Can You Get 2 Fha Loans

Can You Get 2 FHA Loans? Unpacking the Rules and Exceptions

If you currently own a home financed with an FHA loan, you might be wondering about your options if you need to move or buy a new property. It's a common question we hear: Can you get 2 FHA loans at the same time? The short answer is usually "no," but the slightly longer, more helpful answer is "it depends."

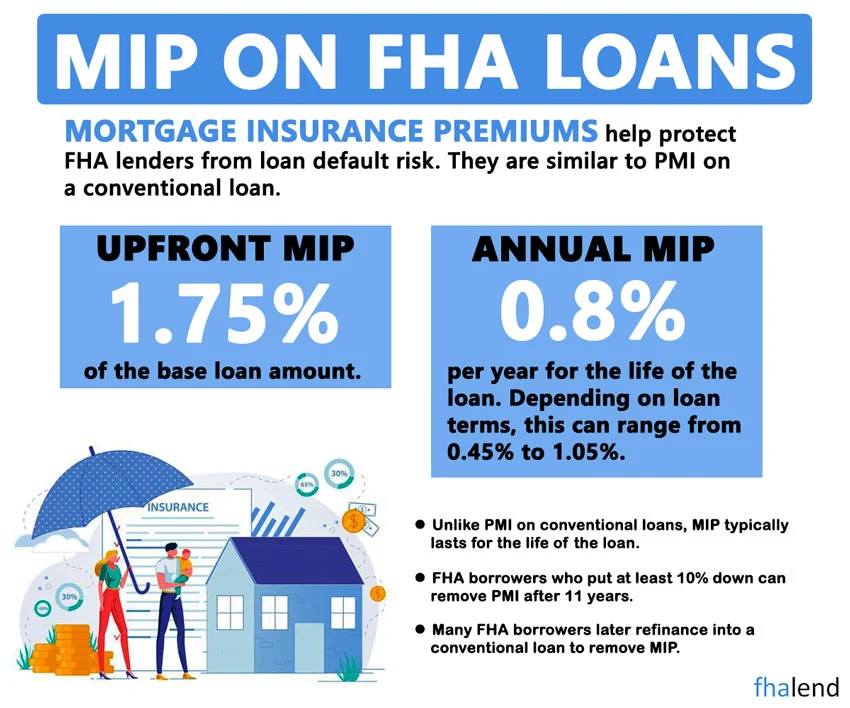

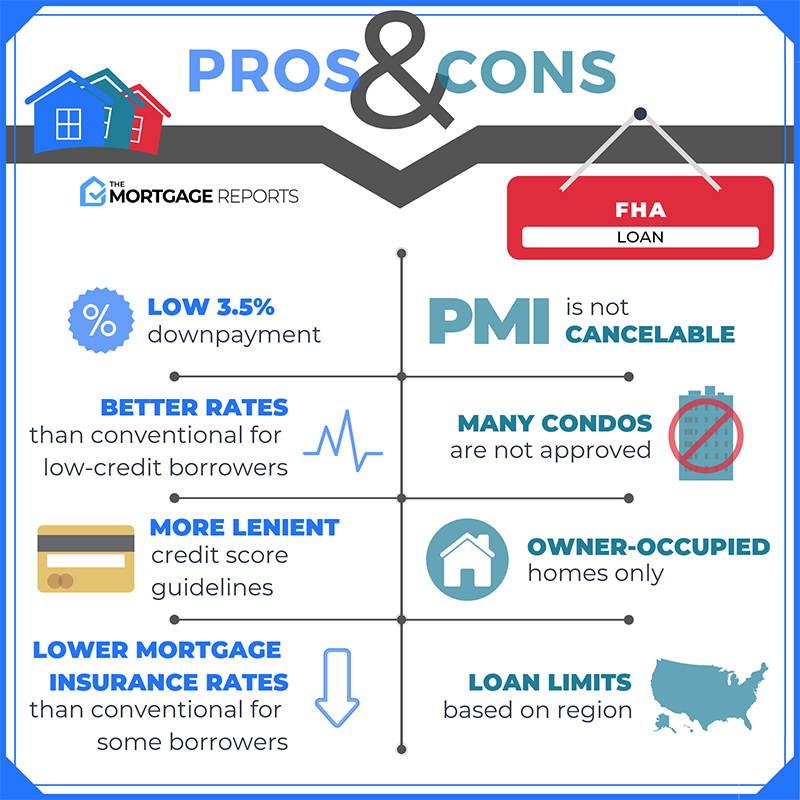

FHA loans are government-backed mortgages designed to help people, especially first-time buyers, achieve homeownership with lower down payments and easier qualification standards. Because these loans are subsidized by the Federal Housing Administration (FHA), they come with strict rules regarding occupancy and eligibility.

Let's dive into the core requirements and explore the specific, detailed exceptions that might allow you to secure a second FHA mortgage.

The Core FHA Rule: One Loan Per Borrower

The fundamental principle guiding FHA financing is the "One Home, One Loan" rule. The FHA's primary purpose is to promote homeownership for owner-occupants, not investors. This means the FHA requires you to live in the property being financed as your primary residence.

If you already have an FHA loan on your current home, the FHA generally assumes that house is your primary residence. Therefore, getting a second FHA loan simultaneously to buy another property—unless you meet a specific exception—is prohibited.

This rule is in place to prevent misuse of the low down payment benefit provided by the FHA program. If you are seeking a second mortgage, you must demonstrate to your lender and the FHA that you are no longer able to occupy the first property, or that the first property is being sold or refinanced.

When Exceptions Apply: Getting a Second FHA Loan

While the standard rule is restrictive, the FHA recognizes that life happens. There are several well-defined scenarios—or exceptions—where the FHA permits a borrower to take out a second FHA-insured mortgage. These exceptions primarily center around situations where the original property can no longer reasonably serve as your primary residence.

Exception 1: Relocation and Distance Requirements

Perhaps the most common exception is job relocation. If your employment requires you to move a significant distance, making it unreasonable to commute from your current FHA-financed home, you may qualify for a second loan.

