Graduate tax could replace ‘doomed’ student loans, says ex-watchdog

Graduate Tax Could Replace 'Doomed' Student Loans, Says Ex-Watchdog

For millions of recent graduates, the monthly student loan deduction is a frustrating reminder of debt that feels infinite. They watch their principal balance balloon, driven by high, market-linked interest rates that seem impossible to outpace. It's a system designed to fund higher education, but which often feels like an unsustainable engine of personal financial stress.

Now, a major intervention has rocked the policy world. A former higher education watchdog has declared the current student loan model "doomed" and has proposed a radical alternative: a mandatory Graduate Tax based on lifetime earnings.

This isn't just academic chatter. This high-profile recommendation comes at a time when the student debt crisis is reaching critical mass, demanding immediate and fundamental policy reform to ensure long-term fiscal stability and intergenerational fairness.

Why the Current Student Loan Model is Failing

The existing system—characterized by high upfront tuition fees and complex, high-interest repayment plans—was intended to shift the cost burden away from the general taxpayer and onto the beneficiaries of higher education. The reality, however, has proven dramatically different.

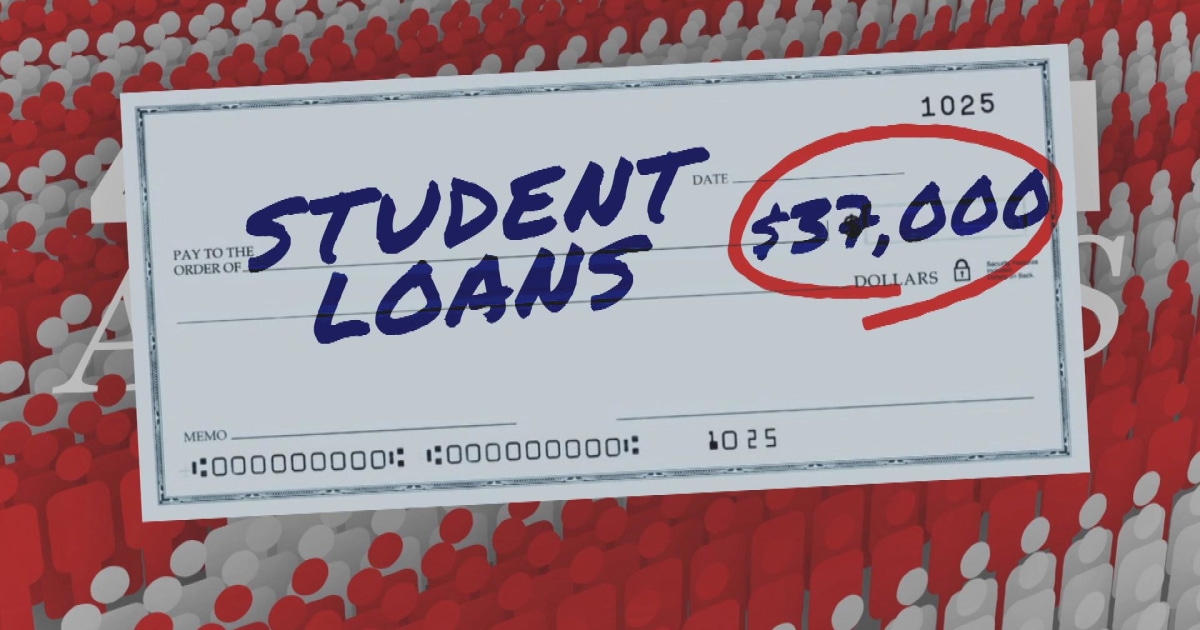

The core problem, according to the ex-watchdog, is twofold: the perceived unfairness of the repayment terms and the massive hole in governmental finances caused by non-repayment. A significant percentage of the debt accumulated is now never expected to be repaid, creating a fiscal illusion where billions are recorded as assets but are effectively dead weight.

Many graduates, particularly those in lower-to-middle income brackets, watch their debt accrue significant interest, often leaving them paying back far more than the initial principal borrowed. This creates psychological distress and acts as a barrier to major life decisions, such as purchasing a home or starting a family.

The watchdog points specifically to the punitive interest rates applied to Plan 2 and subsequent loans, which frequently exceed commercial mortgage rates, making the process feel less like a sensible loan and more like a punitive measure.

Key indicators suggesting the system is 'doomed' include:

- Massive Write-Offs: The government currently expects to write off around 50% of outstanding student loan debt, demonstrating profound inefficiency.

- Ballooning Principal: High-earning graduates often pay off their debt quickly, but mid-earners see interest rates rapidly increase the total amount owed, sometimes doubling the initial loan.

- Complexity and Mistrust: The labyrinthine nature of repayment thresholds and interest calculations erodes public trust in the higher education funding structure.

- Economic Drag: The large mandatory deductions act as a significant drag on disposable income for young professionals, hindering broader economic growth.

