AMD Outlook Disappoints Investors Seeking Bigger AI Payoff

AMD Outlook Disappoints Investors Seeking Bigger AI Payoff

The anticipation was palpable. Wall Street had placed enormous bets on Advanced Micro Devices (AMD), hoping its quarterly earnings report would solidify its position as the undisputed "AI challenger" to Nvidia. However, when the highly anticipated guidance dropped, the collective exhale across trading floors was one of deep disappointment.

For months, aggressive investors have chased AI growth stories, pushing AMD's valuation to staggering heights based on future potential. The belief was simple: if Nvidia is the king of AI compute, AMD's revolutionary MI300X accelerator would guarantee a significant, immediate slice of the lucrative datacenter market. But the numbers revealed a slower ramp-up than expected, resulting in a sharp correction.

Many investors, accustomed to the explosive growth figures posted by market leaders in AI hardware, expected AMD to provide an equally ambitious short-term forecast. The failure to meet these elevated expectations highlights the brutal reality of the semiconductor market, where even excellent execution can be punished if it doesn't align with momentum-driven forecasts.

This report serves as a critical junction, separating the strategic long-term believers from the short-term speculators demanding immediate gratification from the AI boom. The disappointment is rooted not in a product failure, but in a timing mismatch between corporate reality and investor fervor.

