How To Get An Auto Loan From A Bank

How To Get An Auto Loan From A Bank: Your Ultimate Guide

Thinking about driving away in a new (or new-to-you) car? That feeling is exciting! But before you hit the dealership lot, you need to sort out the financing. For many people, the best rates and most straightforward terms come directly from a financial institution. This article is your comprehensive, easy-to-follow guide on How To Get An Auto Loan From A Bank, ensuring you secure the best deal possible without the headaches.

Getting a bank loan might seem intimidating, but it's simpler than you think when you know the steps. We'll break down everything from checking your credit score to finally signing on the dotted line. Let's get started!

Why Choose a Bank for Your Auto Loan?

While dealership financing offers convenience, turning to a bank—especially one you already have a relationship with—often yields significant benefits. Banks tend to offer more competitive interest rates compared to the average dealer markup. Furthermore, having a pre-approved loan from a bank gives you tremendous negotiating power when you finally talk price with the car salesman.

When you secure financing directly from a bank, you become a cash buyer at the dealership. This separation of the car purchase from the financing process simplifies negotiations greatly. Ultimately, you want to focus on getting the best price for the vehicle, not the best terms for the loan—your bank handles the latter.

Step 1: Check Your Financial Health (The Crucial Prep Work)

Before you even step foot inside a bank lobby or fill out an online form, preparation is key. Banks base their loan decisions and interest rates primarily on your financial reliability. The stronger your financial profile, the lower your interest rate will be.

Understanding Your Credit Score

Your credit score is the single most important factor determining the cost of your auto loan. Banks use this three-digit number to assess the risk of lending you money. Generally, scores above 740 are considered "Excellent" and qualify for the absolute best rates. If your score is lower, you might still get a loan, but the interest rate will be higher, costing you more money over time.

It is vital to check your credit report from all three major bureaus (Equifax, Experian, TransUnion) and resolve any errors before applying. A mistake on your report could unfairly bump up your interest rate.

Step 2: Calculate What You Can Afford

Just because a bank offers you a large loan doesn't mean you should take it. You must determine a comfortable monthly payment that fits your budget. Experts recommend that your total transportation costs (loan payment, insurance, fuel, maintenance) should not exceed 10-15% of your monthly take-home pay.

Factors Affecting Your Loan Amount

When applying for a loan, banks look at a few key variables. Knowing these upfront helps you set realistic expectations:

- Debt-to-Income (DTI) Ratio: This is the percentage of your gross monthly income that goes toward paying debts. Banks prefer a low DTI.

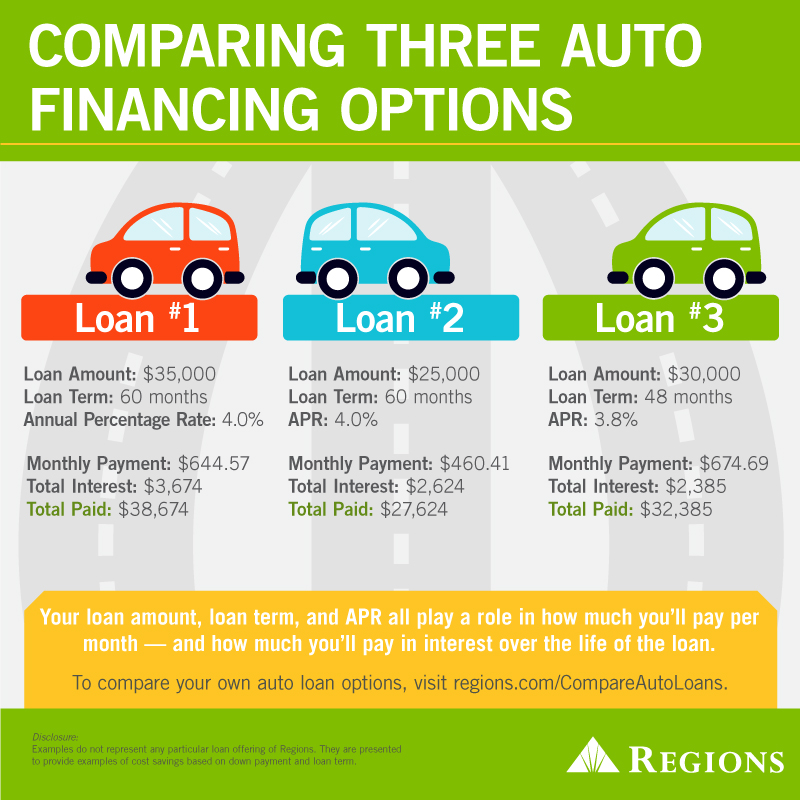

- Loan Term: Shorter loan terms (e.g., 36 or 48 months) usually have lower interest rates but higher monthly payments. Longer terms (60 or 72 months) reduce the monthly payment but increase the total interest paid.