The FHA specifies that the new residence must be at least 100 miles away from the previous residence. If you meet this distance requirement, you can keep the first FHA loan (potentially renting out the old property, depending on specific state rules and lender policy) and use a new FHA loan to finance your home in the new city.

You must provide verifiable documentation from your employer proving the need for relocation. This ensures the exemption is used genuinely for mandatory moves, not simply for investment purposes.

Exception 2: Increase in Family Size (Contingency)

Sometimes your living situation changes drastically, requiring a larger home. If your family size has increased substantially—for instance, due to having more children—and your current FHA-financed property is no longer adequate, you might qualify for a second FHA mortgage.

There are a few requirements for this family increase exception:

- The original home must no longer meet the family's needs.

- The Loan-to-Value (LTV) ratio on the current FHA property must be 75% or less. This means you need a substantial amount of equity in the first home.

- You must agree to occupy the new property as your primary residence.

This exception is critical for growing families who relied on the FHA program initially but now need more space without the immediate ability to sell their first home.

Exception 3: Vacating a Jointly Owned Property

Divorce or legal separation is another common reason someone might need to buy a new primary residence while still being tied to the mortgage of the original property. If you co-signed an FHA loan with a spouse and must now purchase a new home for yourself, the FHA may allow a second loan.

The key here is separation. You must demonstrate that the current home will continue to be occupied by the ex-spouse or co-borrower, and you will establish the new property as your primary residence. This exception acknowledges that removing yourself from the original loan via refinancing or sale can sometimes take a long time.

Exception 4: Non-Occupant Co-borrowers

If you co-signed an FHA loan for someone else (like a child or parent) but never actually occupied the property, you might be eligible to get your own FHA loan later. As long as you were categorized as a non-occupant borrower on the first mortgage, you are generally viewed as still eligible for your "first" owner-occupied FHA loan.

However, you must be able to prove that the first property was occupied by the other borrower and that the new property will genuinely be your primary residence. Always verify your status with your mortgage lender.

