Do Business Owners Get Tax Refunds

Do Business Owners Get Tax Refunds? The Complete Guide

If you own a business, tax season often brings a mix of excitement and anxiety. You might be wondering: "Do business owners get tax refunds, or am I just destined to write a big check to the IRS every year?"

This is one of the most common questions entrepreneurs ask, and it's a great one! The short answer is yes, absolutely. Business owners can, and often do, receive tax refunds. However, the mechanism behind those refunds is very different compared to what a typical W-2 employee experiences.

Let's dive into exactly how a tax refund works for the self-employed, why you might get one, and what strategies you can use to maximize your chances of getting cash back.

The Short Answer: Yes, But It's Complicated

For most W-2 workers, a refund is usually generated because their employer withheld more money from their paychecks throughout the year than they actually owed in taxes. This over-withholding acts as an interest-free loan to the government, which they pay back to you during tax season.

As a business owner, things are slightly different because there is no employer automatically withholding taxes for you. You are responsible for calculating and paying your own income taxes and self-employment taxes (Social Security and Medicare).

So, when a business owner receives a refund, it means that the total amount of tax payments they made throughout the year exceeded their final calculated tax liability.

How Self-Employment Affects Your Tax Situation

The type of business structure you choose (Sole Proprietorship, Partnership, LLC, S-Corp) significantly impacts how your business income is taxed. However, for most small business owners, income "passes through" to their personal tax return (Form 1040).

This means your business's profit (revenue minus expenses) is what you are taxed on. If you accurately estimate this profit and pay your taxes accordingly, your chances of getting a refund improve dramatically.

It is crucial to remember the self-employment tax. This 15.3% tax covers Social Security and Medicare and applies to your net earnings. It's a major factor in determining your overall tax liability.

Understanding Estimated Taxes and Overpayment

The primary mechanism that leads to a refund for business owners is the quarterly estimated tax payment system. If you expect to owe $1,000 or more in taxes for the year, you are generally required to pay your taxes in four installments throughout the year (April 15, June 15, September 15, and January 15 of the following year).

When you make these quarterly payments, you are estimating your income and liability for the entire year. If you overestimate your income or underestimate your deductions, you end up overpaying the government.

That overpayment is exactly what generates a refund when you file your final annual return. Think of estimated taxes as the self-employed version of W-2 withholding.

Key Factors Determining If You'll Get a Refund

Several variables play a role in whether you will receive a check or have to pay a balance due. It's all about balancing your total tax due versus your total payments made.

Here are the key determinants:

- Accuracy of Estimated Payments: Did you intentionally or accidentally pay more than 100% of your final liability during the year?

- Business Profit Fluctuation: Did your business have a highly profitable first half of the year, causing you to pay large estimated taxes, followed by an unexpected slump in the second half?

- Personal Income Adjustments: Changes in your personal life (like marriage, having a child, or losing a spouse) can drastically alter your standard deduction or available credits.

- The Power of Deductions and Credits: Taking advantage of write-offs and credits is crucial for reducing your taxable income.

The Role of Business Deductions

Deductions are your best friend as a business owner looking to lower your tax bill. A deduction is an expense that the IRS allows you to subtract from your gross revenue to determine your taxable income (your profit).

For example, if your business earned $100,000 but you had $30,000 in legitimate business expenses (like software, supplies, or rent), you are only taxed on $70,000. This dramatically reduces your tax liability.

If you made estimated payments based on an expected $100,000 liability but, thanks to accurate record-keeping, you found $10,000 more in deductions than anticipated, you've essentially overpaid—leading directly to a refund.

Tax Credits vs. Tax Deductions

It's important to know the difference between these two powerful tax tools, especially if you are aiming for a refund. A deduction reduces the amount of income subject to tax, while a credit reduces the actual amount of tax you owe, dollar for dollar.

Tax credits are far more valuable than deductions. For instance, if you qualify for a $1,000 tax credit, your tax bill immediately drops by $1,000. If you already paid your full liability through estimated payments, that credit might turn your zero balance into a $1,000 refund.