- Down Payment: A larger down payment reduces the loan amount and signals financial stability to the bank, often resulting in better rates.

The Auto Loan Application Process at the Bank

Once your financial house is in order, it's time to start the official process. Shop around! Don't just apply to your current bank; check rates from at least three different institutions—local credit unions often have excellent terms too. Submitting multiple applications within a short 14-day window counts as only one hard inquiry on your credit report, so take advantage of comparison shopping.

Here's how the process typically flows when you apply to get an auto loan from a bank:

- Initial Application: Fill out the application, either online or in person. You will provide personal information, employment details, and the desired loan amount.

- Documentation Submission: Provide all necessary paperwork (proof of income, ID, etc.).

- Underwriting Review: The bank reviews your credit, DTI, and submitted documents.

- Pre-Approval Offer: If approved, the bank issues a pre-approval letter stating the maximum amount they will lend you, the interest rate, and the loan terms. This offer is usually valid for 30–60 days.

Required Documentation Checklist

To expedite the process, make sure you have these common documents ready:

- Valid Government-Issued ID (Driver's License or Passport).

- Proof of Residence (Utility Bill, Lease Agreement).

- Proof of Income (Recent pay stubs or W-2s/1099s).

- Bank Statements (To confirm your assets and account activity).

- Social Security Number.

Pre-Approval vs. Dealer Financing

Having a bank pre-approval is your golden ticket. It sets a ceiling for your interest rate and loan terms. When you get to the dealership, you can still let them try to beat your bank's rate. If the dealer finds a better deal, fantastic! If not, you simply present your bank's pre-approval letter, and the dealer processes the paperwork as if you were paying cash.

Never tell the dealer your maximum budget before getting a concrete price for the car itself. Always negotiate the price of the car first, and then discuss financing options.

Negotiating and Finalizing Your Bank Auto Loan

Once you've settled on a vehicle, you need to finalize the details with your bank. If you used a pre-approval, you must submit specific information about the car (VIN, mileage, sale price) back to the bank. Since the bank uses the car as collateral, they need to verify its value.

Banks usually lend based on the lower of the purchase price or the vehicle's book value (like Kelley Blue Book). If you are buying a car that the bank deems overvalued, they might only lend you 90% of the purchase price, meaning you need a larger down payment.

Key Details to Review Before Signing

Before putting pen to paper, review your loan agreement carefully. Ensure the bank's final loan document matches the terms of your pre-approval, paying special attention to these points:

- Annual Percentage Rate (APR): Is this the exact rate you were quoted?

- Total Loan Amount: Does this match the vehicle price minus your down payment?

- Loan Term: Confirm the repayment schedule (e.g., 60 months).

- Prepayment Penalties: Ensure there are no penalties if you decide to pay the loan off early. Reputable banks rarely include these for auto loans.

Conclusion: Mastering How To Get An Auto Loan From A Bank

Getting an auto loan from a bank requires planning, but the rewards are well worth the effort. By prioritizing your credit health, determining your budget upfront, and seeking pre-approval, you put yourself in the driver's seat. Remember, the goal is not just to get approved, but to secure the most affordable financing possible.

Following this systematic approach—checking your credit, shopping for rates, and securing pre-approval—empowers you to purchase your new vehicle with confidence and the knowledge that you have negotiated the best deal available for your financial situation. Knowing How To Get An Auto Loan From A Bank means you save thousands of dollars and enjoy your new ride worry-free.

Frequently Asked Questions (FAQ) About Bank Auto Loans

- What is the minimum credit score needed to get an auto loan from a bank?

