Do You Get Social Security Tax Back

Do You Get Social Security Tax Back? The Definitive Guide

That little chunk of money taken out of your paycheck every time you get paid—the Social Security tax—is a mandatory deduction. As tax season approaches, many people wonder: Do you get Social Security tax back? It's a fantastic question, and one rooted in the hope of maximizing your refund. Unfortunately, for most taxpayers, the straightforward answer is usually "no."

Social Security tax, along with Medicare tax, is part of the Federal Insurance Contributions Act (FICA) taxes. These aren't like income taxes, which are subject to credits and deductions that lead to refunds. FICA taxes are contributions to a national retirement and disability insurance fund. Once those funds are paid, they are generally locked in.

However, there are very specific, rare situations where you might actually see a refund of Social Security taxes. Understanding how this system works is key to navigating your annual tax filing. Let's break down exactly what FICA taxes are and under what circumstances you might possibly get some money returned.

Understanding FICA Taxes: Where Does the Money Go?

FICA taxes are a mandatory payroll deduction split between the employee and the employer. This money goes directly into funding the Social Security (Old-Age, Survivors, and Disability Insurance) and Medicare programs.

Currently, the Social Security tax rate for employees is 6.2% of your wages, and your employer pays a matching 6.2%, for a total of 12.4%. Self-employed individuals, who act as both the employee and employer, pay the full 12.4% under the Self-Employment Contributions Act (SECA) tax.

Since these payments are viewed as contributions toward future benefits—not simply prepayments of annual tax liability—they are generally non-refundable.

The Difference Between Social Security Tax and Income Tax

This is where the confusion often lies. When you fill out your W-4 form, you estimate how much federal income tax should be withheld from your paycheck. If too much income tax is withheld, you receive a refund when you file your annual tax return (Form 1040). This is a common occurrence.

Social Security tax, conversely, is a fixed percentage deducted regardless of your filing status, dependents, or itemized deductions. It is not calculated based on your total tax liability, but rather on your gross wages, up to a specific limit.

Think of income tax as an annual settlement, while Social Security tax is a mandatory contribution based purely on earned income.

Tax Limits and Maximum Earnings

The Social Security portion of FICA tax has an annual maximum threshold, officially called the "wage base limit." This limit changes every year to adjust for inflation and wage growth. Earnings above this limit are not subject to the 6.2% Social Security tax.

For example, if the wage base limit is $168,600 (the 2024 limit), once your combined wages for the year reach that figure, your employer stops withholding Social Security tax on any further earnings.

The Medicare portion (1.45%), however, does not have a wage base limit. You pay Medicare tax on all earned income.

Scenarios Where You Might See a "Refund"

While we established that you generally won't receive a refund for Social Security tax, there are two main scenarios where taxpayers might find themselves in the position to recover overpayments, or where the term "refund" is used incorrectly but still applies to taxes associated with Social Security.

When Too Much Was Withheld (Exceeding the Wage Base Limit)

