How To Get Cash Flow

How To Get Cash Flow: A Practical Guide to Financial Freedom

If you run a business, or even if you are managing personal finances, you know that feeling when the money just isn't flowing smoothly. You might be profitable on paper, but if the bank account looks empty, you have a cash flow problem. Learning How To Get Cash Flow moving in the right direction is not just about making more sales; it's about mastering the timing of money entering and leaving your pockets.

This guide is designed to cut through the complex finance jargon and give you actionable steps. We will explore simple yet powerful strategies that business owners and individuals can use right now to improve liquidity and ensure their financial operations are healthy and sustainable. Ready to stop worrying about paying the next bill? Let's dive in.

Understanding What Cash Flow Truly Is

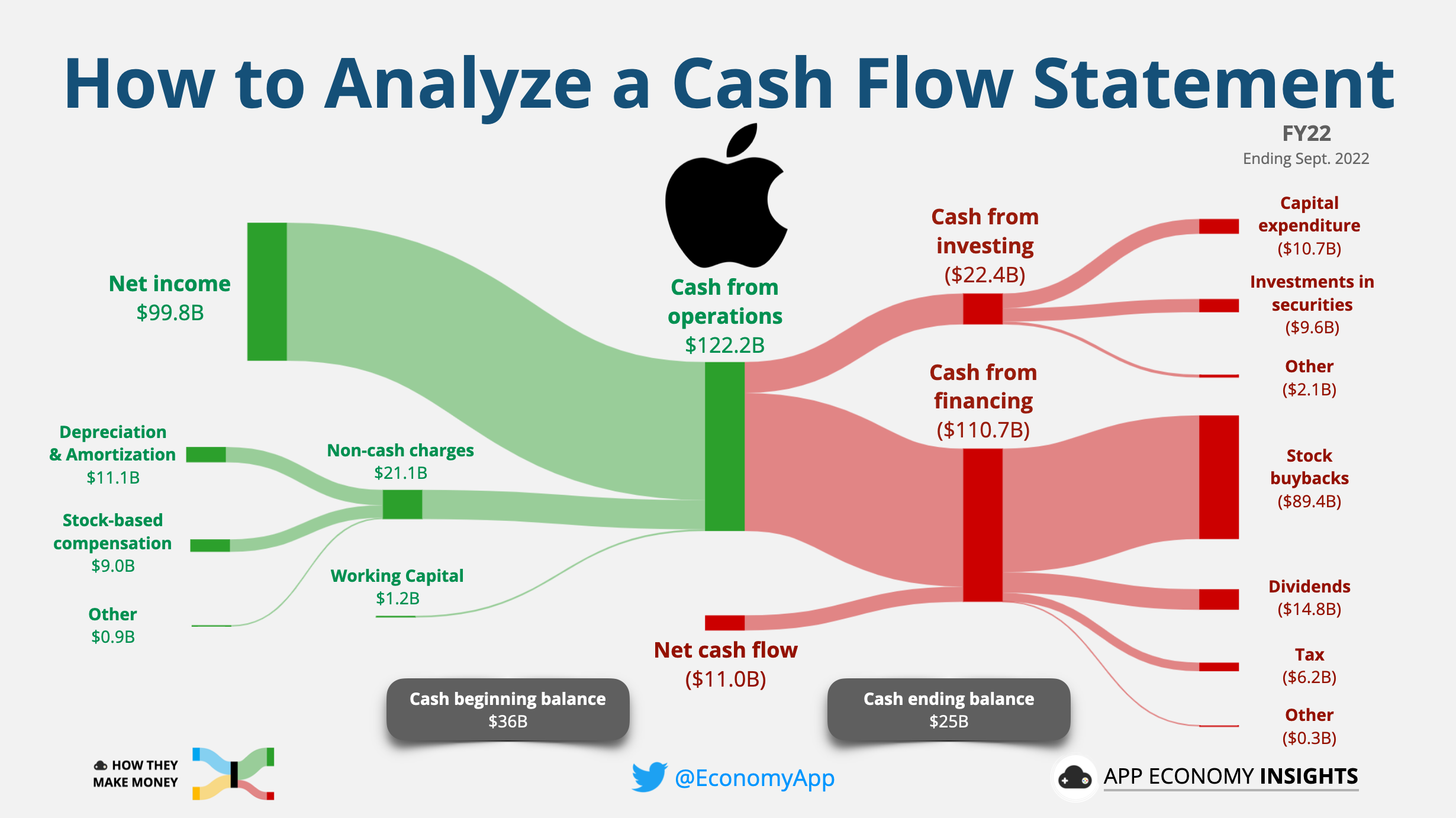

In the simplest terms, cash flow is the net amount of cash and cash-equivalents being transferred into and out of your business or bank account. It's the difference between the cash you receive (inflows) and the cash you spend (outflows) over a period of time. Positive cash flow means you have more money coming in than going out, while negative cash flow means the opposite.

Many people confuse profit with cash flow. Profit is what remains after deducting all expenses from revenue, regardless of whether that money has actually landed in your account. Cash flow, however, deals exclusively with liquid funds. You can be highly profitable yet still go bankrupt if you don't know How To Get Cash Flow managed efficiently because you can't pay immediate bills with theoretical profit.