Exception 5: Selling the Original FHA Property

While this isn't getting two loans simultaneously, it's the simplest way to use the FHA program again. If you sell your original FHA-financed home, the loan is retired. Once that loan is off your record, you are fully eligible to apply for a brand new FHA loan for a subsequent primary residence. This is often the cleanest path forward.

If you haven't technically closed on the sale of the first house yet, some lenders may allow you to proceed with the second FHA loan application, provided you have a fully executed sales contract and the closing date is imminent (usually within 60 days of the new closing). You must demonstrate that the proceeds from the sale will fully retire the original debt.

Key Requirements for the Second FHA Loan

Even if you qualify under one of the exceptions, you must meet all the standard FHA loan requirements for the second mortgage. This includes financial qualifications, debt-to-income ratios, and ensuring both properties meet eligibility standards.

Loan-to-Value (LTV) and Equity Considerations

As mentioned in Exception 2 (family increase), the amount of equity you hold in the first property can be a significant hurdle. If you are seeking to secure two FHA loans simultaneously, the FHA wants assurance that you have been a responsible homeowner and the original property is financially stable.

Lenders will require a current appraisal on the existing FHA home to determine its true market value and calculate the LTV ratio. High equity often signals less risk for the FHA.

Credit Score and Financial Health

For the second loan, your lender will rigorously review your current debt obligations. They must ensure you can comfortably afford the mortgage payments for *both* properties, regardless of whether you plan to rent out the first one. Your debt-to-income (DTI) ratio must remain within acceptable FHA limits, which are typically strict.

Additionally, your credit history must show consistent on-time payments, especially on the existing FHA mortgage. Any delinquencies could instantly disqualify you from getting a second FHA loan.

Alternatives to a Second FHA Loan

If you don't qualify for one of the FHA exceptions, don't worry! You still have plenty of options for purchasing a second home. These typically involve conventional financing, which doesn't carry the same stringent one-loan rule as the FHA.

Conventional Loans

Conventional loans are typically the go-to alternative. These mortgages are offered by private lenders and backed by Fannie Mae and Freddie Mac. While they usually require a slightly higher credit score and may demand a larger down payment (often 5% to 20%), they allow you to easily own multiple properties.

If you are planning to keep the first FHA home and rent it out, you would use a conventional loan for your new primary residence. If the new home is a vacation or investment property, conventional financing is definitely the required route.

VA Loans (If Applicable)

For eligible veterans and service members, a VA loan is an excellent option. VA loans are also backed by the government but offer incredible flexibility, including the potential for 100% financing and generally lower interest rates.

Crucially, a VA loan can often be obtained even if you currently hold an FHA loan, as long as you have remaining VA entitlement. This is a powerful alternative if you are struggling to qualify for a second FHA loan.

Conclusion: Navigating Your Second FHA Loan Eligibility

The question, "Can you get 2 FHA loans?" is nuanced. While the FHA's default position is that you can only have one mortgage at a time, there are specific, documented exceptions designed to accommodate life events like job transfers, family growth, or divorce.

Before applying, you must verify with an FHA-approved lender that you meet the strict criteria for one of these exceptions. If you qualify, the second FHA loan can provide the low down payment benefits you need. If not, exploring conventional or VA options remains a reliable pathway to financing your next property.

Remember, transparency is key. Be prepared to provide extensive documentation regarding your existing FHA loan and the need for the new primary residence. Always consult with a qualified mortgage professional to ensure you navigate these complex federal guidelines correctly.

Frequently Asked Questions (FAQ) About Multiple FHA Loans

- What is the FHA's primary residence requirement?

- The FHA requires borrowers to occupy the financed property as their primary residence within 60 days of closing and intend to live there for at least one year. This rule is why simultaneous FHA loans are generally prohibited.

- Do I have to sell my first home to get another FHA loan?

- Not necessarily. Selling the home makes the process easier, but if you meet one of the specific exceptions (like job relocation or substantial family increase), you may be allowed to keep the first home while purchasing a second with a new FHA loan.

- If I use a Conventional Loan, can I keep my FHA loan?

