How To Get Electric Vehicle Tax Credit

How To Get Electric Vehicle Tax Credit: Your Ultimate Guide

Thinking about switching to an electric vehicle (EV)? That's awesome! You're not just helping the planet; you might also be eligible for a sweet financial break. The Federal Electric Vehicle Tax Credit can be worth up to $7,500, but let's be real—the rules are constantly shifting and can feel incredibly confusing. Don't worry, we're here to cut through the jargon and show you exactly How To Get Electric Vehicle Tax Credit without pulling your hair out.

This comprehensive guide will break down the eligibility requirements, the paperwork you need, and the essential steps to ensure that money stays in your pocket. Let's get started!

Understanding the EV Tax Credit Basics

The Federal Clean Vehicle Tax Credit, established under the Inflation Reduction Act (IRA) of 2022, is designed to encourage consumers to buy new and used electric vehicles. Previously, this credit was tied to manufacturers' sales quotas, but the new rules focus heavily on where the vehicle is built and where its battery components originate.

Here's the main takeaway: the credit is non-refundable, meaning it can only reduce your tax liability to zero. If you owe $3,000 in taxes and qualify for a $7,500 credit, you only save $3,000; you don't get the remaining $4,500 back as a refund.

However, the biggest game-changer starting in 2024 is the option for a Point-of-Sale Rebate. This allows you to transfer the credit to the dealership, who then subtracts the amount from the purchase price immediately. This is often the easiest path to accessing the benefit right away, but you still need to ensure you meet the income requirements.

Eligibility Requirements: Vehicle and Buyer

Eligibility is split into two major categories: the car itself and the person buying it. It's crucial that both parties meet the criteria at the time of purchase and when filing taxes.