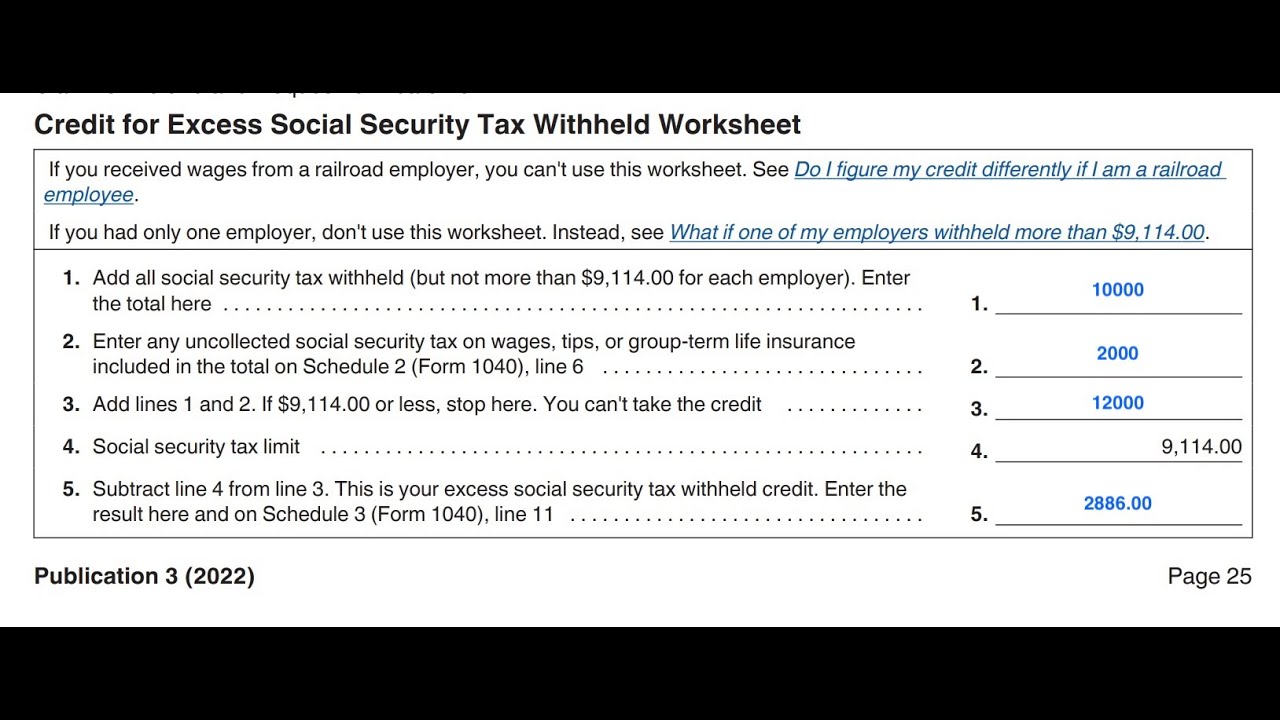

This is the primary way a taxpayer might actually Do You Get Social Security Tax Back. This usually happens only if you worked for two or more different employers during the same tax year, and your total earnings exceeded the annual wage base limit.

Here's why: Employers calculate Social Security tax withholding separately. Neither employer knows what the other is withholding. If the combined wages from both jobs exceed the wage base limit, both employers might continue withholding Social Security tax even after you've hit the cap.

If you find that you paid Social Security tax on wages above the annual limit, the IRS handles this correction automatically when you file your Form 1040. The overage is treated as a credit and added to your general income tax refund.

This happens automatically, provided you:

- Worked for two or more non-related employers.

- Had total combined wages exceeding the wage base limit.

- Paid more than the maximum Social Security tax due for that year.

Getting Taxes Back on Social Security Benefits

Another area of confusion is the difference between paying into Social Security (FICA tax) and having to pay income tax on the Social Security benefits you receive later in retirement. These are two completely separate issues.

If you are receiving benefits, up to 85% of those benefits may be subject to federal income tax, depending on your total provisional income. This income tax is refundable just like any other income tax withheld. However, this has absolutely no bearing on the FICA taxes you paid while you were working; those contributions are permanently non-refundable.

