Get A W2

How to Effortlessly Get A W2: Your Essential Guide to Tax Season Success

Tax season can feel complicated, especially when you are waiting on that crucial piece of paperwork: the W-2 form. If you've been employed, knowing exactly when and how to Get A W2 is the first major step toward filing your taxes accurately and on time.

This guide is designed to cut through the jargon and give you a straightforward, step-by-step approach. We will cover everything from understanding the W-2 deadline to knowing exactly who to call if your form seems to have vanished into thin air. Let's make this tax season stress-free!

Understanding the W-2: What Exactly Is It?

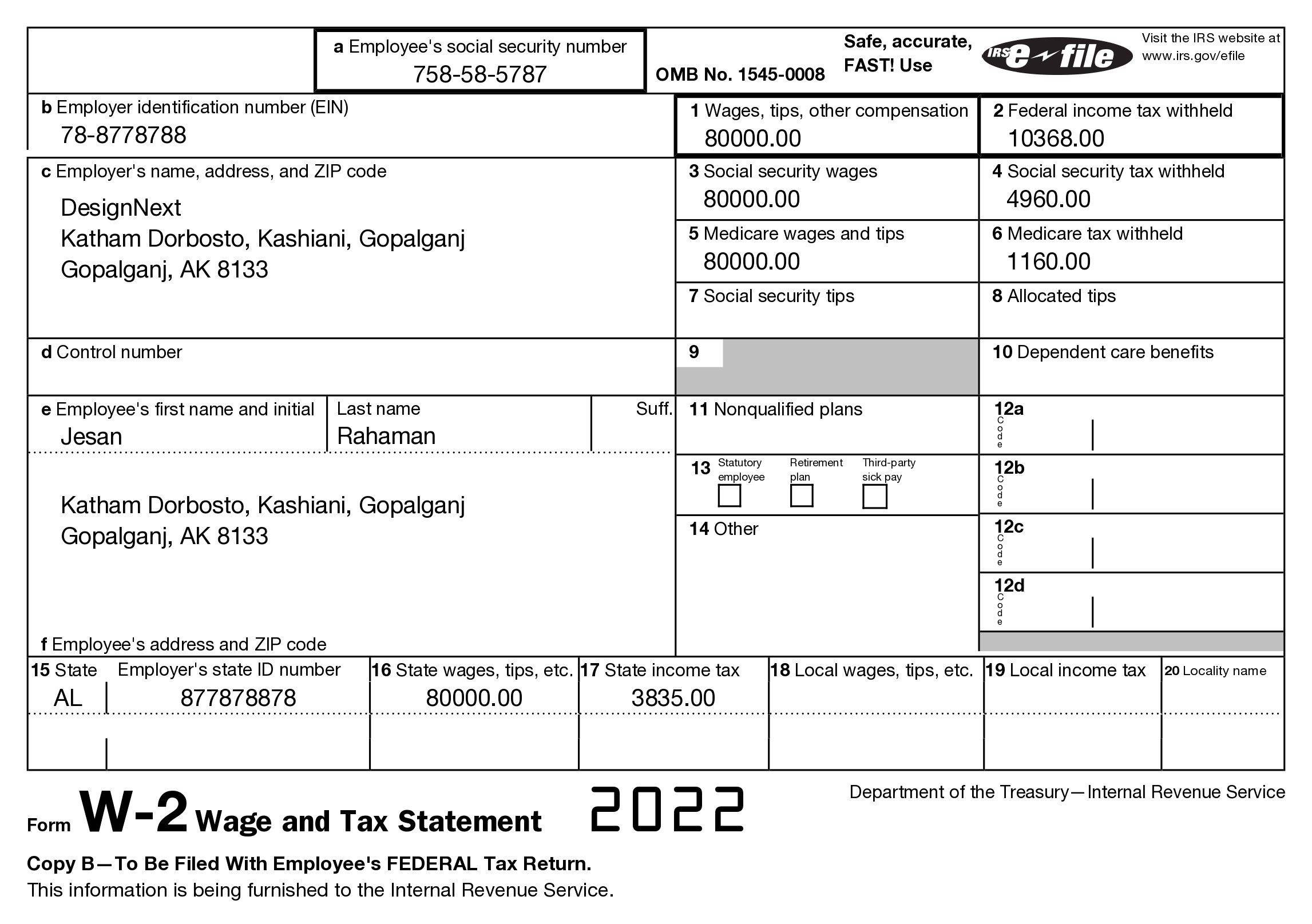

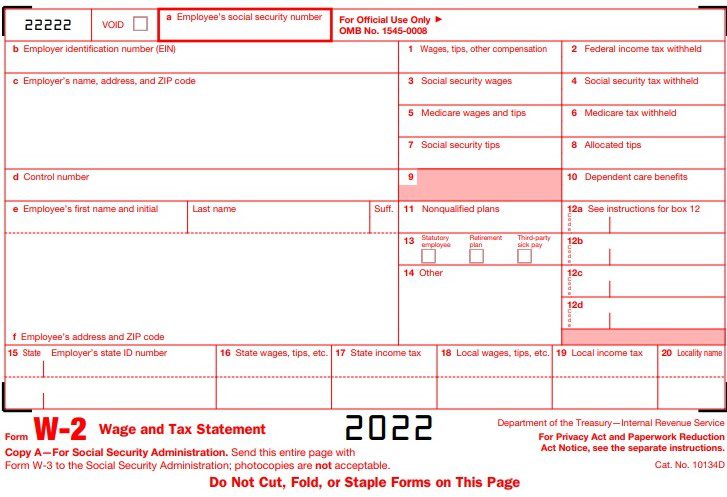

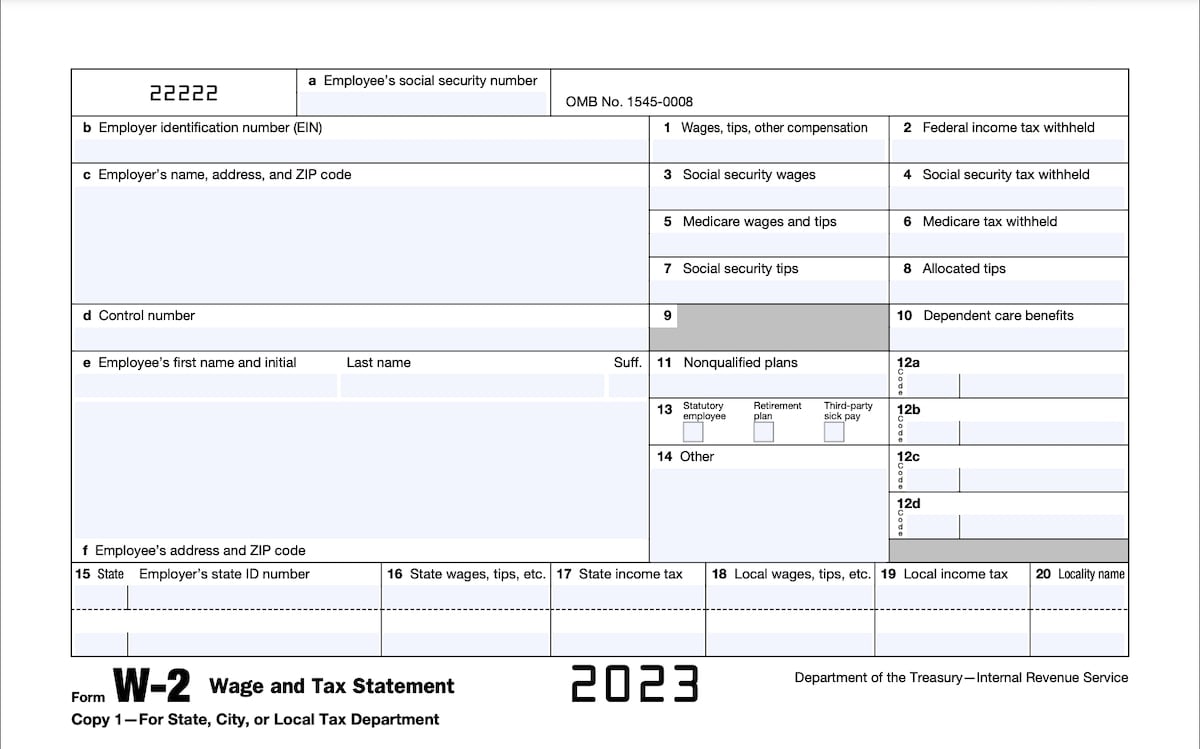

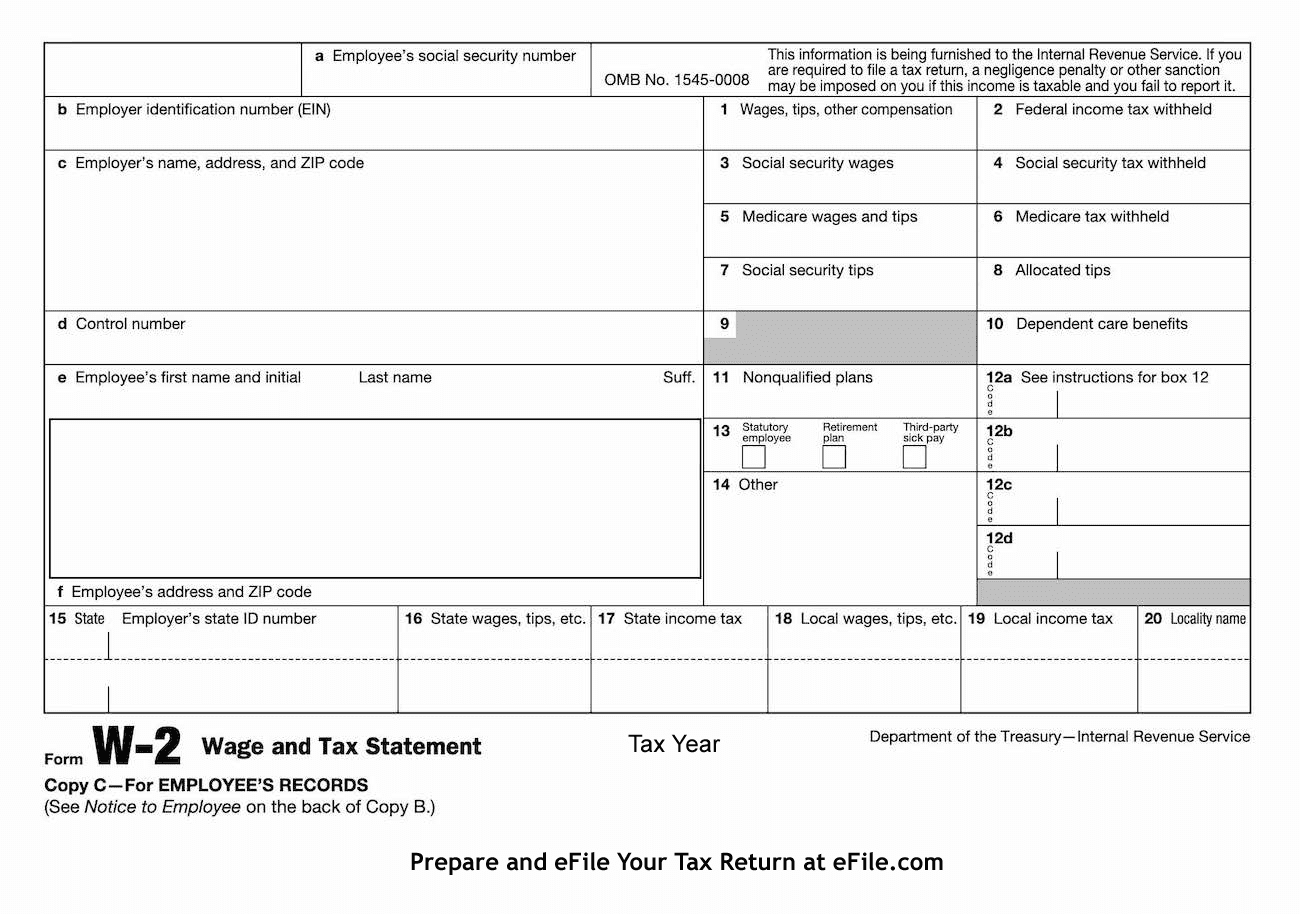

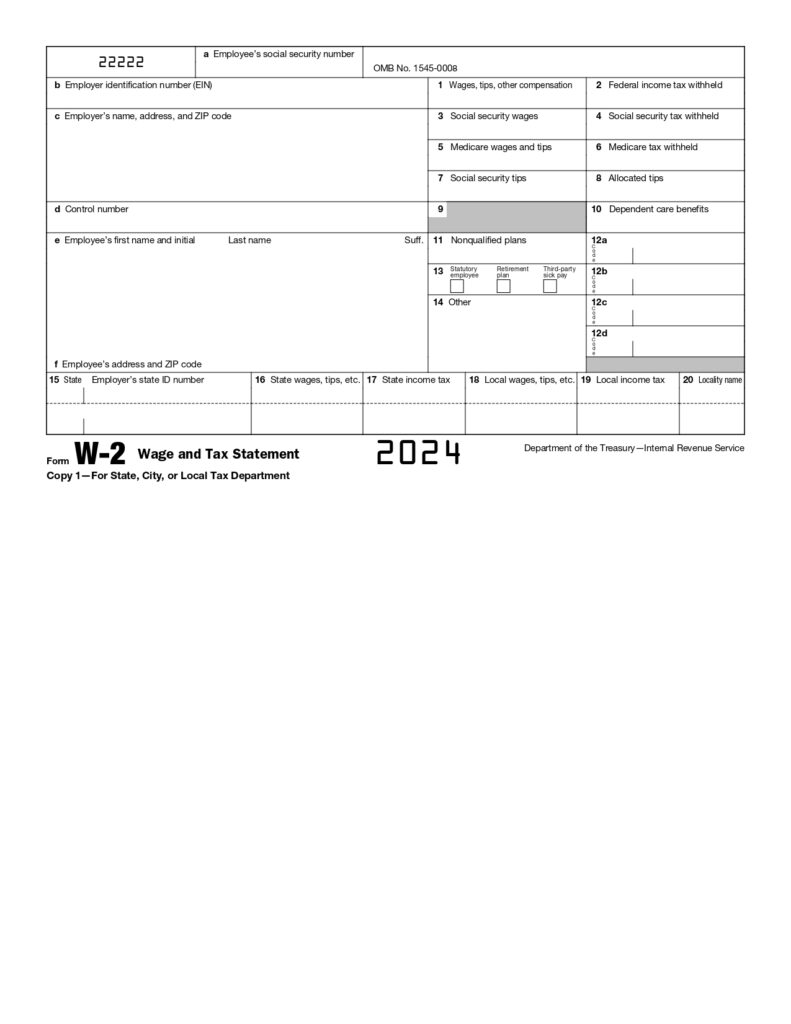