Analyzing Your Current Financial Situation

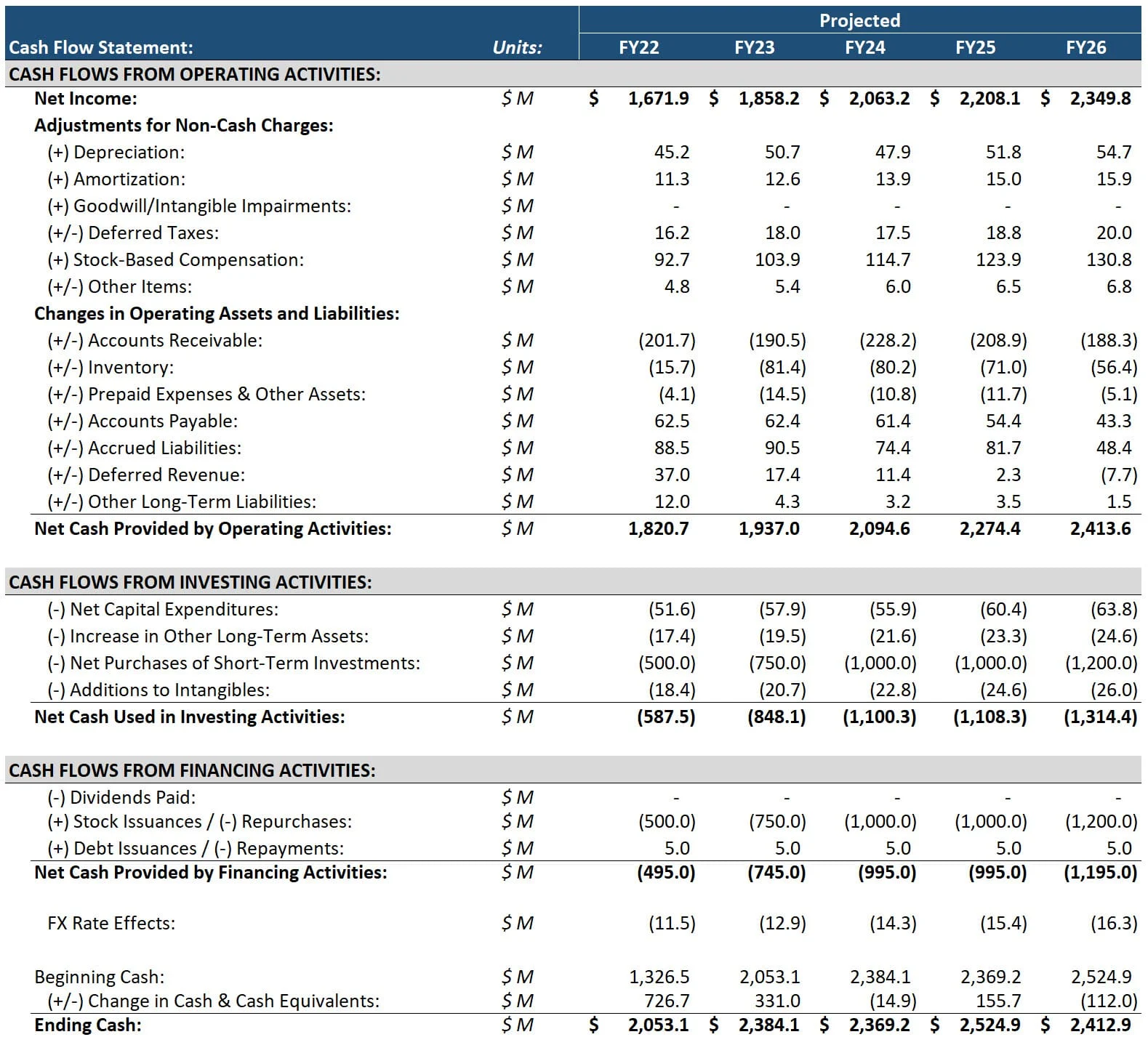

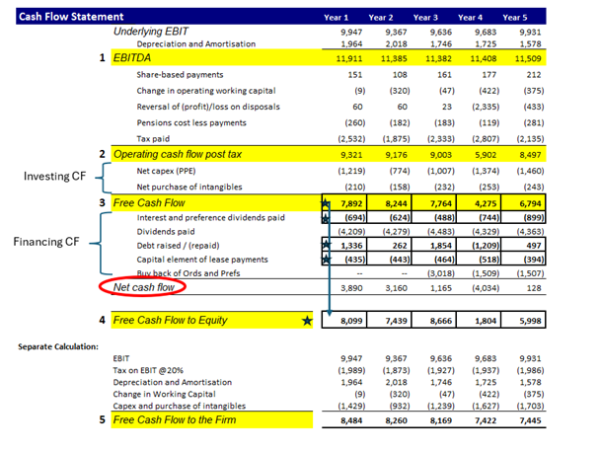

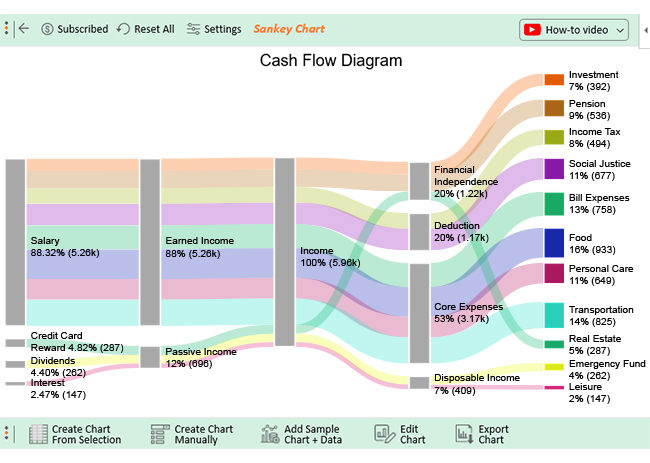

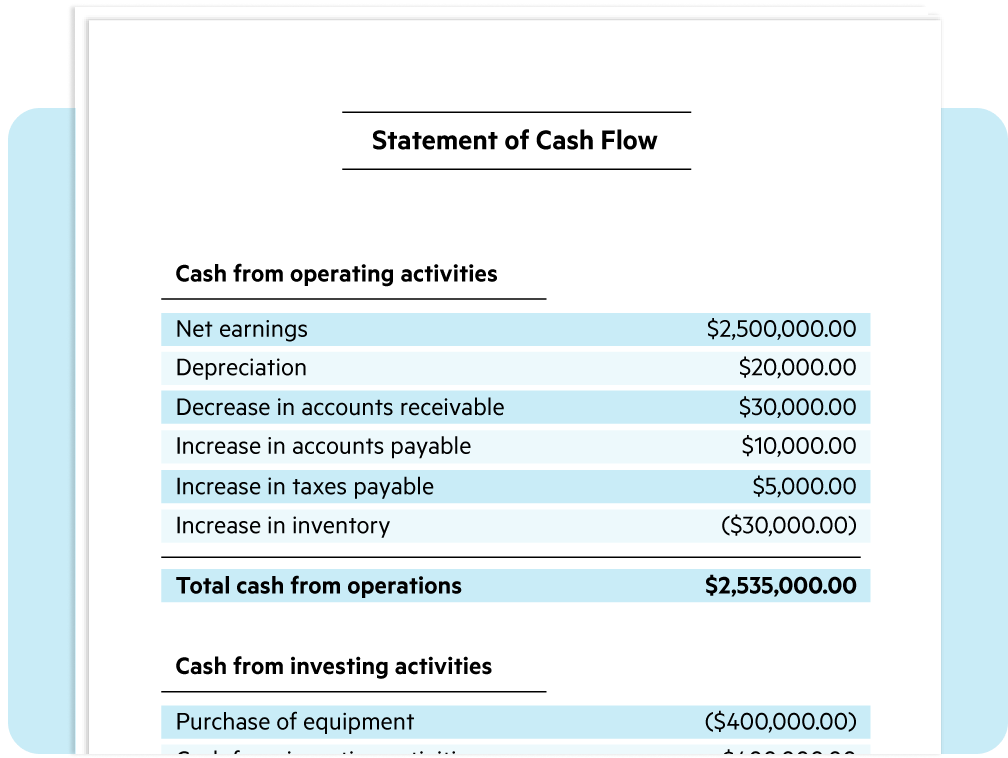

Before you can fix a problem, you need to understand its roots. Start by looking at your cash flow statement (or a simple log if you are managing personal finances). You need absolute clarity on where every dollar is coming from and where it is going.

Specifically, look at your operating, investing, and financing activities. Are your day-to-day operations generating enough cash, or are you constantly relying on borrowing (financing activities) just to stay afloat? Identifying these trends is the critical first step in determining How To Get Cash Flow stable.

Quick Wins: Improving Cash Flow Immediately

