Where Can I Get A Personal Loan With Bad Credit

Where Can I Get A Personal Loan With Bad Credit: Your Guide to Funding Options

If you're facing an unexpected expense or need to consolidate debt but your credit score is less than stellar, you might be asking the crucial question: Where can I get a personal loan with bad credit? We understand how frustrating this situation can be. Having a low credit score doesn't automatically disqualify you from getting financial help, but it certainly makes the process challenging.

The good news is that specialized lenders, specific strategies, and alternative financial products exist just for people in your situation. This comprehensive guide will walk you through exactly where to look, what to expect, and how to increase your chances of approval, even with a history of missed payments or high utilization.

Understanding Bad Credit and Your Loan Options

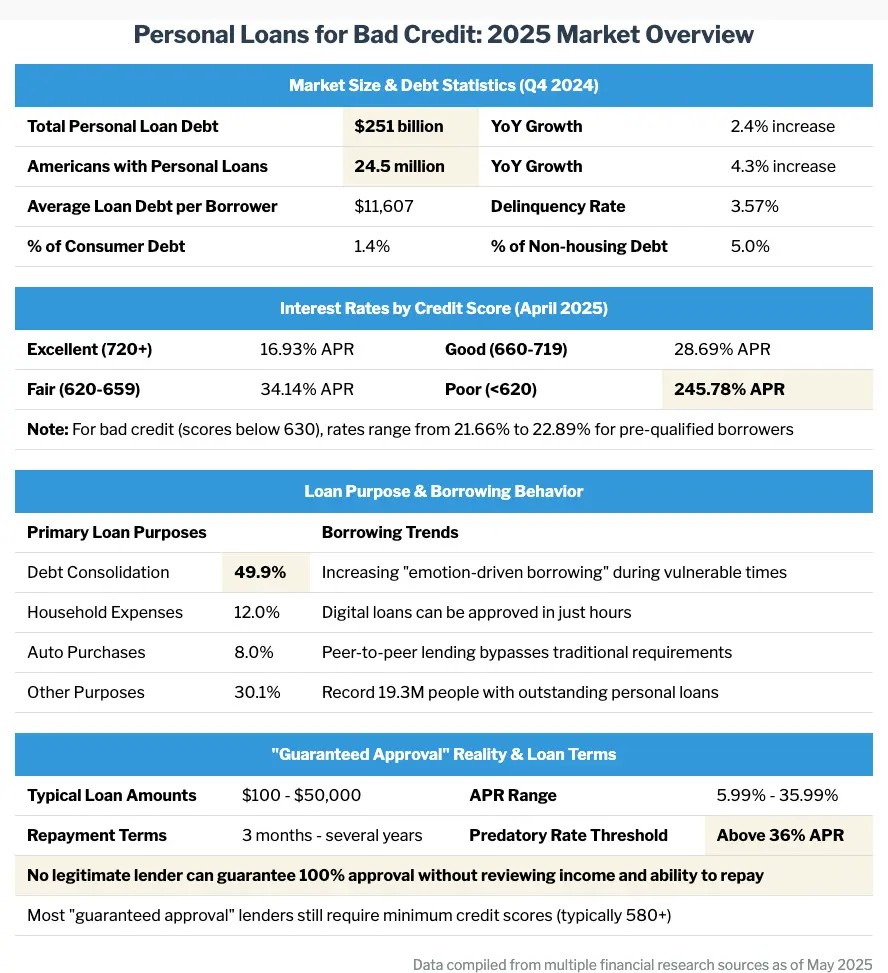

Before diving into specific lenders, it's important to adjust your expectations. "Bad credit" usually means a FICO score below 620, placing you in the subprime lending category. While loans are available here, they won't look the same as those offered to borrowers with excellent credit.

Why Bad Credit Makes Borrowing Harder

Lenders view a low credit score as a higher risk. They worry that if they lend you money, you might default on the payments. Because of this perceived risk, lenders compensate themselves by charging significantly higher interest rates (Annual Percentage Rate or APR) and sometimes adding hefty origination fees.

This means your focus should shift from finding the lowest possible rate to finding a rate that is manageable and affordable for your budget.

Realistic Expectations for Loans with Poor Credit

When searching for a personal loan with bad credit, keep the following realities in mind:

- **Higher APRs:** Expect rates that could reach 30% or even higher, depending on your score and state regulations.