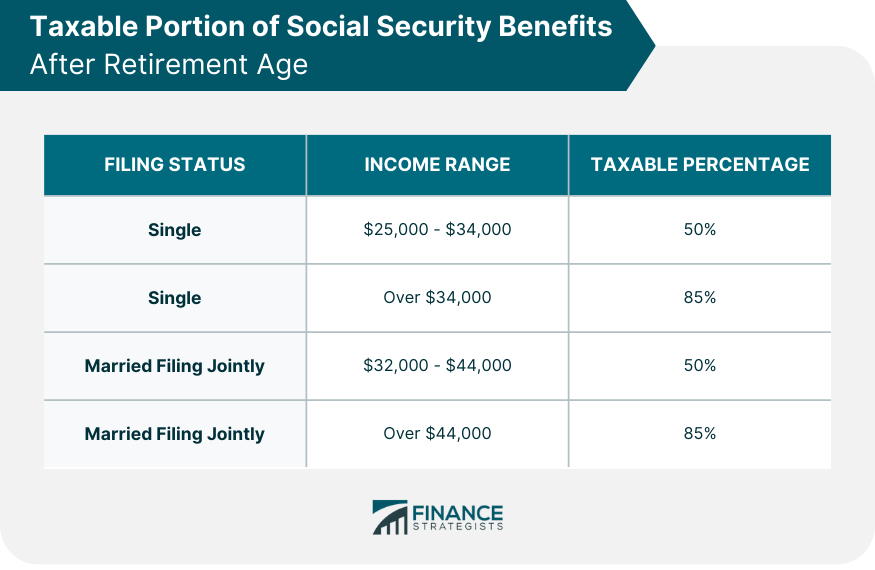

Taxation of Your Benefits Explained

Whether your Social Security benefits are taxable depends on your provisional income, which includes your Adjusted Gross Income (AGI), non-taxable interest, and half of your Social Security benefits. The thresholds are as follows:

- If your provisional income is between $25,000 and $34,000 (single filers), up to 50% of your benefits may be taxable.

- If your provisional income is over $34,000 (single filers), up to 85% of your benefits may be taxable.

- For married couples filing jointly, the thresholds are between $32,000 and $44,000 (50% taxable) and above $44,000 (85% taxable).

If you had income tax withheld on those benefits, you could potentially get that income tax back as part of your federal refund, but again, this is income tax, not the original Social Security tax contribution.

What If I Overpaid or Had an Error?

Occasionally, an error occurs that is not related to exceeding the wage base limit. Maybe your employer mistakenly withheld Social Security tax from income that was exempt (like certain fellowship payments), or maybe the calculation was simply wrong.

In cases of actual payroll error, you should first seek resolution from your employer. They may be able to refund the overpaid amount and adjust your W-2 form.

Correcting Errors on Form W-2

If your employer discovers an error in FICA withholding, they should issue a corrected W-2 (Form W-2c). If the employer refuses or is unable to correct the error, you may have to deal with the IRS directly.

For FICA tax errors, the process usually involves filing Form 843, Claim for Refund and Request for Abatement. This form specifically allows you to ask the IRS to return taxes that were improperly collected. This can be complex, so it's often best to consult with a tax professional if you suspect a significant error.

It's important to remember that if you are self-employed and overpaid your SECA taxes, you generally correct this on Schedule SE of your Form 1040, as you are responsible for calculating the limit yourself.

Conclusion: The Final Word on Social Security Tax Refunds

So, do you get Social Security tax back? In nearly 99% of cases, the answer for the average single-job worker is no. Social Security taxes are contributions designed to fund your future retirement, not prepayments of income tax.

The only time you will truly receive a refund of Social Security tax (FICA tax) is if you worked for multiple employers and those combined employers withheld too much tax after your wages surpassed the annual wage base limit. If this happened to you, congratulations—that overpayment will be credited to you on your Form 1040!

If you are nearing retirement or already receiving benefits, remember that while your contributions (FICA) are non-refundable, the income tax you pay on your benefits is subject to the standard refund process.

Frequently Asked Questions (FAQ)

- Can I get a Social Security tax refund if I didn't work for the whole year?

- No. The Social Security tax is calculated as a percentage of your actual earnings up to the annual limit. Since your contributions were based directly on the income you did earn, they were correctly withheld and are not eligible for a refund.

- Is there a way to opt out of paying Social Security tax?

- Generally, no. FICA taxes are mandatory for all employees, though there are extremely limited exceptions for specific groups, such as some state and local government workers, certain non-resident aliens, or members of specific religious groups (like the Amish) who receive exemptions from the IRS.

- How do I know if I paid too much Social Security tax?