If you need cash today, there are several immediate actions you can take. These quick wins often involve small shifts in how you handle transactions, but they can yield huge results almost overnight. They focus on speeding up inflows and slowing down outflows.

- Invoice Faster: Stop waiting until the end of the month. Send invoices immediately upon project completion or service delivery.

- Offer Discounts for Early Payment: Incentivize clients to pay quickly, perhaps offering a 2% discount for payment within 10 days instead of 30.

- Negotiate Payment Terms with Suppliers: Conversely, ask your suppliers for longer payment terms (e.g., Net 45 instead of Net 30). This keeps your money in your account longer.

- Review Non-Essential Subscriptions: Audit your monthly expenses. Are you paying for software or services you rarely use? Cancel them immediately.

Long-Term Strategies to Maintain Positive Cash Flow

While quick fixes are great for immediate relief, sustainable financial health requires structural changes. These long-term strategies are foundational steps in mastering How To Get Cash Flow consistently positive month after month.

Maintaining strong relationships with customers and suppliers while optimizing internal efficiencies is the core principle here. It's about creating systems that naturally promote timely cash inflow and efficient expenditure.

Mastering Accounts Receivable (AR)

Accounts Receivable (AR) represents the money owed to you by customers. If this pile of outstanding invoices grows too large or ages too quickly, your cash flow suffers tremendously. Effective AR management is non-negotiable for success.

- Clear Payment Policies: Make sure your payment terms are crystal clear before work begins. Get sign-offs on contracts detailing due dates and late fees.

- Systematic Follow-Up: Don't wait until an invoice is 60 days overdue to send a reminder. Implement a polite but firm automated follow-up sequence at 7 days, 3 days before due, on the due date, and then weekly thereafter.

