Get Tax In Hawaii

Get Tax In Hawaii: Your Ultimate Guide to Island Finances

Thinking about moving to, investing in, or starting a business in the Aloha State? That's exciting! Hawaii offers unparalleled beauty, but navigating its financial landscape can feel as complex as trying to read a tide chart.

One of the most common questions newcomers ask is: How exactly do I Get Tax In Hawaii? The system here is unique, especially when dealing with the famous General Excise Tax (GET). Don't worry, we are here to break down the essentials. By the time you finish this guide, you'll be much better equipped to handle your responsibilities, whether you are filing state income tax or figuring out local business requirements.

We'll walk you through the key taxes, filing obligations, and practical tips to ensure you stay compliant and stress-free under the Hawaiian sun.

Aloha, Taxes! What Makes Hawaii's Tax System Unique?

When you look at taxation across the United States, Hawaii stands out primarily because of its reliance on consumption-based taxes rather than a traditional state sales tax. This difference is crucial for anyone engaging in business or selling services here.

Understanding this fundamental difference is the first step to successfully navigating how to Get Tax In Hawaii handled correctly. It affects nearly every commercial transaction, from selling goods to providing professional services.

Understanding the General Excise Tax (GET)

The General Excise Tax (GET) is perhaps the most unique aspect of the state's tax structure. It is applied to the gross income of businesses operating in Hawaii. Unlike a sales tax, which is typically collected from the consumer, the GET is imposed on the business itself.

However, it is common practice for businesses to pass this cost onto the consumer, often listed as a separate line item on your receipt. This is why you often see a tax rate slightly higher than the base rate due to the "pyramiding" effect of the tax.

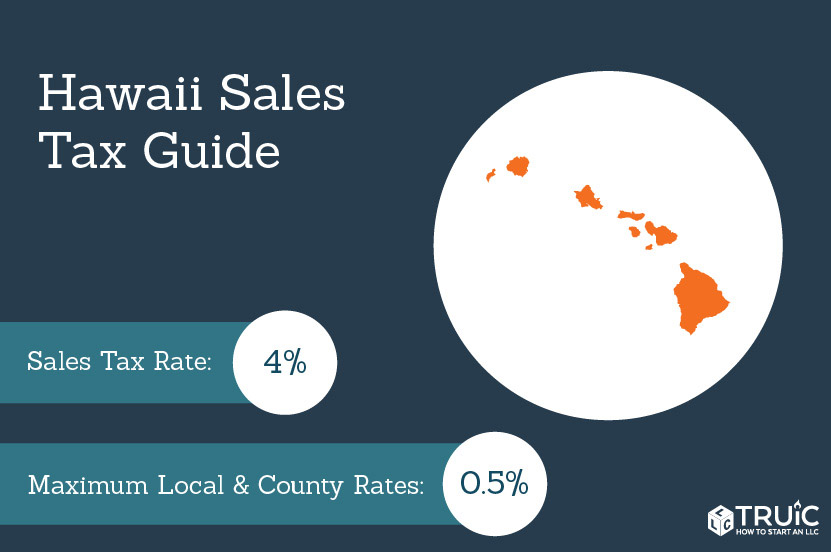

The standard GET rates vary depending on the type of business activity, but generally fall into two main categories:

- **4.0%:** Applies to most business activities, including retail sales, services, and contracting.

- **0.5%:** Applies to wholesaling, manufacturing, producing, and certain other activities.

In addition to the state rate, counties impose a small surcharge. For instance, in Oahu, the total rate often reaches 4.5% (4.0% state GET plus 0.5% county surcharge). Make sure you register your business with the Department of Taxation (DoTax) immediately upon commencing operations.

The Difference Between GET and Sales Tax

It's easy to mistake the GET for a traditional sales tax, but the underlying mechanism is different, which has significant implications for businesses. A key difference lies in what is being taxed.

Sales taxes target the final sale to the consumer, usually only once. GET, however, taxes the gross receipts at multiple stages of production and distribution. This is the "pyramiding" effect mentioned earlier, and it often leads to a higher effective cost structure for businesses.

If you are serious about understanding how to successfully Get Tax In Hawaii processes implemented for your business, recognizing the GET as a tax on your gross revenue—not just a customer charge—is essential for accurate pricing and compliance.