The Guidance Gap: Why the Market Reacted Negatively

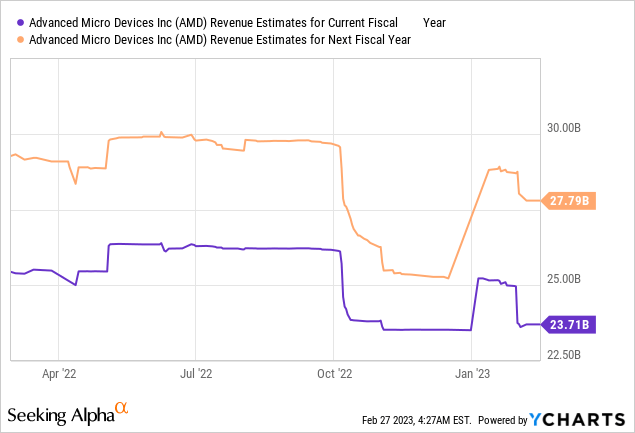

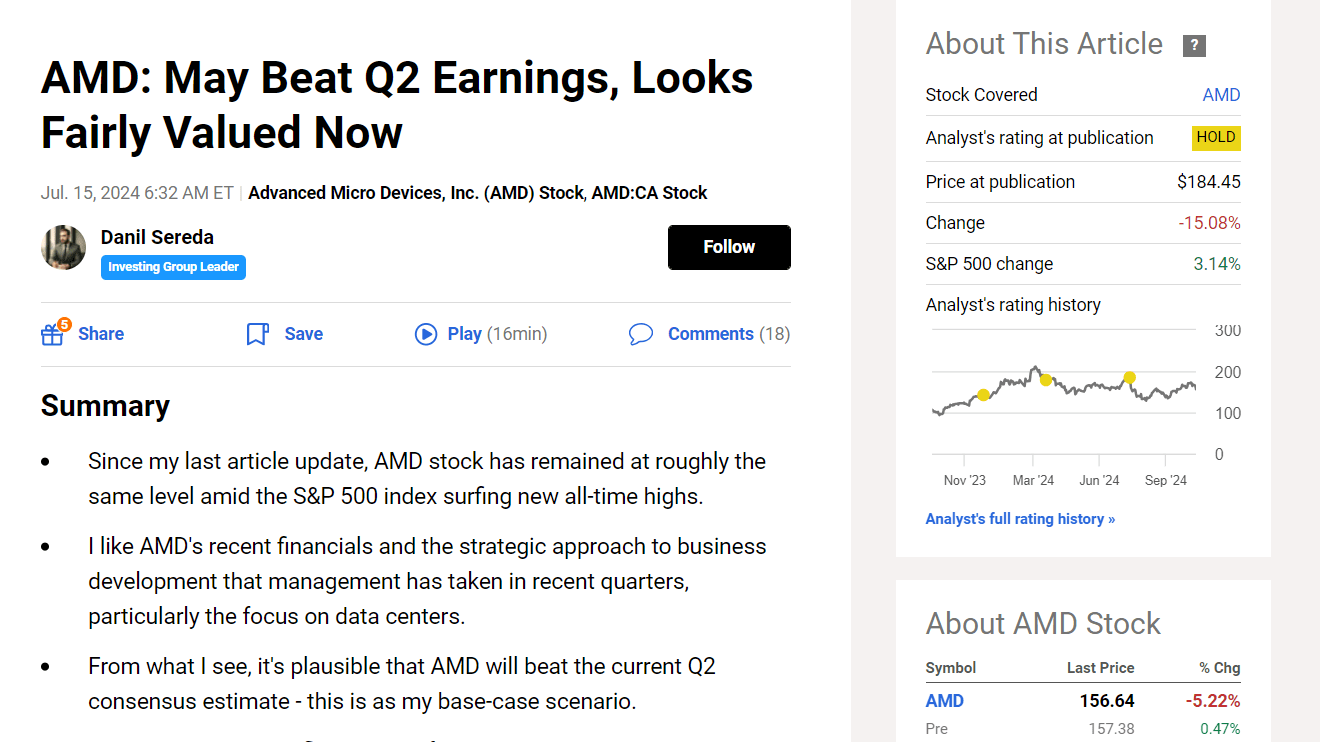

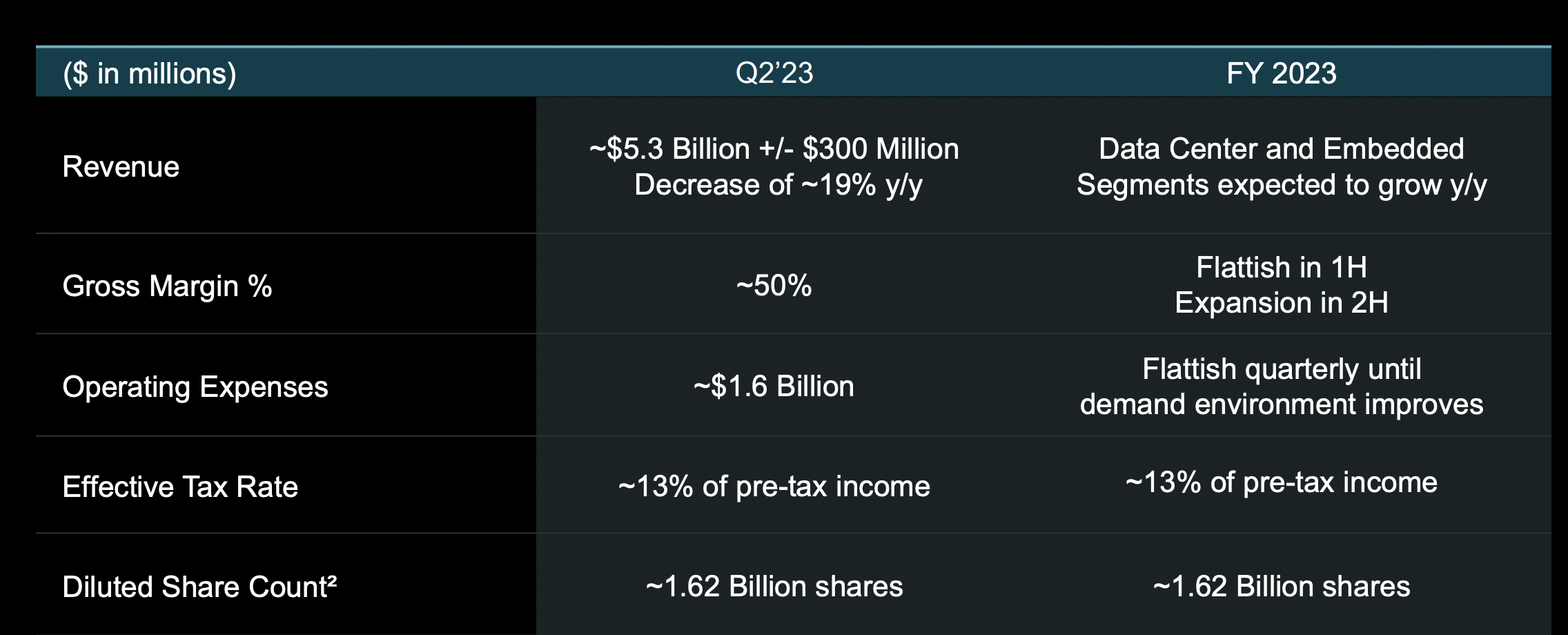

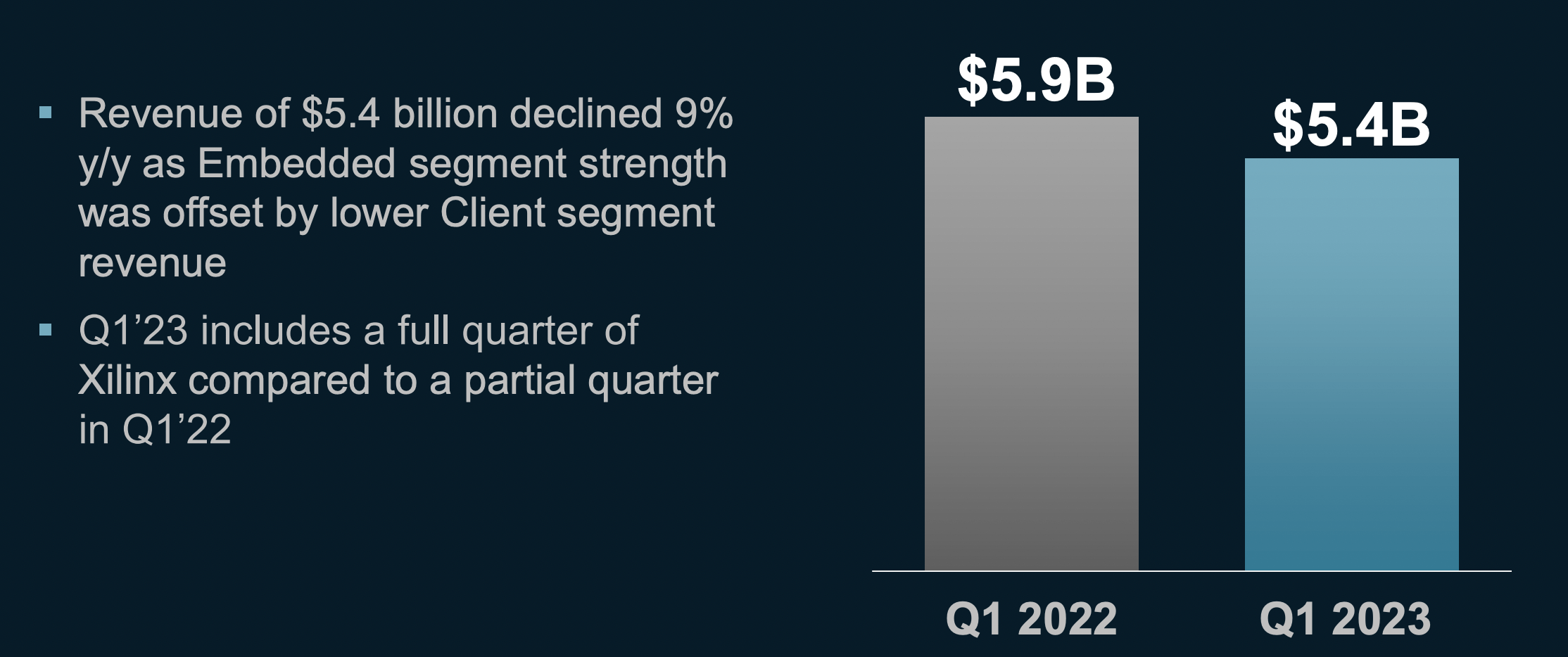

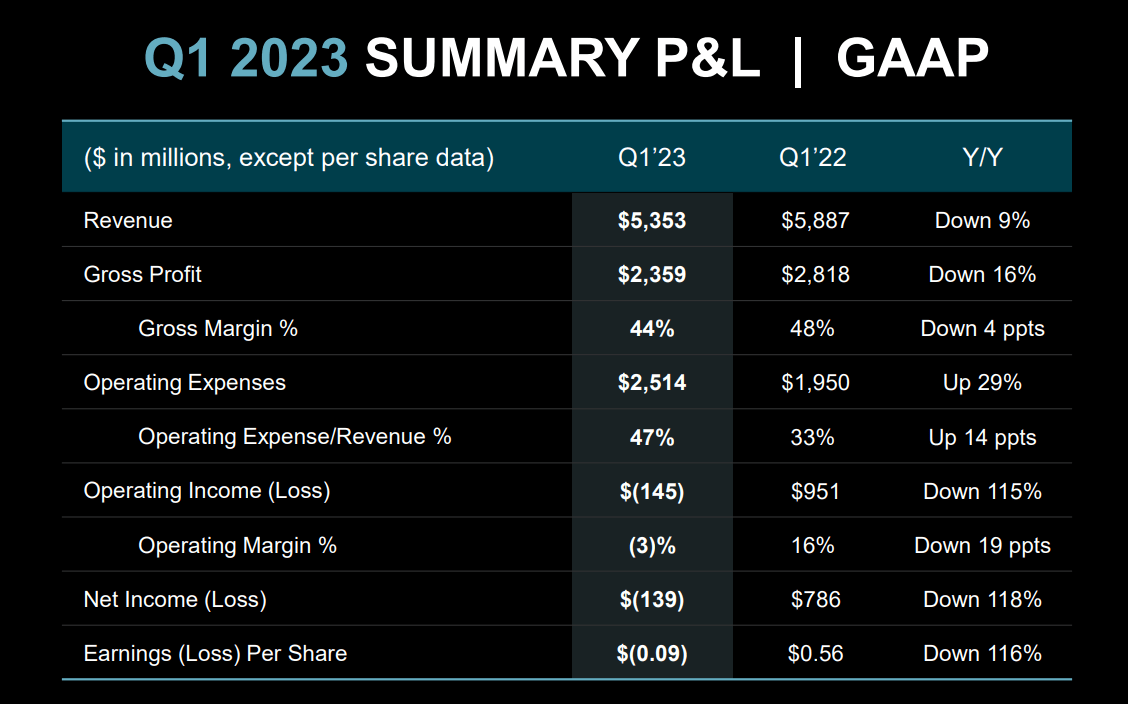

Following the release, AMD's stock experienced immediate volatility, shedding a significant portion of its recent gains in extended trading. The core issue wasn't the past quarter's performance, which was largely in line with expectations, but rather the conservative outlook provided for the next fiscal quarter and the subsequent full-year revenue projection.

The key metric scrutinized by analysts was the projection for Data Center revenue, specifically the contribution from the new MI300 series AI chips. While CEO Lisa Su remained fiercely bullish on the long-term roadmap and confirmed robust customer interest, the near-term forecast did not meet the aggressive, sky-high expectations baked into the stock price.

Investors were looking for guidance that suggested an accelerated, immediate, multi-billion dollar impact in 2024, commencing immediately in the first quarter. Instead, AMD projected a more measured, ramp-up curve, focusing on strategic deployments over volume blitzes in the initial phase.

This conservative stance, while perhaps prudent from a management perspective given the complexity of supply chains and customer integration, triggered a rapid reassessment of the company's near-term growth trajectory. The fear is that a slower initial deployment grants rivals more time to respond.

