Why Netflix Stock May Be a Buy Right Now

Why Netflix Stock May Be a Buy Right Now: The Streaming Titan's Resurgent Narrative

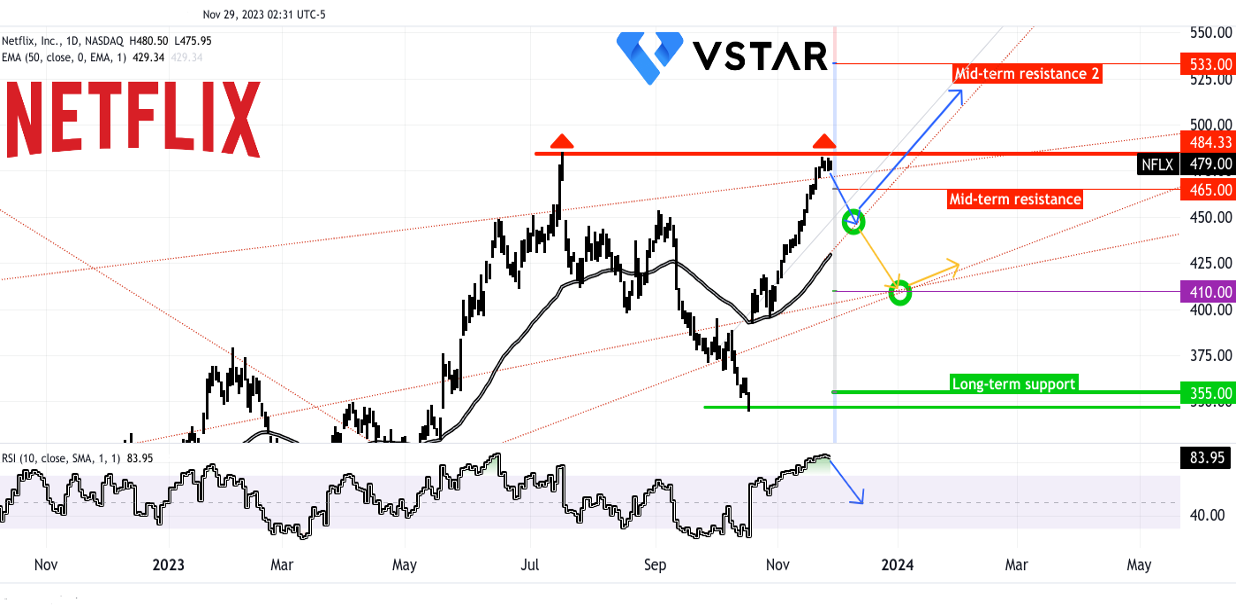

For years, the narrative around Netflix ($NFLX) was simple: unstoppable growth fueled by endless spending. Then came the "Streaming Wars," market saturation, and 2022's brutal stock correction. Wall Street grew skeptical. Was the age of pure subscriber growth over? Had Netflix hit its ceiling?

If you felt that skepticism—I did too. I remember checking my subscription costs during the post-pandemic inflation spike, wondering if I really needed *another* streaming service. But guess which app always stayed? Netflix. Why? Because despite the competition, Netflix mastered one thing: habit formation and essential content.

Today, Netflix isn't just surviving the streaming wars; it's winning them by fundamentally changing its business model. The company has successfully pivoted from focusing solely on gross subscriber additions to prioritizing profitability, monetization, and discipline. This shift makes $NFLX perhaps the most compelling tech stock in the entertainment sector right now.

The Subscription Engine Roars: Ad Tier and Password Crackdown Success

The biggest reason for Netflix's recent financial strength is the successful execution of two massive strategic pivots that investors doubted could be pulled off: monetizing shared accounts and integrating an ad-supported tier.

The "password sharing crackdown" was seen by many analysts as a huge risk—a potential catalyst for customer backlash and high churn rates. Instead, the opposite happened. When Netflix rolled out its plan to convert freeloaders into paid subscribers (or "Extra Members"), the immediate results were outstanding.

In regions where the enforcement was piloted, Netflix experienced historic increases in net additions. Millions of households that were previously sharing accounts either converted to full paid memberships or opted for the lower-cost, ad-supported tier. This effort single-handedly reignited subscriber growth globally.