The consensus among economic policy advisors is growing: the current structure is neither fair to students nor fiscally responsible for the state. A radical new approach to finance higher education is no longer optional; it is essential.

A Radical Shift: Understanding the Graduate Tax Mechanism

The proposed Graduate Tax (GT) system dismantles the concept of 'debt' entirely, replacing it with a small, mandatory levy on the income of all graduates throughout their working lives. This reform fundamentally alters the relationship between the individual, the university, and the state.

Under this model, the government would pay universities directly for tuition. Graduates, in turn, would contribute a fixed, small percentage of their annual income (e.g., 2% or 3%) above a set earnings threshold, potentially for their entire working career, or until they reach retirement age.

The crucial difference lies in proportionality and risk management. If a graduate earns very little, they contribute very little—or nothing at all. There is no debt principal to accrue interest, and therefore, no risk of a spiraling debt burden that outstrips earnings potential.

The former watchdog argues that this system offers genuine progression. Repayments become truly progressive, ensuring that those who benefit most economically from their degree contribute the most, without penalizing those who choose lower-paying but vital public sector roles.

Benefits cited by proponents of the Graduate Tax:

- Zero Debt Stress: Eliminating the concept of a principal loan balance alleviates mental health concerns and allows graduates to focus on wealth creation.

- Simplified Administration: The levy is collected directly via the income tax system, removing the administrative complexity and overhead associated with managing millions of individualized loan accounts.

- Guaranteed Revenue Stream: Because contributions are tied to salaries and collected by HMRC, the government secures a steady, predictable revenue stream for higher education funding, enhancing fiscal stability.

- Automatic Progression: Contributions scale seamlessly with salary increases, ensuring repayment is always proportionate to current earnings.

- End to Interest Rate Hikes: Since there is no loan, there is no interest. This removes the risk of punitive hikes based on RPI (Retail Price Index) inflation measures.

This system moves the focus from personal debt repayment to collective investment in the national educational infrastructure. It treats university education as a public good, funded progressively by its beneficiaries.

Imagine the relief of a new graduate starting their first job. Instead of facing a £50,000 debt pile growing daily, they simply see a minimal, integrated tax deduction, similar to National Insurance, that contributes to the ongoing system.

The Path Forward: Political Viability and Public Debate

While economically and structurally sound, the adoption of a Graduate Tax is fraught with significant political hurdles. Critics immediately label it a 'tax hike' on aspiration, a politically damaging headline that governments are keen to avoid.

The primary opposition argument revolves around the concept of a 'tax for life.' Even though the percentage might be small, the idea of paying an extra levy until retirement can be unappealing, especially for high earners who might repay a conventional loan faster.

Furthermore, policy makers must address the delicate issue of those who attended university under the previous loan system. Any transition would require careful legislative maneuvering to ensure intergenerational fairness between different cohorts of graduates.

Another key LSI keyword in this debate is the impact on non-graduates. Opponents argue that a system funded centrally, even if repaid by a graduate levy, still relies on the broader taxpayer supporting the risk pool. However, proponents counter that the fiscal stability offered by the GT saves the taxpayer billions in written-off loans.

The ex-watchdog acknowledges these political challenges but stresses the necessity of brave leadership. The current system is a ticking time bomb of unrecoverable debt that offers poor value and high stress to its users. Continuing with the status quo is fiscally irresponsible.

The implementation requires a bold governmental move, likely tied to a complete overhaul of the Treasury's higher education funding model.

Key considerations for implementation include:

- Threshold Setting: Establishing the exact income level at which the levy begins to ensure affordability and fairness across different regions and industries.

- Percentage Rate: Determining the optimal tax percentage (e.g., 2% vs 3%) required to ensure the system is self-sustaining without becoming overly burdensome.

- Addressing Non-Graduate Concerns: Clearly articulating how the new system benefits the entire economy through stability and progressive repayment, mitigating claims of unfair subsidy.

- Legacy Debt Transition: Developing a clear, equitable method for transitioning graduates currently holding massive student loan debt into the new GT structure, possibly through significant debt forgiveness linked to future contributions.

The call from the former watchdog is loud and clear: the student loan model is fundamentally broken. While the Graduate Tax introduces its own complexities, it offers a sustainable, progressive, and significantly less stressful model for funding one of the most vital sectors of the national economy.

As the government faces increasing pressure to address the soaring costs of living and generational inequality, this radical proposal is likely to dominate the policy agenda in the coming months, pushing policy makers towards a decision that will define the future of higher education funding.

Graduate tax could replace 'doomed' student loans, says ex-watchdog

Graduate tax could replace 'doomed' student loans, says ex-watchdog Wallpapers

Collection of graduate tax could replace 'doomed' student loans, says ex-watchdog wallpapers for your desktop and mobile devices.

Artistic Graduate Tax Could Replace 'doomed' Student Loans, Says Ex-watchdog Picture Concept

This gorgeous graduate tax could replace 'doomed' student loans, says ex-watchdog photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Crisp Graduate Tax Could Replace 'doomed' Student Loans, Says Ex-watchdog Image for Mobile

Find inspiration with this unique graduate tax could replace 'doomed' student loans, says ex-watchdog illustration, crafted to provide a fresh look for your background.

