Should I Get The Insurance On A Rental Car

Should I Get The Insurance On A Rental Car? The Ultimate Guide

Planning a trip and excited about hitting the open road? Great! But before you grab those keys, you face the confusing, high-pressure question at the rental counter: Should I get the insurance on a rental car?

This decision often feels like a gamble. Say yes, and you're wasting money on redundant coverage. Say no, and you might face astronomical repair bills if something goes wrong. Understanding your existing coverage and the different types of rental protection offered is key to saving money and gaining peace of mind.

Don't worry, we are going to break down this complicated topic step-by-step. By the end of this guide, you will know exactly when to buy the extra policy and when you can confidently say "No, thanks!"

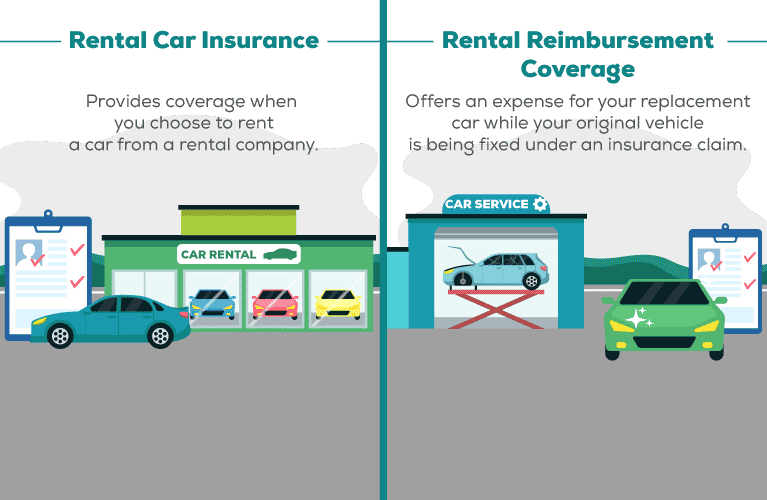

Understanding the Different Types of Rental Car Insurance

When the agent slides that insurance brochure across the desk, they aren't offering one single product. They are offering several different types of protection, each covering a specific risk. Knowing the jargon is the first step in deciding should I get the insurance on a rental car.

The Collision Damage Waiver (CDW) Explained

The Collision Damage Waiver (CDW), sometimes called Loss Damage Waiver (LDW), is perhaps the most common and critical piece of rental coverage. This waiver isn't technically insurance, but a contractual agreement.

If you purchase the CDW, the rental company agrees not to hold you responsible for the cost of repairs if the car is damaged, stolen, or totaled. This typically covers the vehicle itself, regardless of who is at fault.

However, be aware that the CDW usually includes many exclusions. It often doesn't cover damage resulting from driving on unpaved roads, drunk driving, or losing the keys. Always read the fine print regarding limitations.

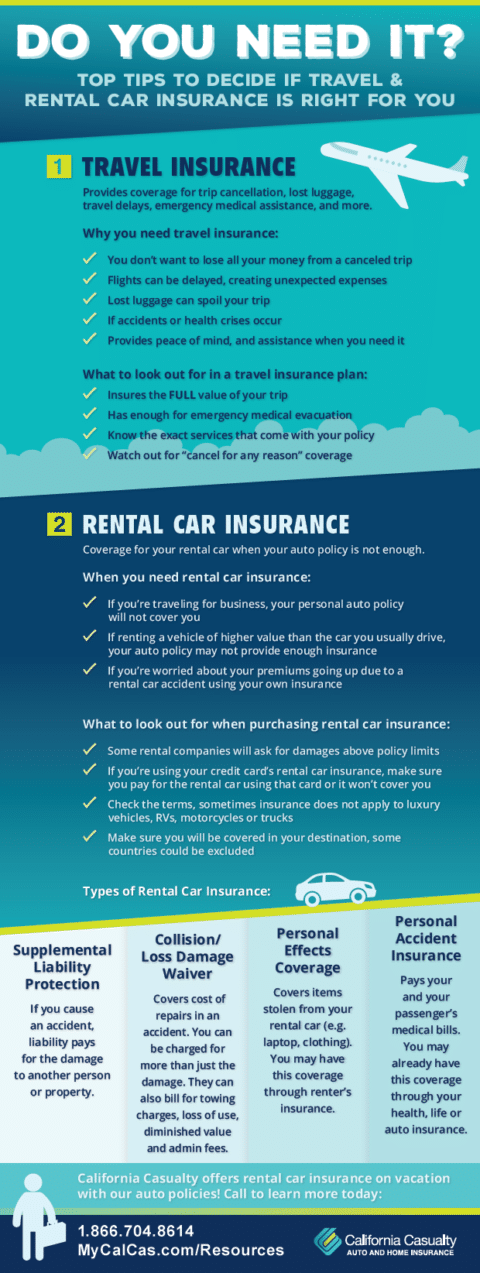

Liability Coverage: Protecting Others

While the CDW protects the rental car itself, liability coverage protects you from the costs associated with damage or injury you cause to other people or their property. If you hit another car, this pays for the other driver's repairs and medical bills.