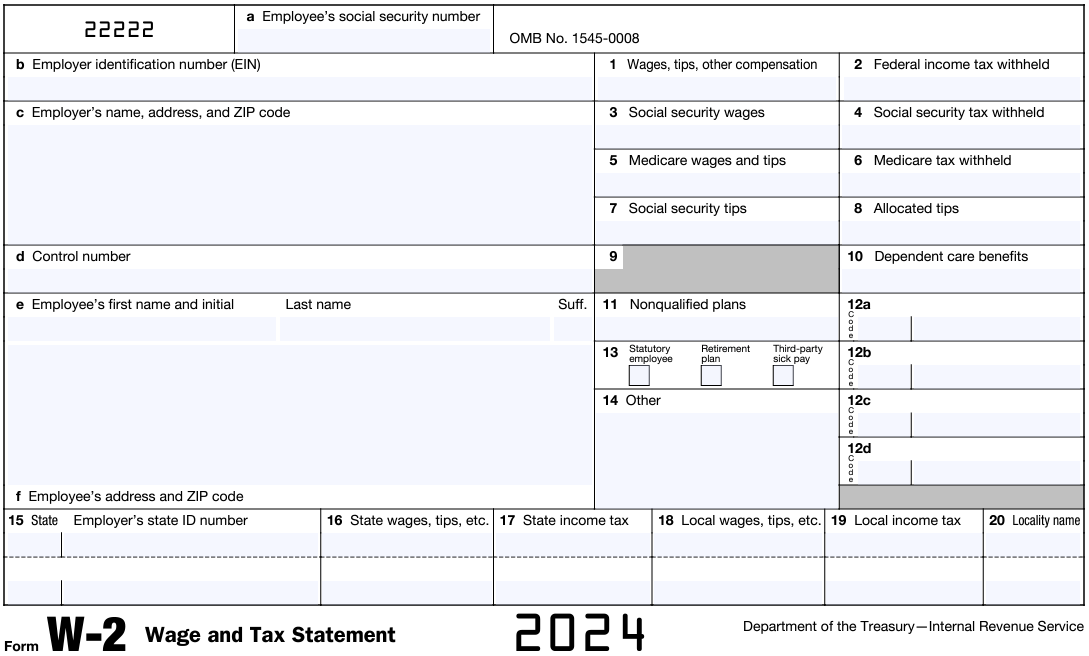

Think of the W-2 Form (officially, the Wage and Tax Statement) as the definitive record of your employment for the previous calendar year. It's issued by your employer and is absolutely essential for filing your federal and state income tax returns.

