Dow tumbles nearly 600 points, S&P 500 goes negative for 2026 in tech sector rout: Live updates

Dow tumbles nearly 600 points, S&P 500 goes negative for 2026 in tech sector rout: Live updates

The highly anticipated market pullback arrived today with a vengeance, sending shockwaves through global finance. Wall Street saw a dramatic sell-off driven almost entirely by mounting inflation fears and aggressive future interest rate hike speculation.

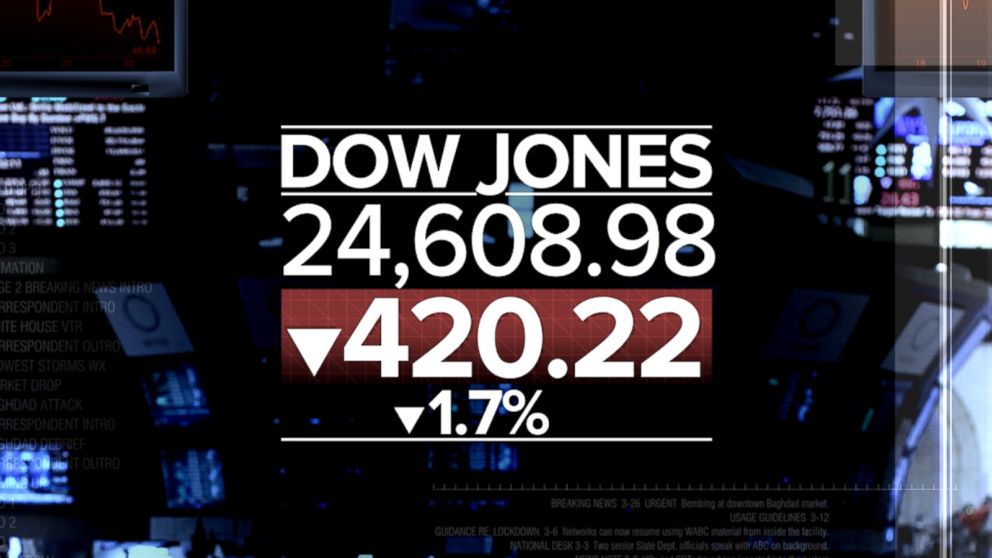

The Dow Jones Industrial Average suffered a crushing defeat, shedding nearly 600 points by the close of trading. This marks one of the most volatile days of the year, amplifying nervousness that has plagued markets for weeks.

But the real headline shocker centers on the technology heavyweights. The S&P 500 officially registered a loss for the 2026 calendar year outlook, a stark indicator that investors are pricing in a significantly cooler period for growth stocks.

I remember feeling this distinct dread around lunchtime. I was tracking the Nasdaq, and the speed of the descent—dropping over 3% in under an hour—was chilling. It wasn't just profit-taking; it felt like a systemic fear response gripping the trading floor.

Today's action confirms that the 'buy the dip' mentality is being severely tested. For many new investors who have only known bull markets, this massive single-day rout is an unprecedented reality check.

We are tracking the fallout moment-by-moment. Stay with us for the live updates on volatility levels, key technical breakdowns, and what analysts are saying about the immediate path forward.

The Core Plunge: Unpacking the Tech Sector Rout

The scale of today's losses was broad, but the pain was disproportionately centered in the Mega Cap tech sector—the stocks that drove most of the recent market buoyancy.

The Dow closed down 588 points, equating to a 1.7% loss. Meanwhile, the benchmark S&P 500 fell 2.3%, officially erasing all gains projected for the early half of 2026.

The Nasdaq Composite, the clearest barometer for growth and technology stocks, bore the brunt of the selling pressure, plunging 3.1%. This index is now firmly in technical correction territory.

Key stocks saw significant valuation cuts:

- Large-cap chipmakers were hammered, with shares falling between 4% and 6%.

- Software giants, previously considered recession-proof, shed an average of 3.5%.

- E-commerce leaders faced heavy institutional selling as future consumer spending projections were downgraded.

