How To Get A Loan With No Bank Account

How To Get A Loan With No Bank Account: Your Guide to Non-Traditional Lending

Are you in urgent need of funds but find yourself locked out of traditional financial institutions because you don't have a bank account? This is a surprisingly common situation, and it can feel overwhelming when you're trying to figure out How To Get A Loan With No Bank Account. Don't worry, you still have options. While traditional lenders definitely prefer an established banking relationship, there are specific non-bank lending avenues designed for people just like you.

It's important to understand upfront that getting a loan without a checking or savings account will significantly narrow your choices, and the costs will likely be higher. However, with the right information, you can navigate these alternatives safely. Let's break down exactly what you need to know and where to look for viable loan options.

Why Is Getting A Loan Without A Bank Account Difficult?

The core reason traditional banks and online lenders hesitate to grant loans without a bank account lies in risk management. A bank account serves two crucial functions for the lender: disbursement and repayment. Without a secure bank account, lenders face challenges in verifying your identity, determining your financial stability, and most importantly, ensuring timely loan repayment.

When you apply for a loan, lenders typically review your bank statements to understand your income consistency and spending habits. If those records are unavailable, the risk profile of the borrower automatically increases significantly. Therefore, options for How To Get A Loan With No Bank Account often involve alternative forms of collateral or higher interest rates to offset this perceived risk.

The Lender's Perspective on Risk

For lenders, minimizing default risk is paramount. A bank account provides an easy and traceable method for withdrawing monthly payments via Automated Clearing House (ACH) transfers. Without this mechanism, the lender must rely on less secure or more labor-intensive methods, such as paper checks, money orders, or requiring the borrower to return to the physical location to pay.

Moreover, bank accounts offer proof of residence and regular employment income, even if you are paid in cash. Lenders use this information during underwriting. If you cannot provide bank statements, you will need strong alternative documentation, such as official pay stubs, utility bills, or a robust employment verification letter.

Top Loan Options When You Lack a Bank Account

The good news is that several avenues specialize in helping borrowers who are excluded from traditional banking systems. These options usually fall into two categories: secured loans, which require collateral, and certain types of unsecured loans that use alternative dispersal methods.

Secured Loans: Using Collateral

Secured loans are often the easiest way to answer the question, How To Get A Loan With No Bank Account, because the collateral itself guarantees the loan. Lenders don't need to worry as much about how you will pay because they can seize the asset if you default.

Common types include title loans (using your vehicle title) and pawnshop loans (using personal items). These loans provide immediate cash and often require minimal documentation beyond proof of ownership and income.

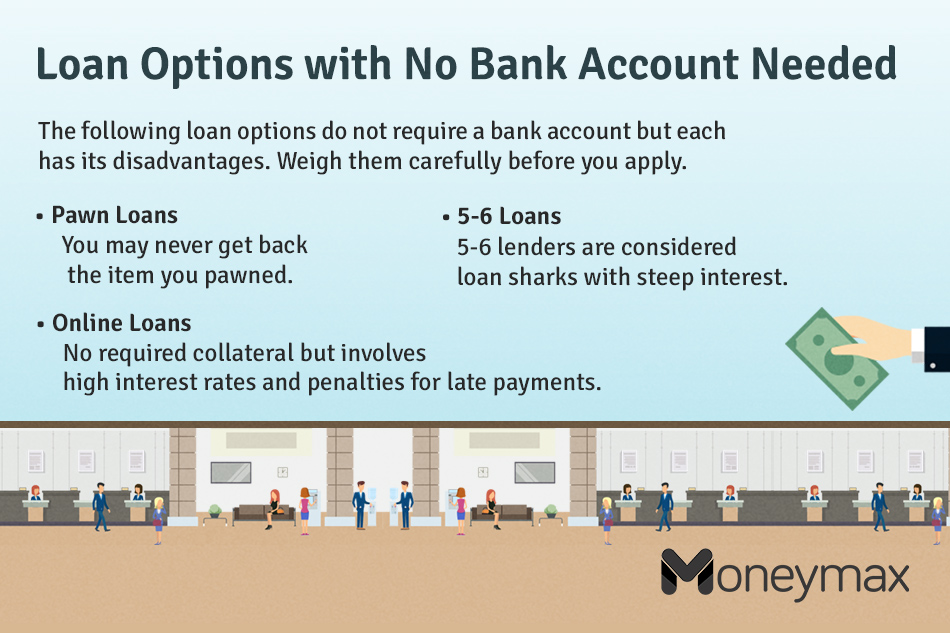

Pawnshop Loans: Fast Cash, High Interest

Pawnshop loans are perhaps the simplest form of secured lending that doesn't require a bank account. You bring in a valuable item—jewelry, electronics, tools—and the pawnbroker gives you a percentage of its value in cash. The item serves as your collateral.

