How To Get A Va Home Loan Pre Approval

How To Get A VA Home Loan Pre Approval: Your Easy Guide to Veteran Homeownership

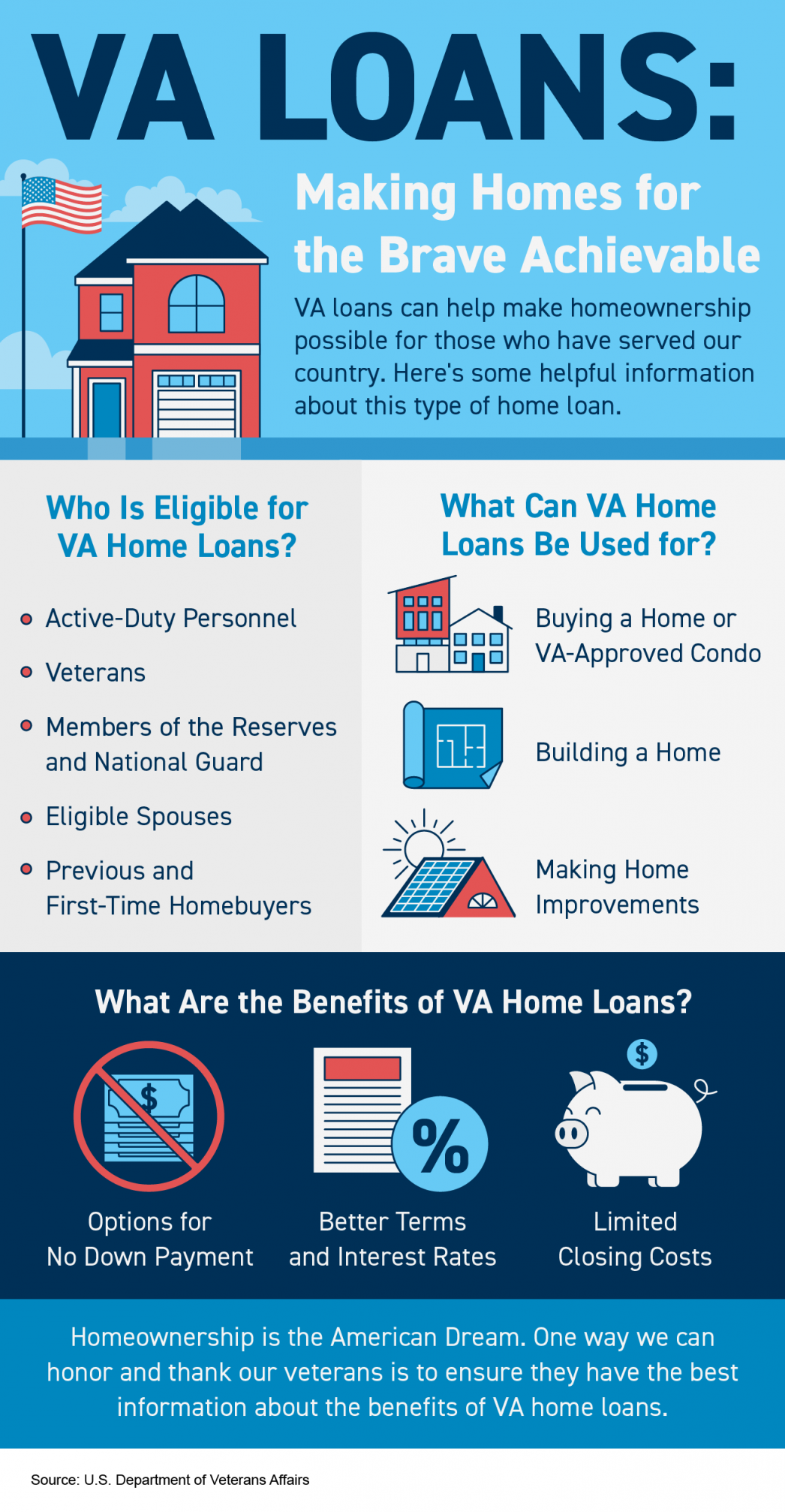

If you're a veteran or an active-duty service member, utilizing your VA home loan benefit is one of the smartest ways to achieve the dream of homeownership. This incredible benefit often requires no down payment and boasts competitive interest rates. However, before you start house hunting, there's one critical step you need to take: getting pre-approved.