Simultaneously, the launch of the Basic with Ads plan has proven to be a high-margin growth lever. This new tier serves multiple critical purposes:

- Attracts the Price-Sensitive Consumer: It provides a lower barrier to entry, attracting millions who might have balked at the standard subscription price.

- Reduces Churn: By offering a cheaper option, subscribers are less likely to fully cancel the service during tough economic times.

- High Revenue Per User (RPU): The revenue generated from advertising often significantly outweighs the discount offered on the subscription price. Netflix retains strong control over ad inventory, ensuring premium CPMs (Cost Per Mille).

- Operational Efficiency: It diversifies Netflix's revenue streams away from reliance solely on monthly subscription fees, stabilizing income during macroeconomic swings.

The success of these two initiatives proves that Netflix still possesses immense pricing power and operational agility. They turned their biggest structural weakness—ubiquitous password sharing—into a powerful source of new, high-quality revenue growth. The so-called "streaming wars" are now less about capturing new users and more about maximizing the RPU of existing ones, a game Netflix is currently mastering.

Mastering Monetization: Free Cash Flow and Valuation Resilience

The transition in Netflix's financial narrative is perhaps the most compelling argument for its current buy rating. The company is no longer the capital-burning machine it was during its aggressive global expansion phase.

For years, bears criticized Netflix for its negative Free Cash Flow (FCF), arguing that the company was masking operational costs through debt financing. That criticism is now obsolete. Netflix is generating enormous amounts of cash.

Management has guided for robust FCF generation, largely due to optimized content spending. While Netflix still spends billions on programming, they are becoming far more disciplined. They are moving away from the "throw everything at the wall" strategy and focusing on renewals and massive tentpole hits with proven global appeal (like *Squid Game* or *The Crown*).

This increased FCF is being channeled into highly attractive returns for shareholders, primarily through strategic share buybacks. A company generating massive cash flow and reducing its share count effectively means that each outstanding share owns a larger piece of a increasingly profitable pie.

Furthermore, operating margins continue to expand. As the ad business scales and technological costs flatten, more revenue drops directly to the bottom line. Analysts project steady, multi-year margin expansion, making Netflix look less like a volatile growth stock and more like a resilient, profitable tech giant.

The current valuation, when judged on a Price-to-Earnings (P/E) ratio relative to its expected growth rate (PEG ratio), is far more attractive than it was during peak pandemic hype. Investors are buying into a stable, profitable business with clear catalysts for continued cash flow generation, rather than a speculative growth story.

- Financial Strength Indicators:

- High Free Cash Flow Conversion Rate.

- Robust Balance Sheet Stability.

- Clear Path to Expanding Operating Margins (Targeting over 25% long-term).

- Aggressive use of Share Buybacks to increase EPS (Earnings Per Share).

Beyond Streaming: Gaming, Live Events, and Global Expansion

While the core subscription business is stronger than ever, Netflix's long-term thesis is underpinned by smart diversification efforts designed to reduce churn and increase customer lifetime value (CLV).

The push into mobile gaming is a critical, yet often underestimated, growth avenue. Netflix is bundling dozens of high-quality mobile games—available exclusively to subscribers with no ads or in-app purchases—into the existing subscription price. This strategy aims to increase the "stickiness" of the platform. If you love a show like *Stranger Things*, having an exclusive mobile game based on the IP gives you another reason not to cancel.

Similarly, live events are proving to be powerful churn mitigators. Netflix has begun experimenting with live sports content (like "The Netflix Slam" tennis match) and high-profile live comedy specials. These events generate massive social media buzz and require viewers to tune in simultaneously, reinforcing the habit of logging into the app regularly—a key driver for reducing the likelihood of subscription cancellation.

Geographically, Netflix still has significant room for penetration. While saturation is high in North America, markets in APAC (Asia-Pacific) and LATAM (Latin America) are still maturing. As broadband infrastructure improves in these regions, Netflix's localized content strategy (producing massive non-English language global hits) positions them perfectly to capture the next billion consumers.

Finally, the inherent strength of their Intellectual Property (IP) is a hidden asset. Unlike competitors who license content from external studios, Netflix owns the global rights to many of its biggest hits. This IP can be leveraged far beyond the screen—into merchandise, consumer products, experiential events, and sequels—creating an ecosystem of revenue streams that further solidifies their financial standing.

