Where Can I Get Workers Compensation Insurance

Where Can I Get Workers Compensation Insurance: A Complete Guide for Business Owners

If you're a business owner, especially one with employees, you've likely spent time wondering: Where can I get Workers Compensation Insurance? It's a critical question because, in almost every state, carrying Workers Compensation (or Workers Comp) coverage is mandatory. But navigating the insurance landscape can feel like a maze.

Don't worry, we're here to simplify the process. This comprehensive guide will walk you through the various options available, ensuring you can secure the necessary coverage quickly and efficiently, keeping your business compliant and your employees protected.

Why Do You Need Workers Compensation Insurance Anyway?

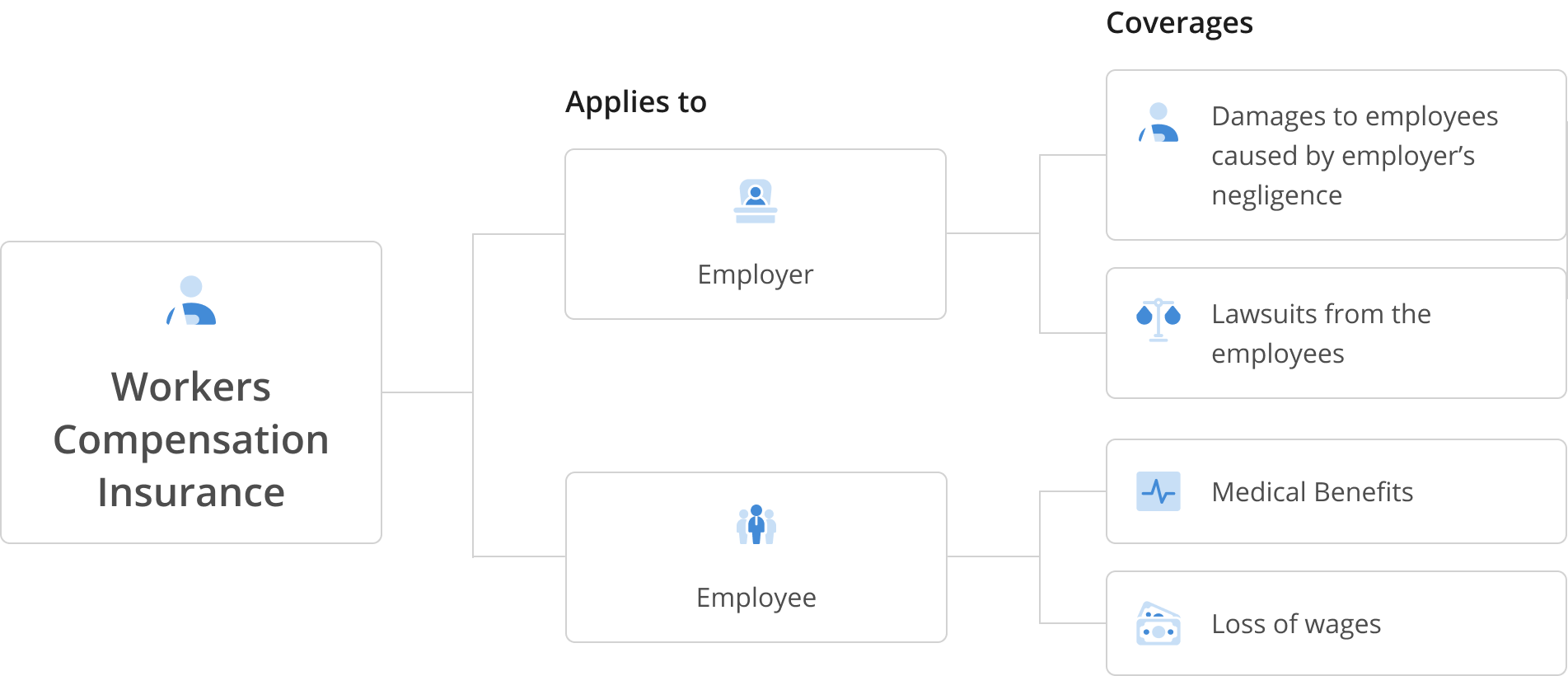

Before diving into the "how" and "where," let's quickly touch on the "why." Workers Compensation is crucial because it provides financial benefits to employees who suffer job-related injuries or illnesses. This coverage typically pays for medical treatment, disability payments, and vocational rehabilitation.

For you, the employer, Workers Comp serves another essential function: it protects your business from costly lawsuits. In exchange for providing this coverage, employees generally give up the right to sue the employer for negligence related to the injury. It's a win-win system that keeps your operations smooth and legal.