Most states require minimum liability coverage, and rental companies usually include this minimum in the rental price. However, state minimums are often incredibly low and won't cover serious accidents.

The rental counter often offers Supplemental Liability Insurance (SLI). This dramatically increases the liability limits, offering much greater financial protection if you are involved in a major incident.

Personal Accident Insurance (PAI) and Personal Effects Coverage (PEC)

These two types of coverage are often unnecessary if you have a robust personal insurance profile. PAI provides medical and death benefits for you and your passengers, regardless of fault.

If you already have excellent health insurance or personal injury protection (PIP) through your standard auto policy, PAI is almost certainly redundant. PEC covers the theft or damage of personal items inside the rental car.

Similarly, your homeowner's or renter's insurance likely covers your belongings outside of your home. Therefore, you can usually skip both the PAI and PEC without major concern.

Before You Pay: What Coverage Do You Already Have?

The biggest reason people overspend at the rental counter is that they panic and forget to check their existing policies. The answer to should I get the insurance on a rental car often lies within the documents you already possess.

Checking Your Primary Auto Insurance Policy

Most comprehensive and collision policies automatically extend coverage to rental cars driven within your home country. This means your personal policy usually acts as primary coverage for the rental vehicle.

Before leaving for your trip, call your insurance agent to confirm exactly what is covered. Ask these crucial questions:

- Does my comprehensive and collision coverage transfer to rental vehicles?

- What is the deductible amount that applies to rental cars?

- Does my liability coverage extend to the rental car?

- Does my policy cover Loss of Use (the revenue the rental company loses while the car is being repaired)?

If your personal insurance provides full collision coverage, you can likely decline the CDW.

The Power of Your Credit Card Benefits

Many credit cards, especially premium cards like Visa Signature or World Elite Mastercard, offer rental car insurance benefits. This coverage is usually secondary, meaning it kicks in after your primary auto insurance pays out.

Crucially, some high-end credit cards offer *primary* coverage, which is fantastic. This means the credit card pays first, preventing you from having to file a claim with your personal insurer, which could raise your rates.

To use this benefit, you must decline the rental company's CDW/LDW and pay for the entire rental transaction using that specific credit card. Always review your card's benefits guide before relying on this coverage, as coverage limits and exclusions vary wildly.

Do You Need Additional Coverage for International Travel?

If you are traveling outside your home country, especially overseas, the rules change dramatically. Your personal auto insurance almost certainly does not cover you internationally.

In many countries, you will be required to purchase minimum liability and often collision coverage directly from the rental agency. If you are driving in Europe or Central America, purchasing the local coverage is usually mandatory and non-negotiable.

Even if your credit card offers international coverage, make sure to check which countries are excluded. Ireland, Israel, Italy, and Jamaica are frequently excluded from credit card policies due to high theft rates or unique local regulations.

Making the Decision: Should I Get The Insurance On A Rental Car?

The final answer to Should I Get The Insurance On A Rental Car depends entirely on your risk tolerance and your existing safety nets. Here is a simplified breakdown to help you make the best choice.

When You Should ALWAYS Buy the Rental Company's Coverage

Sometimes, buying the CDW/LDW is the path of least resistance and best protection. You should almost certainly buy the coverage offered at the counter in the following situations:

- You do not own a personal vehicle, therefore you lack collision and comprehensive coverage.

- You are traveling internationally where your domestic insurance does not apply.

- You want to avoid filing a claim with your personal insurance company, thus protecting your existing low rates.

- Your personal insurance does not cover "Loss of Use" charges or administrative fees imposed by the rental company.

- You are renting a specialty or luxury vehicle that exceeds the coverage limits of your credit card or personal policy.

When You Can Confidently Decline

You can confidently save your money and decline the expensive coverage if all three of these points are true:

Your primary auto insurance provides comprehensive and collision coverage that transfers to the rental car. This covers the car itself.

You have high liability limits on your personal policy, which transfers, offering protection against damage to others.

You have confirmed your credit card offers secondary or, ideally, primary CDW benefits, and you will use that card to pay for the rental.

Remember, the difference between buying the insurance and declining it can easily be $15 to $30 per day. Over a long trip, those savings add up quickly!

Conclusion

The question Should I Get The Insurance On A Rental Car doesn't have a universal answer, but it always requires homework. Before you leave home, spend twenty minutes researching your personal auto policy and your credit card benefits.

For most domestic travelers with full coverage auto insurance, purchasing the Collision Damage Waiver (CDW) is often redundant, thanks to existing policies and credit card protections. However, supplemental liability insurance might be a smart, low-cost investment if your standard limits are low.

Ultimately, renting a car should be about freedom, not financial stress. Arm yourself with information so you can make an informed decision at the counter and hit the road confidently.

Frequently Asked Questions (FAQ) About Rental Car Insurance

- What is the difference between primary and secondary coverage?