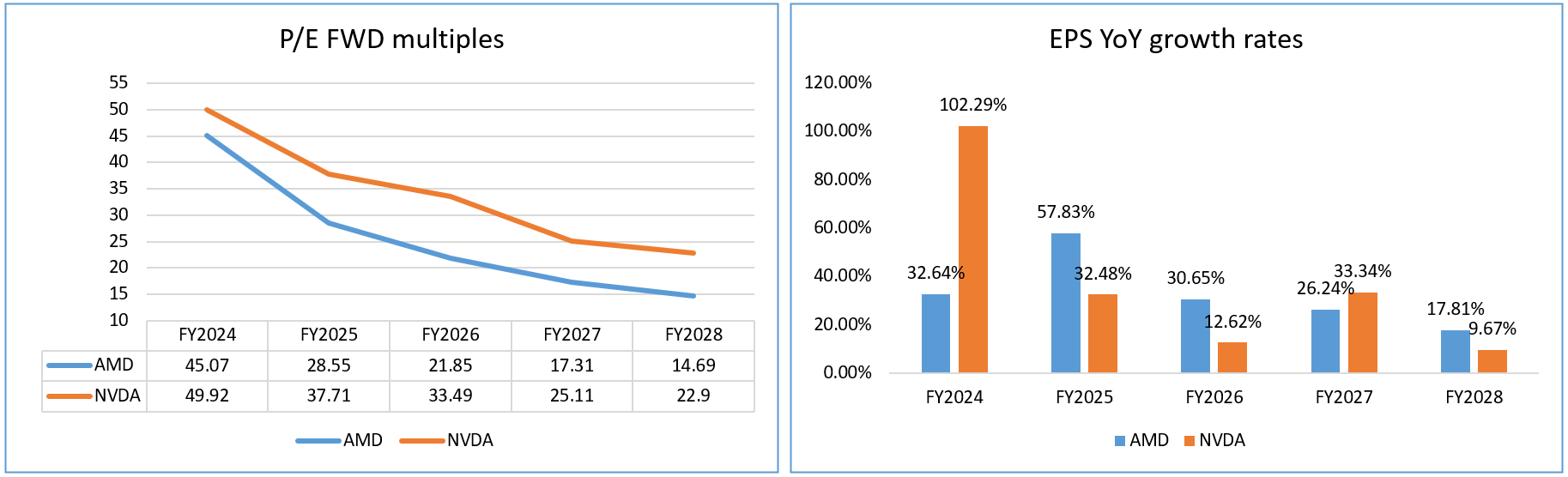

The stock had been trading at a premium valuation relative to its traditional revenue streams. This pricing model demands near-perfect execution in the highest-growth segment—AI acceleration. When that segment's forecasted revenue falls even marginally short of highly optimistic whisper numbers, the adjustment in market capitalization is disproportionately large.

- Muted MI300X Ramp: The volume acceleration for AMD's flagship AI product is projected to be steady rather than explosive immediately, pushing peak revenue recognition further into the second half of the year.

- High Valuation Pressure: The stock traded based on future AI growth, meaning any slowdown in the immediate revenue timeline creates significant selling pressure.

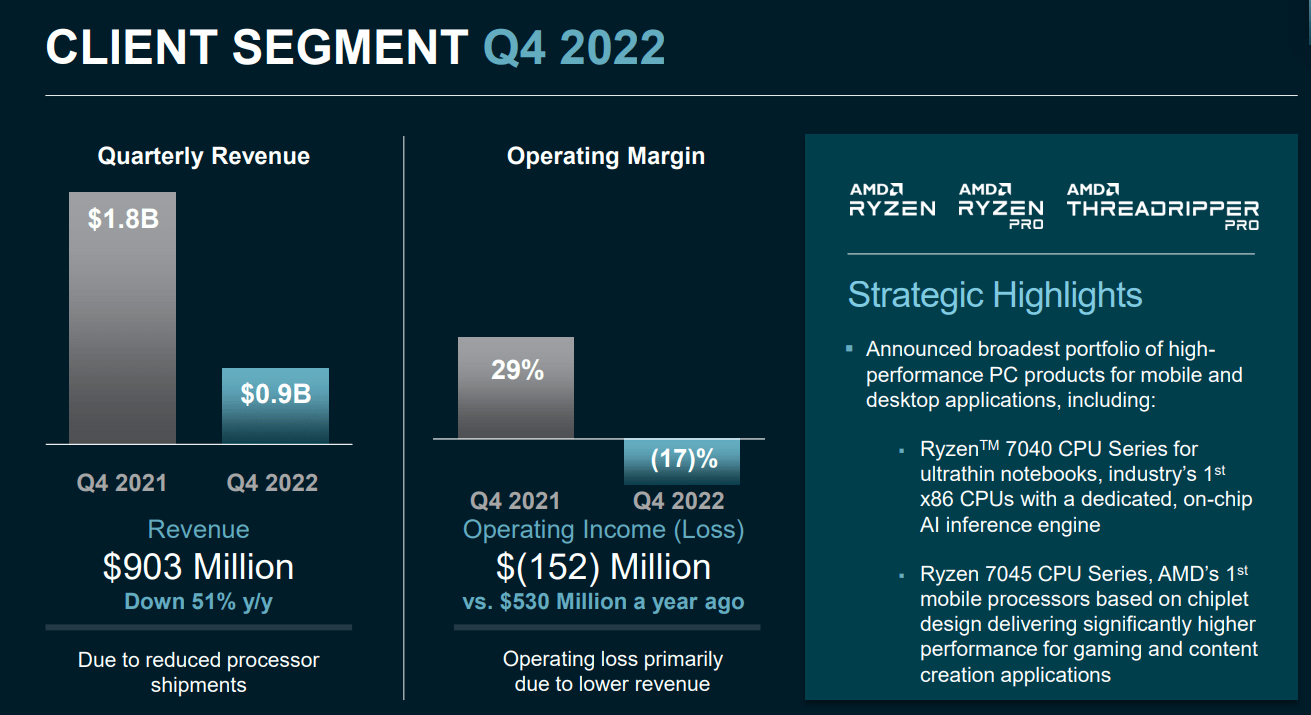

- Client Segment Underwhelms: While the PC market (client segment) showed signs of stabilization, the slight revenue increase here was unable to offset the perceived weakness in the high-margin, high-growth AI division.

AI Hype vs. Datacenter Reality: The MI300 Stakes

The MI300 family of accelerators is central to AMD's strategic pivot toward high-performance computing. Designed specifically to handle the intensive computational demands of large language models (LLMs) and generative AI workloads, these chips represent the company's best chance to break Nvidia's near-monopoly in AI hardware and seize competitive advantage.

