How To Get Out Of Paying Taxes

How To Get Out Of Paying Taxes: Maximizing Legal Tax Savings

Let's be honest: nobody enjoys handing over their hard-earned money to the government. If you've ever searched for information on How To Get Out Of Paying Taxes, you're looking for ways to keep more money in your pocket legally and ethically.

This article isn't about hiding income or engaging in illegal activities—that's tax evasion, and it carries severe penalties. Instead, we're focusing entirely on smart, legal tax avoidance, utilizing every deduction, credit, and strategy the IRS allows. Our goal is tax minimization.

Navigating the tax code might seem complicated, but with the right knowledge, you can significantly reduce your tax liability. Ready to start maximizing your savings? Let's dive into the strategies that truly work.

The Legal Line: Avoidance vs. Evasion

Before we discuss specific reduction techniques, we must establish the fundamental difference between legal tax avoidance and illegal tax evasion. Understanding this distinction is crucial for protecting your financial freedom and avoiding unwanted attention from the tax authorities.

Understanding Tax Evasion (What NOT to do)

Tax evasion involves deliberately misrepresenting your income or financial situation to avoid paying what you legally owe. Examples include failing to report cash income, falsifying documents, or claiming deductions for expenses that never occurred. The risks associated with evasion far outweigh any temporary gains, often resulting in hefty fines, interest charges, and potential jail time.

Legal tax avoidance, however, involves using the tax code as intended. This means structuring your finances, investments, and business activities to qualify for beneficial tax treatments explicitly written into law.

The Power of Deductions and Credits

The ultimate secret to minimizing your tax bill lies in leveraging the available deductions and credits. These tools are the government's way of incentivizing specific behaviors, such as saving for retirement or pursuing education.

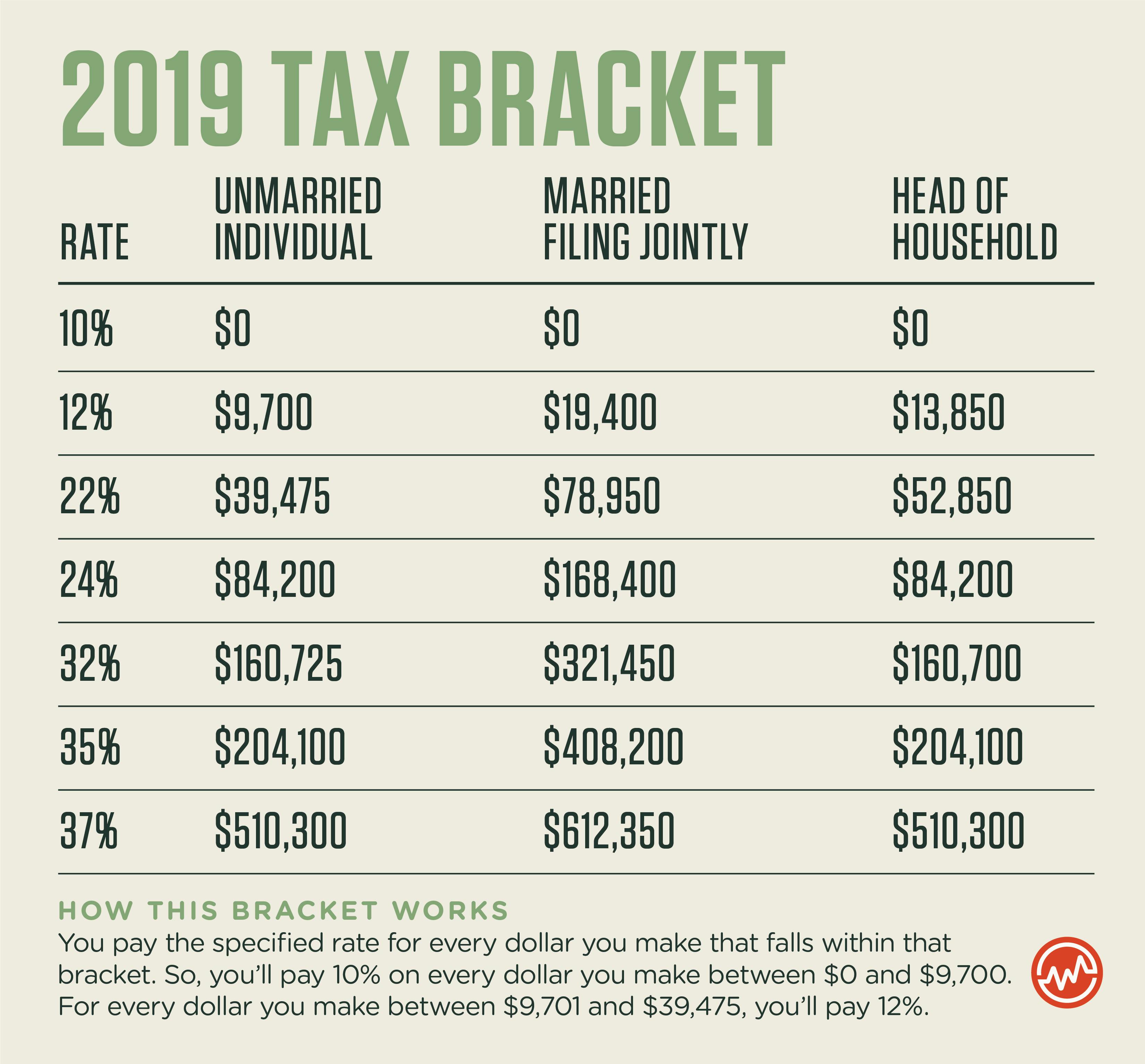

Remember that a deduction reduces the amount of income subject to tax, lowering your overall tax bracket. Conversely, a tax credit directly reduces the tax bill dollar-for-dollar, making credits generally more valuable.