- Primary coverage pays first in the event of an accident, meaning you don't need to involve your personal auto insurance. Secondary coverage kicks in only after your personal insurance has paid its maximum amount or your claim has been denied. Most credit card coverage is secondary.

- Does the Loss Damage Waiver (LDW) cover flat tires or glass damage?

- Generally, yes, the LDW covers accidental damage like broken glass or flat tires, assuming the damage was not caused by negligence. Always confirm the specific terms of the waiver, especially regarding vandalism or damage caused by prohibited activities.

- If I decline the CDW and damage the car, what charges might I face?

- If you decline the CDW and rely on your personal insurance, you could be responsible for several charges your policy might not cover. These include your personal deductible, Loss of Use fees (revenue lost by the rental company), and administrative charges.

- Is it safe to rely solely on my credit card insurance?

- It can be, but proceed with caution. Credit card insurance usually covers the CDW/LDW aspect, but it almost never provides liability coverage. If you rely solely on your card, you must be confident that your personal auto policy provides robust liability coverage that transfers to the rental vehicle.

- Do I need Personal Accident Insurance (PAI) if I have travel insurance?

- If your travel insurance includes sufficient medical coverage and emergency evacuation, you likely do not need the PAI offered by the rental company, as this coverage tends to be duplicative.

Should I Get The Insurance On A Rental Car

Should I Get The Insurance On A Rental Car Wallpapers

Collection of should i get the insurance on a rental car wallpapers for your desktop and mobile devices.

Vivid Should I Get The Insurance On A Rental Car Photo in HD

Discover an amazing should i get the insurance on a rental car background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Serene Should I Get The Insurance On A Rental Car Wallpaper for Your Screen

Discover an amazing should i get the insurance on a rental car background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Dynamic Should I Get The Insurance On A Rental Car Landscape for Your Screen

Immerse yourself in the stunning details of this beautiful should i get the insurance on a rental car wallpaper, designed for a captivating visual experience.

Serene Should I Get The Insurance On A Rental Car View Art

Transform your screen with this vivid should i get the insurance on a rental car artwork, a true masterpiece of digital design.

Beautiful Should I Get The Insurance On A Rental Car Scene Concept

Explore this high-quality should i get the insurance on a rental car image, perfect for enhancing your desktop or mobile wallpaper.

Captivating Should I Get The Insurance On A Rental Car Image Illustration

A captivating should i get the insurance on a rental car scene that brings tranquility and beauty to any device.

Serene Should I Get The Insurance On A Rental Car Image Photography

Discover an amazing should i get the insurance on a rental car background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Crisp Should I Get The Insurance On A Rental Car Design Collection

A captivating should i get the insurance on a rental car scene that brings tranquility and beauty to any device.

Beautiful Should I Get The Insurance On A Rental Car Background Photography

Explore this high-quality should i get the insurance on a rental car image, perfect for enhancing your desktop or mobile wallpaper.

Serene Should I Get The Insurance On A Rental Car Capture Nature

Experience the crisp clarity of this stunning should i get the insurance on a rental car image, available in high resolution for all your screens.

Stunning Should I Get The Insurance On A Rental Car Design Photography

This gorgeous should i get the insurance on a rental car photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

High-Quality Should I Get The Insurance On A Rental Car View Photography

Transform your screen with this vivid should i get the insurance on a rental car artwork, a true masterpiece of digital design.

Amazing Should I Get The Insurance On A Rental Car Abstract Nature

Explore this high-quality should i get the insurance on a rental car image, perfect for enhancing your desktop or mobile wallpaper.

Spectacular Should I Get The Insurance On A Rental Car Wallpaper in 4K

Find inspiration with this unique should i get the insurance on a rental car illustration, crafted to provide a fresh look for your background.

Vivid Should I Get The Insurance On A Rental Car Picture Illustration

Experience the crisp clarity of this stunning should i get the insurance on a rental car image, available in high resolution for all your screens.

High-Quality Should I Get The Insurance On A Rental Car Photo for Mobile

Transform your screen with this vivid should i get the insurance on a rental car artwork, a true masterpiece of digital design.

{

var h1Element = document.querySelector('h1');

if (h1Element) {

var postTitle = h1Element.innerText || h1Element.textContent;

var imageUrl = 'https://tse1.mm.bing.net/th?q=' + encodeURIComponent(postTitle);

var imgElement = document.createElement('img');

imgElement.src = imageUrl;

imgElement.alt = postTitle;

imgElement.style.maxWidth = '100%';

imgElement.style.height = 'auto';

// Insert the image after the <h1> element

h1Element.insertAdjacentElement('afterend', imgElement);

}

});

</script>

<!-- The image will be inserted here automatically -->

<style>

body {

font-family: Arial, sans-serif;

margin: 20px;

}

.hidden {

display: none;

}

#articleForm {

display: none;

}

#hasilArtikel {

text-align: justify;

}

</style>

</div>

<script async src=)