How Do I Get Cheap Insurance

How Do I Get Cheap Insurance: Your Ultimate Guide to Saving Money

We all need insurance—it's the financial safety net that protects us from life's inevitable surprises. But let's be honest, nobody enjoys shelling out hundreds or even thousands of dollars every year for those premiums. If you find yourself constantly stressing and asking, "How do I get cheap insurance?" you've come to the right place.

Getting genuinely affordable coverage isn't about cutting corners; it's about smart strategy and understanding the system. We're going to walk you through the essential steps, from comparison shopping to optimizing your policy details, ensuring you maximize your savings without sacrificing critical protection.

Understanding Insurance Costs and Why They Vary

Before diving into saving methods, it helps to know what drives your current premium. Insurance companies are essentially calculating risk. The higher the perceived risk, the higher your monthly or annual payment.

Factors that heavily influence your premium:

- Location: High crime rates, dense traffic, or areas prone to natural disasters (like hurricanes or wildfires) will significantly increase home and auto insurance costs.

- Credit Score (in most states): Insurers use an "insurance score" derived partially from your credit history. Historically, people with better credit tend to file fewer claims, thus lower scores often result in higher rates.

- Claims History: Frequent claims, regardless of fault (especially for auto insurance), signal higher risk to the insurer.

- The Type of Asset: A brand-new sports car costs more to insure than an older sedan. A large house in an expensive area costs more to cover than a smaller condo.

Once you understand these variables, you can focus on the areas you actually have control over, which leads us to the most effective saving techniques.

Immediate Actions: Shopping Smart and Comparing Quotes

The single most powerful action you can take to lower your rates immediately is to shop around. Loyalty rarely pays in the insurance world.

The Power of Comparison Shopping

Different companies weigh risk factors differently. Company A might penalize you heavily for a minor speeding ticket, while Company B might overlook it entirely but place a higher value on your credit score. This variability means that the price difference between two identical policies can be hundreds of dollars.

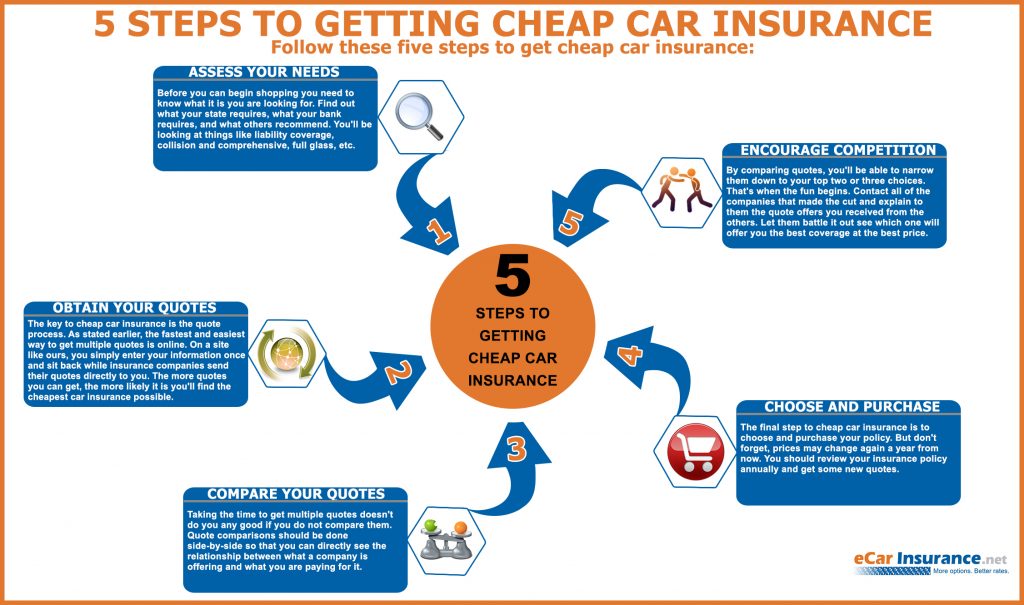

To ensure you truly understand how do I get cheap insurance, make sure you compare apples to apples. Follow these steps every time your policy is up for renewal:

- Gather Your Current Details: Know exactly what coverage levels, deductibles, and endorsements you currently have.

- Use Independent Agents or Comparison Sites: Independent agents work with multiple carriers and can do the shopping for you. Comparison sites can give you baseline quotes quickly.

