How Do I Get Earned Income Tax Credit

How Do I Get Earned Income Tax Credit? Your Simple Guide to Claiming This Valuable Refund

Navigating the world of tax credits can often feel overwhelming, but when you hear about a refundable credit that puts real money back in your pocket, it's certainly worth investigating. If you've been asking, "How Do I Get Earned Income Tax Credit (EITC)?" you're in the right place. This credit is designed specifically for low-to-moderate-income working individuals and families, and it can be substantial.

Don't let complicated rules deter you. We are going to break down the exact steps you need to take, the requirements you must meet, and the best way to file to ensure you don't leave any money on the table. Ready to unlock this major tax benefit?

What Exactly is the Earned Income Tax Credit (EITC)?

The Earned Income Tax Credit is one of the largest and most beneficial federal tax credits available. Unlike a standard deduction or a non-refundable credit which only lowers the amount of tax you owe, the EITC is a refundable credit.

What does "refundable" mean for you? It means that if the credit amount is larger than the taxes you owe, the IRS will actually send you the difference in the form of a refund check. It truly acts as a direct subsidy to help working families and individuals.

However, this credit is not automatic. To benefit from it, you must file a federal tax return and specifically claim the credit, even if your income was low enough that you wouldn't normally need to file.

Crucial Steps on How Do I Get Earned Income Tax Credit

The path to claiming the EITC involves verifying two main criteria: your personal eligibility status and your income level. Let's look closely at the necessary requirements.

Step 1: Meet the Basic Eligibility Requirements

Every person claiming the EITC must meet several fundamental criteria, whether or not they have qualifying children. If you don't have a qualifying child, the rules are often stricter, particularly regarding age.

The standard checklist includes:

- You must have earned income. This includes wages, salaries, tips, and net earnings from self-employment. Unemployment benefits and Social Security are generally not counted as earned income for EITC purposes.

- Your Adjusted Gross Income (AGI) must be within the set limits (we will cover these next).

- Your investment income must be less than a certain threshold (typically around $11,000 for the 2024 tax year, though this amount changes annually).

- You must have a valid Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN) for yourself, your spouse (if filing jointly), and any qualifying children.

- You must be a U.S. citizen or resident alien all year, or you must have filed a joint return with a spouse who is.

- You cannot file using the "Married Filing Separately" status. You must use Single, Head of Household, Qualifying Widow(er), or Married Filing Jointly.

Furthermore, if you are claiming the credit without a qualifying child, you must be between the ages of 25 and 65 at the end of the tax year and cannot be claimed as a dependent on someone else's return.