Vehicle Manufacturing and Price Caps

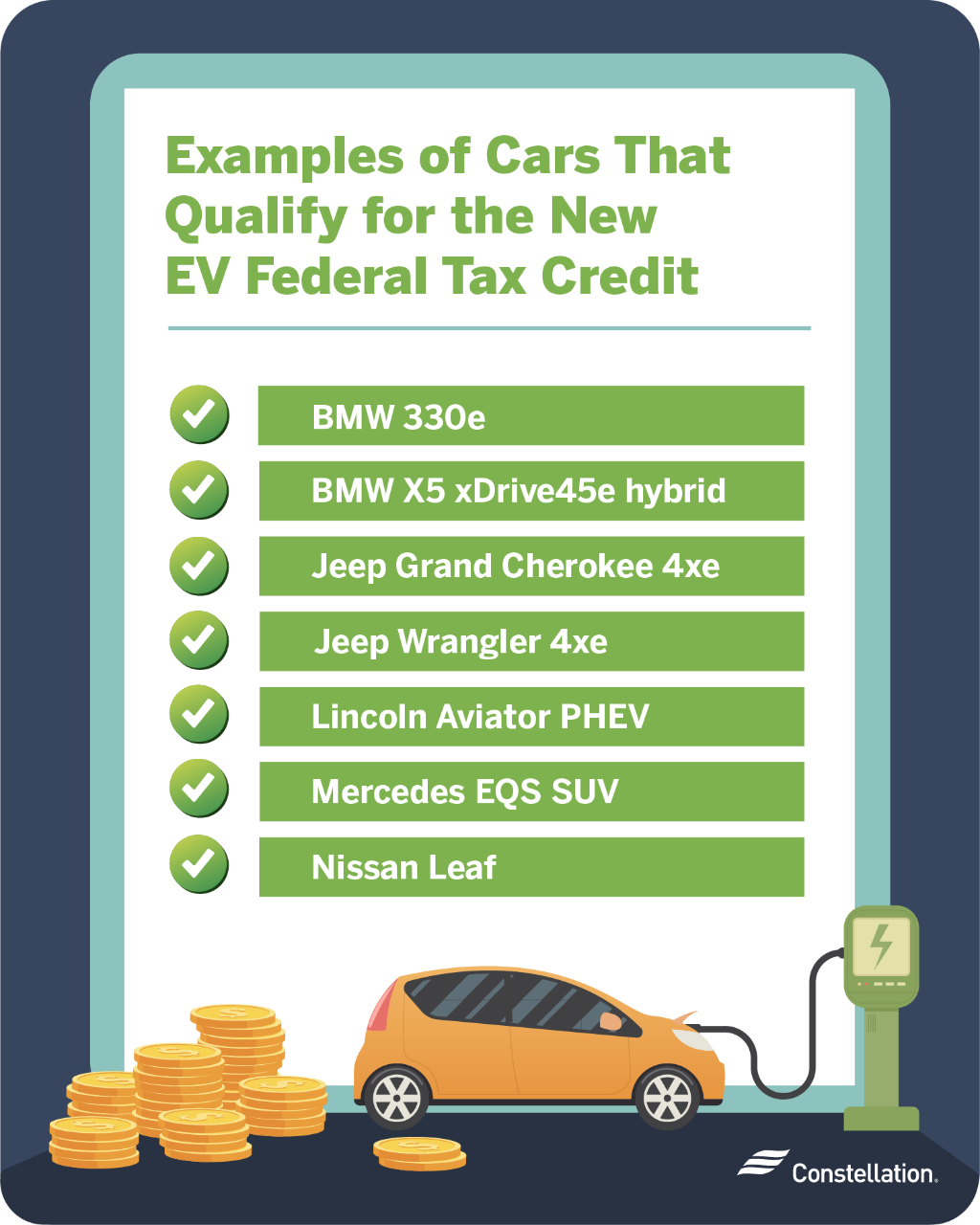

The vehicle must satisfy stringent requirements regarding manufacturing location and battery sourcing. If the vehicle doesn't meet these requirements, you cannot claim the credit, regardless of your income. The IRS maintains a list of qualifying vehicles, which changes frequently as manufacturers adjust their supply chains.

Specifically, the vehicle must meet these requirements:

- Final assembly must occur in North America (including the U.S., Canada, and Mexico).

- It must have a battery capacity of at least 7 kilowatt hours (kWh).

- The Gross Vehicle Weight Rating (GVWR) must be under 14,000 pounds.

- The Manufacturer's Suggested Retail Price (MSRP) must adhere to price caps:

- Vans, SUVs, and Pickup Trucks: Must not exceed $80,000 MSRP.

- Sedans, Hatchbacks, and other vehicles: Must not exceed $55,000 MSRP.

The battery components also matter significantly. The full $7,500 credit is split into two halves: $3,750 based on critical minerals sourcing and $3,750 based on battery component manufacturing. Both these percentages must meet rising domestic content thresholds each year, making it harder for foreign-sourced batteries to qualify.

Buyer Income Restrictions

To qualify for the new clean vehicle credit, your modified Adjusted Gross Income (AGI) must not exceed certain limits. This is often the sticking point for high-income earners. The limits are based on your tax filing status:

- Married filing jointly: $300,000

- Head of household: $225,000

- All other filers (e.g., single): $150,000

You can use your modified AGI from either the year the vehicle was purchased or the preceding tax year, whichever is less. This flexibility is a great benefit if your income suddenly spiked the year you bought the car.

The Crucial Step-by-Step Process for Claiming the Credit

Knowing How To Get Electric Vehicle Tax Credit involves more than just buying the right car; it requires careful documentation and proper filing. Whether you take the credit on your taxes or at the point of sale, follow these steps.

Step 1: Verify Vehicle Qualification and Dealer Registration

Before signing any papers, confirm the vehicle's eligibility on the official IRS website. If you choose the point-of-sale transfer, ensure the dealership is registered with the IRS as a qualifying entity. They will need to submit a seller report to the IRS with all the necessary vehicle and buyer information.