- Yes. Since conventional loans are not subject to the FHA's occupancy rules, you can typically keep your existing FHA loan (which would then become a rental/investment property) and use a conventional loan to finance your new primary residence or investment property.

- Can I use an FHA loan for an investment property?

- No. FHA loans are strictly for owner-occupied residences. You cannot intentionally use an FHA loan to purchase a property solely for investment purposes.

- How does the 100-mile rule work for job relocation?

- If you are relocating for work, the new home you wish to purchase must be at least 100 cumulative miles away from the home currently financed by your FHA loan. This proves that commuting from the old residence is impractical.

Can You Get 2 Fha Loans

Can You Get 2 Fha Loans Wallpapers

Collection of can you get 2 fha loans wallpapers for your desktop and mobile devices.

Gorgeous Can You Get 2 Fha Loans Scene Nature

Immerse yourself in the stunning details of this beautiful can you get 2 fha loans wallpaper, designed for a captivating visual experience.

Stunning Can You Get 2 Fha Loans Background for Desktop

Immerse yourself in the stunning details of this beautiful can you get 2 fha loans wallpaper, designed for a captivating visual experience.

Crisp Can You Get 2 Fha Loans Artwork Photography

Find inspiration with this unique can you get 2 fha loans illustration, crafted to provide a fresh look for your background.

Vibrant Can You Get 2 Fha Loans Abstract Concept

Transform your screen with this vivid can you get 2 fha loans artwork, a true masterpiece of digital design.

Lush Can You Get 2 Fha Loans Design Concept

Find inspiration with this unique can you get 2 fha loans illustration, crafted to provide a fresh look for your background.

Crisp Can You Get 2 Fha Loans Moment Photography

This gorgeous can you get 2 fha loans photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Gorgeous Can You Get 2 Fha Loans Picture Digital Art

Immerse yourself in the stunning details of this beautiful can you get 2 fha loans wallpaper, designed for a captivating visual experience.

Lush Can You Get 2 Fha Loans Capture Nature

Find inspiration with this unique can you get 2 fha loans illustration, crafted to provide a fresh look for your background.

Gorgeous Can You Get 2 Fha Loans Wallpaper Nature

A captivating can you get 2 fha loans scene that brings tranquility and beauty to any device.

Amazing Can You Get 2 Fha Loans Capture Collection

Explore this high-quality can you get 2 fha loans image, perfect for enhancing your desktop or mobile wallpaper.

Serene Can You Get 2 Fha Loans Picture Nature

Experience the crisp clarity of this stunning can you get 2 fha loans image, available in high resolution for all your screens.

Serene Can You Get 2 Fha Loans Image Photography

Discover an amazing can you get 2 fha loans background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Crisp Can You Get 2 Fha Loans Background in HD

Find inspiration with this unique can you get 2 fha loans illustration, crafted to provide a fresh look for your background.

Dynamic Can You Get 2 Fha Loans Design for Desktop

Immerse yourself in the stunning details of this beautiful can you get 2 fha loans wallpaper, designed for a captivating visual experience.

Dynamic Can You Get 2 Fha Loans Artwork for Desktop

A captivating can you get 2 fha loans scene that brings tranquility and beauty to any device.

Beautiful Can You Get 2 Fha Loans Image Concept

Transform your screen with this vivid can you get 2 fha loans artwork, a true masterpiece of digital design.

Amazing Can You Get 2 Fha Loans Wallpaper Art

Explore this high-quality can you get 2 fha loans image, perfect for enhancing your desktop or mobile wallpaper.

Detailed Can You Get 2 Fha Loans View Collection

Experience the crisp clarity of this stunning can you get 2 fha loans image, available in high resolution for all your screens.

Serene Can You Get 2 Fha Loans View in HD

Transform your screen with this vivid can you get 2 fha loans artwork, a true masterpiece of digital design.

High-Quality Can You Get 2 Fha Loans Wallpaper in 4K

Discover an amazing can you get 2 fha loans background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Download these can you get 2 fha loans wallpapers for free and use them on your desktop or mobile devices.

0 Response to "Can You Get 2 Fha Loans"

Post a Comment