- **Smaller Loan Amounts:** Lenders are less likely to approve you for a very large loan, often capping amounts at $5,000 or less initially.

- **Focus on Affordability:** The lender will scrutinize your income and existing debt heavily to ensure you have the capacity to repay the loan.

Top Places to Look for Personal Loans with Bad Credit

When you need to know Where Can I Get A Personal Loan With Bad Credit, the answer is usually not traditional big banks. You need to look toward lenders who specialize in alternative risk assessment.

Online Lenders Specializing in Subprime Credit

Online lenders are often your best bet. They use sophisticated algorithms that look beyond just the FICO score, focusing on your current income, employment stability, and banking history. This makes them much more flexible than traditional institutions.

Some prominent examples include companies that offer peer-to-peer lending or direct consumer installment loans tailored for lower credit tiers. It is highly recommended to pre-qualify with several of these lenders to compare offers without impacting your credit score (most use a soft credit pull initially).

How to Vet Online Lenders

Because the online lending space has less regulation than traditional banking, you must be cautious. Avoid predatory lenders who demand upfront fees or guarantee approval regardless of your income.

Before applying, ensure the lender is reputable by checking:

- Their registration status and consumer reviews (BBB, Trustpilot).

- Clarity on all fees, including origination fees and prepayment penalties.

- Whether they report payments to the major credit bureaus (this is crucial for rebuilding credit).

Credit Unions and Community Banks

If you are a member of a local credit union, they might be surprisingly helpful. Credit unions are non-profit and member-owned, meaning they often prioritize serving their community members over maximizing shareholder profits. They are typically more willing to look at your entire financial history—not just your score—especially if you have an existing relationship with them.

Many credit unions offer "Payday Alternative Loans" (PALs) which are small, short-term loans designed to be much safer and more affordable than standard high-cost payday loans.

Secured Loans (Using Collateral)

If you own an asset like a car, savings account, or certificate of deposit (CD), you may be able to secure your loan with it. Secured loans reduce the risk for the lender, which usually results in a lower interest rate, even for those with poor credit.

However, be aware that if you default on a secured loan, the lender has the legal right to seize your collateral. Only consider this option if you are highly confident in your ability to repay the debt.

Alternatives to Traditional Personal Loans

Sometimes, a traditional personal loan isn't the only way forward. When searching for Where Can I Get A Personal Loan With Bad Credit, expanding your view to non-traditional borrowing methods can open up viable solutions.