Captivating Graduate Tax Could Replace 'doomed' Student Loans, Says Ex-watchdog View for Your Screen

This gorgeous graduate tax could replace 'doomed' student loans, says ex-watchdog photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Lush Graduate Tax Could Replace 'doomed' Student Loans, Says Ex-watchdog Image in 4K

Immerse yourself in the stunning details of this beautiful graduate tax could replace 'doomed' student loans, says ex-watchdog wallpaper, designed for a captivating visual experience.

Serene Graduate Tax Could Replace 'doomed' Student Loans, Says Ex-watchdog Abstract Digital Art

Transform your screen with this vivid graduate tax could replace 'doomed' student loans, says ex-watchdog artwork, a true masterpiece of digital design.

Gorgeous Graduate Tax Could Replace 'doomed' Student Loans, Says Ex-watchdog Landscape for Desktop

This gorgeous graduate tax could replace 'doomed' student loans, says ex-watchdog photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Exquisite Graduate Tax Could Replace 'doomed' Student Loans, Says Ex-watchdog Image Collection

This gorgeous graduate tax could replace 'doomed' student loans, says ex-watchdog photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Spectacular Graduate Tax Could Replace 'doomed' Student Loans, Says Ex-watchdog Scene for Desktop

A captivating graduate tax could replace 'doomed' student loans, says ex-watchdog scene that brings tranquility and beauty to any device.

Vibrant Graduate Tax Could Replace 'doomed' Student Loans, Says Ex-watchdog Design Digital Art

Experience the crisp clarity of this stunning graduate tax could replace 'doomed' student loans, says ex-watchdog image, available in high resolution for all your screens.

/cdn.vox-cdn.com/uploads/chorus_asset/file/9781671/aparkin_171129_2167_0023.jpg)

Detailed Graduate Tax Could Replace 'doomed' Student Loans, Says Ex-watchdog View for Desktop

Discover an amazing graduate tax could replace 'doomed' student loans, says ex-watchdog background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Exquisite Graduate Tax Could Replace 'doomed' Student Loans, Says Ex-watchdog Wallpaper Illustration

A captivating graduate tax could replace 'doomed' student loans, says ex-watchdog scene that brings tranquility and beauty to any device.

Exquisite Graduate Tax Could Replace 'doomed' Student Loans, Says Ex-watchdog Wallpaper for Your Screen

Find inspiration with this unique graduate tax could replace 'doomed' student loans, says ex-watchdog illustration, crafted to provide a fresh look for your background.

%2Fcdn.vox-cdn.com%2Fuploads%2Fchorus_asset%2Ffile%2F16102352%2Fstudent_loans_e1531446236977.jpeg)

Lush Graduate Tax Could Replace 'doomed' Student Loans, Says Ex-watchdog Design Art

This gorgeous graduate tax could replace 'doomed' student loans, says ex-watchdog photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Amazing Graduate Tax Could Replace 'doomed' Student Loans, Says Ex-watchdog Background Nature

Transform your screen with this vivid graduate tax could replace 'doomed' student loans, says ex-watchdog artwork, a true masterpiece of digital design.

Serene Graduate Tax Could Replace 'doomed' Student Loans, Says Ex-watchdog Wallpaper for Your Screen

Experience the crisp clarity of this stunning graduate tax could replace 'doomed' student loans, says ex-watchdog image, available in high resolution for all your screens.

Amazing Graduate Tax Could Replace 'doomed' Student Loans, Says Ex-watchdog Landscape for Desktop

Transform your screen with this vivid graduate tax could replace 'doomed' student loans, says ex-watchdog artwork, a true masterpiece of digital design.

Exquisite Graduate Tax Could Replace 'doomed' Student Loans, Says Ex-watchdog View Photography

A captivating graduate tax could replace 'doomed' student loans, says ex-watchdog scene that brings tranquility and beauty to any device.

Spectacular Graduate Tax Could Replace 'doomed' Student Loans, Says Ex-watchdog Artwork Digital Art

Immerse yourself in the stunning details of this beautiful graduate tax could replace 'doomed' student loans, says ex-watchdog wallpaper, designed for a captivating visual experience.

Beautiful Graduate Tax Could Replace 'doomed' Student Loans, Says Ex-watchdog Moment Art

Explore this high-quality graduate tax could replace 'doomed' student loans, says ex-watchdog image, perfect for enhancing your desktop or mobile wallpaper.

Gorgeous Graduate Tax Could Replace 'doomed' Student Loans, Says Ex-watchdog Landscape Photography

A captivating graduate tax could replace 'doomed' student loans, says ex-watchdog scene that brings tranquility and beauty to any device.

Download these graduate tax could replace 'doomed' student loans, says ex-watchdog wallpapers for free and use them on your desktop or mobile devices.