Market chatter suggested that major hyperscalers—the Googles, Amazons, and Microsofts of the world—were eager to diversify their chip supply away from Nvidia due to cost considerations, security of supply, and proprietary architectural needs. This powerful context fueled the belief that AMD was poised for an immediate, major breakthrough quarter.

Dr. Su confirmed strong design wins and increasing customer interest, specifically naming major cloud providers as early adopters. She noted that demand for the MI300X, the high-end variant, remains extremely high. Yet, she acknowledged that the deployment cycle is inherently complex and time-consuming.

Deploying specialized AI infrastructure takes substantial time. Hyperscalers must integrate the new hardware into their complex proprietary software stacks, run extensive testing, and ensure compatibility with existing cloud services. This process of qualification and integration does not happen overnight. The conservative guidance, therefore, reflects the reality of enterprise adoption cycles, even for revolutionary technology.

One analyst summarized the situation concisely: "We aren't seeing a demand problem for the MI300. We are seeing a deployment scheduling issue. Wall Street priced in Q1 volume; AMD delivered Q2 or Q3 volume." This delay in immediate monetization is precisely what spooked momentum traders who prioritize short-term revenue spikes over disciplined capacity planning.

Furthermore, AMD's projections indicate that while the AI chips are indeed selling at pace, the massive, instantaneous scaling seen in rival guidance reports remains a future target, not a present reality. This gap between the promised long-term total addressable market (TAM) and the current quarter's revenue contribution proved too wide for many aggressive investment funds to reconcile.

The fundamental challenge for AMD is bridging the gap between hardware superiority and software integration. While the MI300 series offers compelling performance and price advantages, the maturity of AMD's ROCm software platform, which competes directly with Nvidia's ubiquitous CUDA, remains a key bottleneck for rapid adoption across the broader developer community.