- Require Deposits or Progress Payments: For large projects, always require an upfront deposit (e.g., 25-50%). Structure the remaining payments based on milestones, ensuring cash trickles in as the work progresses, reducing your financial risk.

- Accept Various Payment Methods: The easier it is for a customer to pay you (credit card, bank transfer, PayPal), the faster you will receive the money.

Optimizing Inventory and Supply Chain

If you sell physical products, inventory is often the single biggest drain on cash flow. Every dollar tied up in stock sitting on a shelf is a dollar you can't use for marketing, payroll, or equipment. Poor inventory management directly impacts how quickly you can achieve positive cash flow.

Adopt principles like Just-In-Time (JIT) inventory where possible. This means ordering goods only when they are needed for production or immediate sale. While this takes careful planning, it minimizes storage costs and reduces the risk of obsolescence, freeing up significant working capital.

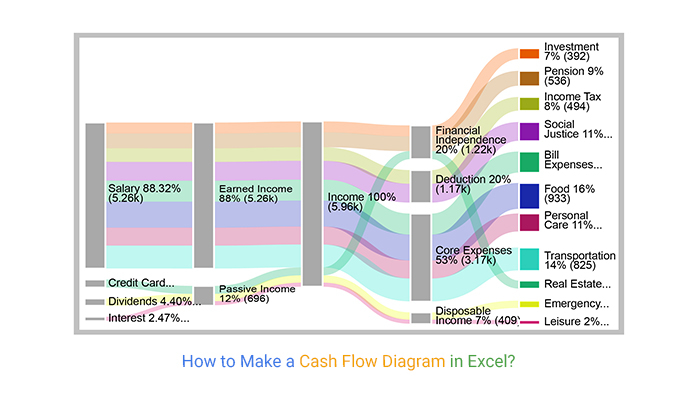

Leverage Technology and Forecasting

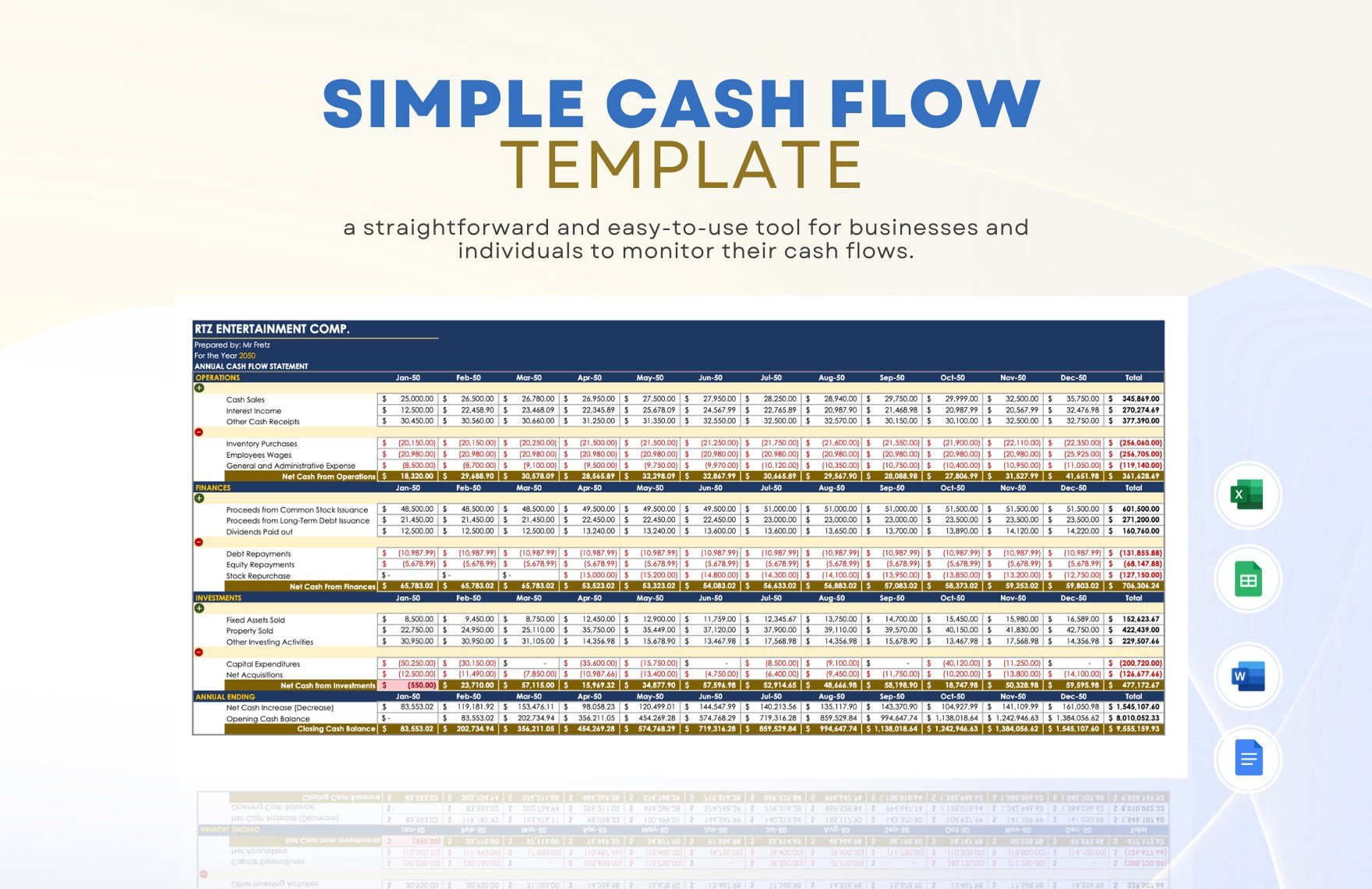

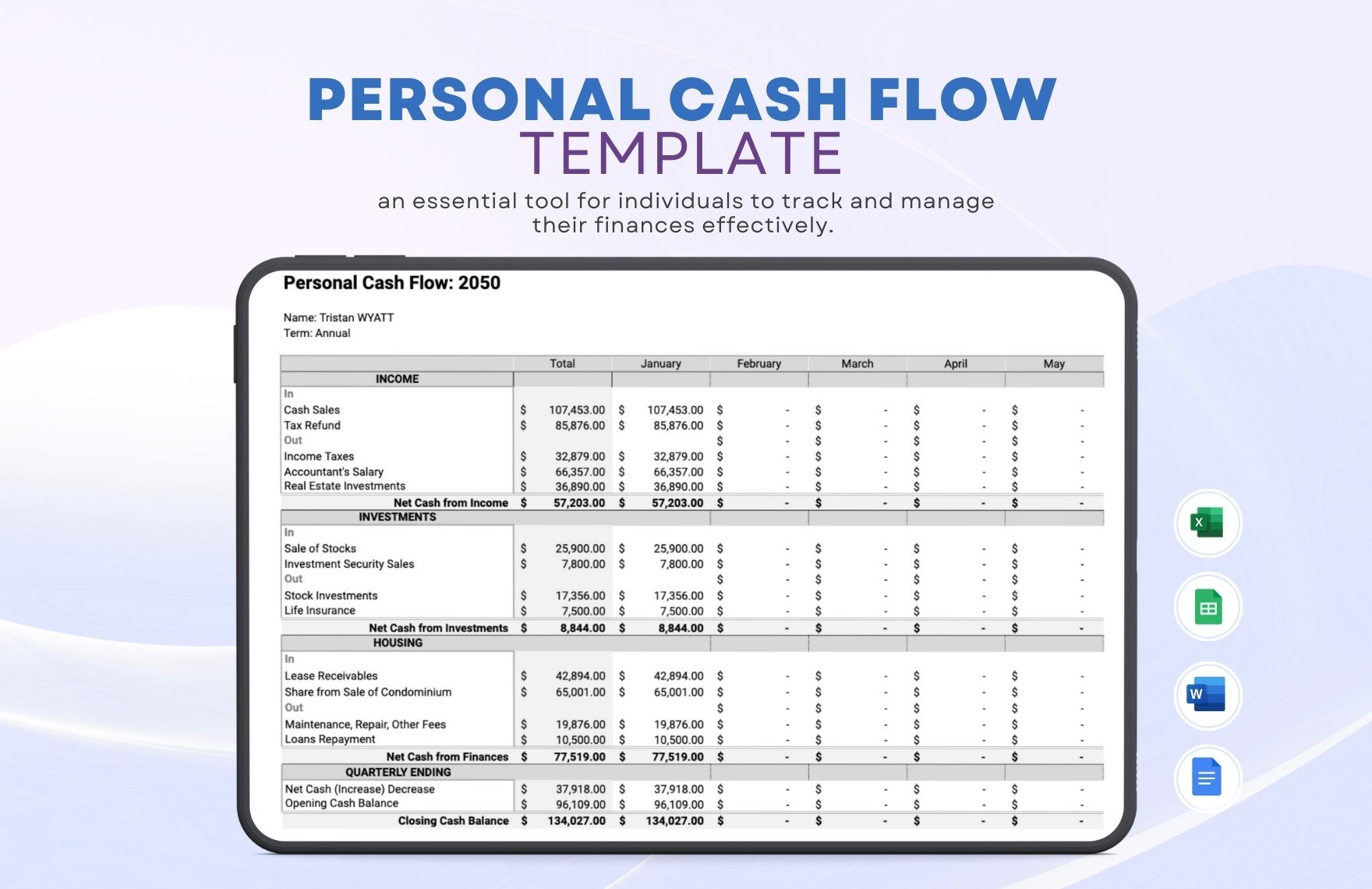