Strategies for Employed Individuals (W-2)

Even if you receive a traditional W-2 salary, you still have powerful opportunities to reduce your taxable income. The key here is utilizing pre-tax contributions, which lower your Adjusted Gross Income (AGI) before taxes are even calculated.

Maximizing Retirement Contributions

This is arguably the easiest and most powerful way to legally reduce your tax burden year after year. Contributions to traditional 401(k)s and traditional IRAs are made with pre-tax dollars. This means every dollar you save for retirement is a dollar removed from your current taxable income.

If you contribute the maximum allowable amount, you could potentially shield thousands of dollars from the IRS annually. Furthermore, the money grows tax-deferred until you withdraw it in retirement, providing dual benefits.

Understanding Tax Credits for Families and Education

Many valuable tax credits exist specifically for families, students, and homeowners. These credits can drastically minimize your final tax bill.

Some crucial credits to investigate include:

- The Child Tax Credit (CTC), which is often partially refundable.

- The Earned Income Tax Credit (EITC), specifically for low-to-moderate-income workers.

- The American Opportunity Tax Credit (AOTC) or Lifetime Learning Credit for educational expenses.

- The Child and Dependent Care Credit, for expenses related to childcare while you work.

Utilizing Health Savings Accounts (HSAs)

If you have a high-deductible health plan (HDHP), an HSA offers the best tax advantage available today. The HSA is often called the "triple-tax advantage" account.

Contributions are tax-deductible, the money grows tax-free, and withdrawals are tax-free if used for qualified medical expenses. This powerful combination makes the HSA a top-tier tool for legally reducing income and preparing for future healthcare costs.

Strategies for Self-Employed and Business Owners

If you run your own business or work as a freelancer, you have the greatest flexibility when determining How To Get Out Of Paying Taxes. Every legitimate business expense is a deduction, significantly lowering your Adjusted Gross Income (AGI).

However, this flexibility comes with responsibility. You must maintain excellent records to substantiate every single deduction if the IRS comes calling.

Smart Business Expense Tracking

Consistency and detail are absolutely essential for self-employed deductions. Missing even small, recurring costs can add up to hundreds or thousands in unnecessary taxes. Use dedicated accounting software to streamline this process.

Here are some frequently missed deductions for freelancers and small businesses:

- Home Office Deduction (must be used exclusively and regularly for business).

- Business Use of Vehicle (use the standard mileage rate or track actual expenses).

- Continuing Education, Training, and Professional Development.

- Self-Employed Retirement Plans (SEP IRAs or Solo 401(k)s).

- Self-Employed Health Insurance Premiums (often fully deductible).

Leveraging Business Structure (LLCs, S-Corps)

Choosing the correct business entity can drastically alter your tax liability, especially regarding self-employment taxes. For instance, an S Corporation allows owners to split their income into a reasonable salary and distributions.

While the salary is subject to payroll taxes, the distributions are generally exempt from Self-Employment Tax (Social Security and Medicare). This specific tax strategy is extremely effective for profitable businesses looking to minimize their overall tax burden.

Investment and Wealth Management Tactics

Savvy investors understand that taxes shouldn't be an afterthought—they should be integrated into every investment decision. Strategic management of your portfolio can defer or eliminate taxes on investment gains.

The Magic of Tax-Loss Harvesting

Tax-loss harvesting is a strategy where you sell investments that have lost money to offset the taxes owed on investments that had gains. This is typically done at the end of the calendar year.

You can use realized investment losses to offset realized investment gains dollar-for-dollar. Furthermore, if your losses exceed your gains, you can deduct up to $3,000 of those net losses against your ordinary income annually, which directly helps you keep more money.

Exploring Tax-Advantaged Investment Vehicles

Beyond standard retirement accounts, several specialized accounts offer unique tax benefits depending on your goals. These accounts allow assets to grow without being immediately subject to capital gains tax.

Consider leveraging these options:

- **529 Plans:** Used for education savings. Growth is tax-free if used for qualified education expenses.

- **Roth Conversions:** Though you pay tax now, future withdrawals (principal and earnings) in retirement are tax-free, protecting you from potentially higher future tax rates.

- **Qualified Opportunity Funds (QOFs):** These allow investors to defer and reduce taxes on capital gains by reinvesting them into specified economically distressed areas.