Navigating the Competitive Landscape and Valuation Concerns

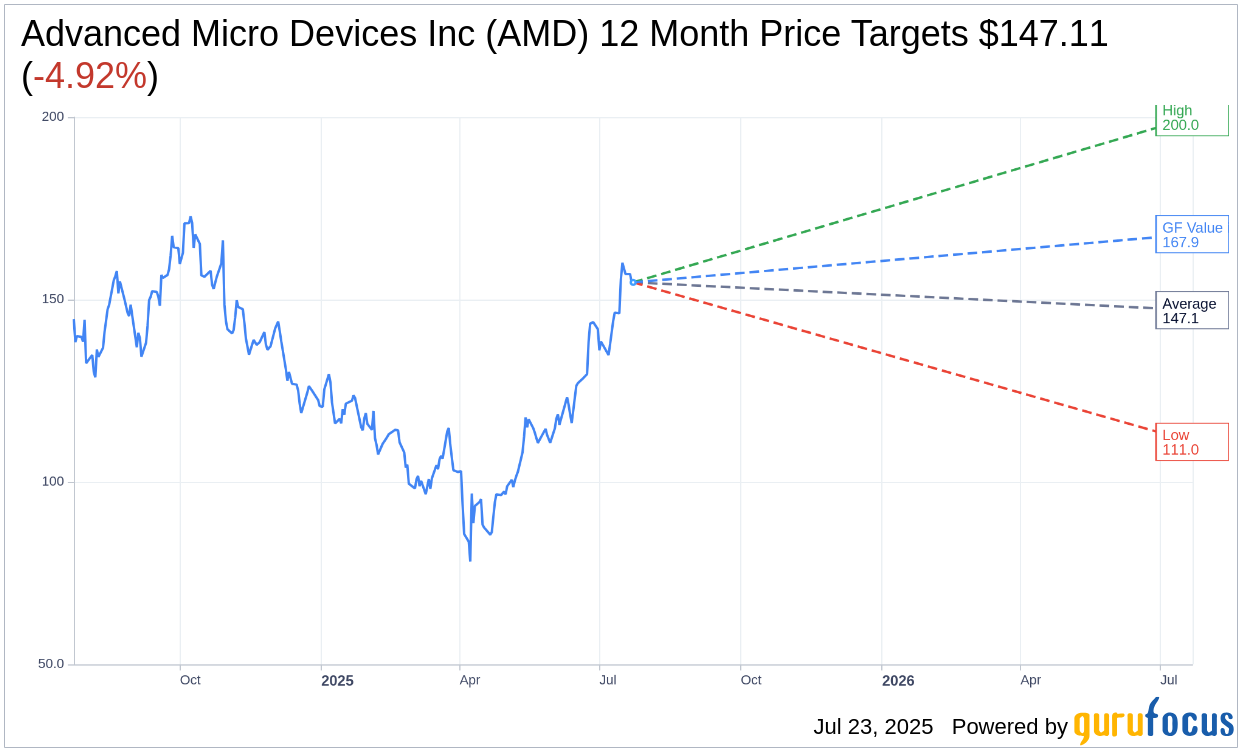

The reaction to AMD's outlook is also a clear reflection of heightened sensitivity surrounding technology valuations across the entire sector. The company's massive market capitalization hinges heavily on its ability to execute flawlessly in the high-stakes AI sector, where the pace of innovation is relentless. Any indication of friction gives bears immediate ammunition.

While the AI story dominated headlines, AMD's core Server CPU business, driven by the highly successful Epyc processors, continued to perform solidly. This stability in the traditional server market often gets overlooked when the focus is entirely on the volatile, high-growth AI accelerator division. The consistency in Epyc sales provides a vital financial foundation, but it is no longer the primary driver of stock momentum.

The competitive pressure remains intense and relentless. Nvidia continues to rapidly innovate, launching new generations of its H100 and newer chips, all while maintaining a massive advantage through its established software ecosystem. Meanwhile, Intel is aggressively signaling its own intentions to regain lost market share, particularly in the client and server segments, alongside its own push into AI infrastructure.

For AMD to ultimately achieve and sustain its high valuation targets, it must not only deliver industry-leading hardware but also expand and deepen its software ecosystem to truly challenge the incumbent. Investors need assurance that adoption will be frictionless.

Dr. Su emphasized that the total AI chip opportunity remains a multi-year growth runway, reassuring stakeholders that the company is still firmly on track to hit its major AI revenue targets for the calendar year 2024, and potentially exceed them based on current customer interest. However, the market, operating on quarterly deadlines, prefers immediate, visible acceleration.

The disappointing guidance essentially served as a necessary recalibration point for investors who had perhaps allowed speculative enthusiasm to outpace achievable financial milestones. The powerful rally leading up to the report had priced in near-perfect, immediate execution. When the outlook suggested merely excellent, yet disciplined, execution, the adjustment was swift and punitive.

Investor Sentiment and the Road Ahead

Despite the immediate market slump, the fundamental technological foundation of AMD remains robust. The company has successfully launched a highly competitive AI chip, secured major client commitments from key hyperscalers, and continues to gain ground in the traditional server CPU market via its Epyc line.

The disappointment stemmed primarily from the timeline of monetization, not the viability of the eventual outcome. For long-term, value-oriented investors focused on strategic growth and market share capture, the stock dip may present a crucial buying opportunity, allowing them to acquire shares at a lower multiple relative to projected future earnings.

However, for momentum traders and shorter-term funds, the outlook signals the potential end of the immediate rally cycle driven purely by speculative AI fervor. They will now shift their focus to companies offering more immediate, steeper growth curves.

The next few quarters will be critical for AMD to rebuild confidence. Stakeholders will be closely monitoring the following quantifiable indicators to assess the success of the MI300 rollout:

- MI300 Volume Metrics: Specific updates detailing how quickly hyperscalers are deploying the new accelerators into live production environments.

- Software Ecosystem Development: Tangible progress in expanding ROCm (AMD's open-source software platform) to close the functionality and developer adoption gap with CUDA.

- Gross Margin Trends: Confirmation that the sales of high-value AI chips are positively impacting and raising overall corporate profitability and gross margins, confirming their economic advantage.

- New Design Wins: Announcements of further major commitments from other enterprise clients beyond the initial hyperscaler set.

In the high-stakes world of semiconductor AI, the margin for error is razor thin, and market expectations are currently astronomical. While AMD's long-term vision remains compelling and intact, the latest outlook reminds investors that the path to AI dominance is a marathon, not a sprint, punctuated by periods of intense market skepticism when immediate payoffs are delayed.

The search for the next massive AI payoff continues, but for now, AMD is tasked with proving its disciplined execution capabilities quarter after quarter to regain the full confidence of the investment community.

AMD Outlook Disappoints Investors Seeking Bigger AI Payoff

AMD Outlook Disappoints Investors Seeking Bigger AI Payoff Wallpapers

Collection of amd outlook disappoints investors seeking bigger ai payoff wallpapers for your desktop and mobile devices.