- Check Major and Regional Carriers: Don't just look at the big national names. Local and regional insurance companies often offer competitive rates specifically tailored to your state or area.

- Get at Least Five Quotes: Aim to get quotes from at least five different providers to see the full range of prices available to you.

Bundle and Save: Combining Policies

Almost every major insurance carrier offers a discount for bundling multiple policies. If you have auto, home, renter's, or umbrella insurance, buying them all from the same company can result in significant savings—often 15% to 25% overall.

While bundling is usually a great way to save money, always confirm the bundled rate is truly cheaper than buying the cheapest individual policies separately. Sometimes a non-bundled, highly specialized policy (like a cheap renter's policy from a niche provider) combined with a separate auto policy still wins out.

Optimizing Your Policy Details for Lower Premiums

Once you've found a competitive carrier, the next step is fine-tuning the actual policy itself. This is where you have direct control over the pricing levers.

Adjusting Deductibles and Coverage Limits

A deductible is the amount you pay out-of-pocket before your insurance coverage kicks in. This is a critical factor in determining how cheap your insurance premium will be.

If you raise your deductible, your premium goes down. Why? Because you are assuming more of the initial financial risk. If you can afford to pay $1,000 or $2,500 out of pocket in case of an accident or claim, opting for a higher deductible is a fantastic way to lower your premium significantly—sometimes by 30% or more.

Additionally, review your coverage limits. For older items, especially vehicles, consider dropping coverage entirely. If your car is worth less than $3,000, paying for comprehensive and collision coverage might not be worth the cost. You are essentially paying too much to protect too little.

Utilizing Discounts You Didn't Know Existed (Crucial Savings)

Many people miss out on discounts simply because they don't ask. When you speak to an agent, always request a full list of every available discount. These savings stack up rapidly.

Vehicle-Specific Discounts

- Anti-Theft Devices: Having alarms, GPS trackers, or vehicle recovery systems installed.

- Low Mileage: If you work from home or use public transit and drive less than the national average (usually 7,500-10,000 miles per year).

- Safety Features: Discounts for cars equipped with standard safety features like airbags, anti-lock brakes (ABS), or stability control.

- Telematics/Usage-Based Programs: Programs like Snapshot or Drivewise track your actual driving habits via an app or device. Safe drivers receive major discounts.

Personal Profile Discounts

Your personal background can often qualify you for unexpected savings:

- Good Student Discount: Available for young drivers who maintain a high GPA (usually B average or higher).

- Professional/Affinity Groups: Discounts for members of certain professional organizations, alumni associations, or employee groups.

- Defensive Driving Courses: Completing an accredited defensive driving course can lower your rate and potentially remove points from your license.

- Paying in Full: Paying the entire annual or semi-annual premium upfront, rather than monthly installments, nearly always reduces the total cost.

Maintaining Low Premiums Over Time

Getting cheap insurance today is one thing; keeping it cheap is another. This requires long-term effort focused on minimizing risk factors.

The best long-term strategy involves maintaining a clean claims history. Avoid filing small claims that you could cover out of pocket. Filing a claim—even if it is small—can often raise your premiums enough that it cancels out the money you received from the claim itself over the next three to five years.

Furthermore, actively manage your credit score. Since insurance scores are tied to credit health, improving your credit habits can gradually lead to lower premiums when you renew your policies.

Finally, review your policy annually. Your life changes—you might pay off a mortgage, get married, or move to a safer zip code. These changes are discounts waiting to happen, but your insurer won't apply them unless you call and update your profile.

Conclusion

If you've been wondering, "How do I get cheap insurance?" the answer is a combination of diligent shopping and smart policy management. Start by comparing quotes widely and aggressively utilizing the bundling discount. Then, raise your deductibles to an affordable level and ensure you have claimed every single discount you qualify for, from low mileage to multi-policy savings.

Insurance costs are not fixed; they are flexible based on your choices and diligence. By adopting these strategies, you can significantly reduce your financial burden while maintaining the peace of mind that quality coverage provides.

Frequently Asked Questions (FAQ) About Cheap Insurance

- Can my credit score really affect how cheap my insurance is?

- Yes, absolutely (in most states). Insurance companies use a proprietary "insurance score," which assesses risk based on credit history. Generally, better scores correlate with lower premiums because statistically, individuals with good credit file fewer claims.

