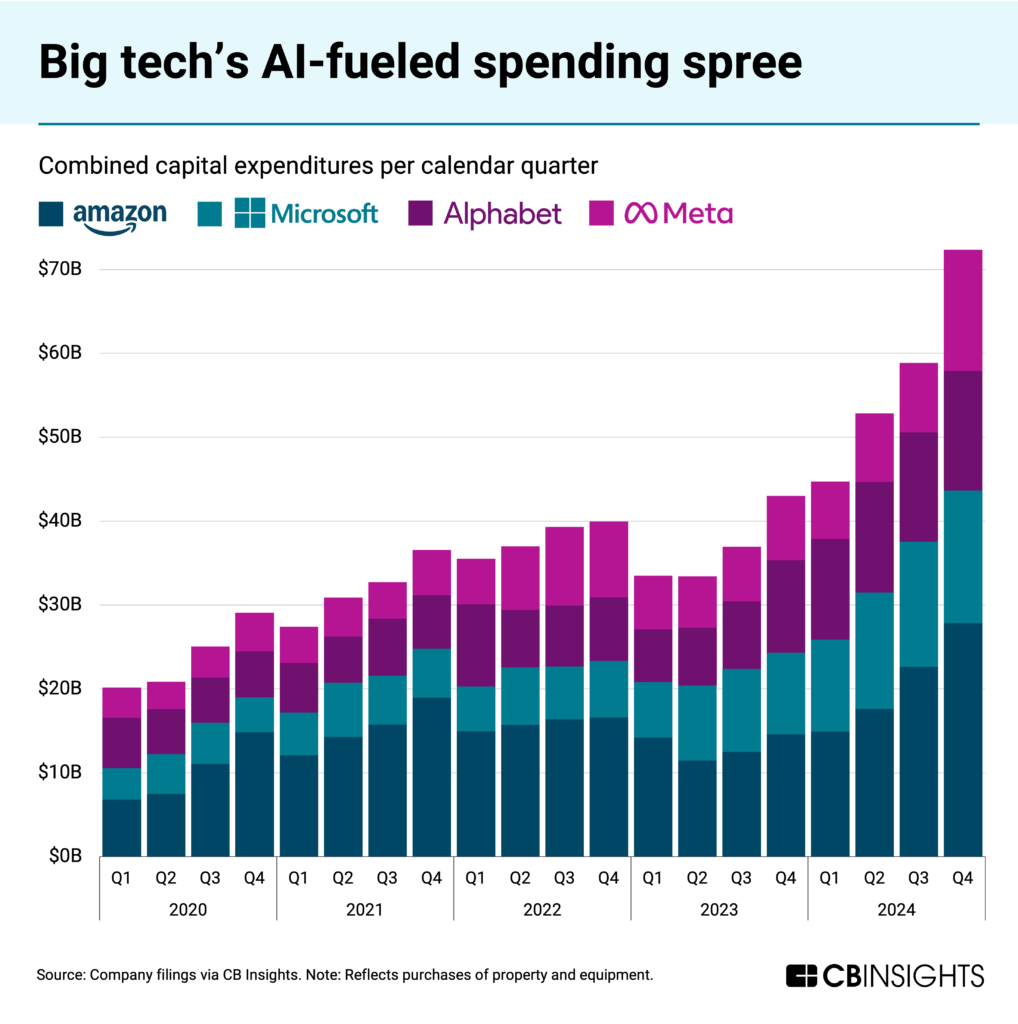

Microsoft's financial guidance revealed the heart of the matter. While the company's core cloud platform, Azure, continued its robust growth trajectory, the forward-looking forecast for capital expenditure became the primary concern. Microsoft signaled an astronomical spend increase dedicated almost entirely to AI infrastructure development.

This CapEx commitment is not merely about incremental server upgrades; it represents the largest, most aggressive infrastructure build-out in the company's history. It is a necessary prerequisite for handling the massive computational demands of large language models (LLMs) and integrating AI features into nearly every product, from Office 365 to Dynamics 365.

For context, CapEx figures are typically viewed by investors as a measure of future growth potential. But when the numbers surge exponentially, they signal a dramatic short-term drag on free cash flow and operating margins. This surge includes:

- Acquisition of thousands of powerful Nvidia H100 and AMD MI300X GPUs.

- Rapid construction and expansion of specialized AI data centers globally.

- Massive investments in interconnectivity hardware necessary for high-speed AI cluster communication.

- R&D dedicated to optimizing AI models specifically for the Azure environment.

"We are not holding back," was the implicit message from the leadership team. But for investors accustomed to tightly managed spending, the immediate dilution of near-term earnings potential was too much to stomach. One financial analyst described the situation as "burning the furniture to heat the house," acknowledging the long-term necessity but fearing the short-term impact on the balance sheet.

The challenge for Microsoft is communicating that this expense is fundamentally different from previous infrastructure cycles. It's not just scaling up; it's building entirely new computational architecture designed for the hyperscaler future. The high cost of specialized AI chips means that every dollar of CapEx now carries more weight and risk than in the era of traditional cloud scaling.