Detailed Amd Outlook Disappoints Investors Seeking Bigger Ai Payoff View Photography

Discover an amazing amd outlook disappoints investors seeking bigger ai payoff background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Serene Amd Outlook Disappoints Investors Seeking Bigger Ai Payoff Wallpaper for Your Screen

Experience the crisp clarity of this stunning amd outlook disappoints investors seeking bigger ai payoff image, available in high resolution for all your screens.

Vivid Amd Outlook Disappoints Investors Seeking Bigger Ai Payoff Landscape Illustration

Experience the crisp clarity of this stunning amd outlook disappoints investors seeking bigger ai payoff image, available in high resolution for all your screens.

Stunning Amd Outlook Disappoints Investors Seeking Bigger Ai Payoff Scene Collection

This gorgeous amd outlook disappoints investors seeking bigger ai payoff photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Lush Amd Outlook Disappoints Investors Seeking Bigger Ai Payoff Moment Illustration

A captivating amd outlook disappoints investors seeking bigger ai payoff scene that brings tranquility and beauty to any device.

High-Quality Amd Outlook Disappoints Investors Seeking Bigger Ai Payoff Landscape Photography

Transform your screen with this vivid amd outlook disappoints investors seeking bigger ai payoff artwork, a true masterpiece of digital design.

Amazing Amd Outlook Disappoints Investors Seeking Bigger Ai Payoff Abstract Art

Explore this high-quality amd outlook disappoints investors seeking bigger ai payoff image, perfect for enhancing your desktop or mobile wallpaper.

Beautiful Amd Outlook Disappoints Investors Seeking Bigger Ai Payoff Picture for Mobile

Discover an amazing amd outlook disappoints investors seeking bigger ai payoff background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Stunning Amd Outlook Disappoints Investors Seeking Bigger Ai Payoff Picture Nature

A captivating amd outlook disappoints investors seeking bigger ai payoff scene that brings tranquility and beauty to any device.

Dynamic Amd Outlook Disappoints Investors Seeking Bigger Ai Payoff Abstract Photography

Find inspiration with this unique amd outlook disappoints investors seeking bigger ai payoff illustration, crafted to provide a fresh look for your background.

Vibrant Amd Outlook Disappoints Investors Seeking Bigger Ai Payoff View for Your Screen

Discover an amazing amd outlook disappoints investors seeking bigger ai payoff background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Detailed Amd Outlook Disappoints Investors Seeking Bigger Ai Payoff Wallpaper Art

Explore this high-quality amd outlook disappoints investors seeking bigger ai payoff image, perfect for enhancing your desktop or mobile wallpaper.

Detailed Amd Outlook Disappoints Investors Seeking Bigger Ai Payoff View Collection

Transform your screen with this vivid amd outlook disappoints investors seeking bigger ai payoff artwork, a true masterpiece of digital design.

Artistic Amd Outlook Disappoints Investors Seeking Bigger Ai Payoff Artwork in HD

This gorgeous amd outlook disappoints investors seeking bigger ai payoff photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Beautiful Amd Outlook Disappoints Investors Seeking Bigger Ai Payoff Background Photography

Discover an amazing amd outlook disappoints investors seeking bigger ai payoff background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Spectacular Amd Outlook Disappoints Investors Seeking Bigger Ai Payoff Artwork for Mobile

Find inspiration with this unique amd outlook disappoints investors seeking bigger ai payoff illustration, crafted to provide a fresh look for your background.

Crisp Amd Outlook Disappoints Investors Seeking Bigger Ai Payoff Photo Illustration

Find inspiration with this unique amd outlook disappoints investors seeking bigger ai payoff illustration, crafted to provide a fresh look for your background.

Lush Amd Outlook Disappoints Investors Seeking Bigger Ai Payoff Artwork in HD

Find inspiration with this unique amd outlook disappoints investors seeking bigger ai payoff illustration, crafted to provide a fresh look for your background.

Beautiful Amd Outlook Disappoints Investors Seeking Bigger Ai Payoff Design Concept

Transform your screen with this vivid amd outlook disappoints investors seeking bigger ai payoff artwork, a true masterpiece of digital design.

Dynamic Amd Outlook Disappoints Investors Seeking Bigger Ai Payoff Photo Digital Art

A captivating amd outlook disappoints investors seeking bigger ai payoff scene that brings tranquility and beauty to any device.

Download these amd outlook disappoints investors seeking bigger ai payoff wallpapers for free and use them on your desktop or mobile devices.