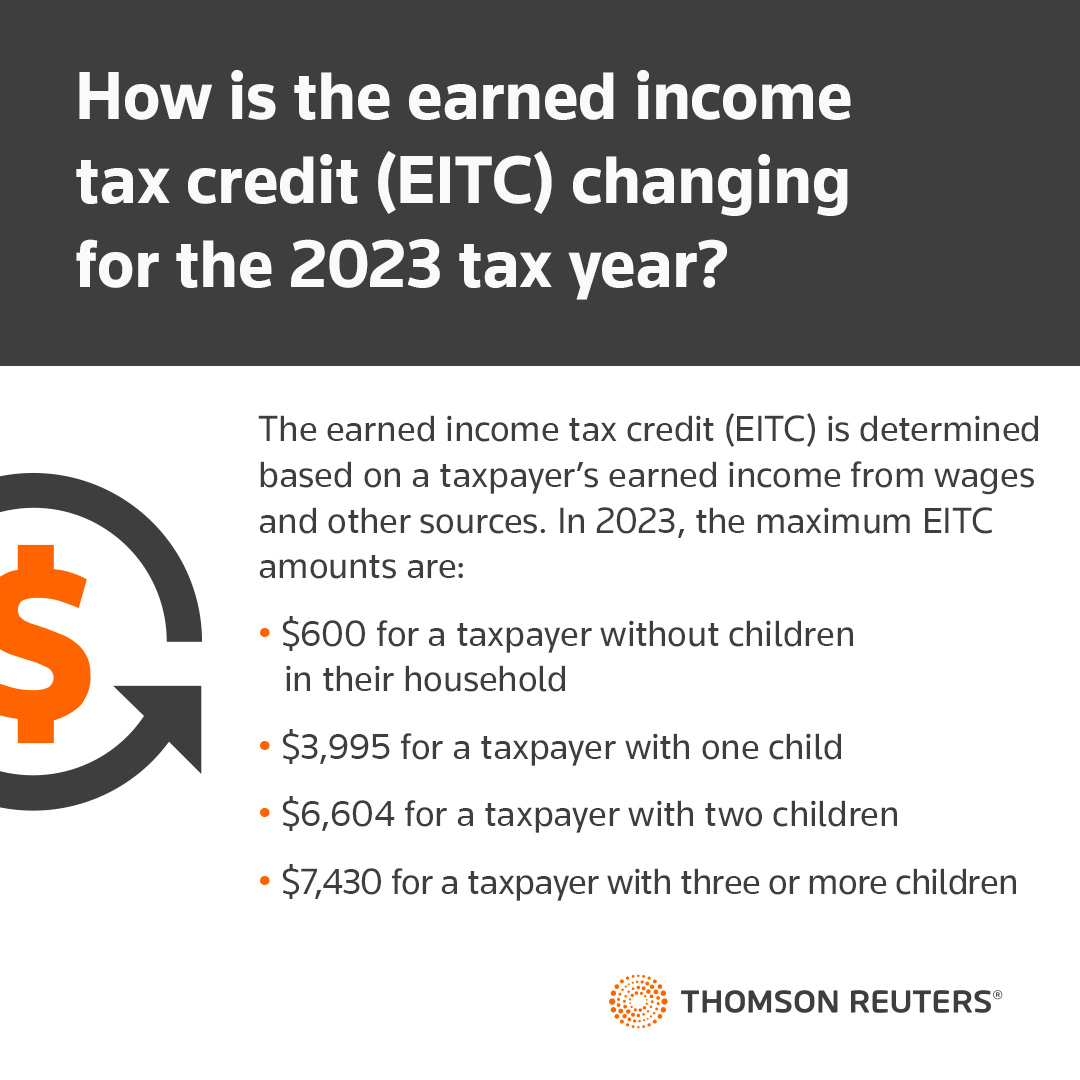

Step 2: Understand Income Limits and Filing Status

The exact amount of the EITC you receive depends heavily on two factors: your filing status and the number of qualifying children you have. Generally, the more children you have, and the lower your income is (while still being "earned income"), the higher your credit will be.

A qualifying child must meet the relationship test, the age test, the residency test, and the joint return test. If you are uncertain about who counts as a qualifying child, the IRS provides an EITC Assistant tool that can help clear things up quickly.

Maximum Income Limits for EITC

The income limits change every year due to inflation adjustments, so you must always check the current year's IRS publication. However, here is a simplified look at how the limits work based on the number of children (using estimated 2024 tax year thresholds for illustration):

- No Qualifying Children: Maximum AGI for filing statuses like Single or Married Filing Jointly must be below roughly $17,640 (Single) or $24,210 (Married Filing Jointly).

- One Qualifying Child: Maximum AGI must be below roughly $46,560 (Single) or $53,120 (Married Filing Jointly).

- Two Qualifying Children: Maximum AGI must be below roughly $52,900 (Single) or $59,470 (Married Filing Jointly).

- Three or More Qualifying Children: Maximum AGI must be below roughly $56,830 (Single) or $63,698 (Married Filing Jointly).

It's important to note that the credit phases in (increases as income rises from zero), peaks, and then phases out (decreases as income gets closer to the maximum threshold). You must be earning *some* income to qualify.

Special Rules for Military and Clergy

If you are a member of the U.S. military or clergy, you might have special considerations when determining your earned income for the EITC. For example, military members can elect to include certain combat pay in their earned income, even though it is typically excluded from gross income.

Making this election can sometimes boost you into the optimal earning range for the EITC, resulting in a higher refund. Always consult Publication 3 or a tax professional familiar with military or clergy income rules to maximize your credit.

Documentation and Filing Methods

Once you've determined that you meet the eligibility criteria, the final step is ensuring proper documentation and filing. You must file Form 1040 (or 1040-SR) and attach Schedule EIC if you have qualifying children.

To prepare your filing, make sure you have all essential income documents, such as W-2s, 1099s (if self-employed), and documentation proving your child's residency (if applicable).

For many low-to-moderate-income filers, the best way to get Earned Income Tax Credit is through free tax preparation services. The IRS offers two excellent options:

- **VITA (Volunteer Income Tax Assistance):** This program offers free tax help to people who generally make $64,000 or less, persons with disabilities, and limited-English-speaking taxpayers. VITA volunteers are certified by the IRS.

- **Free File:** If your AGI is below a certain limit (often around $79,000), you can use commercial tax preparation software provided for free through the IRS Free File partnership. This software guides you step-by-step and automatically calculates the EITC.

Using certified software or professional assistance significantly reduces the chances of errors, which are common with EITC claims and can delay your refund.

Conclusion

The Earned Income Tax Credit is a vital tool for boosting the finances of working Americans. Successfully figuring out "How Do I Get Earned Income Tax Credit?" comes down to careful attention to detail regarding your earned income, your AGI, and your qualifying children.