Investor Jitters: Fear of Commitment vs. Future Dominance

Why did such a significant stock dip occur if the underlying business, especially Azure, remains strong? The answer lies in market psychology and the fear surrounding execution risk in the highly competitive generative AI market.

I recall speaking with a fund manager shortly after the earnings call. His immediate concern wasn't the revenue; it was the *certainty* of the return on investment (ROI). He noted, "When you commit billions now, the market wants proof that the return pipeline is equally certain. Microsoft is asking us to trust that Copilot revenue will materialize fast enough to justify the burn rate."

The market is essentially undergoing a crisis of confidence concerning the timeline. While everyone agrees that AI is the future, investors are scared of two key factors:

- **The Payback Period:** How long will it take for the substantial investment in high-cost hardware (GPUs) to be fully utilized and generate profit? If customer adoption of Copilot tools lags, Microsoft could be left with massive, underutilized infrastructure.

- **Competitive Erosion:** The AI arms race involves Amazon (AWS) and Google (GCP), who are making equally aggressive CapEx commitments. Investors fear a pricing war in cloud AI services, which could drive down margins even as usage skyrockets.

Microsoft's aggressive posture is a bet on market dominance. Satya Nadella believes that scaling infrastructure now will create an insurmountable advantage—a moat—that competitors cannot easily cross. However, the financial community often favors short-term profitability over long-term strategic sacrifices. The $360 billion valuation cut reflects the immediate penalty the market imposes for sacrificing near-term operating leverage.

The messaging from Microsoft emphasized that the investments are paying off, pointing to early enterprise adoption of generative AI features. Yet, translating early adoption into sustained, high-margin revenue streams remains the critical challenge that the company must prove in the coming quarters to reassure nervous shareholders.

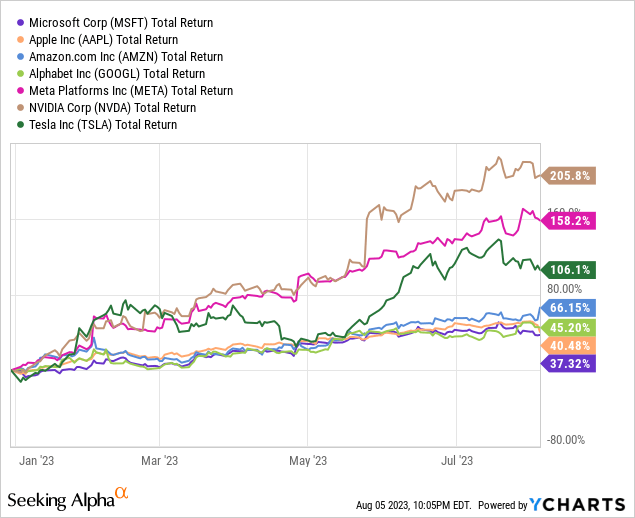

The Generative AI Arms Race and Big Tech Valuations

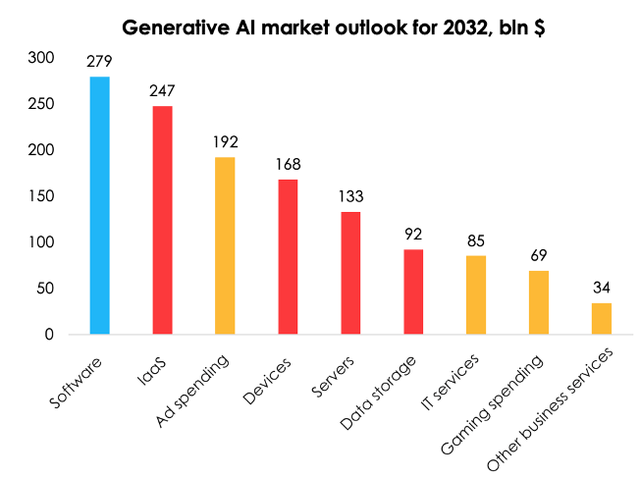

This incident is not unique to Microsoft; it's symptomatic of the entire Big Tech landscape adjusting to the enormous resource demands of AI. The investment required to build foundational models and deploy them at scale is fundamentally changing how tech companies are valued.

In the past, tech valuation favored lean operating models and high profitability. The AI era, however, demands intense, front-loaded capital investment akin to building a utility or laying fiber optic cables across continents. This shift necessitates higher acceptable levels of short-term capital expenditure, even if it temporarily dampens quarterly results.

The irony is that Microsoft's stock drop came precisely because it is executing its AI strategy aggressively. They are paying the "AI entrance fee." Companies that hesitate or underinvest now risk being permanently relegated in the next technological cycle.

Ultimately, the $360 billion drop is a powerful signal that the market is still struggling to price in the volatility and gargantuan cost of the AI transition. Is this temporary pain for massive long-term gain? Or does it signal unsustainable CapEx levels? The answer hinges entirely on the speed and efficacy of customer monetization.

For savvy long-term investors, the significant dip might represent a buying opportunity—a chance to acquire shares in a leading hyperscaler that is demonstrably prioritizing future relevance over immediate margin comfort. For others, the event serves as a stark warning: the cost of competing in the AI future is far higher than previously anticipated.