- Cloud computing infrastructure providers, which usually maintain resilience, showed surprising weakness, indicating deep systemic anxiety.

This widespread weakness signals a dramatic shift in investor sentiment away from high-multiple growth stocks and toward safer, dividend-paying value sectors.

The rotation is brutal. Capital that fled defensive positions is now rushing back, causing dislocation and creating massive imbalances in daily trading volumes.

Financial media outlets are confirming that circuit breakers were nearly triggered several times on the major exchanges as automated trading systems amplified the sell-off cascade.

Retail investor accounts are reporting substantial drawdowns, particularly those heavily weighted in speculative, high-beta assets that thrived during the zero-interest rate environment.

The concept of "TINA" (There Is No Alternative) regarding stocks is rapidly dissolving as bond yields become increasingly attractive.

The immediate target for the S&P 500 now shifts to its critical 4,000-point support level, a psychological barrier that market technicians view as essential to preventing further panic selling.

Today was not just a bad day; it was an inflection point where the market finally capitulated to the growing macroeconomic pressures that have been brewing beneath the surface.

Domino Effect: What Triggered the Massive Sell-Off?

While the actual daily losses were shocking, the underlying causes are not new. They coalesced today into a perfect storm of negativity, primarily centered around policy and profitability.

1. Aggressive Federal Reserve Policy Hints

Comments from several key Federal Reserve officials throughout the week have strongly hinted at an accelerated schedule for quantitative tightening and interest rate hikes.

The prospect of four, perhaps five, rate increases this year has severely spooked equity markets.

Higher rates fundamentally reduce the present value of future earnings, hitting high-growth tech companies—whose profits are projected far into the future—the hardest.

The market is rapidly adjusting its discounting models, leading to sudden, sharp repricings across the entire valuation spectrum.

2. Spiking Treasury Yields

The yield on the 10-year Treasury bond surged past a critical psychological level today, moving substantially higher than anticipated by most analysts.

This spike acts as a direct competitor to equities. When bond yields offer attractive, near-risk-free returns, the incentive to hold volatile stocks diminishes rapidly.

The ongoing flattening of the yield curve is also heightening concerns about a potential economic slowdown or recession in the intermediate term, adding another layer of macroeconomic dread.

3. Disappointing Earnings Guidance

A few prominent tech companies issued cautious guidance for Q4 2025 and Q1 2026 late yesterday afternoon. While results were decent, the outlook was grim.

Supply chain constraints, rising labor costs, and ongoing global geopolitical instability were cited as major headwinds expected to erode profit margins.

This provided the necessary fundamental catalyst for institutions looking for an excuse to de-risk their portfolios after a sustained period of excess.

The confluence of higher borrowing costs (rates) and lower expected future earnings (guidance) proved catastrophic for highly levered and high-multiple stocks.

We are now seeing a decisive shift away from companies that prioritize 'growth at any cost' toward those that exhibit strong free cash flow and reliable profitability.

Navigating Volatility: Investor Strategy and the Road Ahead

Today's extreme volatility tests the patience and conviction of every investor. Senior strategists are advising clients to avoid panic selling and focus on long-term goals.

This level of market correction, while painful, is often necessary to clear out speculative froth and establish a healthier, more sustainable baseline for future growth.

Expert Recommendations for Current Exposure:

- Rebalancing is Crucial: Use this dip to rebalance portfolios back toward target allocations. Over-weighting in tech must be reduced.

- Focus on Quality: Prioritize stocks with strong balance sheets, consistent profitability, and proven pricing power—companies able to pass inflation costs onto consumers.

- Dollar-Cost Averaging: For those with cash on the sidelines, systematically investing small amounts on red days can mitigate risk and capitalize on lower prices.

- Watch Technical Levels: Monitor the VIX (volatility index), which surged today. A peak in the VIX often precedes a short-term market bottom.

The current environment is clearly moving out of the liquidity-fueled boom and into a phase of financial tightening. Investors must adjust their expectations accordingly.