- While there isn't a strict minimum across all banks, most major banks prefer applicants with scores above 660 (Prime). Scores below 600 might qualify but will face much higher interest rates, often requiring a larger down payment or a co-signer.

- How long does the bank auto loan application process take?

- The initial pre-approval application can often be completed in under 15 minutes online. The bank's decision usually comes within 24 to 48 hours. Once you have chosen the car, the final funding process (from submitting the vehicle details to the bank releasing the funds) typically takes another 1-3 business days.

- Is it better to get a short-term or long-term auto loan?

- A shorter loan term (e.g., 36 or 48 months) is usually better financially because it saves you substantial money in interest over the life of the loan. However, if monthly affordability is your primary concern, a longer term (60 or 72 months) may be necessary to lower the payment.

- Do I need a down payment when getting an auto loan from a bank?

- While 100% financing is possible for highly qualified buyers, banks strongly prefer a down payment. Putting down at least 10% for a used car or 20% for a new car is standard advice. A down payment reduces your risk to the bank and helps prevent you from being "upside down" (owing more than the car is worth).

How To Get An Auto Loan From A Bank

How To Get An Auto Loan From A Bank Wallpapers

Collection of how to get an auto loan from a bank wallpapers for your desktop and mobile devices.

Crisp How To Get An Auto Loan From A Bank Capture for Mobile

This gorgeous how to get an auto loan from a bank photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Amazing How To Get An Auto Loan From A Bank Abstract Concept

Transform your screen with this vivid how to get an auto loan from a bank artwork, a true masterpiece of digital design.

Beautiful How To Get An Auto Loan From A Bank Moment Collection

Experience the crisp clarity of this stunning how to get an auto loan from a bank image, available in high resolution for all your screens.

Breathtaking How To Get An Auto Loan From A Bank Picture Digital Art

Discover an amazing how to get an auto loan from a bank background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Exquisite How To Get An Auto Loan From A Bank Image Illustration

A captivating how to get an auto loan from a bank scene that brings tranquility and beauty to any device.

Spectacular How To Get An Auto Loan From A Bank Design Photography

A captivating how to get an auto loan from a bank scene that brings tranquility and beauty to any device.

Stunning How To Get An Auto Loan From A Bank Picture Photography

This gorgeous how to get an auto loan from a bank photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Spectacular How To Get An Auto Loan From A Bank Landscape Collection

Find inspiration with this unique how to get an auto loan from a bank illustration, crafted to provide a fresh look for your background.

Artistic How To Get An Auto Loan From A Bank Artwork Digital Art

This gorgeous how to get an auto loan from a bank photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Lush How To Get An Auto Loan From A Bank Artwork Art

Find inspiration with this unique how to get an auto loan from a bank illustration, crafted to provide a fresh look for your background.

Serene How To Get An Auto Loan From A Bank Moment for Your Screen

Discover an amazing how to get an auto loan from a bank background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Gorgeous How To Get An Auto Loan From A Bank Capture in 4K

Immerse yourself in the stunning details of this beautiful how to get an auto loan from a bank wallpaper, designed for a captivating visual experience.

Exquisite How To Get An Auto Loan From A Bank View Digital Art

This gorgeous how to get an auto loan from a bank photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Stunning How To Get An Auto Loan From A Bank Abstract Photography

Immerse yourself in the stunning details of this beautiful how to get an auto loan from a bank wallpaper, designed for a captivating visual experience.

Stunning How To Get An Auto Loan From A Bank Design Photography

Find inspiration with this unique how to get an auto loan from a bank illustration, crafted to provide a fresh look for your background.

Exquisite How To Get An Auto Loan From A Bank Capture Illustration

Immerse yourself in the stunning details of this beautiful how to get an auto loan from a bank wallpaper, designed for a captivating visual experience.

Beautiful How To Get An Auto Loan From A Bank Moment Collection

Experience the crisp clarity of this stunning how to get an auto loan from a bank image, available in high resolution for all your screens.

Beautiful How To Get An Auto Loan From A Bank View Photography

Discover an amazing how to get an auto loan from a bank background image, ideal for personalizing your devices with vibrant colors and intricate designs.

:max_bytes(150000):strip_icc()/GettyImages-1158728857-eade4de9daf04c7f904627b888d84b03.jpg)