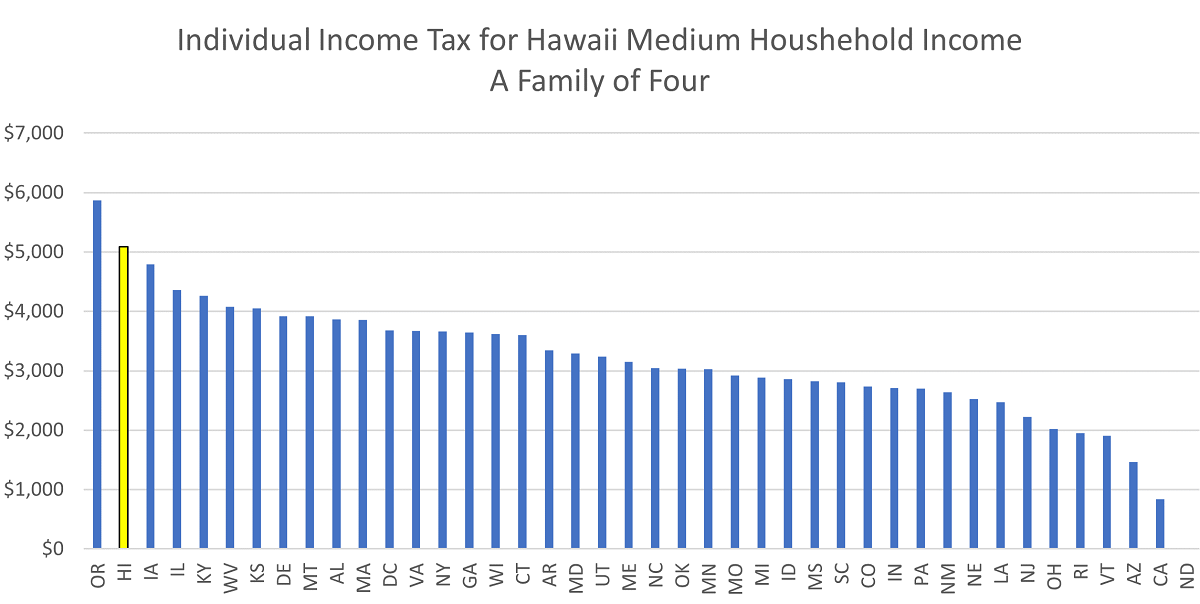

Income Tax in Paradise: Filing Requirements for Residents and Non-Residents

Like most states, Hawaii requires residents and those who earn income within the state to file an income tax return (Form N-11 or N-15). Hawaii's income tax tends to be relatively high compared to other states, but it offers various deductions and exemptions that can soften the blow.

Determining your residency status is the first step. If you are considered a resident, all your income, regardless of where it was earned, is subject to Hawaii income tax. Non-residents only pay tax on income derived from Hawaii sources.

Hawaii State Income Tax Brackets

Hawaii utilizes a progressive income tax system, meaning the higher your income, the higher your marginal tax rate. The state has 12 income tax brackets, which is more than most states, contributing to its complexity.

The rates range from a low of 1.4% up to a high of 11% for top earners. It's crucial to consult the current tax year's N-11 instructions to determine your exact bracket, as thresholds are adjusted annually.

Key tax benefits to look out for include the exclusion of a portion of your pension and certain retirement income, which can be a significant advantage for retirees planning to enjoy their golden years on the islands.

Special Considerations for Rental Income (The Vacation Rental Tax Niche)

If you own investment property in Hawaii, especially a short-term vacation rental (like an Airbnb), you must deal with an extra layer of taxation: the Transient Accommodations Tax (TAT).

The TAT is currently 10.25% and is applied on top of the GET (which is approximately 4.5%). This means that short-term rental income is subject to a total tax rate of roughly 14.75%. This is a huge factor when determining the profitability of your rental venture.

Owners of vacation rentals must register for both a GET license and a TAT license and file separate returns for each. This specific compliance detail is vital for those looking to successfully Get Tax In Hawaii paperwork done for investment properties.

Property Tax and Exemptions (For the Homeowner)

Good news for homeowners: Hawaii typically boasts some of the lowest property tax rates in the entire nation, primarily due to the high values of the properties themselves. This can provide a welcome offset to the high cost of living.

However, rates and rules are far from uniform. They depend entirely on which island and county your property is located on.

County vs. State Property Taxes

Unlike income tax, which is handled at the state level, property taxes in Hawaii are administered and collected entirely by the four individual county governments: Honolulu (Oahu), Maui, Hawaii (Big Island), and Kauai.

Each county sets its own tax rate, assessment methods, and homeowner exemption amounts. For example, the homeowner exemption on Oahu is typically much higher than on the Big Island, providing a larger reduction in the taxable value of your primary residence.