If you repay the loan plus interest and fees within the agreed time frame, you get your item back. If you fail to repay, the pawnbroker keeps the item and sells it. This option is quick, but the loan amounts are often small, and the annual percentage rates (APRs) can be extremely high.

- Pros: No credit check, no bank account required, instant cash dispersal.

- Cons: Risk of losing valuable property, interest rates are very high, loan amounts are limited.

Unsecured Options (Cash Advance, Payday Alternatives)

While most traditional unsecured personal loans require a bank account, certain types of cash advance loans geared towards the "unbanked" population may be accessible. These lenders focus on your income source rather than your bank history.

Lenders who operate outside the ACH system often require you to provide post-dated checks or authorization to debit a prepaid debit card (if they support that feature). This is generally where the infamous payday loan industry operates, so extreme caution is advised.

Prepaid Debit Card Loans

Some niche lenders have adapted to use prepaid debit cards for both depositing the loan funds and arranging repayment. This is a crucial alternative for borrowers asking How To Get A Loan With No Bank Account. The lender loads the approved amount onto your prepaid card, and on your due date, they are authorized to debit the card for the repayment amount.

While this solves the disbursement problem, remember that these loans come with significant fees associated with using the card platform, in addition to the already high interest rates charged by non-traditional lenders.

Understanding the Risks and Costs

When dealing with lending solutions that exist outside of mainstream banking, you must be extremely vigilant. These alternative paths often target vulnerable borrowers and charge excessive fees, creating a potential debt cycle.

Before you commit to any loan, regardless of how desperate you are, you must thoroughly review the entire loan agreement. Always ensure you can realistically repay the loan on time to avoid losing collateral or incurring massive rollover fees.

The APR Trap: Expect Higher Rates

If you bypass the need for a bank account, expect the Annual Percentage Rate (APR) to jump dramatically. Traditional bank personal loans might range from 6% to 36% APR. Conversely, payday loans or certain title loans can have APRs that soar into the triple digits, sometimes exceeding 400%.

Because the lender is taking on maximum risk—no bank account, potentially poor credit—they compensate by charging the highest legally allowed interest rates. Therefore, treat these loans as absolute last resorts for true emergencies.

Here are key elements you must verify before signing any agreement:

- The Total Cost of the Loan: Don't just look at the monthly payment; calculate the total amount you will pay back (principal + fees + interest).

- Rollover Penalties: Understand what happens if you cannot repay on the due date. Many lenders charge a fee to "roll over" the loan, drastically increasing the debt.

- Collateral Risk: If it's a secured loan (like a title loan), be prepared to lose your asset if you default.

- Licensing and Regulation: Check if the lender is licensed to operate in your state and if they adhere to local maximum interest rate caps.

While it is challenging, figuring out How To Get A Loan With No Bank Account is certainly possible by exploring secured options and prepaid card services. Always prioritize finding a solution that offers the clearest repayment terms and the lowest possible cost.

Conclusion

Finding a loan when you are unbanked presents significant obstacles, but alternative lending markets have developed solutions specifically for this demographic. Your best options generally involve secured loans, such as title loans or pawnshop loans, where collateral offsets the risk posed by the lack of a traditional banking relationship. Some non-bank lenders also utilize prepaid debit cards for fund dispersal, offering another viable path.

Remember that convenience always comes at a price in this sector. Loans secured outside the traditional banking system almost always carry much higher APRs and fees. By understanding these risks, carefully scrutinizing loan agreements, and treating these options as short-term emergency fixes only, you can successfully answer the question: How To Get A Loan With No Bank Account and manage your immediate financial needs responsibly.

Frequently Asked Questions (FAQ)

- Can I get a traditional personal loan without a bank account?

- Generally, no. Traditional personal lenders (banks, credit unions, and most major online platforms) require an active bank account for identity verification, credit analysis, and mandatory ACH electronic fund transfer for repayment.