Some business-related credits include the Small Business Health Care Tax Credit or credits for specific energy-efficient improvements. Always check with a tax professional to see which credits you qualify for.

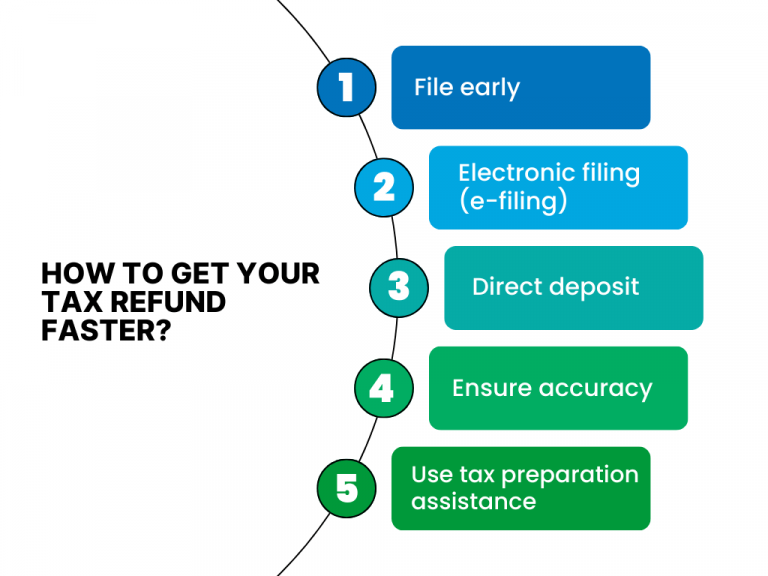

Strategies for Business Owners to Maximize Refunds (or Minimize Liability)

While receiving a massive refund might feel great, savvy business owners know that the goal isn't necessarily a huge refund; it's accurate taxation. A huge refund simply means you lent the government your money interest-free for too long.

However, if you want to ensure you get something back, or at least keep your tax bill low, here are effective strategies:

- Master Your Record Keeping: This cannot be overstated. Diligent tracking of every single business expense is the easiest way to increase your deductions and lower your taxable income. Use accounting software religiously.

- Maximize Retirement Contributions: Contributing to self-employed retirement accounts like a SEP IRA or Solo 401(k) is an amazing way to reduce your taxable income. These contributions are usually deductible.

- Strategic Timing of Purchases: Consider making large, deductible business purchases (like equipment) before the end of the tax year. This increases your deductions for the current period, potentially leading to a refund if you've already paid quarterly taxes.

- Adjust Estimated Payments Mid-Year: If your business income slows down unexpectedly, don't keep paying the same estimated amount. Adjust your payments downwards with the IRS to avoid significant overpayment.

- Don't Miss the QBI Deduction: Many small business owners are eligible for the Qualified Business Income (QBI) deduction, which allows certain pass-through businesses to deduct up to 20% of their qualified business income. This is a game-changer!

By implementing these strategies, you can ensure that you are maximizing all available write-offs, thereby reducing your liability and increasing the likelihood of a positive outcome—whether that's a small refund or a break-even filing.

Conclusion: Yes, Do Business Owners Get Tax Refunds

The clear answer to whether do business owners get tax refunds is yes, absolutely! But unlike traditional employees, the process is reliant on careful estimation.

If you intentionally or accidentally overpay your quarterly estimated taxes, or if you effectively utilize powerful deductions and tax credits that significantly lower your taxable income, you will be due a refund.

The goal is always tax efficiency, not just a large refund. By maintaining impeccable records, working closely with a tax professional, and understanding the estimated tax system, you can ensure you pay exactly what you owe and keep your business finances healthy.

Frequently Asked Questions (FAQ) About Business Owner Tax Refunds

- What is the main reason a business owner would receive a tax refund?

- The main reason a business owner gets a tax refund is overpayment of quarterly estimated taxes. This happens when the owner predicts higher profits than they actually achieve, or when substantial deductions and credits are applied at year-end that were not accounted for in the quarterly payments.

- Is it better for a business owner to get a tax refund or owe money?