If you are a resident owner-occupant, ensure you apply for the homeowner's exemption in your specific county to minimize your tax liability. This step is critical and is not automatic when you purchase a home.

Essential Tips to Get Tax In Hawaii Right

Dealing with a new state tax system can be daunting. Here are some quick, actionable tips to ensure you handle your Hawaiian taxes efficiently and accurately:

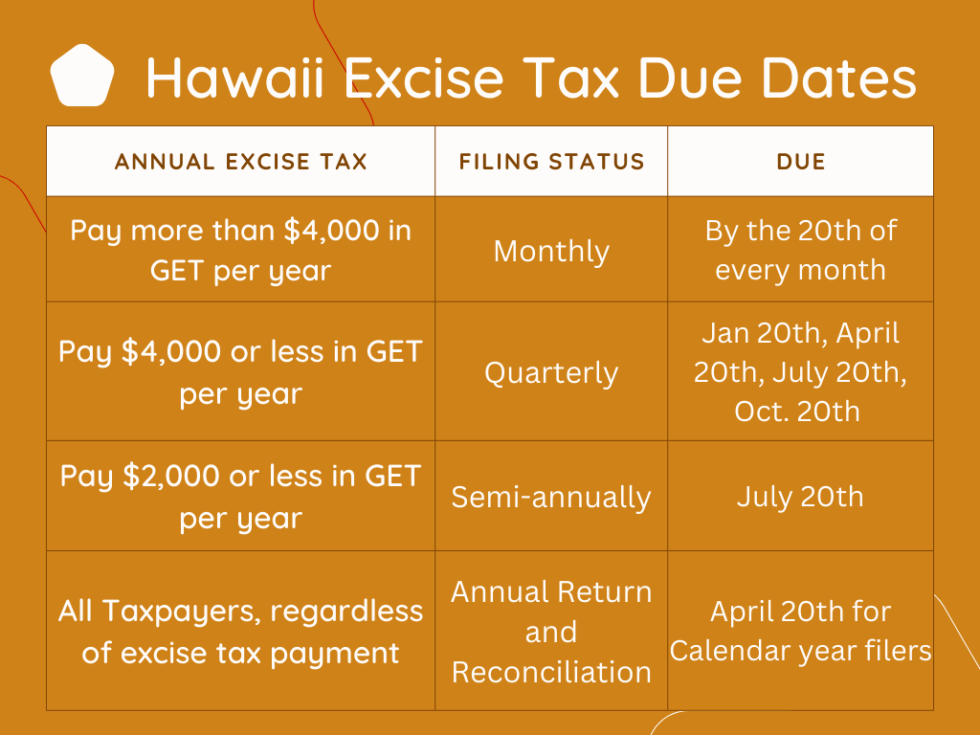

- **Register for GET Immediately:** If you sell any product or service—even occasionally or as a side hustle—you must register for your GET license (often called a tax ID). Failure to do so can result in hefty penalties.

- **Check County Surcharges:** Remember that the GET rate varies slightly by county. Make sure your accounting software and invoicing reflect the correct local rate for compliance.

- **File Quarterly Estimates:** Because Hawaii has high income tax rates, you may be required to file estimated quarterly payments (Form N-201) to avoid underpayment penalties at the end of the year, especially if you are self-employed.

- **Document Residency:** If you spend time both inside and outside Hawaii, maintain excellent documentation (driver's license, utility bills, etc.) to clearly establish your true state of residency for income tax purposes, thereby determining how much income is subject to the 11% top rate.

- **Use Hawaii-Specific Software:** Rely on tax preparation software that explicitly supports Hawaii's specific forms (N-11, N-15, N-201, G-45) to minimize errors.

These practices are the bedrock of successfully managing your finances here. The goal is to successfully Get Tax In Hawaii compliance nailed down so you can spend more time enjoying the beautiful beaches.

Conclusion: Mastering the Hawaiian Tax Wave

Navigating the tax system in Hawaii requires a keen understanding of the state's distinct tax tools, especially the General Excise Tax and the specific requirements for rental income. Whether you are a business owner registering for GET, an employee filing income tax, or an investor managing TAT, preparation is key.

While the state income tax brackets are steep, careful planning—utilizing exemptions and deductions—can significantly mitigate your liability. By focusing on proper registration, accurate quarterly filing, and paying attention to the county-specific nuances (like property tax and GET surcharges), you can efficiently Get Tax In Hawaii handled, leaving you free to enjoy the best the islands have to offer.