- Are pawnshop loans safe?

- Pawnshop loans are relatively safe in the sense that they are highly regulated, and your only risk upon default is losing the item you pledged as collateral. They do not typically involve the aggressive collection tactics associated with unsecured payday loans.

- What documents do I need if I don't have bank statements?

- Lenders will need strong alternatives to verify income and residence. You will likely need official government-issued photo ID, proof of income (recent pay stubs, tax returns), and utility bills or lease agreements in your name to prove residence.

- What is the cheapest way to borrow cash without a bank account?

- The cheapest way is typically borrowing from family or friends. Among commercial options, if you own a vehicle, a title loan may offer slightly better terms than a pure unsecured payday or cash advance loan, though it carries the risk of losing your car.

How To Get A Loan With No Bank Account

How To Get A Loan With No Bank Account Wallpapers

Collection of how to get a loan with no bank account wallpapers for your desktop and mobile devices.

Detailed How To Get A Loan With No Bank Account Capture Digital Art

Explore this high-quality how to get a loan with no bank account image, perfect for enhancing your desktop or mobile wallpaper.

High-Quality How To Get A Loan With No Bank Account Design Photography

Transform your screen with this vivid how to get a loan with no bank account artwork, a true masterpiece of digital design.

Amazing How To Get A Loan With No Bank Account Background Concept

Discover an amazing how to get a loan with no bank account background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Stunning How To Get A Loan With No Bank Account View for Mobile

Immerse yourself in the stunning details of this beautiful how to get a loan with no bank account wallpaper, designed for a captivating visual experience.

Crisp How To Get A Loan With No Bank Account Design Digital Art

A captivating how to get a loan with no bank account scene that brings tranquility and beauty to any device.

Artistic How To Get A Loan With No Bank Account Image Art

This gorgeous how to get a loan with no bank account photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

High-Quality How To Get A Loan With No Bank Account Image for Your Screen

Explore this high-quality how to get a loan with no bank account image, perfect for enhancing your desktop or mobile wallpaper.

Breathtaking How To Get A Loan With No Bank Account Capture for Mobile

Transform your screen with this vivid how to get a loan with no bank account artwork, a true masterpiece of digital design.

Dynamic How To Get A Loan With No Bank Account Moment Art

Find inspiration with this unique how to get a loan with no bank account illustration, crafted to provide a fresh look for your background.

Stunning How To Get A Loan With No Bank Account Capture Illustration

Find inspiration with this unique how to get a loan with no bank account illustration, crafted to provide a fresh look for your background.

Dynamic How To Get A Loan With No Bank Account Moment for Mobile

This gorgeous how to get a loan with no bank account photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

High-Quality How To Get A Loan With No Bank Account Landscape for Your Screen

Transform your screen with this vivid how to get a loan with no bank account artwork, a true masterpiece of digital design.

Stunning How To Get A Loan With No Bank Account Scene Collection

This gorgeous how to get a loan with no bank account photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Detailed How To Get A Loan With No Bank Account Picture in 4K

Transform your screen with this vivid how to get a loan with no bank account artwork, a true masterpiece of digital design.

Vibrant How To Get A Loan With No Bank Account Scene for Mobile

Discover an amazing how to get a loan with no bank account background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Breathtaking How To Get A Loan With No Bank Account Scene Nature

Transform your screen with this vivid how to get a loan with no bank account artwork, a true masterpiece of digital design.

:max_bytes(150000):strip_icc()/how-to-get-a-loan-315510_V1-e8212e1a3dfe43358308f689cf51a284.png)

Vibrant How To Get A Loan With No Bank Account Scene for Mobile

Transform your screen with this vivid how to get a loan with no bank account artwork, a true masterpiece of digital design.

Breathtaking How To Get A Loan With No Bank Account View in HD

Discover an amazing how to get a loan with no bank account background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Amazing How To Get A Loan With No Bank Account Image for Your Screen

Discover an amazing how to get a loan with no bank account background image, ideal for personalizing your devices with vibrant colors and intricate designs.

High-Quality How To Get A Loan With No Bank Account Wallpaper Art

Experience the crisp clarity of this stunning how to get a loan with no bank account image, available in high resolution for all your screens.

Download these how to get a loan with no bank account wallpapers for free and use them on your desktop or mobile devices.

0 Response to "How To Get A Loan With No Bank Account"

Post a Comment