- From a financial management standpoint, it is generally better to owe a small amount or break even. A large refund means you gave the government an interest-free loan throughout the year. Efficient business owners aim to pay exactly what they owe throughout the year and maintain cash flow within their business.

- How does an S-Corp handle tax refunds differently?

- In an S-Corp, the owner is often treated as both an employee (receiving a W-2 salary with mandatory withholding) and an owner (receiving distributions). Any tax refund could result from over-withholding on the W-2 salary component, or overpaying quarterly estimated taxes on distributions and business profits.

- If I just started my business, should I plan to pay estimated taxes?

- Yes, if you anticipate earning a profit that will result in owing $1,000 or more in federal taxes for the year, you must pay estimated taxes. Failure to do so can result in underpayment penalties from the IRS.

Do Business Owners Get Tax Refunds

Do Business Owners Get Tax Refunds Wallpapers

Collection of do business owners get tax refunds wallpapers for your desktop and mobile devices.

Gorgeous Do Business Owners Get Tax Refunds Landscape for Desktop

This gorgeous do business owners get tax refunds photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Detailed Do Business Owners Get Tax Refunds Picture Nature

Explore this high-quality do business owners get tax refunds image, perfect for enhancing your desktop or mobile wallpaper.

Detailed Do Business Owners Get Tax Refunds Background Nature

Explore this high-quality do business owners get tax refunds image, perfect for enhancing your desktop or mobile wallpaper.

High-Quality Do Business Owners Get Tax Refunds Photo in 4K

Experience the crisp clarity of this stunning do business owners get tax refunds image, available in high resolution for all your screens.

Captivating Do Business Owners Get Tax Refunds Landscape Art

This gorgeous do business owners get tax refunds photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Crisp Do Business Owners Get Tax Refunds Artwork for Your Screen

This gorgeous do business owners get tax refunds photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Amazing Do Business Owners Get Tax Refunds Moment Photography

Discover an amazing do business owners get tax refunds background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Crisp Do Business Owners Get Tax Refunds Capture Art

A captivating do business owners get tax refunds scene that brings tranquility and beauty to any device.

Crisp Do Business Owners Get Tax Refunds Landscape Concept

Immerse yourself in the stunning details of this beautiful do business owners get tax refunds wallpaper, designed for a captivating visual experience.

Dynamic Do Business Owners Get Tax Refunds Image for Your Screen

Find inspiration with this unique do business owners get tax refunds illustration, crafted to provide a fresh look for your background.

Serene Do Business Owners Get Tax Refunds Wallpaper Collection

Explore this high-quality do business owners get tax refunds image, perfect for enhancing your desktop or mobile wallpaper.

Mesmerizing Do Business Owners Get Tax Refunds View in HD

Discover an amazing do business owners get tax refunds background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Stunning Do Business Owners Get Tax Refunds Landscape Digital Art

This gorgeous do business owners get tax refunds photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Dynamic Do Business Owners Get Tax Refunds Wallpaper Digital Art

This gorgeous do business owners get tax refunds photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Stunning Do Business Owners Get Tax Refunds View Concept

Find inspiration with this unique do business owners get tax refunds illustration, crafted to provide a fresh look for your background.

Mesmerizing Do Business Owners Get Tax Refunds Photo for Mobile

Transform your screen with this vivid do business owners get tax refunds artwork, a true masterpiece of digital design.

Captivating Do Business Owners Get Tax Refunds Abstract for Desktop

Find inspiration with this unique do business owners get tax refunds illustration, crafted to provide a fresh look for your background.

Stunning Do Business Owners Get Tax Refunds Background Photography

Find inspiration with this unique do business owners get tax refunds illustration, crafted to provide a fresh look for your background.

Detailed Do Business Owners Get Tax Refunds View in HD

Discover an amazing do business owners get tax refunds background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Vivid Do Business Owners Get Tax Refunds Design for Your Screen

Experience the crisp clarity of this stunning do business owners get tax refunds image, available in high resolution for all your screens.

Download these do business owners get tax refunds wallpapers for free and use them on your desktop or mobile devices.

0 Response to "Do Business Owners Get Tax Refunds"

Post a Comment