If you are asking, "Where can I get Workers Compensation Insurance?" it shows you are taking your compliance obligations seriously. Failure to carry coverage, even if you only have one employee, can lead to steep fines, penalties, and even criminal charges depending on your state.

The Main Sources: Where Can I Get Workers Compensation Insurance?

There are generally three primary avenues businesses use to obtain Workers Compensation Insurance. The best choice for you will depend on your state's regulations, your industry, and your company's risk profile.

Option 1: Independent Insurance Agents and Brokers

For most small and medium-sized businesses, working with an independent insurance agent or broker is the easiest and most effective way to secure coverage. These professionals don't work for a single insurance company; instead, they work for you.

An independent broker can shop around among multiple carriers to find the best policy and rate that fits your specific needs. They are also experts in state regulations and can ensure your coverage limits are compliant. If you are struggling with the question, "Where can I get Workers Compensation Insurance," starting with a local, reputable broker is highly recommended.

Benefits of Using a Broker:

- They compare quotes from many different carriers.

- They understand complex underwriting rules specific to your industry.

- They provide personalized advice and support during policy renewal or claim filings.

Option 2: Direct Carriers (Insurance Companies)

You can also purchase a Workers Comp policy directly from a major insurance carrier, such as Travelers, Hartford, or Liberty Mutual. Many large carriers offer online portals for quoting and purchasing, which can be convenient if you have a straightforward business model.

However, when buying direct, you are relying solely on that carrier's product offerings and pricing. While you might save on agent commission fees, you lose the personalized advice that a broker provides, which is especially valuable if your business has unique risk factors or a history of claims.

Option 3: State-Funded Programs or Assigned Risk Pools

Some states operate their own monopolistic or competitive state funds. States like Ohio, Washington, and Wyoming require businesses to purchase coverage directly through their state programs. If you operate in one of these states, your question "Where can I get Workers Compensation Insurance" has a single answer: the state fund.

Furthermore, if your business has a very high claim history or operates in a high-risk industry, private insurers might decline to offer you coverage. In this scenario, you would turn to the "Assigned Risk Market" or "Residual Market." This is a mechanism mandated by the state to ensure every legitimate business can secure required coverage. Premiums in this pool are often higher, but it guarantees compliance.

Understanding the Factors that Affect Your Premium

When you start shopping for quotes, you'll notice that premiums vary widely. Understanding what drives these costs helps you find the most competitive rate.

- Employee Classification (The Rate): This is the biggest factor. Every job is assigned a four-digit classification code based on the inherent risk of the work. For example, an office worker has a much lower rate than a roofer.

- Payroll: The premium is calculated by multiplying the rate for each classification code by every $100 of your employee payroll.

- Experience Modification Rating (e-Mod): If your company has been operating for a few years, you will have an e-Mod rating. This factor compares your company's actual claims history to the expected average claims for businesses in your industry. If your e-Mod is below 1.0, you receive a discount; if it's above 1.0, you pay a surcharge.

- State Regulations: Rates are heavily regulated by state rating bureaus, meaning pricing can differ significantly from one state to the next.

Steps to Secure Your Workers Comp Policy

Ready to move forward? Follow these steps, which are crucial regardless of whether you choose a broker or a direct carrier, to successfully obtain your coverage.

First, gather all the necessary documentation. This includes detailed payroll records, accurate employee job descriptions (to determine classification codes), and your Federal Employer Identification Number (FEIN).

Next, determine your desired effective date. Insurance coverage must be continuous. If you are starting a new policy, ensure the date aligns perfectly with the termination of your old policy or your company's start date.

Finally, review the quotes carefully. Don't just look at the total premium. Pay attention to the payment structure. Some carriers offer "Pay-As-You-Go" options, where premium payments are tied directly to your real-time payroll, which can save you from a massive audit bill at the end of the year.

What to Look for in a Workers Comp Provider

When choosing where to get Workers Compensation Insurance, it's not just about the cheapest price. A good carrier or broker should offer support that minimizes your risk and helps you handle claims effectively.

Look for providers who emphasize safety programs and loss control services. A strong carrier will provide resources to help you reduce workplace hazards, which directly lowers your e-Mod rating and saves you money in the long run. Also, investigate their claims handling reputation. A slow or difficult claims process can severely impact your injured employee and potentially lead to litigation.

Make sure they are also comfortable integrating with your existing payroll systems, making the administrative burden of managing your policy much lighter.