Understanding How To Get A VA Home Loan Pre Approval might seem daunting, but we're here to break down the process into simple, manageable steps. Think of pre-approval as your financial passport—it tells real estate agents and sellers that you are a serious, qualified buyer. Let's dive in and get you ready for the market!

Why Pre-Approval Matters in the VA Loan Process

You might be wondering, "Do I really need pre-approval, or can I just jump into looking at houses?" The answer is a resounding yes, you absolutely need it. In today's competitive real estate market, sellers won't even consider an offer unless it's backed by a solid pre-approval letter.

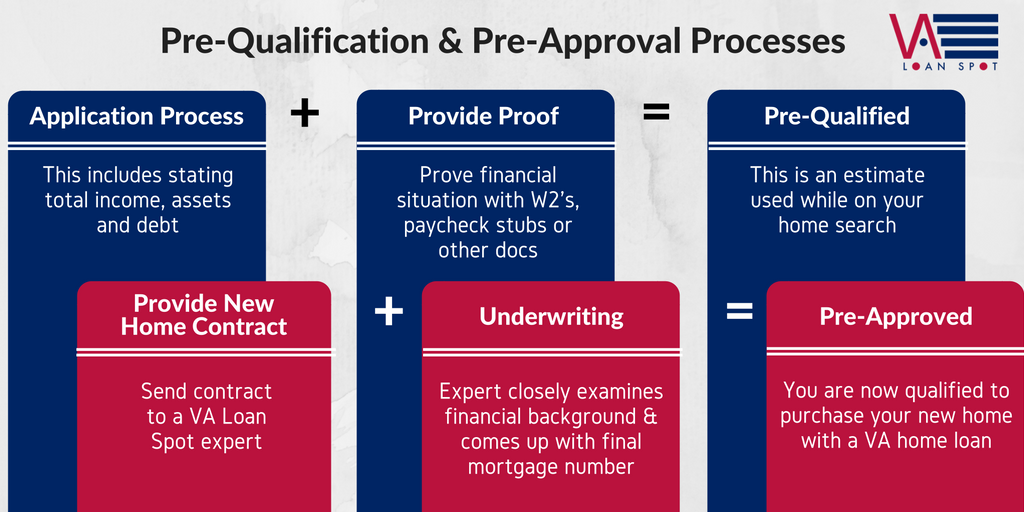

A VA loan pre-approval is different from a pre-qualification. Pre-qualification is a rough estimate, while pre-approval involves a lender reviewing your finances, credit history, and documentation to determine exactly how much you can borrow. This sets your budget and gives you significant leverage when negotiating.

Step 1: Confirming Your Eligibility (The Basics)

The very first step in learning How To Get A VA Home Loan Pre Approval is confirming that you meet the VA's service requirements. Eligibility is determined by the length and character of your service. While a lender can often help verify this, it's best to have your ducks in a row.

Getting Your Certificate of Eligibility (COE)

Your Certificate of Eligibility (COE) is the definitive proof that you qualify for the VA home loan benefit. Without this document, your lender cannot move forward with your pre-approval application. You can obtain your COE in a few ways, but the easiest is usually through your VA-approved lender, who can access the VA's portal directly.

If you prefer to get it yourself, you can apply online through the VA's eBenefits portal or by completing VA Form 26-1880 and mailing it in. Make sure you have the necessary documentation ready:

- If you are a veteran: DD Form 214 (Discharge or Separation Documents).

- If you are active duty: Statement of Service signed by your commander.

- If you are a Reservist or National Guard member: Copy of your most recent annual retirement points statement and evidence of honorable service.

Step 2: Finding the Right VA-Approved Lender

Not all mortgage lenders are created equal, especially when dealing with specialized programs like VA loans. You want a lender who is experienced and dedicated to serving the military community. A VA-savvy lender understands the nuances of the COE, the appraisal process, and the specific documentation required to secure your pre-approval swiftly.