In conclusion, the Netflix of today is fundamentally different from the company struggling just two years ago. It has successfully navigated structural market headwinds by embracing monetization through advertising and converting password sharing into paid growth. Coupled with a strong focus on Free Cash Flow and smart diversification into gaming and live content, Netflix represents a compelling buy opportunity for investors seeking exposure to a newly mature, highly profitable, and resilient streaming leader.

Why Netflix Stock May Be a Buy Right Now

Why Netflix Stock May Be a Buy Right Now Wallpapers

Collection of why netflix stock may be a buy right now wallpapers for your desktop and mobile devices.

Lush Why Netflix Stock May Be A Buy Right Now Artwork Nature

Find inspiration with this unique why netflix stock may be a buy right now illustration, crafted to provide a fresh look for your background.

Mesmerizing Why Netflix Stock May Be A Buy Right Now Design for Your Screen

Explore this high-quality why netflix stock may be a buy right now image, perfect for enhancing your desktop or mobile wallpaper.

Dynamic Why Netflix Stock May Be A Buy Right Now Artwork for Your Screen

This gorgeous why netflix stock may be a buy right now photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Exquisite Why Netflix Stock May Be A Buy Right Now Photo Collection

This gorgeous why netflix stock may be a buy right now photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Lush Why Netflix Stock May Be A Buy Right Now Artwork Nature

Find inspiration with this unique why netflix stock may be a buy right now illustration, crafted to provide a fresh look for your background.

Mesmerizing Why Netflix Stock May Be A Buy Right Now Wallpaper Illustration

Explore this high-quality why netflix stock may be a buy right now image, perfect for enhancing your desktop or mobile wallpaper.

Gorgeous Why Netflix Stock May Be A Buy Right Now Background Illustration

A captivating why netflix stock may be a buy right now scene that brings tranquility and beauty to any device.

Breathtaking Why Netflix Stock May Be A Buy Right Now Image Photography

Explore this high-quality why netflix stock may be a buy right now image, perfect for enhancing your desktop or mobile wallpaper.

Captivating Why Netflix Stock May Be A Buy Right Now Design for Desktop

Immerse yourself in the stunning details of this beautiful why netflix stock may be a buy right now wallpaper, designed for a captivating visual experience.

Lush Why Netflix Stock May Be A Buy Right Now View Illustration

A captivating why netflix stock may be a buy right now scene that brings tranquility and beauty to any device.

Captivating Why Netflix Stock May Be A Buy Right Now Artwork Nature

Find inspiration with this unique why netflix stock may be a buy right now illustration, crafted to provide a fresh look for your background.

Captivating Why Netflix Stock May Be A Buy Right Now Scene Collection

Find inspiration with this unique why netflix stock may be a buy right now illustration, crafted to provide a fresh look for your background.

Crisp Why Netflix Stock May Be A Buy Right Now Photo Photography

Find inspiration with this unique why netflix stock may be a buy right now illustration, crafted to provide a fresh look for your background.

Dynamic Why Netflix Stock May Be A Buy Right Now Scene Collection

This gorgeous why netflix stock may be a buy right now photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Artistic Why Netflix Stock May Be A Buy Right Now Wallpaper Concept

A captivating why netflix stock may be a buy right now scene that brings tranquility and beauty to any device.

Spectacular Why Netflix Stock May Be A Buy Right Now Background Digital Art

Immerse yourself in the stunning details of this beautiful why netflix stock may be a buy right now wallpaper, designed for a captivating visual experience.

Beautiful Why Netflix Stock May Be A Buy Right Now Landscape in HD

Explore this high-quality why netflix stock may be a buy right now image, perfect for enhancing your desktop or mobile wallpaper.

Crisp Why Netflix Stock May Be A Buy Right Now Picture Art

Find inspiration with this unique why netflix stock may be a buy right now illustration, crafted to provide a fresh look for your background.

Breathtaking Why Netflix Stock May Be A Buy Right Now Scene for Desktop

Discover an amazing why netflix stock may be a buy right now background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Amazing Why Netflix Stock May Be A Buy Right Now Design Nature

Experience the crisp clarity of this stunning why netflix stock may be a buy right now image, available in high resolution for all your screens.

Download these why netflix stock may be a buy right now wallpapers for free and use them on your desktop or mobile devices.