Modern accounting software and forecasting tools are essential allies in the quest for improved cash flow. Tools like QuickBooks, Xero, or specialized budgeting apps automate the tracking process, reducing human error and providing real-time data access.

However, simply tracking past data is not enough. You must actively forecast your future cash position. A robust cash flow forecast predicts inflows and outflows for the next 3, 6, or 12 months. This allows you to spot potential future shortages—the "cash gaps"—long before they happen, giving you time to arrange financing or scale back spending.

Using Financial Models to Predict Gaps

Creating a model doesn't need to be complex. Start with a simple spreadsheet listing expected dates for major income (e.g., large client payments) and major expenses (e.g., quarterly rent, tax payments, large purchases).

By comparing these dates, you can visualize when your cash balance will dip critically low. Knowing this early gives you power. You can then strategically delay an expense or intensify collections efforts to bridge the impending gap, demonstrating practical knowledge of How To Get Cash Flow under control.

Remember that continuous monitoring is key. Cash flow is fluid, changing weekly, sometimes daily. Set a schedule to review your forecasts and actuals regularly—weekly for fast-growing businesses, or at least monthly for stable operations.

Conclusion: The Path to Consistent Cash Flow

Learning How To Get Cash Flow positive is really about cultivating financial discipline. It requires you to be proactive in your billing, firm in your collection efforts, careful in your spending, and diligent in your planning. Cash flow management is an ongoing process, not a one-time fix.

By implementing quick wins like faster invoicing, establishing long-term policies like structured AR management, and leveraging technology for accurate forecasting, you move from surviving month-to-month to thriving financially. Take these steps seriously, and you will ensure your business always has the liquid funds necessary to seize opportunities and weather unexpected storms.

Frequently Asked Questions (FAQ)

- What is the main difference between profit and cash flow?

- Profit (or net income) is calculated after all revenues and expenses (including non-cash items like depreciation) are accounted for, based on accrual accounting principles. Cash flow tracks the movement of actual money in and out of the bank account. A company can be profitable but have poor cash flow if customers are slow to pay.