- Is it better to pay annually or monthly for insurance?

- It is almost always cheaper to pay the premium annually in one lump sum. Insurers typically add "installment fees" or administrative charges when you opt for monthly payments. Paying upfront can save you 5% to 8% instantly.

- If I switch companies to get a cheaper rate, will I lose my previous "loyalty" discounts?

- While your old insurer might drop a loyalty discount, the savings you gain from switching to a new, cheaper policy usually outweigh the lost loyalty discount. Furthermore, many new carriers offer a "new customer discount" that often matches or exceeds old loyalty rewards.

- What is the '6-month rule' for auto insurance savings?

- Insurance companies often reward drivers who shop for new quotes about six months after their last renewal or six months after any incident. This is a good time to compare rates because your current provider might hike rates, while a new provider might offer significant introductory savings based on your improved driving record during that period.

How Do I Get Cheap Insurance

How Do I Get Cheap Insurance Wallpapers

Collection of how do i get cheap insurance wallpapers for your desktop and mobile devices.

Beautiful How Do I Get Cheap Insurance Image for Mobile

Explore this high-quality how do i get cheap insurance image, perfect for enhancing your desktop or mobile wallpaper.

Exquisite How Do I Get Cheap Insurance Wallpaper Collection

This gorgeous how do i get cheap insurance photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

High-Quality How Do I Get Cheap Insurance Capture for Desktop

Explore this high-quality how do i get cheap insurance image, perfect for enhancing your desktop or mobile wallpaper.

Beautiful How Do I Get Cheap Insurance Background Illustration

Explore this high-quality how do i get cheap insurance image, perfect for enhancing your desktop or mobile wallpaper.

Breathtaking How Do I Get Cheap Insurance Picture Illustration

Explore this high-quality how do i get cheap insurance image, perfect for enhancing your desktop or mobile wallpaper.

Breathtaking How Do I Get Cheap Insurance Wallpaper Collection

Explore this high-quality how do i get cheap insurance image, perfect for enhancing your desktop or mobile wallpaper.

Detailed How Do I Get Cheap Insurance Moment in 4K

Transform your screen with this vivid how do i get cheap insurance artwork, a true masterpiece of digital design.

Stunning How Do I Get Cheap Insurance Photo for Mobile

Find inspiration with this unique how do i get cheap insurance illustration, crafted to provide a fresh look for your background.

Lush How Do I Get Cheap Insurance Photo Collection

A captivating how do i get cheap insurance scene that brings tranquility and beauty to any device.

Serene How Do I Get Cheap Insurance Landscape in HD

Discover an amazing how do i get cheap insurance background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Gorgeous How Do I Get Cheap Insurance Image for Mobile

This gorgeous how do i get cheap insurance photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Beautiful How Do I Get Cheap Insurance Landscape Collection

Discover an amazing how do i get cheap insurance background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Dynamic How Do I Get Cheap Insurance Image Art

A captivating how do i get cheap insurance scene that brings tranquility and beauty to any device.

Lush How Do I Get Cheap Insurance Scene Art

Immerse yourself in the stunning details of this beautiful how do i get cheap insurance wallpaper, designed for a captivating visual experience.

High-Quality How Do I Get Cheap Insurance Abstract Photography

Transform your screen with this vivid how do i get cheap insurance artwork, a true masterpiece of digital design.

Amazing How Do I Get Cheap Insurance Picture Nature

Explore this high-quality how do i get cheap insurance image, perfect for enhancing your desktop or mobile wallpaper.

Spectacular How Do I Get Cheap Insurance Abstract in HD

A captivating how do i get cheap insurance scene that brings tranquility and beauty to any device.

Detailed How Do I Get Cheap Insurance Background Photography

Discover an amazing how do i get cheap insurance background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Exquisite How Do I Get Cheap Insurance Photo for Mobile

A captivating how do i get cheap insurance scene that brings tranquility and beauty to any device.

Captivating How Do I Get Cheap Insurance Picture Concept

Immerse yourself in the stunning details of this beautiful how do i get cheap insurance wallpaper, designed for a captivating visual experience.

Download these how do i get cheap insurance wallpapers for free and use them on your desktop or mobile devices.

0 Response to "How Do I Get Cheap Insurance"

Post a Comment