Conclusion: The Smart Way to Get Out Of Paying Taxes

Finding ways to reduce your tax bill is not just about filing your return; it's about strategic planning throughout the entire year. By focusing on maximizing pre-tax contributions, diligently tracking every legitimate business expense, and utilizing tax-advantaged investment vehicles, you are executing the optimal legal strategy for How To Get Out Of Paying Taxes.

Remember that tax laws are always changing. Therefore, the most effective strategy involves staying informed and consulting with a qualified tax professional. Start implementing these strategies today to ensure you keep every dollar you are legally entitled to.

Frequently Asked Questions (FAQ)

- Can I legally avoid paying taxes completely?

- No, legally avoiding taxes entirely is typically not possible unless your income falls below the mandatory filing threshold. However, through aggressive use of deductions, credits, and tax deferral strategies (like retirement accounts), you can often reduce your taxable income to zero or close to zero, effectively minimizing your tax liability.

- What is the single best way to lower my taxable income?

- The most straightforward and powerful way to lower your taxable income is by maximizing contributions to tax-deferred retirement accounts, such as a traditional 401(k) or IRA. These contributions reduce your Adjusted Gross Income (AGI) dollar-for-dollar.

- Is it better to take the standard deduction or itemize?

- You should always calculate both options. Itemizing is only beneficial if your total eligible itemized deductions (like state and local taxes, mortgage interest, and medical expenses) exceed the current standard deduction amount for your filing status. Use whichever method results in the lowest taxable income.

- How does tax deferral help me "get out of paying taxes"?

- Tax deferral, commonly used in traditional retirement accounts, doesn't eliminate taxes; it postpones them until retirement. This helps because you save money now (when your income and tax rate are high) and pay taxes later (when you are retired and likely in a lower tax bracket).

How To Get Out Of Paying Taxes

How To Get Out Of Paying Taxes Wallpapers

Collection of how to get out of paying taxes wallpapers for your desktop and mobile devices.

Dynamic How To Get Out Of Paying Taxes Background for Mobile

Immerse yourself in the stunning details of this beautiful how to get out of paying taxes wallpaper, designed for a captivating visual experience.

Stunning How To Get Out Of Paying Taxes Capture in 4K

This gorgeous how to get out of paying taxes photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Spectacular How To Get Out Of Paying Taxes Artwork for Your Screen

Find inspiration with this unique how to get out of paying taxes illustration, crafted to provide a fresh look for your background.

High-Quality How To Get Out Of Paying Taxes Photo for Mobile

Transform your screen with this vivid how to get out of paying taxes artwork, a true masterpiece of digital design.

Amazing How To Get Out Of Paying Taxes Capture for Mobile

Discover an amazing how to get out of paying taxes background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Artistic How To Get Out Of Paying Taxes View Collection

This gorgeous how to get out of paying taxes photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Stunning How To Get Out Of Paying Taxes Wallpaper Digital Art

A captivating how to get out of paying taxes scene that brings tranquility and beauty to any device.

Mesmerizing How To Get Out Of Paying Taxes Abstract Collection

Transform your screen with this vivid how to get out of paying taxes artwork, a true masterpiece of digital design.

High-Quality How To Get Out Of Paying Taxes Photo Concept

Explore this high-quality how to get out of paying taxes image, perfect for enhancing your desktop or mobile wallpaper.

Mesmerizing How To Get Out Of Paying Taxes Abstract for Mobile

Transform your screen with this vivid how to get out of paying taxes artwork, a true masterpiece of digital design.

Detailed How To Get Out Of Paying Taxes Image Art

Explore this high-quality how to get out of paying taxes image, perfect for enhancing your desktop or mobile wallpaper.

Mesmerizing How To Get Out Of Paying Taxes Abstract for Your Screen

Explore this high-quality how to get out of paying taxes image, perfect for enhancing your desktop or mobile wallpaper.

Dynamic How To Get Out Of Paying Taxes Image for Desktop

A captivating how to get out of paying taxes scene that brings tranquility and beauty to any device.

Lush How To Get Out Of Paying Taxes Capture in HD

Find inspiration with this unique how to get out of paying taxes illustration, crafted to provide a fresh look for your background.

High-Quality How To Get Out Of Paying Taxes Scene in HD

Transform your screen with this vivid how to get out of paying taxes artwork, a true masterpiece of digital design.

Exquisite How To Get Out Of Paying Taxes Landscape Concept

A captivating how to get out of paying taxes scene that brings tranquility and beauty to any device.

Spectacular How To Get Out Of Paying Taxes Moment Collection

This gorgeous how to get out of paying taxes photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Captivating How To Get Out Of Paying Taxes Artwork for Desktop

This gorgeous how to get out of paying taxes photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Stunning How To Get Out Of Paying Taxes Photo Digital Art

This gorgeous how to get out of paying taxes photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Stunning How To Get Out Of Paying Taxes Background for Your Screen

Find inspiration with this unique how to get out of paying taxes illustration, crafted to provide a fresh look for your background.

Download these how to get out of paying taxes wallpapers for free and use them on your desktop or mobile devices.