Vetting Potential Lenders

Don't just go with the first lender you find. Shop around! Interest rates and lender fees can vary significantly. Once you have a shortlist, ask pointed questions to ensure they are the best fit for your VA pre-approval needs.

- Do you specialize in VA loans, and how many do you close annually?

- What are your typical turn-around times for the pre-approval application?

- What are your current interest rates and lender fees for a VA loan in my area?

- Do you understand the nuances of VA funding fees and potential fee waivers for service-connected disability?

Getting multiple quotes within a short time frame (usually 14-45 days, depending on the credit bureau) will not harm your credit score significantly, as they are generally counted as a single inquiry. This comparison is vital to ensure you get the best deal.

Step 3: Mastering the Pre-Approval Application

Once you've selected a lender, the application process is similar to any other mortgage pre-approval, but with a specific focus on military income and benefits. Your lender will look closely at three main factors: your credit score, your debt-to-income ratio (DTI), and your residual income.

While the VA doesn't set a minimum credit score, most lenders require a score of 620 or higher for a smooth process. They are also unique in utilizing the "residual income" calculation—a measure designed to ensure veterans have enough money left over each month after paying major bills to maintain a decent quality of life.

What Documentation Will You Need?

Preparedness is key to speeding up How To Get A VA Home Loan Pre Approval. Gathering all your documents before you apply saves weeks of back-and-forth communication with your loan officer. The more organized you are, the faster your pre-approval will be finalized.

Financial Documents Checklist

Ensure you have access to digital copies of the following documents, categorized for easy submission:

- Your Certificate of Eligibility (COE).

- Pay Stubs: Your most recent two months of pay stubs.

- W-2 Forms: W-2 forms covering the last two years.

- Tax Returns: Full personal tax returns from the last two years (especially if you are self-employed or receive rental income).

- Bank Statements: Statements for the last two months for all checking and savings accounts.

- Investment Accounts: Statements for 401(k), brokerage, or other asset accounts.

- Documentation of Other Income: Any documentation related to disability pay, retirement, or educational benefits (like GI Bill housing allowance, if applicable).

Your lender will review these documents thoroughly. They are looking for stability in your income and assets, ensuring you can comfortably afford the proposed monthly mortgage payments.

Step 4: Understanding the Pre-Approval Letter

Congratulations! Once your lender has successfully reviewed your finances and COE, they will issue you a VA Loan Pre-Approval Letter. This letter is gold. It will specify the maximum loan amount you are approved for, demonstrating your purchasing power to sellers.

Remember that pre-approval is contingent upon a few factors, primarily the property itself. The home you select must meet VA minimum property requirements (MPRs) and pass a VA appraisal. The pre-approval confirms your ability to pay; the appraisal confirms the property's value and condition.

The pre-approval letter usually has an expiration date, often 60 to 90 days. If you haven't found a home by then, you will need to refresh your documents for a renewed letter.

Conclusion

Navigating How To Get A VA Home Loan Pre Approval is your first major victory on the path to homeownership. By confirming your eligibility with a COE, choosing a VA-specific lender, and meticulously gathering your financial documents, you position yourself as a strong and prepared buyer.

The VA loan benefit is a significant reward for your service, designed to make housing affordable and accessible. Don't delay the pre-approval process; secure your financial foundation today so you can confidently start shopping for the perfect home tomorrow. If you have any remaining questions, consult with your chosen VA mortgage expert.

Frequently Asked Questions (FAQ)

- What is the difference between pre-qualification and pre-approval for a VA loan?

- Pre-qualification is a preliminary estimate based on self-reported information and generally does not involve a credit check. Pre-approval, however, is a formal commitment from the lender, verifying your credit, income, and assets, and requires a hard credit pull.

- How long does the VA pre-approval process take?

- If you have your COE and all necessary documentation prepared, the pre-approval process can often be completed within 24 to 72 hours. Delays typically occur when waiting for missing documents.

- Do I need perfect credit to get a VA loan pre-approval?

- No, the VA does not set a minimum credit score. However, most VA-approved lenders require a minimum credit score, usually 620, to feel comfortable approving the loan, especially since the lender carries some risk.