Step 2: Get the Required Paperwork from the Dealer

You need proof that the vehicle qualifies. The dealer must provide you with a written document at the time of sale. This document must contain the VIN, the maximum credit amount, the date of sale, and confirmation that the sale met all the sourcing requirements.

Step 3: Decide on Claim Method (Tax Filing vs. Point-of-Sale)

If you opt for the Point-of-Sale Rebate (available since January 1, 2024), the dealer deducts the estimated credit from the price. If you choose this method, you will still confirm your eligibility on your tax return, but you won't file for the credit itself.

If you don't take the point-of-sale rebate, or if the dealer isn't participating, you must claim the credit when you file your annual tax return. This means you pay the full price upfront and wait for the refund when you file.

Essential IRS Forms You Need

The primary form for claiming the credit is IRS Form 8936, Clean Vehicle Credits. You will complete this form and attach it to your personal income tax return (Form 1040).

Here is what you'll need to complete Form 8936:

- The Vehicle Identification Number (VIN).

- The date the car was placed in service (usually the purchase date).

- Confirmation of your modified AGI status.

If you utilized the point-of-sale transfer, you may need additional documentation or clarification on Form 8936 to verify the transfer, but the dealership handles the heavy lifting of reporting the sale.

Navigating the Used EV Tax Credit (A Quick Look)

Great news: A separate credit exists for used EVs! This benefit is aimed at making EVs accessible to more budgets. While the maximum credit is lower, the eligibility requirements for the vehicle itself are less strict regarding battery sourcing.

The used EV tax credit is the lesser of $4,000 or 30% of the sale price. To qualify, both the vehicle and the buyer must meet specific criteria:

Used EV Requirements:

- The sale price must be $25,000 or less.

- The vehicle must be at least two model years older than the calendar year of sale.

- It must be the first qualified transfer of the vehicle since the IRA was enacted.

- The vehicle must be sold by a licensed dealer (private sales do not qualify).

Used EV Buyer Income Restrictions:

The income limits for the used EV credit are lower than for new vehicles:

- Married filing jointly: $150,000

- Head of household: $112,500

- All other filers: $75,000

If you meet these criteria, you claim the credit using the same form, Form 8936, just indicating the used clean vehicle details instead of the new one.

Conclusion

Understanding How To Get Electric Vehicle Tax Credit requires diligence, especially given the constantly evolving rules under the IRA. The maximum $7,500 credit is a fantastic incentive, but remember that the key is verifying eligibility before you buy.

First, check the IRS list for qualified vehicles and adhere to the MSRP limits. Second, make sure your income falls within the modified AGI caps. Finally, whether you use the instantaneous point-of-sale rebate or file Form 8936 at tax time, ensure you receive the proper documentation from your registered dealership. With careful planning, you can drive away in your new EV knowing you successfully claimed your benefit!

Frequently Asked Questions (FAQ) About EV Tax Credits

- Can I qualify for the full $7,500 credit?

- It depends. The full $7,500 credit is generally split into two halves based on battery component manufacturing ($3,750) and critical mineral sourcing ($3,750). Many qualifying vehicles today only meet one requirement, resulting in a $3,750 credit. You must check the official IRS list for the exact credit amount for your specific vehicle.

- Is the EV tax credit refundable?

- No, the credit is non-refundable. This means it can only reduce your tax liability down to $0. If your tax liability is less than the credit amount, you will not receive the difference as a cash refund (unless you utilize the 2024 point-of-sale transfer, which essentially gives you the cash upfront).

- What is the 'Point-of-Sale Rebate' and how does it affect how I get the Electric Vehicle Tax Credit?

- Since January 1, 2024, buyers can transfer the credit to the dealer. The dealer then provides the amount as an immediate reduction in the purchase price. This is effectively like getting the rebate instantly, rather than waiting until tax season. You still must meet the income eligibility requirements to avoid potential clawbacks later.

- Do I need to keep the EV for a certain amount of time?

- The IRS requires that you place the vehicle "in service" for use and not for resale. If you sell the vehicle immediately after purchase, the IRS may disqualify you. While there is no specific time frame defined, keeping the vehicle for at least the full tax year is generally advisable.