Don't hesitate to consult a Hawaii-based CPA or tax professional if your financial situation is complex. They can provide tailored advice specific to your business or residency status.

Frequently Asked Questions (FAQ) About Hawaii Taxes

- What is the main tax I need to worry about in Hawaii?

- The two primary taxes are the State Income Tax (progressive rates up to 11%) and the General Excise Tax (GET), which is applied to nearly all business gross receipts, typically at 4.0% plus a county surcharge.

- Does Hawaii have a state sales tax?

- No, Hawaii does not have a traditional sales tax. Instead, it relies on the General Excise Tax (GET). While the GET is often passed on to the consumer and feels like a sales tax, legally it is a tax on the business's revenue, not on the transaction itself.

- Is the GET rate the same across all Hawaiian Islands?

- The state base rate of GET is 4.0%, but all counties currently impose a surcharge. This means the total rate varies slightly by island. For instance, Oahu currently has a total GET rate of 4.5%.

- How do non-residents Get Tax In Hawaii filing done?

- Non-residents must file Form N-15 if they receive income sourced from Hawaii (e.g., rental income, wages earned while physically in Hawaii). They only pay Hawaii income tax on that Hawaii-sourced income.

- Are property taxes high in Hawaii?

- No, Hawaii generally has very low property tax rates based on percentage of home value. However, since home values are exceptionally high, the actual dollar amount paid can still be significant. Property taxes are managed at the county level, not the state level.

Get Tax In Hawaii

Get Tax In Hawaii Wallpapers

Collection of get tax in hawaii wallpapers for your desktop and mobile devices.

High-Quality Get Tax In Hawaii View Illustration

Explore this high-quality get tax in hawaii image, perfect for enhancing your desktop or mobile wallpaper.

Vibrant Get Tax In Hawaii Image Nature

Experience the crisp clarity of this stunning get tax in hawaii image, available in high resolution for all your screens.

Captivating Get Tax In Hawaii Wallpaper in HD

This gorgeous get tax in hawaii photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Mesmerizing Get Tax In Hawaii Landscape for Mobile

Explore this high-quality get tax in hawaii image, perfect for enhancing your desktop or mobile wallpaper.

Beautiful Get Tax In Hawaii Artwork Nature

Discover an amazing get tax in hawaii background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Gorgeous Get Tax In Hawaii Capture Photography

A captivating get tax in hawaii scene that brings tranquility and beauty to any device.

Vivid Get Tax In Hawaii Wallpaper Nature

Transform your screen with this vivid get tax in hawaii artwork, a true masterpiece of digital design.

Dynamic Get Tax In Hawaii Picture Art

Find inspiration with this unique get tax in hawaii illustration, crafted to provide a fresh look for your background.

Amazing Get Tax In Hawaii Artwork Collection

Transform your screen with this vivid get tax in hawaii artwork, a true masterpiece of digital design.

Vibrant Get Tax In Hawaii Landscape Photography

Explore this high-quality get tax in hawaii image, perfect for enhancing your desktop or mobile wallpaper.

High-Quality Get Tax In Hawaii Photo for Your Screen

Discover an amazing get tax in hawaii background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Serene Get Tax In Hawaii Picture Concept

Transform your screen with this vivid get tax in hawaii artwork, a true masterpiece of digital design.

Vibrant Get Tax In Hawaii Design Art

Transform your screen with this vivid get tax in hawaii artwork, a true masterpiece of digital design.

Amazing Get Tax In Hawaii Wallpaper for Mobile

Experience the crisp clarity of this stunning get tax in hawaii image, available in high resolution for all your screens.

Stunning Get Tax In Hawaii Background Photography

Find inspiration with this unique get tax in hawaii illustration, crafted to provide a fresh look for your background.

Spectacular Get Tax In Hawaii Design in 4K

This gorgeous get tax in hawaii photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Exquisite Get Tax In Hawaii Artwork for Desktop

A captivating get tax in hawaii scene that brings tranquility and beauty to any device.

Lush Get Tax In Hawaii Picture Concept

Immerse yourself in the stunning details of this beautiful get tax in hawaii wallpaper, designed for a captivating visual experience.

Amazing Get Tax In Hawaii View in HD

Transform your screen with this vivid get tax in hawaii artwork, a true masterpiece of digital design.

High-Quality Get Tax In Hawaii Design Collection

Experience the crisp clarity of this stunning get tax in hawaii image, available in high resolution for all your screens.

Download these get tax in hawaii wallpapers for free and use them on your desktop or mobile devices.