The W-2 details several key pieces of information. It clearly shows how much money you earned, alongside how much income tax, Social Security tax, and Medicare tax was withheld from your paychecks. Without it, calculating your final tax liability or refund is nearly impossible.

Every person who is considered an employee, rather than an independent contractor, must receive a W-2 form. If you worked as a contractor (receiving a 1099 form), the rules for getting your tax documents are slightly different.

When and How to Expect Your W2

Timing is everything when it comes to taxes. You can't file until you have all your necessary paperwork in hand. Fortunately, the IRS sets a very strict timeline for employers regarding when they must mail or electronically deliver your W-2.

The Deadline Myth

The firm deadline for employers to send out W-2 forms is January 31st of the calendar year following the tax year. For example, W-2s detailing 2023 income must be issued by January 31, 2024. This deadline applies whether the employer sends the form electronically or via standard mail.

While most employers are compliant, remember that mailing times can vary, especially during the busy holiday season leading up to the end of January. You should generally expect your form to arrive within the first two weeks of February.

Digital vs. Paper W2s

The method you use to Get A W2 often depends on your employer's preference and any consent you may have given. Many large companies now default to electronic delivery because it is faster, safer, and more efficient.

If you consented to a digital W-2, you can typically access it through a company payroll portal, often hosted by third-party services like ADP or Paychex. Always double-check your spam folder or junk mail if you are expecting an email notification.

If you receive a paper copy, ensure your employer has your current, correct mailing address on file. This is crucial for avoiding delays during delivery.

Crucial Steps If You Don't Get A W2

What happens if February rolls around and you still haven't managed to Get A W2? Don't panic! Missing W-2s are common, often due to an outdated address or simply a clerical delay.

Wait a Little Longer

Before taking drastic action, give the mail system a little grace period. The IRS recommends waiting until at least mid-February before assuming your W-2 is officially lost. If you usually receive your mail late, this small wait can save you unnecessary phone calls.

Contacting Your Employer

After mid-February, your first and most direct action is to contact your employer. Do not contact the IRS yet—they will simply direct you back to your employer first. Try to contact the payroll or human resources department directly. Here is a clear process to follow:

- Verify your current mailing address, email address, and phone number on file.

- Ask if the W-2 has been issued and, if so, when and how (electronically or physically).

- Request a duplicate copy immediately. Employers are required to provide duplicates upon request.

Previous Employer Issues

If the missing W-2 is from a previous employer, the process is largely the same, but it might require more persistence. Ensure you contact them using the most up-to-date contact information you have.

If the company has gone out of business, the situation becomes more complex. You will need to move quickly to contact the IRS (as detailed below) or potentially the state revenue department that handled the company's closure.

Dealing with the IRS

If you still cannot Get A W2 after contacting your employer multiple times (and you've waited past January 31st), it's time to call the IRS. You should contact them typically after February 28th if the issue remains unresolved.

When you call the IRS, you need to have specific information ready:

- Your name, address, Social Security number, and phone number.

- Your employer's name, address, and phone number.

- The dates you worked for the employer during the tax year.

- An estimate of your wages and the federal income tax withheld. You can usually find these estimates on your last pay stub.

The IRS will contact the employer on your behalf. They will send you a Form 4852, Substitute for Form W-2, Wage and Tax Statement, which you can use to file your return based on your estimates if the tax deadline looms.

What to Do Once You Have Your W2

Once you successfully Get A W2, don't just immediately plug the numbers into your tax software. Take a moment to review the document carefully to ensure everything is correct.

Check for Common Errors

Errors on your W-2 can cause significant headaches during processing, potentially delaying your refund or triggering an audit. Look closely at the following:

- Social Security Number: Is your SSN correct? A single digit mistake can cause major filing issues.

- Name and Address: Ensure they match the details on your tax return.

- Wage Amounts: Do the totals in Box 1 (Wages, Tips, Other Compensation) look about right compared to your yearly earnings?

- Withholding Amounts: Review the amounts in Boxes 2, 4, and 6 (Federal Income Tax Withheld, Social Security Tax Withheld, and Medicare Tax Withheld, respectively).

If you find an error, contact your employer immediately and request a corrected W-2, known as a W-2c. Do not file your return using a form you know is incorrect.