Conclusion

Finding the answer to "Where can I get Workers Compensation Insurance?" doesn't have to be overwhelming. Whether you choose the personalized service of an independent agent, the direct relationship with a major carrier, or are directed to a state fund, the most important thing is securing adequate coverage before your employees start working.

Workers Compensation is a necessary investment in your team's safety and your business's legal protection. Start gathering your payroll information today and reach out to a broker or carrier to ensure you remain compliant and protected against the unexpected risks inherent in running a thriving business.

Remember, prioritizing workplace safety is the best long-term strategy to keep your premiums low and ensure that your workers comp policy is there when you truly need it.

Frequently Asked Questions (FAQ)

- Is Workers Compensation mandatory in every state?

- While rules vary, Workers Compensation is mandatory in nearly every state if you have even one employee. Texas is the main exception, where it is generally optional for private employers, though highly recommended.

- Can I purchase Workers Comp Insurance online?

- Yes, many direct carriers and digital insurance platforms allow small businesses to get quotes and purchase Workers Compensation Insurance policies entirely online, especially for low-risk industries like professional services.

- What is the difference between a broker and an agent?

- An agent usually represents one or a few specific insurance companies, whereas a broker works independently and can shop the market by comparing quotes from many different carriers to find you the best fit.

- How often should I review my Workers Compensation policy?

- You should review your policy annually upon renewal, but also anytime there is a significant change to your business, such as hiring employees in a new job classification (e.g., adding a warehouse position to an otherwise office-based staff) or making major payroll adjustments.

- Does the state fund offer better rates than private carriers?

- Not necessarily. State funds are designed to ensure coverage availability. While they may be competitive, private carriers often offer better rates and superior customer service for businesses with a good safety record (low e-Mod) due to the competition in the open market.

Where Can I Get Workers Compensation Insurance

Where Can I Get Workers Compensation Insurance Wallpapers

Collection of where can i get workers compensation insurance wallpapers for your desktop and mobile devices.

Dynamic Where Can I Get Workers Compensation Insurance Background for Mobile

Find inspiration with this unique where can i get workers compensation insurance illustration, crafted to provide a fresh look for your background.

Spectacular Where Can I Get Workers Compensation Insurance View Collection

Immerse yourself in the stunning details of this beautiful where can i get workers compensation insurance wallpaper, designed for a captivating visual experience.

Exquisite Where Can I Get Workers Compensation Insurance Design for Desktop

A captivating where can i get workers compensation insurance scene that brings tranquility and beauty to any device.

Spectacular Where Can I Get Workers Compensation Insurance Picture Nature

This gorgeous where can i get workers compensation insurance photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Amazing Where Can I Get Workers Compensation Insurance Image Art

Transform your screen with this vivid where can i get workers compensation insurance artwork, a true masterpiece of digital design.

Exquisite Where Can I Get Workers Compensation Insurance Picture Nature

Immerse yourself in the stunning details of this beautiful where can i get workers compensation insurance wallpaper, designed for a captivating visual experience.

Crisp Where Can I Get Workers Compensation Insurance View in HD

Find inspiration with this unique where can i get workers compensation insurance illustration, crafted to provide a fresh look for your background.

Vibrant Where Can I Get Workers Compensation Insurance Abstract for Mobile

Discover an amazing where can i get workers compensation insurance background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Mesmerizing Where Can I Get Workers Compensation Insurance Design Collection

Discover an amazing where can i get workers compensation insurance background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Detailed Where Can I Get Workers Compensation Insurance View Concept

Discover an amazing where can i get workers compensation insurance background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Captivating Where Can I Get Workers Compensation Insurance Capture Art

Immerse yourself in the stunning details of this beautiful where can i get workers compensation insurance wallpaper, designed for a captivating visual experience.

Captivating Where Can I Get Workers Compensation Insurance Moment for Desktop

This gorgeous where can i get workers compensation insurance photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Amazing Where Can I Get Workers Compensation Insurance Picture Photography

Discover an amazing where can i get workers compensation insurance background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Dynamic Where Can I Get Workers Compensation Insurance Image Illustration

Immerse yourself in the stunning details of this beautiful where can i get workers compensation insurance wallpaper, designed for a captivating visual experience.

Spectacular Where Can I Get Workers Compensation Insurance Landscape Photography

A captivating where can i get workers compensation insurance scene that brings tranquility and beauty to any device.

Breathtaking Where Can I Get Workers Compensation Insurance Picture for Desktop

Discover an amazing where can i get workers compensation insurance background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Amazing Where Can I Get Workers Compensation Insurance Artwork in 4K

Explore this high-quality where can i get workers compensation insurance image, perfect for enhancing your desktop or mobile wallpaper.