- You need to check the amount reported in Box 4 (Social Security tax withheld) on all of your W-2 forms. Compare this total amount to the maximum Social Security tax liability for that tax year (6.2% of the wage base limit). If Box 4 exceeds the maximum liability, you overpaid and should receive an automatic refund when filing your 1040.

- If I am self-employed, can I get Social Security tax back?

- If you are self-employed, you pay SECA tax (the self-employment equivalent). If you overpaid your SECA tax—meaning you reported too much income subject to Social Security tax—you correct this when filing your Schedule SE, and the correction will affect your total tax liability, potentially increasing your overall refund.

Do You Get Social Security Tax Back

Do You Get Social Security Tax Back Wallpapers

Collection of do you get social security tax back wallpapers for your desktop and mobile devices.

Dynamic Do You Get Social Security Tax Back Wallpaper Concept

Find inspiration with this unique do you get social security tax back illustration, crafted to provide a fresh look for your background.

Amazing Do You Get Social Security Tax Back Moment for Desktop

Explore this high-quality do you get social security tax back image, perfect for enhancing your desktop or mobile wallpaper.

Amazing Do You Get Social Security Tax Back Design for Your Screen

Experience the crisp clarity of this stunning do you get social security tax back image, available in high resolution for all your screens.

Beautiful Do You Get Social Security Tax Back Artwork Digital Art

Experience the crisp clarity of this stunning do you get social security tax back image, available in high resolution for all your screens.

Dynamic Do You Get Social Security Tax Back Scene for Your Screen

This gorgeous do you get social security tax back photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Spectacular Do You Get Social Security Tax Back Capture in 4K

This gorgeous do you get social security tax back photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

/GettyImages-576720420-27eaa138a2e144d2b957315f18ef2725.jpg)

Lush Do You Get Social Security Tax Back Capture Concept

This gorgeous do you get social security tax back photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Serene Do You Get Social Security Tax Back Artwork Digital Art

Experience the crisp clarity of this stunning do you get social security tax back image, available in high resolution for all your screens.

Exquisite Do You Get Social Security Tax Back Image Illustration

A captivating do you get social security tax back scene that brings tranquility and beauty to any device.

Amazing Do You Get Social Security Tax Back Image in 4K

Experience the crisp clarity of this stunning do you get social security tax back image, available in high resolution for all your screens.

Exquisite Do You Get Social Security Tax Back Design Art

This gorgeous do you get social security tax back photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Spectacular Do You Get Social Security Tax Back Capture for Your Screen

A captivating do you get social security tax back scene that brings tranquility and beauty to any device.

Exquisite Do You Get Social Security Tax Back Artwork Illustration

Immerse yourself in the stunning details of this beautiful do you get social security tax back wallpaper, designed for a captivating visual experience.

Gorgeous Do You Get Social Security Tax Back Background for Desktop

Immerse yourself in the stunning details of this beautiful do you get social security tax back wallpaper, designed for a captivating visual experience.

Exquisite Do You Get Social Security Tax Back Picture Nature

This gorgeous do you get social security tax back photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Crisp Do You Get Social Security Tax Back Wallpaper in HD

A captivating do you get social security tax back scene that brings tranquility and beauty to any device.

Spectacular Do You Get Social Security Tax Back Moment for Mobile

Immerse yourself in the stunning details of this beautiful do you get social security tax back wallpaper, designed for a captivating visual experience.

Breathtaking Do You Get Social Security Tax Back Photo for Your Screen

Experience the crisp clarity of this stunning do you get social security tax back image, available in high resolution for all your screens.

Vibrant Do You Get Social Security Tax Back Scene for Your Screen

Explore this high-quality do you get social security tax back image, perfect for enhancing your desktop or mobile wallpaper.

Crisp Do You Get Social Security Tax Back Abstract Concept

Find inspiration with this unique do you get social security tax back illustration, crafted to provide a fresh look for your background.

Download these do you get social security tax back wallpapers for free and use them on your desktop or mobile devices.

0 Response to "Do You Get Social Security Tax Back"

Post a Comment