- How often should I review my cash flow statement?

- For effective management and control, most financial advisors recommend reviewing your actual cash flow at least monthly. However, if you are actively forecasting or struggling with liquidity, a weekly review is often necessary to make timely operational decisions.

- Is it always better to delay paying suppliers?

- Delaying supplier payments (within agreed terms) is a valid strategy to improve cash flow, as it keeps your cash working for you longer. However, be cautious not to damage supplier relationships or incur late fees. If a supplier offers an early payment discount, calculate if the discount saves you more than the benefit of holding onto the cash for the full term.

- Does debt always negatively impact cash flow?

- Not always. While debt repayment (principal and interest) is a cash outflow, strategic debt (like a line of credit used temporarily to bridge a forecasted cash gap) can protect and stabilize your cash flow, ensuring you can meet immediate operating needs without disrupting production or services.

How To Get Cash Flow

How To Get Cash Flow Wallpapers

Collection of how to get cash flow wallpapers for your desktop and mobile devices.

Mesmerizing How To Get Cash Flow Abstract Illustration

Experience the crisp clarity of this stunning how to get cash flow image, available in high resolution for all your screens.

Detailed How To Get Cash Flow Capture Digital Art

Explore this high-quality how to get cash flow image, perfect for enhancing your desktop or mobile wallpaper.

Artistic How To Get Cash Flow Wallpaper for Your Screen

Immerse yourself in the stunning details of this beautiful how to get cash flow wallpaper, designed for a captivating visual experience.

Vibrant How To Get Cash Flow Capture Illustration

Transform your screen with this vivid how to get cash flow artwork, a true masterpiece of digital design.

Captivating How To Get Cash Flow Background Art

Find inspiration with this unique how to get cash flow illustration, crafted to provide a fresh look for your background.

Spectacular How To Get Cash Flow Landscape in 4K

Immerse yourself in the stunning details of this beautiful how to get cash flow wallpaper, designed for a captivating visual experience.

High-Quality How To Get Cash Flow Moment Art

Explore this high-quality how to get cash flow image, perfect for enhancing your desktop or mobile wallpaper.

High-Quality How To Get Cash Flow Artwork Photography

Transform your screen with this vivid how to get cash flow artwork, a true masterpiece of digital design.

Serene How To Get Cash Flow View for Mobile

Discover an amazing how to get cash flow background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Artistic How To Get Cash Flow Abstract for Your Screen

A captivating how to get cash flow scene that brings tranquility and beauty to any device.

Captivating How To Get Cash Flow Picture for Your Screen

A captivating how to get cash flow scene that brings tranquility and beauty to any device.

Mesmerizing How To Get Cash Flow Photo in 4K

Explore this high-quality how to get cash flow image, perfect for enhancing your desktop or mobile wallpaper.

Vivid How To Get Cash Flow Abstract Digital Art

Explore this high-quality how to get cash flow image, perfect for enhancing your desktop or mobile wallpaper.

Vivid How To Get Cash Flow Photo Illustration

Explore this high-quality how to get cash flow image, perfect for enhancing your desktop or mobile wallpaper.

Captivating How To Get Cash Flow Picture Collection

Immerse yourself in the stunning details of this beautiful how to get cash flow wallpaper, designed for a captivating visual experience.

Detailed How To Get Cash Flow Background Collection

Experience the crisp clarity of this stunning how to get cash flow image, available in high resolution for all your screens.

Captivating How To Get Cash Flow Scene Illustration

This gorgeous how to get cash flow photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Amazing How To Get Cash Flow Photo in 4K

Transform your screen with this vivid how to get cash flow artwork, a true masterpiece of digital design.

Exquisite How To Get Cash Flow Photo for Desktop

This gorgeous how to get cash flow photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

High-Quality How To Get Cash Flow Image Nature

Experience the crisp clarity of this stunning how to get cash flow image, available in high resolution for all your screens.

Download these how to get cash flow wallpapers for free and use them on your desktop or mobile devices.