- Does getting pre-approved commit me to using that specific lender?

- No. A pre-approval simply states the amount that lender is willing to lend you. You are free to shop around for better rates or choose a different lender before officially signing the final loan papers.

- What is residual income, and why is it important for a VA pre-approval?

- Residual income is the amount of money remaining each month after all major debts (including the new mortgage payment) are paid. The VA uses minimum residual income guidelines based on family size and region to ensure veterans have sufficient disposable income, making the VA loan program more forgiving than conventional loans.

How To Get A Va Home Loan Pre Approval

How To Get A Va Home Loan Pre Approval Wallpapers

Collection of how to get a va home loan pre approval wallpapers for your desktop and mobile devices.

Artistic How To Get A Va Home Loan Pre Approval Picture for Mobile

Find inspiration with this unique how to get a va home loan pre approval illustration, crafted to provide a fresh look for your background.

Crisp How To Get A Va Home Loan Pre Approval Capture for Desktop

A captivating how to get a va home loan pre approval scene that brings tranquility and beauty to any device.

Artistic How To Get A Va Home Loan Pre Approval Capture Concept

This gorgeous how to get a va home loan pre approval photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Detailed How To Get A Va Home Loan Pre Approval Landscape Collection

Transform your screen with this vivid how to get a va home loan pre approval artwork, a true masterpiece of digital design.

Dynamic How To Get A Va Home Loan Pre Approval Moment for Desktop

Find inspiration with this unique how to get a va home loan pre approval illustration, crafted to provide a fresh look for your background.

Breathtaking How To Get A Va Home Loan Pre Approval Image Photography

Experience the crisp clarity of this stunning how to get a va home loan pre approval image, available in high resolution for all your screens.

Dynamic How To Get A Va Home Loan Pre Approval Wallpaper for Your Screen

This gorgeous how to get a va home loan pre approval photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Breathtaking How To Get A Va Home Loan Pre Approval Moment for Desktop

Experience the crisp clarity of this stunning how to get a va home loan pre approval image, available in high resolution for all your screens.

Crisp How To Get A Va Home Loan Pre Approval Image Illustration

This gorgeous how to get a va home loan pre approval photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Gorgeous How To Get A Va Home Loan Pre Approval Moment in 4K

A captivating how to get a va home loan pre approval scene that brings tranquility and beauty to any device.

Detailed How To Get A Va Home Loan Pre Approval Scene Nature

Transform your screen with this vivid how to get a va home loan pre approval artwork, a true masterpiece of digital design.

Vibrant How To Get A Va Home Loan Pre Approval Picture Nature

Experience the crisp clarity of this stunning how to get a va home loan pre approval image, available in high resolution for all your screens.

Detailed How To Get A Va Home Loan Pre Approval Scene Photography

Discover an amazing how to get a va home loan pre approval background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Detailed How To Get A Va Home Loan Pre Approval Design for Desktop

Transform your screen with this vivid how to get a va home loan pre approval artwork, a true masterpiece of digital design.

Captivating How To Get A Va Home Loan Pre Approval Landscape Nature

Find inspiration with this unique how to get a va home loan pre approval illustration, crafted to provide a fresh look for your background.

Breathtaking How To Get A Va Home Loan Pre Approval Background Illustration

Transform your screen with this vivid how to get a va home loan pre approval artwork, a true masterpiece of digital design.

Crisp How To Get A Va Home Loan Pre Approval Capture Illustration

This gorgeous how to get a va home loan pre approval photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Spectacular How To Get A Va Home Loan Pre Approval View Art

This gorgeous how to get a va home loan pre approval photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Amazing How To Get A Va Home Loan Pre Approval View Nature

Experience the crisp clarity of this stunning how to get a va home loan pre approval image, available in high resolution for all your screens.

Amazing How To Get A Va Home Loan Pre Approval Scene for Desktop

Explore this high-quality how to get a va home loan pre approval image, perfect for enhancing your desktop or mobile wallpaper.

Download these how to get a va home loan pre approval wallpapers for free and use them on your desktop or mobile devices.