The key question now is how deep the market correction will go. Analysts at major investment banks suggest that the S&P 500 could face another 5% to 8% downside before a solid support level is established.

We must remember that historically, severe market downturns are followed by periods of substantial recovery. This requires discipline and a long-term economic outlook.

The true test for high-flying Mega Cap tech companies will be their ability to sustain innovation and profits in a higher interest rate environment, where capital is no longer cheap and abundant.

The rout confirms that the easy money era is over. Prudence and risk management are now paramount concerns for every institutional and retail player.

As the closing bell rings, the mood remains somber. Today was a clear victory for bears and a massive wake-up call for the market as a whole.

We will continue tracking after-hours trading and futures markets for any signs of stabilization heading into tomorrow's open.

Final closing totals confirm the Dow's largest single-day percentage drop in three months. The focus now shifts entirely to upcoming corporate earnings reports and the Federal Reserve's next move.

Stay tuned for our continuing live coverage and deeper analysis on what this historic market shift means for your portfolio.

Dow tumbles nearly 600 points, S&P 500 goes negative for 2026 in tech sector rout: Live updates

Dow tumbles nearly 600 points, S&P 500 goes negative for 2026 in tech sector rout: Live updates Wallpapers

Collection of dow tumbles nearly 600 points, s&p 500 goes negative for 2026 in tech sector rout: live updates wallpapers for your desktop and mobile devices.

Artistic Dow Tumbles Nearly 600 Points, S&p 500 Goes Negative For 2026 In Tech Sector Rout: Live Updates Artwork Art

This gorgeous dow tumbles nearly 600 points, s&p 500 goes negative for 2026 in tech sector rout: live updates photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Spectacular Dow Tumbles Nearly 600 Points, S&p 500 Goes Negative For 2026 In Tech Sector Rout: Live Updates Design Digital Art

This gorgeous dow tumbles nearly 600 points, s&p 500 goes negative for 2026 in tech sector rout: live updates photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Serene Dow Tumbles Nearly 600 Points, S&p 500 Goes Negative For 2026 In Tech Sector Rout: Live Updates Design Concept

Explore this high-quality dow tumbles nearly 600 points, s&p 500 goes negative for 2026 in tech sector rout: live updates image, perfect for enhancing your desktop or mobile wallpaper.

Artistic Dow Tumbles Nearly 600 Points, S&p 500 Goes Negative For 2026 In Tech Sector Rout: Live Updates Abstract for Mobile

A captivating dow tumbles nearly 600 points, s&p 500 goes negative for 2026 in tech sector rout: live updates scene that brings tranquility and beauty to any device.

Vivid Dow Tumbles Nearly 600 Points, S&p 500 Goes Negative For 2026 In Tech Sector Rout: Live Updates Picture Art

Discover an amazing dow tumbles nearly 600 points, s&p 500 goes negative for 2026 in tech sector rout: live updates background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Exquisite Dow Tumbles Nearly 600 Points, S&p 500 Goes Negative For 2026 In Tech Sector Rout: Live Updates Artwork for Mobile

Immerse yourself in the stunning details of this beautiful dow tumbles nearly 600 points, s&p 500 goes negative for 2026 in tech sector rout: live updates wallpaper, designed for a captivating visual experience.

Beautiful Dow Tumbles Nearly 600 Points, S&p 500 Goes Negative For 2026 In Tech Sector Rout: Live Updates Capture Illustration

Transform your screen with this vivid dow tumbles nearly 600 points, s&p 500 goes negative for 2026 in tech sector rout: live updates artwork, a true masterpiece of digital design.

Detailed Dow Tumbles Nearly 600 Points, S&p 500 Goes Negative For 2026 In Tech Sector Rout: Live Updates Landscape for Your Screen

Experience the crisp clarity of this stunning dow tumbles nearly 600 points, s&p 500 goes negative for 2026 in tech sector rout: live updates image, available in high resolution for all your screens.