Co-Signers: The Power of Shared Responsibility

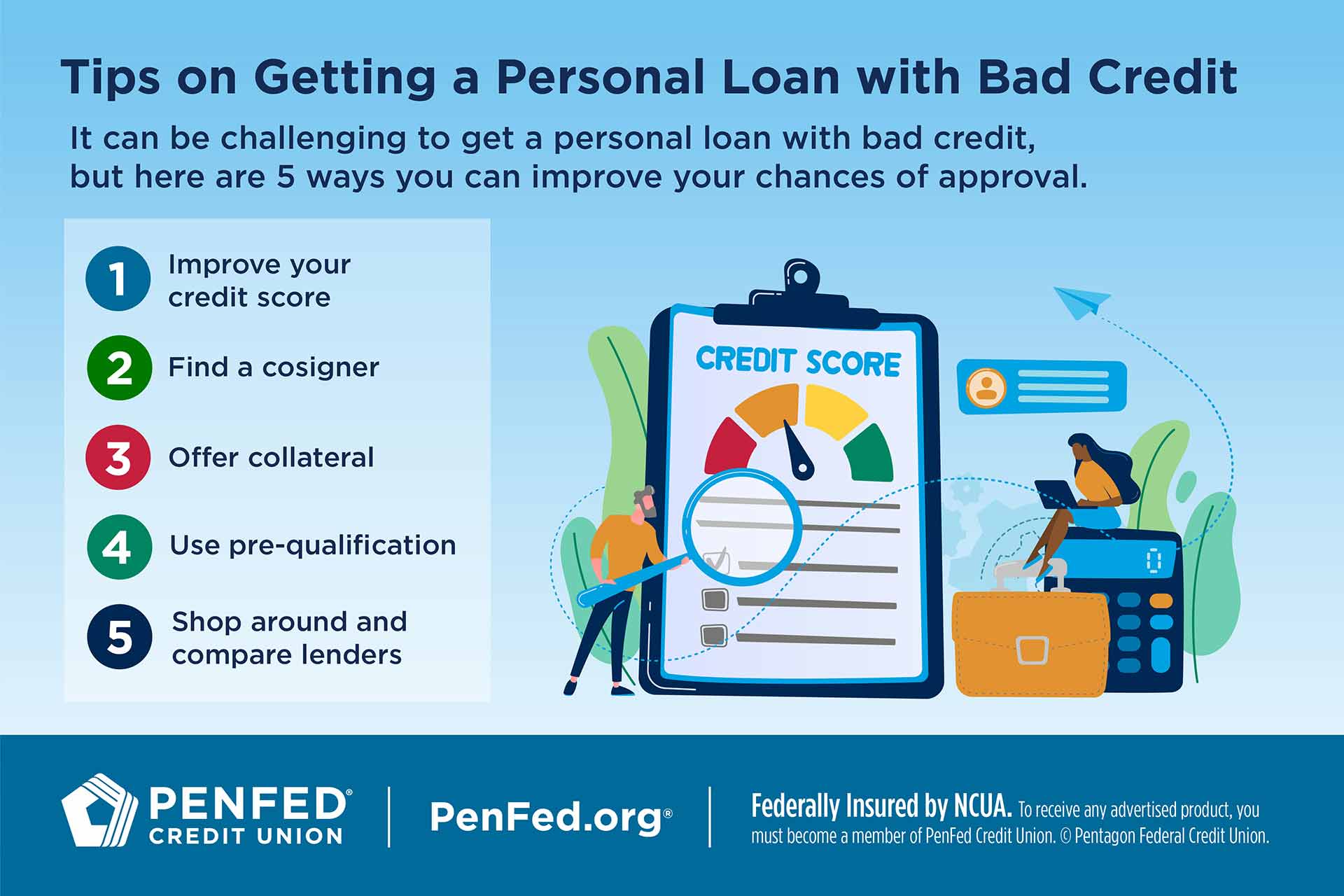

A co-signer is a person, usually a family member or close friend, with excellent credit who agrees to take full responsibility for the loan if you fail to pay. Their credit score essentially acts as your leverage, significantly improving your approval odds and securing you a much better interest rate than you could get alone.

This is a major commitment for the co-signer, as their credit will be damaged if you default. Only enter into a co-signing arrangement if you are absolutely sure you can make every payment on time.

Payday Loans: Proceed with Extreme Caution

While extremely accessible to those with bad credit, payday loans carry astronomical interest rates—often reaching 400% APR or more. They are designed to be paid off completely within two to four weeks. If you cannot meet this short deadline, you risk getting trapped in a cycle of debt where fees accumulate rapidly.

Use payday loans only as an absolute, last-resort emergency measure, and only if you have a guaranteed repayment plan within the initial term.

Tips to Improve Your Approval Chances and Lower Rates

Before you even submit your first application, taking proactive steps can make a difference in the offers you receive. Lenders are always looking for borrowers who demonstrate financial responsibility, even if their past record is spotty.

Here are crucial steps to take:

- **Check Your Credit Report:** Look for errors and dispute them immediately. Removing one incorrect negative mark can boost your score quickly.

- **Calculate Your Debt-to-Income (DTI) Ratio:** Most lenders prefer a DTI below 40%. Pay down any small credit card balances before applying to improve this ratio.

- **Gather Documents:** Have proof of income (pay stubs, tax returns), employment history, and identification ready. Being organized makes you look like a lower-risk borrower.

- **Apply for Pre-Approval:** This allows you to see potential rates and terms without committing to a full application or enduring a hard inquiry on your report.

If you can wait six months, focusing intensively on raising your score by making all existing payments on time will provide the biggest return on investment by unlocking lower rates and better loan products.

Conclusion

Finding Where Can I Get A Personal Loan With Bad Credit requires diligent research and an understanding that the terms won't be perfect. Your best options generally lie with online lenders specializing in subprime credit, followed closely by local credit unions, especially if you have an established relationship.

Remember to prioritize affordability over the immediate cash injection. Scrutinize the APR, term length, and total cost of the loan. By approaching the process carefully and exploring secured options or co-signers, you can secure the necessary financing while simultaneously working toward rebuilding a stronger financial future.

Frequently Asked Questions (FAQ)

- Can I get a personal loan if my credit score is below 580?