Keep Excellent Records

Even after filing, your W-2 is a critical document. You should keep tax records, including all W-2s, for at least three years from the date you filed the return, or two years from the date you paid the tax, whichever is later. This is especially important in case of an audit.

Conclusion: Success in Getting Your W2

The process to successfully Get A W2 involves simple steps: understanding the January 31st deadline, ensuring your employer has your updated address, and being proactive if the document doesn't arrive on time. Remember that waiting until mid-February is prudent, but after that, do not hesitate to reach out to your employer's payroll department.

If all else fails, the IRS is your ultimate resource, providing the necessary Form 4852 to ensure you can still meet the April tax deadline. By staying organized and following these steps, you can tackle tax season confidently and ensure your documentation is flawless.

Frequently Asked Questions (FAQ) About Getting Your W2

- What if my employer sent the W-2, but I moved and didn't receive it?

- If you moved and failed to update your address with your former employer, the W-2 was likely sent to your old address. You must contact the employer's payroll department immediately and request a duplicate be sent to your new address. They may charge a small fee for duplicate copies.

- Can I file my taxes without my W-2?

- The IRS strongly advises against filing without the official W-2 or the substitute Form 4852. If you try to file using estimated numbers without proper documentation, the IRS will flag your return, leading to significant delays and potential penalties.

- I only worked for my employer for a few weeks; do I still get a W-2?

- Yes. If you earned $600 or more from that employer during the year, you must receive a W-2, regardless of how short your term of employment was. If you earned less than $600, you are still legally due the form, though it may not be necessary to file, depending on your total income.

- How long does it take for the IRS to follow up if I report a missing W-2?

- The IRS will typically give the employer a reasonable amount of time (often 30 days) to respond to the inquiry and send out the form. They will then send you Form 4852 if the issue is still unresolved near the tax deadline.

- If I get my W-2 digitally, do I need to print it?

- If you file electronically, you generally don't need to print it unless your state requires a paper copy of tax documents. However, it is always a good practice to download and securely save a digital copy for your records.

Get A W2

Get A W2 Wallpapers

Collection of get a w2 wallpapers for your desktop and mobile devices.

Serene Get A W2 Background Concept

Explore this high-quality get a w2 image, perfect for enhancing your desktop or mobile wallpaper.

Stunning Get A W2 Background in 4K

A captivating get a w2 scene that brings tranquility and beauty to any device.

Beautiful Get A W2 Landscape for Your Screen

Explore this high-quality get a w2 image, perfect for enhancing your desktop or mobile wallpaper.

Artistic Get A W2 Background for Desktop

This gorgeous get a w2 photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Serene Get A W2 Picture Concept

Discover an amazing get a w2 background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Crisp Get A W2 Photo Illustration

This gorgeous get a w2 photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Amazing Get A W2 View Digital Art

Transform your screen with this vivid get a w2 artwork, a true masterpiece of digital design.

Spectacular Get A W2 View for Desktop

This gorgeous get a w2 photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Beautiful Get A W2 Abstract Collection

Discover an amazing get a w2 background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Vibrant Get A W2 View Art

Transform your screen with this vivid get a w2 artwork, a true masterpiece of digital design.

High-Quality Get A W2 Wallpaper Illustration

Explore this high-quality get a w2 image, perfect for enhancing your desktop or mobile wallpaper.

Breathtaking Get A W2 Moment Collection

Transform your screen with this vivid get a w2 artwork, a true masterpiece of digital design.

Dynamic Get A W2 Capture for Desktop

Find inspiration with this unique get a w2 illustration, crafted to provide a fresh look for your background.

Captivating Get A W2 Capture Art

Immerse yourself in the stunning details of this beautiful get a w2 wallpaper, designed for a captivating visual experience.

Mesmerizing Get A W2 Design Nature

Transform your screen with this vivid get a w2 artwork, a true masterpiece of digital design.

Exquisite Get A W2 Picture Concept

This gorgeous get a w2 photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Artistic Get A W2 Moment Collection

This gorgeous get a w2 photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Artistic Get A W2 Scene for Mobile

Find inspiration with this unique get a w2 illustration, crafted to provide a fresh look for your background.

Detailed Get A W2 Picture Nature

Explore this high-quality get a w2 image, perfect for enhancing your desktop or mobile wallpaper.

Crisp Get A W2 Picture for Your Screen

Find inspiration with this unique get a w2 illustration, crafted to provide a fresh look for your background.

Download these get a w2 wallpapers for free and use them on your desktop or mobile devices.