Crisp Dow Tumbles Nearly 600 Points, S&p 500 Goes Negative For 2026 In Tech Sector Rout: Live Updates Landscape Art

Find inspiration with this unique dow tumbles nearly 600 points, s&p 500 goes negative for 2026 in tech sector rout: live updates illustration, crafted to provide a fresh look for your background.

Serene Dow Tumbles Nearly 600 Points, S&p 500 Goes Negative For 2026 In Tech Sector Rout: Live Updates Moment Concept

Transform your screen with this vivid dow tumbles nearly 600 points, s&p 500 goes negative for 2026 in tech sector rout: live updates artwork, a true masterpiece of digital design.

Stunning Dow Tumbles Nearly 600 Points, S&p 500 Goes Negative For 2026 In Tech Sector Rout: Live Updates Picture for Desktop

A captivating dow tumbles nearly 600 points, s&p 500 goes negative for 2026 in tech sector rout: live updates scene that brings tranquility and beauty to any device.

Spectacular Dow Tumbles Nearly 600 Points, S&p 500 Goes Negative For 2026 In Tech Sector Rout: Live Updates Landscape Nature

This gorgeous dow tumbles nearly 600 points, s&p 500 goes negative for 2026 in tech sector rout: live updates photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Vibrant Dow Tumbles Nearly 600 Points, S&p 500 Goes Negative For 2026 In Tech Sector Rout: Live Updates Picture Collection

Discover an amazing dow tumbles nearly 600 points, s&p 500 goes negative for 2026 in tech sector rout: live updates background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Lush Dow Tumbles Nearly 600 Points, S&p 500 Goes Negative For 2026 In Tech Sector Rout: Live Updates Design Concept

Find inspiration with this unique dow tumbles nearly 600 points, s&p 500 goes negative for 2026 in tech sector rout: live updates illustration, crafted to provide a fresh look for your background.

Exquisite Dow Tumbles Nearly 600 Points, S&p 500 Goes Negative For 2026 In Tech Sector Rout: Live Updates Design in HD

A captivating dow tumbles nearly 600 points, s&p 500 goes negative for 2026 in tech sector rout: live updates scene that brings tranquility and beauty to any device.

Serene Dow Tumbles Nearly 600 Points, S&p 500 Goes Negative For 2026 In Tech Sector Rout: Live Updates Capture for Mobile

Experience the crisp clarity of this stunning dow tumbles nearly 600 points, s&p 500 goes negative for 2026 in tech sector rout: live updates image, available in high resolution for all your screens.

Dynamic Dow Tumbles Nearly 600 Points, S&p 500 Goes Negative For 2026 In Tech Sector Rout: Live Updates Landscape Collection

A captivating dow tumbles nearly 600 points, s&p 500 goes negative for 2026 in tech sector rout: live updates scene that brings tranquility and beauty to any device.

Detailed Dow Tumbles Nearly 600 Points, S&p 500 Goes Negative For 2026 In Tech Sector Rout: Live Updates Scene in 4K

Explore this high-quality dow tumbles nearly 600 points, s&p 500 goes negative for 2026 in tech sector rout: live updates image, perfect for enhancing your desktop or mobile wallpaper.

Beautiful Dow Tumbles Nearly 600 Points, S&p 500 Goes Negative For 2026 In Tech Sector Rout: Live Updates Wallpaper Collection

Discover an amazing dow tumbles nearly 600 points, s&p 500 goes negative for 2026 in tech sector rout: live updates background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Artistic Dow Tumbles Nearly 600 Points, S&p 500 Goes Negative For 2026 In Tech Sector Rout: Live Updates Design for Your Screen

Immerse yourself in the stunning details of this beautiful dow tumbles nearly 600 points, s&p 500 goes negative for 2026 in tech sector rout: live updates wallpaper, designed for a captivating visual experience.

Download these dow tumbles nearly 600 points, s&p 500 goes negative for 2026 in tech sector rout: live updates wallpapers for free and use them on your desktop or mobile devices.