- Yes, it is possible, but highly challenging. Lenders catering to scores below 580 will offer very high APRs (often 35%+). You should focus primarily on online specialty lenders or secured loan options in this credit range.

- What interest rate should I expect with bad credit?

- For bad credit (FICO 580–620), you should generally expect an APR ranging from 20% up to 36%. Rates closer to 36% are common for the lowest credit scores.

- Will applying for pre-approval hurt my credit score?

- No. Most reputable online lenders offer pre-qualification using a soft credit inquiry, which does not affect your score. A hard inquiry (which slightly lowers your score) only happens when you accept an offer and submit the final application.

- Are there loans with guaranteed approval for bad credit?

- You should be wary of any lender promising "guaranteed approval." Legitimate lenders must review your ability to repay the loan (income and existing debt) before approving you. Guarantees often indicate predatory behavior or very high-interest options like title loans or payday loans.

Where Can I Get A Personal Loan With Bad Credit

Where Can I Get A Personal Loan With Bad Credit Wallpapers

Collection of where can i get a personal loan with bad credit wallpapers for your desktop and mobile devices.

Artistic Where Can I Get A Personal Loan With Bad Credit View Nature

This gorgeous where can i get a personal loan with bad credit photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Amazing Where Can I Get A Personal Loan With Bad Credit Scene for Mobile

Experience the crisp clarity of this stunning where can i get a personal loan with bad credit image, available in high resolution for all your screens.

Breathtaking Where Can I Get A Personal Loan With Bad Credit Scene Collection

Explore this high-quality where can i get a personal loan with bad credit image, perfect for enhancing your desktop or mobile wallpaper.

Gorgeous Where Can I Get A Personal Loan With Bad Credit Photo for Your Screen

A captivating where can i get a personal loan with bad credit scene that brings tranquility and beauty to any device.

Amazing Where Can I Get A Personal Loan With Bad Credit View Collection

Transform your screen with this vivid where can i get a personal loan with bad credit artwork, a true masterpiece of digital design.

Breathtaking Where Can I Get A Personal Loan With Bad Credit View Art

Discover an amazing where can i get a personal loan with bad credit background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Stunning Where Can I Get A Personal Loan With Bad Credit Moment Art

Find inspiration with this unique where can i get a personal loan with bad credit illustration, crafted to provide a fresh look for your background.

High-Quality Where Can I Get A Personal Loan With Bad Credit Wallpaper Nature

Discover an amazing where can i get a personal loan with bad credit background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Lush Where Can I Get A Personal Loan With Bad Credit Scene Art

Find inspiration with this unique where can i get a personal loan with bad credit illustration, crafted to provide a fresh look for your background.

Artistic Where Can I Get A Personal Loan With Bad Credit Capture Nature

Immerse yourself in the stunning details of this beautiful where can i get a personal loan with bad credit wallpaper, designed for a captivating visual experience.

Stunning Where Can I Get A Personal Loan With Bad Credit Wallpaper for Your Screen

Immerse yourself in the stunning details of this beautiful where can i get a personal loan with bad credit wallpaper, designed for a captivating visual experience.

Lush Where Can I Get A Personal Loan With Bad Credit Photo Concept

Find inspiration with this unique where can i get a personal loan with bad credit illustration, crafted to provide a fresh look for your background.

Vibrant Where Can I Get A Personal Loan With Bad Credit Artwork in 4K

Experience the crisp clarity of this stunning where can i get a personal loan with bad credit image, available in high resolution for all your screens.

Beautiful Where Can I Get A Personal Loan With Bad Credit Background Photography

Explore this high-quality where can i get a personal loan with bad credit image, perfect for enhancing your desktop or mobile wallpaper.

Mesmerizing Where Can I Get A Personal Loan With Bad Credit Picture in 4K

Explore this high-quality where can i get a personal loan with bad credit image, perfect for enhancing your desktop or mobile wallpaper.

Breathtaking Where Can I Get A Personal Loan With Bad Credit Landscape Illustration

Transform your screen with this vivid where can i get a personal loan with bad credit artwork, a true masterpiece of digital design.

Captivating Where Can I Get A Personal Loan With Bad Credit Background for Mobile

This gorgeous where can i get a personal loan with bad credit photo offers a breathtaking view, making it a perfect choice for your next wallpaper.