How To Get Electric Vehicle Tax Credit

How To Get Electric Vehicle Tax Credit Wallpapers

Collection of how to get electric vehicle tax credit wallpapers for your desktop and mobile devices.

Mesmerizing How To Get Electric Vehicle Tax Credit Artwork Collection

Transform your screen with this vivid how to get electric vehicle tax credit artwork, a true masterpiece of digital design.

Dynamic How To Get Electric Vehicle Tax Credit Artwork in 4K

A captivating how to get electric vehicle tax credit scene that brings tranquility and beauty to any device.

Stunning How To Get Electric Vehicle Tax Credit Picture Digital Art

This gorgeous how to get electric vehicle tax credit photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Serene How To Get Electric Vehicle Tax Credit Scene in 4K

Explore this high-quality how to get electric vehicle tax credit image, perfect for enhancing your desktop or mobile wallpaper.

Breathtaking How To Get Electric Vehicle Tax Credit Photo Nature

Transform your screen with this vivid how to get electric vehicle tax credit artwork, a true masterpiece of digital design.

Detailed How To Get Electric Vehicle Tax Credit Wallpaper in HD

Explore this high-quality how to get electric vehicle tax credit image, perfect for enhancing your desktop or mobile wallpaper.

Gorgeous How To Get Electric Vehicle Tax Credit Picture in 4K

Immerse yourself in the stunning details of this beautiful how to get electric vehicle tax credit wallpaper, designed for a captivating visual experience.

Captivating How To Get Electric Vehicle Tax Credit Picture for Your Screen

This gorgeous how to get electric vehicle tax credit photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Lush How To Get Electric Vehicle Tax Credit View Illustration

A captivating how to get electric vehicle tax credit scene that brings tranquility and beauty to any device.

Mesmerizing How To Get Electric Vehicle Tax Credit Wallpaper for Desktop

Experience the crisp clarity of this stunning how to get electric vehicle tax credit image, available in high resolution for all your screens.

Breathtaking How To Get Electric Vehicle Tax Credit Moment in HD

Experience the crisp clarity of this stunning how to get electric vehicle tax credit image, available in high resolution for all your screens.

Vibrant How To Get Electric Vehicle Tax Credit Capture Collection

Experience the crisp clarity of this stunning how to get electric vehicle tax credit image, available in high resolution for all your screens.

Dynamic How To Get Electric Vehicle Tax Credit Wallpaper Illustration

Immerse yourself in the stunning details of this beautiful how to get electric vehicle tax credit wallpaper, designed for a captivating visual experience.

Gorgeous How To Get Electric Vehicle Tax Credit Artwork Nature

Find inspiration with this unique how to get electric vehicle tax credit illustration, crafted to provide a fresh look for your background.

Mesmerizing How To Get Electric Vehicle Tax Credit Artwork Illustration

Experience the crisp clarity of this stunning how to get electric vehicle tax credit image, available in high resolution for all your screens.

Stunning How To Get Electric Vehicle Tax Credit Scene Art

Find inspiration with this unique how to get electric vehicle tax credit illustration, crafted to provide a fresh look for your background.

Breathtaking How To Get Electric Vehicle Tax Credit Moment Photography

Transform your screen with this vivid how to get electric vehicle tax credit artwork, a true masterpiece of digital design.

Dynamic How To Get Electric Vehicle Tax Credit Design in 4K

A captivating how to get electric vehicle tax credit scene that brings tranquility and beauty to any device.

Vivid How To Get Electric Vehicle Tax Credit Design Art

Discover an amazing how to get electric vehicle tax credit background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Vivid How To Get Electric Vehicle Tax Credit View Art

Experience the crisp clarity of this stunning how to get electric vehicle tax credit image, available in high resolution for all your screens.

Download these how to get electric vehicle tax credit wallpapers for free and use them on your desktop or mobile devices.