The battle for AI supremacy is now officially a high-stakes, high-spend endeavor, and Microsoft just paid the opening ante in front of a very skeptical audience.

Microsoft sheds $360bn in market value as AI spending spooks investors

Microsoft sheds $360bn in market value as AI spending spooks investors Wallpapers

Collection of microsoft sheds $360bn in market value as ai spending spooks investors wallpapers for your desktop and mobile devices.

Lush Microsoft Sheds $360bn In Market Value As Ai Spending Spooks Investors View for Mobile

A captivating microsoft sheds $360bn in market value as ai spending spooks investors scene that brings tranquility and beauty to any device.

Serene Microsoft Sheds $360bn In Market Value As Ai Spending Spooks Investors Picture Photography

Experience the crisp clarity of this stunning microsoft sheds $360bn in market value as ai spending spooks investors image, available in high resolution for all your screens.

Beautiful Microsoft Sheds $360bn In Market Value As Ai Spending Spooks Investors Scene in 4K

Experience the crisp clarity of this stunning microsoft sheds $360bn in market value as ai spending spooks investors image, available in high resolution for all your screens.

Artistic Microsoft Sheds $360bn In Market Value As Ai Spending Spooks Investors Photo for Your Screen

Find inspiration with this unique microsoft sheds $360bn in market value as ai spending spooks investors illustration, crafted to provide a fresh look for your background.

Breathtaking Microsoft Sheds $360bn In Market Value As Ai Spending Spooks Investors Landscape Digital Art

Explore this high-quality microsoft sheds $360bn in market value as ai spending spooks investors image, perfect for enhancing your desktop or mobile wallpaper.

Serene Microsoft Sheds $360bn In Market Value As Ai Spending Spooks Investors Background Art

Explore this high-quality microsoft sheds $360bn in market value as ai spending spooks investors image, perfect for enhancing your desktop or mobile wallpaper.

Dynamic Microsoft Sheds $360bn In Market Value As Ai Spending Spooks Investors Capture in HD

A captivating microsoft sheds $360bn in market value as ai spending spooks investors scene that brings tranquility and beauty to any device.

Mesmerizing Microsoft Sheds $360bn In Market Value As Ai Spending Spooks Investors Design Photography

Transform your screen with this vivid microsoft sheds $360bn in market value as ai spending spooks investors artwork, a true masterpiece of digital design.

Stunning Microsoft Sheds $360bn In Market Value As Ai Spending Spooks Investors Picture Illustration

This gorgeous microsoft sheds $360bn in market value as ai spending spooks investors photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Lush Microsoft Sheds $360bn In Market Value As Ai Spending Spooks Investors Abstract for Mobile

This gorgeous microsoft sheds $360bn in market value as ai spending spooks investors photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Vibrant Microsoft Sheds $360bn In Market Value As Ai Spending Spooks Investors Landscape for Your Screen

Discover an amazing microsoft sheds $360bn in market value as ai spending spooks investors background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Gorgeous Microsoft Sheds $360bn In Market Value As Ai Spending Spooks Investors Image in HD

This gorgeous microsoft sheds $360bn in market value as ai spending spooks investors photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Crisp Microsoft Sheds $360bn In Market Value As Ai Spending Spooks Investors Artwork for Your Screen

This gorgeous microsoft sheds $360bn in market value as ai spending spooks investors photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Lush Microsoft Sheds $360bn In Market Value As Ai Spending Spooks Investors Background for Your Screen

A captivating microsoft sheds $360bn in market value as ai spending spooks investors scene that brings tranquility and beauty to any device.

Lush Microsoft Sheds $360bn In Market Value As Ai Spending Spooks Investors Artwork for Your Screen

A captivating microsoft sheds $360bn in market value as ai spending spooks investors scene that brings tranquility and beauty to any device.

Dynamic Microsoft Sheds $360bn In Market Value As Ai Spending Spooks Investors Moment Digital Art

This gorgeous microsoft sheds $360bn in market value as ai spending spooks investors photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Exquisite Microsoft Sheds $360bn In Market Value As Ai Spending Spooks Investors Abstract in 4K

Immerse yourself in the stunning details of this beautiful microsoft sheds $360bn in market value as ai spending spooks investors wallpaper, designed for a captivating visual experience.

Mesmerizing Microsoft Sheds $360bn In Market Value As Ai Spending Spooks Investors View in HD

Experience the crisp clarity of this stunning microsoft sheds $360bn in market value as ai spending spooks investors image, available in high resolution for all your screens.

Serene Microsoft Sheds $360bn In Market Value As Ai Spending Spooks Investors Artwork Nature

Transform your screen with this vivid microsoft sheds $360bn in market value as ai spending spooks investors artwork, a true masterpiece of digital design.

Serene Microsoft Sheds $360bn In Market Value As Ai Spending Spooks Investors Design Digital Art

Transform your screen with this vivid microsoft sheds $360bn in market value as ai spending spooks investors artwork, a true masterpiece of digital design.

Download these microsoft sheds $360bn in market value as ai spending spooks investors wallpapers for free and use them on your desktop or mobile devices.