Remember that you must file a tax return to claim this credit, even if you owe no tax. Use the free resources available—VITA or Free File—to ensure your return is filed accurately and promptly, allowing you to benefit fully from this refundable credit.

Frequently Asked Questions (FAQ) About EITC

- Can I claim the EITC if I am self-employed?

- Yes, absolutely. Net earnings from self-employment count as earned income for the EITC. You will need to calculate your profit or loss using Schedule C to determine your net earnings.

- How long does it take to get my EITC refund?

- Due to regulations aimed at preventing fraud, the IRS must wait until mid-February to release refunds involving the EITC and the Additional Child Tax Credit (ACTC). If you e-file and select direct deposit, you typically receive your refund within one to three weeks after that mid-February date.

- What if I missed claiming the EITC in previous years?

- You can file an amended return using Form 1040-X to claim the EITC for up to three years after the original due date of the return. If you qualified but missed it, definitely go back and amend those returns!

- Do I need to report my EITC refund as income next year?

- No, the Earned Income Tax Credit is not considered taxable income and should not be reported on your tax return for the following year.

How Do I Get Earned Income Tax Credit

How Do I Get Earned Income Tax Credit Wallpapers

Collection of how do i get earned income tax credit wallpapers for your desktop and mobile devices.

Detailed How Do I Get Earned Income Tax Credit Photo for Your Screen

Experience the crisp clarity of this stunning how do i get earned income tax credit image, available in high resolution for all your screens.

Artistic How Do I Get Earned Income Tax Credit Design Collection

Immerse yourself in the stunning details of this beautiful how do i get earned income tax credit wallpaper, designed for a captivating visual experience.

Breathtaking How Do I Get Earned Income Tax Credit View Concept

Experience the crisp clarity of this stunning how do i get earned income tax credit image, available in high resolution for all your screens.

Beautiful How Do I Get Earned Income Tax Credit Artwork for Your Screen

Discover an amazing how do i get earned income tax credit background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Breathtaking How Do I Get Earned Income Tax Credit Abstract Concept

Experience the crisp clarity of this stunning how do i get earned income tax credit image, available in high resolution for all your screens.

Gorgeous How Do I Get Earned Income Tax Credit Picture Collection

Find inspiration with this unique how do i get earned income tax credit illustration, crafted to provide a fresh look for your background.

Stunning How Do I Get Earned Income Tax Credit View Digital Art

A captivating how do i get earned income tax credit scene that brings tranquility and beauty to any device.

Beautiful How Do I Get Earned Income Tax Credit Scene for Your Screen

Explore this high-quality how do i get earned income tax credit image, perfect for enhancing your desktop or mobile wallpaper.

Lush How Do I Get Earned Income Tax Credit Wallpaper Illustration

A captivating how do i get earned income tax credit scene that brings tranquility and beauty to any device.

High-Quality How Do I Get Earned Income Tax Credit Artwork Digital Art

Experience the crisp clarity of this stunning how do i get earned income tax credit image, available in high resolution for all your screens.

Serene How Do I Get Earned Income Tax Credit Picture Collection

Transform your screen with this vivid how do i get earned income tax credit artwork, a true masterpiece of digital design.

Serene How Do I Get Earned Income Tax Credit Image in 4K

Transform your screen with this vivid how do i get earned income tax credit artwork, a true masterpiece of digital design.

Stunning How Do I Get Earned Income Tax Credit Background in HD

Find inspiration with this unique how do i get earned income tax credit illustration, crafted to provide a fresh look for your background.

High-Quality How Do I Get Earned Income Tax Credit Moment Nature

Experience the crisp clarity of this stunning how do i get earned income tax credit image, available in high resolution for all your screens.

Beautiful How Do I Get Earned Income Tax Credit Scene Digital Art

Discover an amazing how do i get earned income tax credit background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Lush How Do I Get Earned Income Tax Credit Photo Nature

A captivating how do i get earned income tax credit scene that brings tranquility and beauty to any device.

Dynamic How Do I Get Earned Income Tax Credit Capture Art

Immerse yourself in the stunning details of this beautiful how do i get earned income tax credit wallpaper, designed for a captivating visual experience.

Breathtaking How Do I Get Earned Income Tax Credit Design Art

Experience the crisp clarity of this stunning how do i get earned income tax credit image, available in high resolution for all your screens.

Detailed How Do I Get Earned Income Tax Credit Moment Digital Art

Transform your screen with this vivid how do i get earned income tax credit artwork, a true masterpiece of digital design.

Breathtaking How Do I Get Earned Income Tax Credit Capture Concept

Experience the crisp clarity of this stunning how do i get earned income tax credit image, available in high resolution for all your screens.

Download these how do i get earned income tax credit wallpapers for free and use them on your desktop or mobile devices.